Significant US Growth Slowdown Predicted By Deloitte

Table of Contents

Key Factors Contributing to the Predicted Slowdown

Several interconnected factors contribute to Deloitte's prediction of a significant US economic growth slowdown. Understanding these is vital for businesses to anticipate and adapt to the changing economic climate.

Inflation and Rising Interest Rates

Persistent high inflation and the Federal Reserve's aggressive interest rate hikes are major culprits. This dual pressure significantly impacts consumer spending and business investment.

- Reduced consumer purchasing power due to inflation: High inflation erodes the value of wages, leaving consumers with less disposable income and reducing their spending capacity. This decreased consumer demand ripples through the economy.

- Increased borrowing costs for businesses hamper expansion plans: Higher interest rates increase the cost of borrowing for businesses, making expansion plans, new investments, and even maintaining operations more expensive. This leads to delayed projects and potentially reduced hiring.

- Potential for a recessionary environment due to tightening monetary policy: The Federal Reserve's aim to curb inflation through tighter monetary policy carries the risk of triggering a recession. A recession would severely impact business performance and profitability.

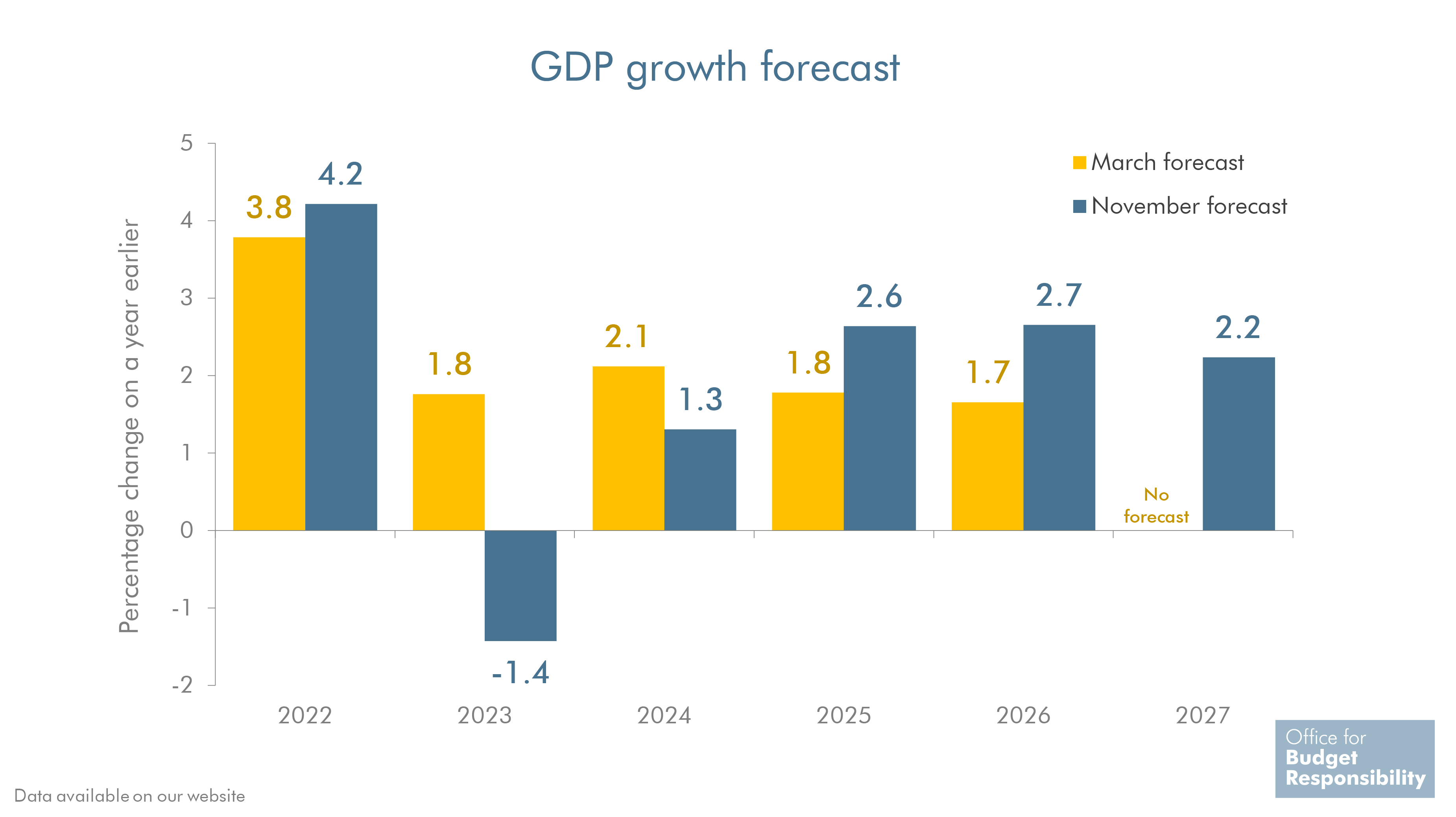

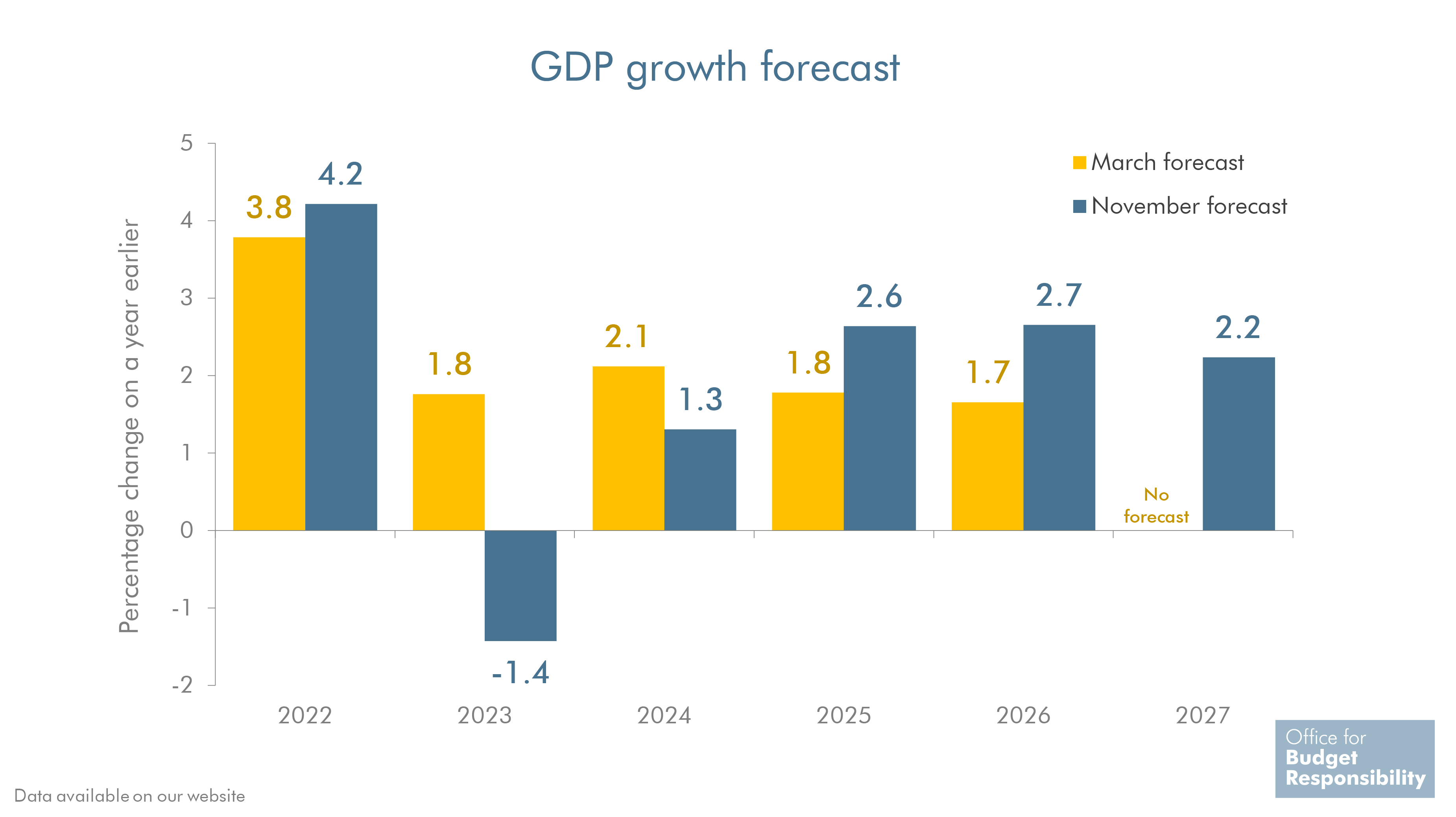

Global Economic Uncertainty

The US economy is not an island; global events significantly influence its trajectory. Current global uncertainties exacerbate the domestic challenges.

- Increased energy prices due to geopolitical events: The war in Ukraine has significantly impacted global energy markets, leading to increased energy prices that affect businesses and consumers alike, increasing production costs and reducing disposable income.

