Should You Buy Palantir Stock Before May 5? A Pre-Earnings Analysis

Table of Contents

Palantir's Recent Performance and Market Trends

Palantir Technologies (PLTR) has experienced a rollercoaster ride in recent months. Understanding its recent performance is crucial for assessing the potential for future Palantir stock price movements. The stock has shown sensitivity to broader market sentiment, mirroring the fluctuations seen across the tech sector. Let's examine some key trends:

- Stock Price Fluctuations: In the last quarter, Palantir stock saw a significant dip in February, followed by a period of recovery in March and early April. These fluctuations highlight the inherent risk associated with investing in Palantir stock.

- Key Events: A major contract win with a large government agency in March likely contributed to the positive price movement, while concerns about slowing revenue growth in certain sectors might have dampened investor enthusiasm. Staying abreast of news surrounding Palantir is key to understanding its stock performance.

- Competitor Performance: Comparing Palantir's performance against competitors in the big data analytics space is vital. While some competitors experienced similar market headwinds, others showed more resilience, influencing the overall investor perception of the sector and impacting Palantir stock.

Analyzing Palantir's Q1 2024 Expectations

Analyst predictions for Palantir's Q1 2024 earnings vary, creating uncertainty around the potential movement of Palantir stock post-earnings. While some analysts project robust revenue growth driven by increased demand for Palantir's data analytics platforms, others express concerns about the sustainability of this growth.

- Key Financial Metrics to Watch: Investors should closely monitor revenue growth, operating margins, and customer acquisition costs. Any significant deviations from expectations could significantly impact the Palantir stock price.

- Consensus Estimates: A range of consensus estimates from various financial institutions provides a broader view of market expectations. However, it's crucial to remember that these are just predictions and the actual results could differ significantly.

- Upside and Downside Scenarios: Considering both positive and negative scenarios is essential. An exceeding of expectations could lead to a significant surge in Palantir stock, whereas a shortfall could trigger a sell-off.

Key Factors to Consider Before Investing in Palantir Stock

Before investing in Palantir stock, a thorough assessment of both its potential and risks is paramount. Palantir's long-term growth prospects hinge on several factors:

- Strengths and Weaknesses: Palantir boasts a strong government contracting base, but its reliance on this sector introduces vulnerability. The company's expanding commercial business offers diversification opportunities, but this segment is also competitive.

- Growth Potential and Risks: The expansion into new markets and the development of innovative data analytics solutions represent major growth opportunities. However, intense competition and potential regulatory changes pose significant risks to Palantir's future.

