Should You Invest In This SPAC Challenging MicroStrategy's Dominance?

Table of Contents

Understanding the Challenger SPAC

This new SPAC, let's call it "Bitcoin Acquisition Corp" (BAC) for the purpose of this analysis, aims to disrupt the market by focusing on [Specific niche within Bitcoin investment, e.g., Bitcoin mining infrastructure, Bitcoin-backed lending, etc.]. Their strategy hinges on acquiring or merging with existing companies in this niche, leveraging efficiencies and innovative technologies.

The SPAC's Business Model

BAC's business model revolves around acquiring a target company with a proven track record in [Specific niche]. Their management team boasts extensive experience in [Relevant industry], with a strong financial backing from [Investors/Venture Capital firms]. The stated acquisition targets include companies demonstrating [Key characteristics, e.g., superior mining efficiency, innovative lending platforms, etc.].

Competitive Advantages

BAC believes its competitive advantage lies in [Specific competitive advantage, e.g., proprietary mining technology, a superior risk management model for lending, etc.]. This, coupled with their access to capital and strategic partnerships, positions them to potentially capture significant market share.

- Strengths: Strong management team, substantial funding, potentially disruptive technology.

- Weaknesses: Unproven track record, dependence on successful acquisition, vulnerability to market fluctuations.

- Management Comparison: While MicroStrategy's leadership is established and well-known, BAC's team may offer fresh perspectives and innovative strategies. A direct comparison requires detailed analysis of their experience and track record.

- Acquisition Synergies: The success of BAC hinges on identifying and successfully integrating complementary acquisitions. Potential challenges include integration difficulties, cultural clashes, and unexpected costs.

Analyzing MicroStrategy's Position

MicroStrategy, a publicly traded company, is a well-established player with a significant market share in Bitcoin holdings and related activities. This established presence translates into considerable brand equity and a loyal customer base.

MicroStrategy's Market Share and Influence

MicroStrategy's substantial Bitcoin holdings and its prominent role in the industry have cemented its position as a market leader. Its brand recognition and established infrastructure provide a significant competitive advantage.

MicroStrategy's Future Strategy

MicroStrategy is likely to respond to BAC's challenge by further consolidating its market position. This might involve strategic acquisitions, technology advancements, and aggressive marketing campaigns. They may also explore new avenues for Bitcoin-related investments and services.

- Key Competitive Advantages: Brand recognition, established infrastructure, significant Bitcoin holdings, financial strength.

- Impact of BAC: The impact of BAC on MicroStrategy's market share depends largely on BAC's ability to execute its acquisition strategy and deliver on its promises. A successful BAC could potentially erode MicroStrategy’s dominance, but the likelihood depends on several factors.

- Financial Strength: MicroStrategy's robust financial position makes it resilient to competitive pressures.

Assessing the Investment Risks and Rewards

Investing in either BAC or MicroStrategy involves inherent risks and rewards. A careful assessment of both is crucial for making informed investment decisions.

Financial Projections and Valuation

Comparing BAC's financial projections (post-acquisition) with MicroStrategy's current performance and future outlook is crucial. Key metrics include revenue growth, profitability, and valuation multiples (e.g., Price-to-Earnings ratio). These comparisons will highlight the relative attractiveness of each investment.

Market Volatility and Uncertainty

The cryptocurrency market is notoriously volatile. Investing in SPACs adds another layer of risk, especially those targeting disruptive technologies. Significant losses are possible.

- ROI Analysis: Projecting ROI for both BAC and MicroStrategy requires detailed financial modeling and considers various market scenarios.

- Investment Scenarios: Best-case scenarios assume successful acquisitions and strong market growth for BAC. Worst-case scenarios involve failed acquisitions, market crashes, or regulatory challenges. A likely-case scenario should reflect a more realistic outlook based on historical data and market trends.

- Macroeconomic Impact: Interest rates, inflation, and overall economic conditions can significantly impact both BAC and MicroStrategy's performance.

Conclusion: Should You Invest in This SPAC Challenging MicroStrategy's Dominance?

Investing in BAC presents a high-risk, high-reward proposition. While the potential for significant returns exists, the uncertainties associated with SPACs and the competitive pressure from MicroStrategy cannot be ignored. BAC's success hinges on several factors, including successful acquisitions, effective integration, and favorable market conditions. MicroStrategy's established position, strong financials, and brand recognition offer a more stable, albeit potentially less volatile, investment opportunity.

Therefore, a balanced recommendation is to proceed with extreme caution. Investing in BAC should only be considered by investors with a high-risk tolerance and a thorough understanding of the competitive landscape and inherent uncertainties involved in SPAC investments. While the potential to disrupt MicroStrategy's dominance is exciting, thorough due diligence is paramount. Conduct thorough research before investing in this SPAC challenging MicroStrategy's dominance, carefully assessing the risks involved.