- Supply chain bottlenecks impacting production and increasing costs: Ongoing global supply chain disruptions continue to cause delays and shortages, pushing up production costs and impacting businesses' ability to meet demand.

- Reduced global demand impacting US exports: Weakening global economies reduce demand for US exports, impacting American businesses that rely on international trade for revenue.

Weakening Consumer Confidence

Declining consumer confidence is a critical indicator of economic health. A pessimistic outlook translates directly into reduced spending.

- High inflation eroding consumer confidence: Persistent high inflation fuels uncertainty about the future, leading to a decrease in consumer confidence and a reluctance to spend.

- Uncertainty about future job security impacting spending habits: Fears of job losses and economic instability cause consumers to postpone purchases and prioritize saving, further dampening economic activity.

- Shift in consumer spending priorities towards necessities: Consumers tend to prioritize essential goods and services during times of economic uncertainty, reducing spending on discretionary items.

Impact on Different Sectors

Deloitte's forecast will differentially impact various sectors of the US economy. Understanding these sector-specific impacts allows businesses to better prepare.

Manufacturing and Industrial Production

The predicted slowdown will likely hit the manufacturing and industrial production sectors hard, potentially leading to significant consequences.

- Reduced demand for goods leading to decreased production: Lower consumer spending and business investment result in decreased demand, forcing manufacturers to reduce production levels.

