Should You Buy Palantir Stock Before May 5th? Risks And Rewards

Table of Contents

Understanding Palantir's Current Market Position and Recent Performance

Recent Financial Performance and Key Metrics

Analyzing Palantir's recent quarterly earnings reports is crucial for understanding its current financial health. Key performance indicators (KPIs) such as revenue growth, profitability (or lack thereof), and operating margins paint a picture of the company's financial trajectory. While Palantir has shown significant revenue growth, achieving profitability consistently remains a challenge. Let's look at some examples:

-

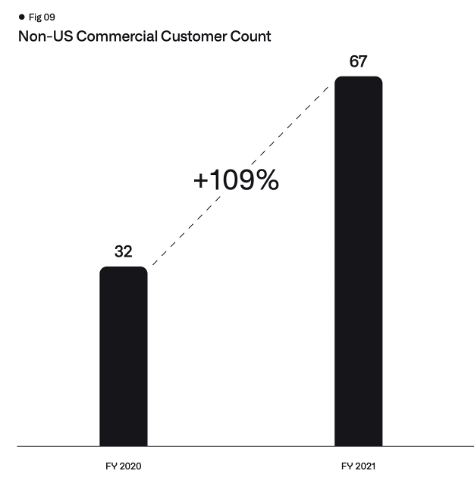

Revenue Growth: Examining the year-over-year and quarter-over-quarter revenue growth is essential. A consistent upward trend indicates healthy growth, while stagnation or decline is a red flag. Charts visualizing this data would offer a clearer picture. Keywords: Palantir earnings, PLTR financials, revenue growth, profitability, stock performance.

-

Profitability: Assessing profitability requires looking at metrics like net income, operating income, and free cash flow. While Palantir may be showing revenue growth, consistent losses would raise concerns about its long-term sustainability.

-

Operating Margins: Analyzing operating margins provides insight into Palantir's efficiency in managing its costs. Improving margins indicate operational efficiency and improved profitability potential.

Analyzing the Potential Risks of Investing in Palantir Stock

Market Volatility and Geopolitical Factors

The stock market is inherently volatile. External factors like inflation, interest rate hikes, and geopolitical instability can significantly impact Palantir's stock price, irrespective of its internal performance. Furthermore, Palantir's reliance on government contracts exposes it to geopolitical risks. Changes in government priorities or international relations could affect its revenue stream. Keywords: market volatility, geopolitical risk, competition, Palantir competitors, stock market risk.

-

Competitor Analysis: The big data and analytics market is competitive. Analyzing Palantir's competitive landscape, including competitors like AWS, Microsoft Azure, and Google Cloud, is crucial to assess its market share and future growth potential.

-

Market Saturation: The increasing market saturation in the data analytics space poses a risk to Palantir's future growth. Intense competition could pressure pricing and profitability.

Financial Risks and Dependence on Government Contracts

Palantir's significant revenue stream comes from government contracts, particularly in defense and intelligence. This concentration presents a substantial risk. A decrease in government spending or a loss of major contracts could severely impact Palantir's financial performance. Keywords: government contracts, revenue concentration, financial risk, PLTR debt, contract renewal.

-

Debt Levels: High debt levels can increase financial vulnerability, especially during economic downturns. Analyzing Palantir's debt-to-equity ratio and other debt metrics is important.

-

Contract Renewals: The uncertainty surrounding contract renewals adds another layer of risk. Failure to secure renewals could lead to revenue shortfalls.

Exploring the Potential Rewards of Investing in Palantir Stock

Growth Potential in the Big Data and AI Markets

The big data and artificial intelligence (AI) markets are experiencing rapid growth, presenting significant opportunities for Palantir. Its advanced technologies in data analytics and AI position it well to capitalize on this growth. Keywords: big data analytics, artificial intelligence, AI, market growth, technological innovation, Palantir technology.

-

Technological Innovation: Palantir's continuous innovation in developing new AI and data analytics solutions is crucial for maintaining its competitive edge.

-

Market Expansion: Palantir's expansion into new markets, both geographically and within different sectors, presents opportunities for revenue diversification and growth.

Strategic Partnerships and Future Growth Initiatives

Palantir's strategic partnerships with major technology companies and its active pursuit of new growth initiatives can drive future success. Keywords: strategic partnerships, product launches, market expansion, acquisitions, mergers, Palantir growth.

-

Product Launches: New product launches and upgrades to existing platforms demonstrate Palantir's commitment to innovation and expansion.

-

Acquisitions and Mergers: Strategic acquisitions and mergers can accelerate growth and provide access to new technologies and markets.

Should You Buy Before May 5th? A Balanced Perspective

Weighing the potential risks and rewards requires considering the information presented above. Are the potential gains from the growth of the big data and AI markets sufficient to offset the risks associated with market volatility, government contract dependence, and competition? Any specific announcements or events planned around May 5th should also be factored into your analysis. The stock market is inherently unpredictable, and no analysis can guarantee a positive outcome. Keywords: buy Palantir stock, investment decision, stock market prediction, Palantir forecast, risk assessment.

Conclusion: Making Informed Decisions About Palantir Stock

Investing in Palantir stock involves significant risks and potential rewards. The company's growth in the big data and AI markets is promising, but its reliance on government contracts and exposure to market volatility are significant concerns. Remember to conduct thorough due diligence, including reviewing financial statements, understanding the competitive landscape, and considering geopolitical factors. Consult a qualified financial advisor before making any investment decisions. Should you buy Palantir stock before May 5th? Only you can answer that after careful consideration of the risks and rewards outlined above. Conduct your own research and make an informed investment decision. A comprehensive Palantir stock analysis is crucial for any investment strategy.

Featured Posts

-

Analyzing The Trade Crisis The Case Of Bubble Blasters And Other Affected Chinese Products

May 09, 2025

Analyzing The Trade Crisis The Case Of Bubble Blasters And Other Affected Chinese Products

May 09, 2025 -

Should You Buy Palantir Stock Before May 5th Wall Streets Surprising Consensus

May 09, 2025

Should You Buy Palantir Stock Before May 5th Wall Streets Surprising Consensus

May 09, 2025 -

Dijon 2500 M De Vignes Plantes Aux Valendons

May 09, 2025

Dijon 2500 M De Vignes Plantes Aux Valendons

May 09, 2025 -

Aeroport Permi Vremennoe Zakrytie V Svyazi S Neblagopriyatnymi Pogodnymi Usloviyami

May 09, 2025

Aeroport Permi Vremennoe Zakrytie V Svyazi S Neblagopriyatnymi Pogodnymi Usloviyami

May 09, 2025 -

Stiven King Kritika Trampa Ta Maska Na Platformi Kh

May 09, 2025

Stiven King Kritika Trampa Ta Maska Na Platformi Kh

May 09, 2025