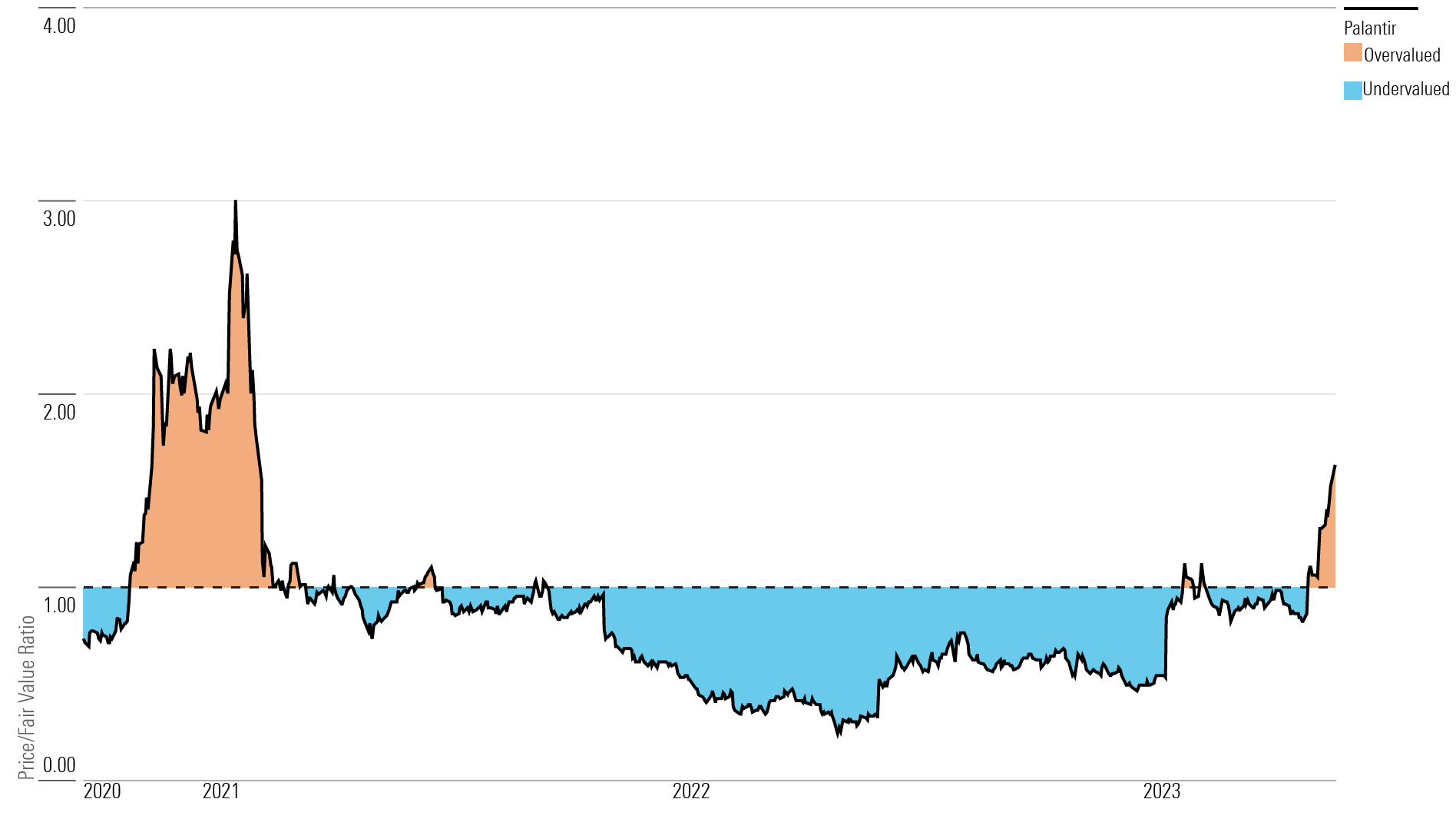

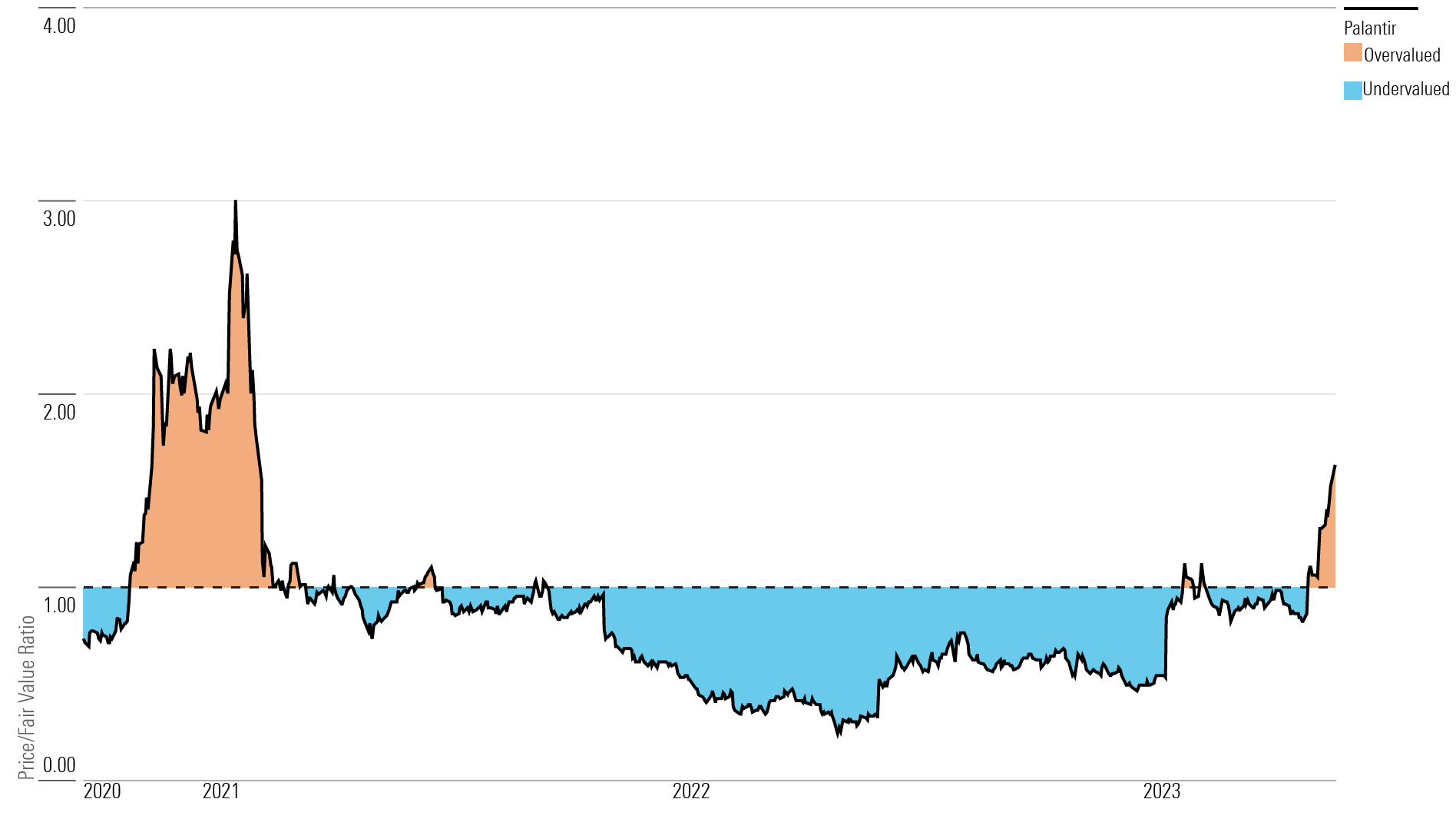

- Valuation Compared to Peers: Comparing Palantir's valuation metrics (e.g., Price-to-Sales ratio) to its competitors helps determine if the current Palantir stock price reflects its growth prospects adequately.

Technical Analysis of Palantir Stock

Technical analysis can provide insights into potential short-term price movements of Palantir stock, although it's crucial to understand that this is not a foolproof prediction method. By studying chart patterns, support and resistance levels, and technical indicators, one can identify potential trends. Disclaimer: This information is for educational purposes only and not financial advice.

- Technical Indicators: Moving averages, Relative Strength Index (RSI), and other indicators can highlight potential overbought or oversold conditions, providing clues about potential price reversals.

- Importance of Combined Analysis: It's crucial to combine technical analysis with fundamental analysis (examining the company's financials and business model) for a comprehensive assessment before making any decisions about buying Palantir stock.

Conclusion: Should You Buy Palantir Stock Before May 5th?

The decision of whether or not to buy Palantir stock before May 5th is complex and depends on your individual risk tolerance and investment strategy. While Palantir presents growth potential, the volatility of the tech sector and the company's