- Potential for factory closures and layoffs: To cope with reduced demand and increased costs, manufacturers might be forced to close factories and lay off workers.

- Increased pressure on businesses to cut costs: Manufacturers will face intense pressure to cut costs across the board, potentially impacting quality, innovation, and employee morale.

Real Estate and Construction

The rising interest rates are expected to severely impact the real estate and construction industries, potentially triggering a market downturn.

- Reduced affordability for homebuyers due to higher mortgage rates: Higher mortgage rates make homeownership less affordable, reducing demand for new homes and potentially driving down property values.

- Decreased demand for new construction projects: Developers might postpone or cancel new construction projects due to decreased demand and increased borrowing costs.

- Potential for a decline in property values: A decline in demand could lead to a decrease in property values across various segments of the real estate market.

Technology and Innovation

While the tech sector often demonstrates some resilience, the overall economic slowdown will still impact investment and hiring.

- Reduced venture capital funding: Venture capitalists might become more cautious, reducing funding for startups and established tech companies.

- Potential for hiring freezes and layoffs: Companies might implement hiring freezes or even layoffs to cut costs and conserve resources.

- Increased pressure to demonstrate profitability: Investors will place a greater emphasis on profitability and sustainable business models, increasing pressure on tech companies to demonstrate financial health.

Strategies for Businesses to Navigate the Slowdown

Proactive strategies are crucial for businesses to navigate the predicted economic slowdown. Adaptability and strategic planning are key to survival and future success.

