Should You Buy Palantir Technologies Stock In 2024?

Table of Contents

Palantir's Current Financial Performance and Valuation

Understanding Palantir's financial health is crucial before considering an investment. Analyzing recent financial reports reveals key insights into the company's performance and valuation.

-

Revenue Growth: Palantir has demonstrated consistent revenue growth in recent years, though the rate of growth may fluctuate quarter-to-quarter. Examining year-over-year and quarter-over-quarter trends provides a clearer picture of the company's trajectory. Analyzing the sources of this revenue growth (government vs. commercial sectors) is also critical.

-

Profitability: Palantir's profitability margins (gross, operating, and net) offer insight into its operational efficiency and ability to translate revenue into profit. Tracking these margins over time helps assess the company's progress toward sustainable profitability.

-

Key Financial Ratios: Examining key financial ratios such as the P/E ratio (Price-to-Earnings) and price-to-sales ratio provides a comparative valuation against industry benchmarks and competitors. A high P/E ratio may indicate high growth expectations, but also increased risk.

-

Industry Comparison: Comparing Palantir's financial performance and valuation to similar data analytics companies like Snowflake or Datadog is crucial to gain perspective on its relative strength and potential for future growth.

-

Future Financial Performance: Projecting future financial performance requires considering current trends, the success of new product launches, and the overall economic climate. Analysts' predictions should be viewed with caution, and investors should form their own independent assessments.

Palantir's Growth Potential and Market Opportunities

Palantir operates in two primary markets: government and commercial. The size and growth potential of these markets significantly influence the company's future prospects.

-

Government Sector: Palantir's government contracts, particularly in defense and intelligence, represent a significant portion of its revenue. Growth in this sector depends on government budgets, national security priorities, and international geopolitical factors. Expansion into new government agencies and international markets presents significant opportunities.

-

Commercial Sector: Palantir's expansion into the commercial sector is a key driver of future growth. Identifying specific industries where its data analytics platforms offer compelling value propositions (e.g., healthcare, finance, manufacturing) is crucial. Successful penetration into these markets could dramatically increase Palantir's revenue streams.

-

New Markets and Products: Palantir's ability to innovate and expand into new markets and develop new product offerings will be a major determinant of its long-term success. Strategic partnerships and acquisitions can accelerate this process.

-

Competitive Landscape: Palantir faces competition from established and emerging players in the data analytics space. Assessing its competitive advantages (e.g., proprietary technology, strong customer relationships) is vital.

Risks and Challenges Facing Palantir Technologies

Despite its growth potential, Palantir faces several significant risks:

-

Government Contract Dependence: Over-reliance on government contracts exposes Palantir to potential budget cuts or changes in government priorities. Diversifying its revenue streams is critical to mitigate this risk.

-

Competition: Intense competition from established tech giants and agile startups could pressure Palantir's market share and pricing power.

-

Data Security and Privacy: Operating in the data analytics space requires robust data security measures and strict adherence to privacy regulations. Breaches or non-compliance could severely damage Palantir's reputation and financial performance.

-

Geopolitical Risks: International operations expose Palantir to geopolitical instability and potential disruptions.

-

Regulatory Changes: Changes in data privacy regulations (e.g., GDPR, CCPA) could impact Palantir's operations and require substantial compliance investments.

Analyst Opinions and Price Targets for Palantir Stock

Before investing in Palantir stock, it's wise to review analyst reports and price targets. However, remember that these are just opinions and should not be the sole basis for your investment decision.

-

Analyst Ratings: Leading financial institutions provide buy, sell, and hold ratings on Palantir stock. These ratings reflect analysts' assessments of the company's future prospects and risks.

-

Price Targets: Analysts often provide price targets, representing their estimations of the stock's future price. These targets vary widely, reflecting differing perspectives and methodologies.

-

Analyst Track Record: Consider the track record of individual analysts and their potential biases when evaluating their opinions.

-

Independent Assessment: Always conduct your own independent research and assessment before making any investment decisions.

Conclusion: Should you buy Palantir Technologies stock in 2024?

The decision of whether to buy Palantir Technologies stock in 2024 is a complex one. Palantir operates in a high-growth market and possesses significant technological capabilities. However, it faces considerable risks related to its dependence on government contracts, competition, and regulatory changes. Carefully weigh the potential rewards against the inherent uncertainties. Thoroughly research Palantir's financial performance, growth prospects, and risks before making any investment decision. Consider seeking professional financial advice tailored to your risk tolerance and investment objectives. Remember to always conduct your own due diligence before buying Palantir Technologies stock or any other stock.

Featured Posts

-

Makron I Tusk Podpisanie Oboronnogo Soglasheniya 9 Maya Detali I Posledstviya

May 10, 2025

Makron I Tusk Podpisanie Oboronnogo Soglasheniya 9 Maya Detali I Posledstviya

May 10, 2025 -

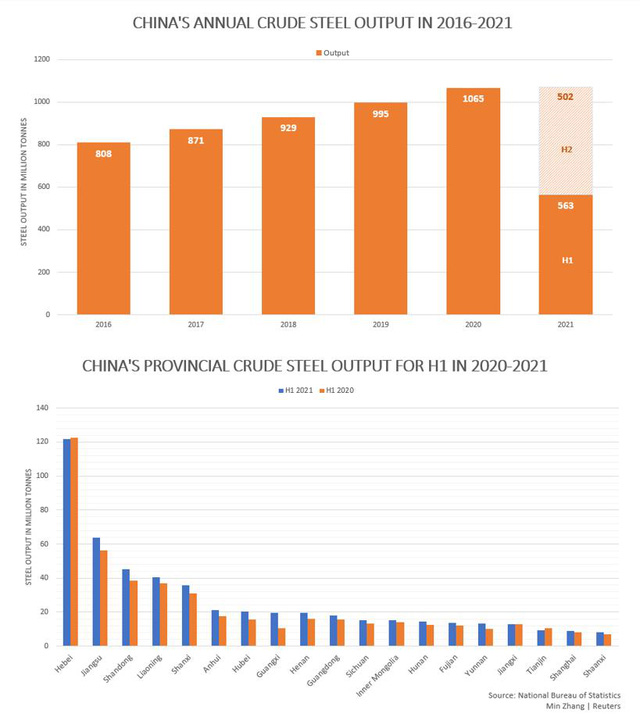

Falling Iron Ore Prices Impact Of Chinese Steel Production Cuts

May 10, 2025

Falling Iron Ore Prices Impact Of Chinese Steel Production Cuts

May 10, 2025 -

Indian Insurance Sector Seeks Simplification Of Bond Forward Rules

May 10, 2025

Indian Insurance Sector Seeks Simplification Of Bond Forward Rules

May 10, 2025 -

Cite De La Gastronomie De Dijon L Implication Municipale Face Aux Difficultes D Epicure

May 10, 2025

Cite De La Gastronomie De Dijon L Implication Municipale Face Aux Difficultes D Epicure

May 10, 2025 -

Jeanine Pirro Her Life Career And Financial Standing

May 10, 2025

Jeanine Pirro Her Life Career And Financial Standing

May 10, 2025