Featured Posts

-

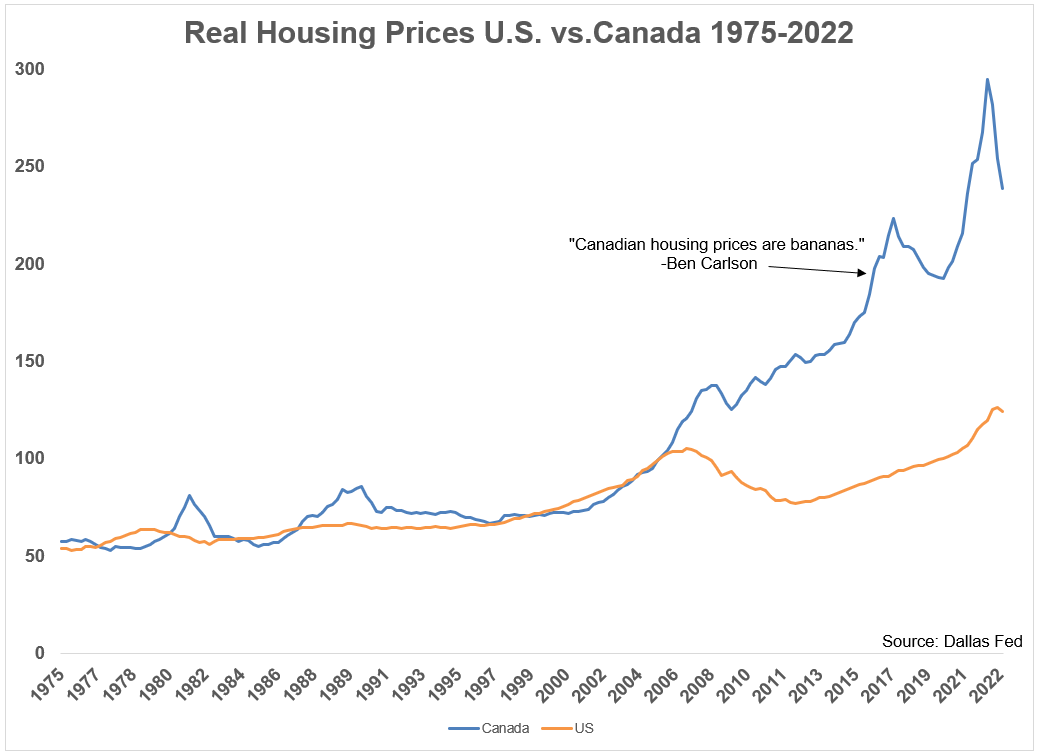

The Unaffordable Dream Examining High Down Payments In The Canadian Housing Market

May 09, 2025

The Unaffordable Dream Examining High Down Payments In The Canadian Housing Market

May 09, 2025 -

Nyt Spelling Bee April 1 2025 Find The Pangram And All Answers

May 09, 2025

Nyt Spelling Bee April 1 2025 Find The Pangram And All Answers

May 09, 2025 -

1509

May 09, 2025

1509

May 09, 2025 -

Podrobnosti Oboronnogo Soglasheniya Mezhdu Makronom I Tuskom 9 Maya

May 09, 2025

Podrobnosti Oboronnogo Soglasheniya Mezhdu Makronom I Tuskom 9 Maya

May 09, 2025 -

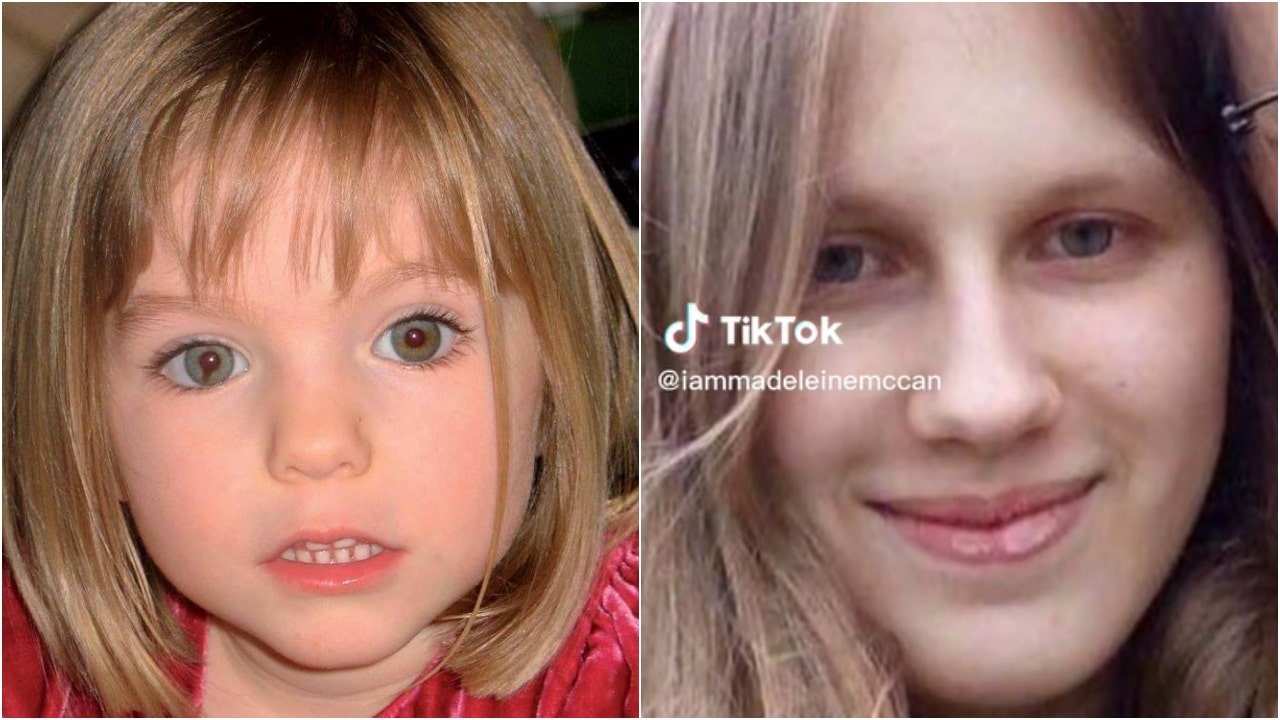

Madeleine Mc Cann Case Polish Woman Charged With Stalking Following Bristol Airport Incident

May 09, 2025

Madeleine Mc Cann Case Polish Woman Charged With Stalking Following Bristol Airport Incident

May 09, 2025