Significant Losses In Frankfurt: DAX Closes Near 24,000

Table of Contents

Key Factors Contributing to the DAX Decline

Several interconnected factors contributed to the DAX's decline, creating a perfect storm of negative market sentiment.

Global Economic Uncertainty

Rising inflation, the potential for a global recession, and aggressive interest rate hikes by the European Central Bank (ECB) are significantly impacting investor confidence.

- Inflation: Persistently high inflation erodes purchasing power and increases the cost of borrowing, dampening economic growth and reducing corporate profits. This uncertainty leads investors to seek safer havens, pulling money away from riskier assets like stocks included in the DAX.

- Recession Fears: Concerns about a potential recession in major economies, including the Eurozone, are fueling market volatility. A recession would severely impact corporate earnings, leading to further downward pressure on stock prices.

- ECB Interest Rate Hikes: The ECB's efforts to combat inflation through interest rate increases are increasing borrowing costs for businesses and consumers. Higher interest rates make it more expensive for companies to invest and expand, hindering economic growth and impacting DAX performance. This directly affects investor confidence and the overall DAX valuation.

Geopolitical Instability

The ongoing war in Ukraine, escalating tensions between China and the West, and other geopolitical risks are contributing to market uncertainty and volatility.

- Ukraine War: The war's impact on energy prices, supply chains, and global trade is creating significant uncertainty for businesses and investors. The resulting volatility directly affects the DAX's performance.

- China Tensions: Strained relations between China and several Western countries create instability in global trade and supply chains. This uncertainty makes investors hesitant, leading to decreased investment in the DAX and other global markets.

- Market Volatility: The cumulative effect of these geopolitical events is increased market volatility, making it difficult for investors to predict future market movements and impacting the DAX negatively.

Energy Crisis and Inflation

Soaring energy prices, driven by the war in Ukraine and reduced energy supply, are significantly impacting corporate earnings and consumer spending.

- Corporate Earnings: High energy costs are squeezing profit margins for many German companies, leading to reduced earnings and impacting their stock valuations within the DAX.

- Consumer Spending: Rising energy bills are reducing consumer disposable income, leading to decreased consumer spending. This reduced demand further impacts corporate profits and overall economic growth, reflecting negatively on the DAX.

- Inflationary Pressure: The energy crisis is a major contributor to inflation, exacerbating the challenges outlined above and intensifying the downward pressure on the DAX.

Analysis of DAX Performance and Individual Stock Movements

The DAX's decline is not isolated; however, its performance is significantly impacted compared to other major indices.

- Market Comparison: While other major indices like the FTSE 100, CAC 40, Dow Jones, and S&P 500 have also experienced losses recently, the DAX's decline has been comparatively steeper, reflecting specific vulnerabilities in the German economy.

- Influential DAX Companies: Several key companies within the DAX, including [insert examples of major DAX companies, e.g., Volkswagen, Siemens, Allianz], have experienced significant drops in their stock prices, contributing substantially to the overall index decline. Their individual market capitalization decreases directly impact the DAX's overall value. Analysis of their individual stock performance reveals specific sector-related vulnerabilities contributing to the overall decline.

Potential Implications and Future Outlook for the DAX

The DAX's decline has significant implications for the German economy and investor confidence.

- Economic Impact: A weakening DAX indicates potential slowdown in economic activity within Germany. This can affect employment, investment, and overall consumer confidence.

- Investor Sentiment: The current market sentiment remains cautious, as investors are wary of further economic downturns and geopolitical risks. This negative sentiment could continue to put downward pressure on the DAX.

- Market Forecast: Predictions for the DAX's future performance vary amongst analysts. Some predict a continued downward trend in the short term, while others anticipate a recovery depending on the resolution of global economic and geopolitical uncertainties.

- Analyst Predictions: [Insert quotes from reputable financial analysts regarding their outlook on the DAX, citing their source]. These predictions often vary depending on their interpretation of the current economic and geopolitical landscape.

Conclusion

The significant losses in the DAX, bringing it perilously close to 24,000, are the result of a confluence of factors: global economic uncertainty, geopolitical instability, and the ongoing energy crisis. These challenges have negatively impacted investor confidence and put downward pressure on the German economy. The short-term and long-term implications for the DAX are uncertain, with forecasts varying widely among analysts.

Call to Action: Stay informed about the fluctuating DAX performance and broader market trends. Regularly check for updates on the DAX index and its constituent stocks to make informed investment decisions. Monitor news and analysis related to the DAX to better understand its movements and potential future performance. Continue to track the DAX and its implications for the German economy and global markets. Understanding the intricacies of the DAX is crucial for navigating the current economic climate.

Featured Posts

-

M56 Road Closure Current Traffic Conditions And Congestion

May 25, 2025

M56 Road Closure Current Traffic Conditions And Congestion

May 25, 2025 -

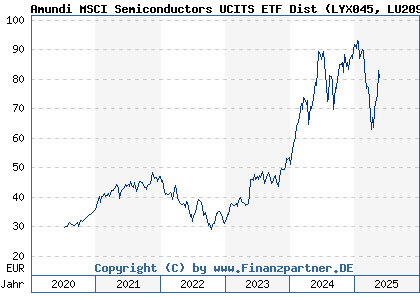

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist Key Factors

May 25, 2025

Net Asset Value Nav Of Amundi Msci World Ii Ucits Etf Usd Hedged Dist Key Factors

May 25, 2025 -

Amundi Djia Ucits Etf A Comprehensive Guide To Net Asset Value

May 25, 2025

Amundi Djia Ucits Etf A Comprehensive Guide To Net Asset Value

May 25, 2025 -

Konchita Vurst Ee Prognoz Na Chetyrekh Pobediteley Evrovideniya 2025

May 25, 2025

Konchita Vurst Ee Prognoz Na Chetyrekh Pobediteley Evrovideniya 2025

May 25, 2025 -

Imcd N V Shareholders Approve All Resolutions At Agm

May 25, 2025

Imcd N V Shareholders Approve All Resolutions At Agm

May 25, 2025

Latest Posts

-

Major Bangladesh Showcase In The Netherlands 1 500 Visitors Projected

May 25, 2025

Major Bangladesh Showcase In The Netherlands 1 500 Visitors Projected

May 25, 2025 -

Best Of Bangladesh Event In Netherlands Over 1 500 Visitors Expected

May 25, 2025

Best Of Bangladesh Event In Netherlands Over 1 500 Visitors Expected

May 25, 2025 -

L Impact De Mathieu Avanzi Sur L Enseignement Et L Usage Du Francais

May 25, 2025

L Impact De Mathieu Avanzi Sur L Enseignement Et L Usage Du Francais

May 25, 2025 -

Le Francais Selon Mathieu Avanzi Plus Qu Une Langue D Enseignement

May 25, 2025

Le Francais Selon Mathieu Avanzi Plus Qu Une Langue D Enseignement

May 25, 2025 -

Mathieu Avanzi L Evolution Du Francais Au Dela Des Salles De Classe

May 25, 2025

Mathieu Avanzi L Evolution Du Francais Au Dela Des Salles De Classe

May 25, 2025