reliance on government contracts introduce significant risks. This pre-earnings analysis aims to provide you with insights to aid your decision-making process. Remember that thorough due diligence is crucial before investing in Palantir stock or any other security. Conduct further research and consider consulting a financial advisor before making any investment decisions regarding investing in Palantir. Consider all factors and assess if Palantir stock aligns with your personal investment strategy and risk tolerance before buying Palantir stock.

Featured Posts

-

Edmonton Oilers Leon Draisaitls Injury And The Road To The Playoffs

May 10, 2025

Edmonton Oilers Leon Draisaitls Injury And The Road To The Playoffs

May 10, 2025 -

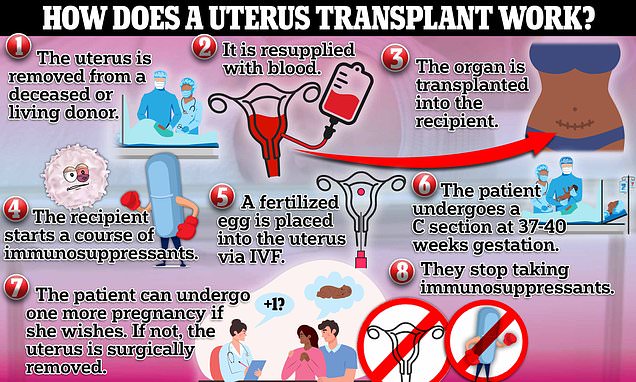

Community Activist Suggests Live Womb Transplants For Transgender Mothers

May 10, 2025

Community Activist Suggests Live Womb Transplants For Transgender Mothers

May 10, 2025 -

Judge Orders Release Of Detained Tufts Student Rumeysa Ozturk

May 10, 2025

Judge Orders Release Of Detained Tufts Student Rumeysa Ozturk

May 10, 2025 -

Pakistan Stock Market Instability Exchange Portal Outage Amidst Rising Concerns

May 10, 2025

Pakistan Stock Market Instability Exchange Portal Outage Amidst Rising Concerns

May 10, 2025 -

Elon Musks Net Worth How Us Power Dynamics Impact Teslas Ceo Fortune

May 10, 2025

Elon Musks Net Worth How Us Power Dynamics Impact Teslas Ceo Fortune

May 10, 2025