Cost Optimization and Efficiency Improvements

Streamlining operations and boosting efficiency are paramount to surviving the economic headwinds.

- Implementing lean management principles: Adopting lean management techniques helps to eliminate waste, improve productivity, and reduce costs.

- Investing in automation and technology: Automation and technological advancements can boost efficiency, reduce labor costs, and improve productivity.

- Negotiating better deals with suppliers: Strong supplier relationships and effective negotiation can help businesses secure better pricing and terms.

Diversification and Risk Management

Diversifying revenue streams and implementing robust risk management are essential for resilience.

- Exploring new markets and product lines: Expanding into new markets and developing new product lines can mitigate the impact of a slowdown in a single market or product segment.

- Implementing hedging strategies to mitigate risks: Hedging strategies can help businesses protect themselves against potential losses due to fluctuating commodity prices or currency exchange rates.

- Building strong relationships with customers and suppliers: Strong relationships foster trust and collaboration, helping businesses navigate challenging times.

Investing in Innovation and Talent

Investing in innovation and talent provides a competitive advantage during economic downturns.

- Investing in R&D and new technologies: Continuous innovation helps companies stay ahead of the curve and adapt to changing market demands.

- Offering competitive salaries and benefits: Attracting and retaining top talent is crucial, especially during economic downturns.

- Focusing on employee training and development: Investing in employee training and development ensures a skilled workforce capable of adapting to changing circumstances.

Conclusion

Deloitte's prediction of a significant US growth slowdown presents a serious challenge for businesses. However, by proactively understanding the underlying factors, assessing sector-specific impacts, and strategically implementing the measures outlined above, businesses can navigate this economic uncertainty and position themselves for future success. Staying informed about the evolving economic landscape and adapting business strategies accordingly is vital. Don't wait for the US economic growth to decline further; proactively address the predicted economic slowdown and prepare your business for the challenges ahead. Proactive planning and strategic decision-making are crucial for mitigating the risks associated with the projected US growth decline. Prepare your business now.

Featured Posts

-

Motherhood And Victory Bencic In The Abu Dhabi Open Final

Apr 27, 2025

Motherhood And Victory Bencic In The Abu Dhabi Open Final

Apr 27, 2025 -

How To Buy Ariana Grandes Lovenote Fragrance Set Online Pricing And Best Deals

Apr 27, 2025

How To Buy Ariana Grandes Lovenote Fragrance Set Online Pricing And Best Deals

Apr 27, 2025 -

Juliette Binoche Appointed President Of The Cannes Jury For 2025

Apr 27, 2025

Juliette Binoche Appointed President Of The Cannes Jury For 2025

Apr 27, 2025 -

Cerundolo Avanza A Cuartos De Final En Indian Wells Tras Bajas De Fritz Y Gauff

Apr 27, 2025

Cerundolo Avanza A Cuartos De Final En Indian Wells Tras Bajas De Fritz Y Gauff

Apr 27, 2025 -

The Importance Of Middle Managers Bridging The Gap Between Leadership And Employees

Apr 27, 2025

The Importance Of Middle Managers Bridging The Gap Between Leadership And Employees

Apr 27, 2025

Latest Posts

-

The China Factor Analyzing The Automotive Challenges Faced By Bmw Porsche And Competitors

Apr 27, 2025

The China Factor Analyzing The Automotive Challenges Faced By Bmw Porsche And Competitors

Apr 27, 2025 -

Chinas Auto Market The Struggles Of Bmw Porsche And Others

Apr 27, 2025

Chinas Auto Market The Struggles Of Bmw Porsche And Others

Apr 27, 2025 -

Bmw And Porsche In China Market Headwinds And Strategic Adjustments

Apr 27, 2025

Bmw And Porsche In China Market Headwinds And Strategic Adjustments

Apr 27, 2025 -

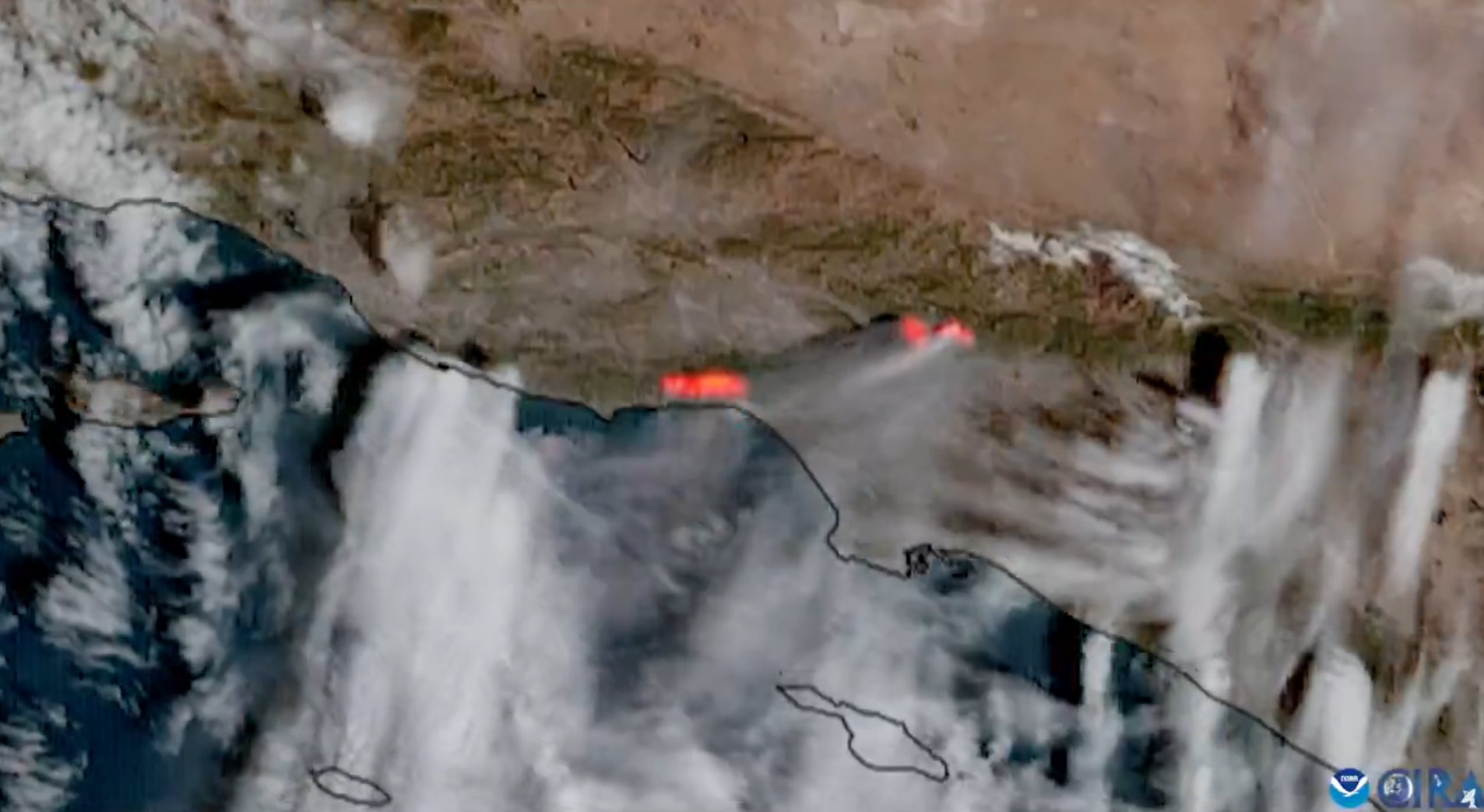

Los Angeles Wildfires A Reflection Of Our Times Through Disaster Betting

Apr 27, 2025

Los Angeles Wildfires A Reflection Of Our Times Through Disaster Betting

Apr 27, 2025 -

Wildfire Wagers Examining The Implications Of Betting On The La Fires

Apr 27, 2025

Wildfire Wagers Examining The Implications Of Betting On The La Fires

Apr 27, 2025