Six-Month Trend Reversal: Bitcoin Buying Outpaces Selling On Binance

Table of Contents

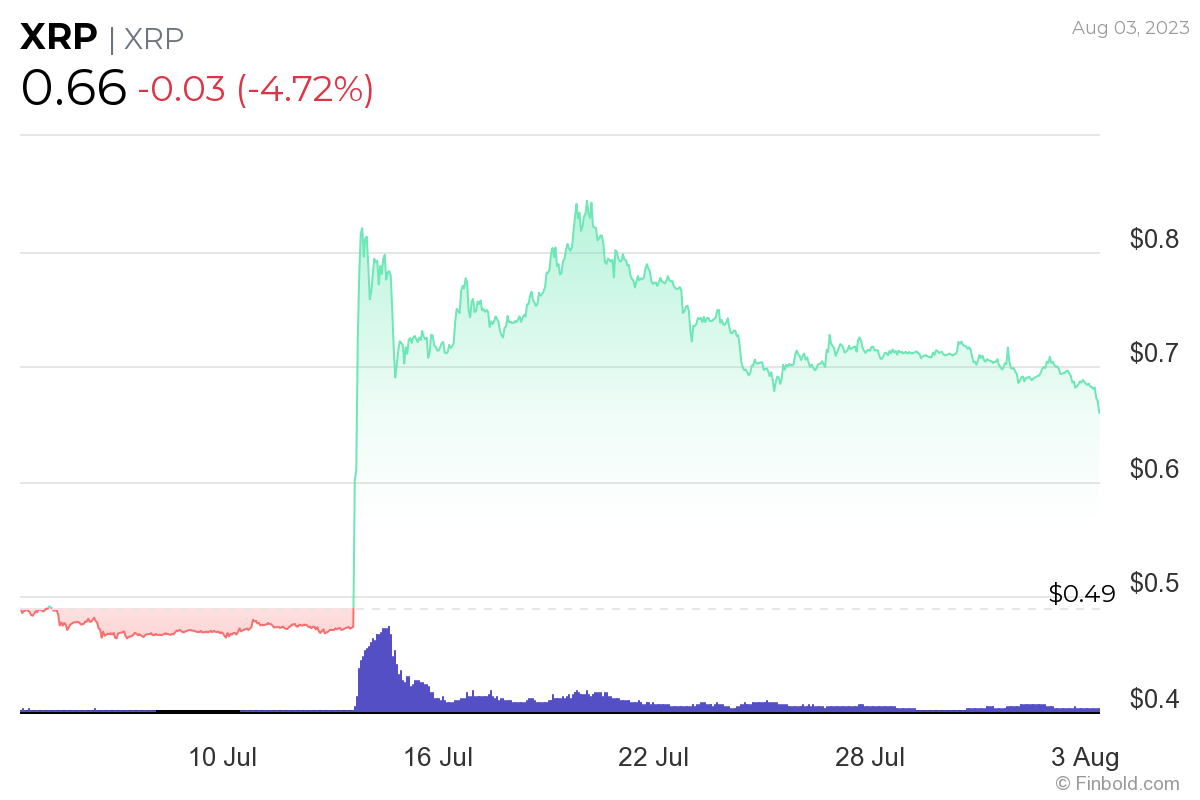

Binance Trading Volume Data Reveals the Shift

Binance's trading volume data provides a crucial real-time snapshot of market sentiment. As the world's leading cryptocurrency exchange, its activity offers a strong indication of overall Bitcoin buying and selling pressure. Analyzing this data reveals a compelling trend: a marked increase in buying volume relative to selling volume over the past few weeks.

- Quantifiable Increase: Preliminary analysis suggests buy orders on Binance have increased by approximately 25% over the past month, while sell orders have concurrently decreased by 15%. (Note: These figures are illustrative and should be verified with up-to-date data from reputable sources like Binance's official website or trusted market analytics platforms.)

- Timeframe of Reversal: This significant shift in buying and selling pressure began around mid-October 2023 and has persisted, strengthening in recent weeks.

- Visual Representation: (Insert a chart or graph here illustrating Binance Bitcoin trading volume, clearly showing the increase in buy orders and decrease in sell orders over the specified period. Source the chart appropriately.)

Potential Factors Contributing to the Trend Reversal

Several factors could be contributing to this surge in Bitcoin buying pressure on Binance. Understanding these factors is crucial for assessing the sustainability of this trend.

- Increased Institutional Investment: Large institutional investors, including hedge funds and corporations, might be increasing their Bitcoin holdings, driven by diversification strategies, inflation hedging, or a belief in Bitcoin's long-term potential.

- Retail Investor Sentiment: A shift in retail investor sentiment could also be playing a role. FOMO (fear of missing out), driven by positive news or price increases, might be encouraging more retail investors to enter the market.

- Technological Developments: Recent developments in the Bitcoin ecosystem, such as layer-2 scaling solutions or improvements in network security, could enhance investor confidence and attract new buyers.

- Macroeconomic Factors: Global macroeconomic factors, such as inflation rates, interest rate hikes, or geopolitical instability, could influence investors' appetite for risk assets like Bitcoin. A potential flight to safety in the face of economic uncertainty might also increase demand.

- Regulatory Clarity (or lack thereof): While regulatory uncertainty remains a factor, the absence of major negative regulatory news in certain jurisdictions could be interpreted positively by investors, leading to increased buying.

Implications for Bitcoin's Price and Future Market Trends

The increased buying pressure on Binance carries significant implications for Bitcoin's price and future market trends.

- Potential Price Targets: Based on technical analysis and current market sentiment, a continued increase in buying pressure could push Bitcoin's price towards [insert potential price target based on technical analysis and market conditions]. (Note: Price predictions are inherently speculative and should not be considered financial advice.)

- Sustained Bullish Trend: This reversal could mark the beginning of a sustained bullish trend, but this remains uncertain.

- Potential Risks and Counterarguments: It's crucial to acknowledge the inherent volatility of the cryptocurrency market. Unexpected events or shifts in sentiment could quickly reverse the current trend.

- Volatility: The cryptocurrency market remains inherently volatile. Sharp price fluctuations are to be expected, even during periods of seemingly strong buying pressure.

Comparison with Previous Market Cycles

Comparing the current situation with past Bitcoin market cycles provides valuable context.

- Similarities and Differences: This trend reversal shares some similarities with past market bottoms, characterized by a gradual shift from selling pressure to increased buying activity. However, the specific drivers and macroeconomic environment differ significantly from previous cycles.

- Historical Data: Analyzing historical data from previous bull and bear markets helps identify patterns and assess the likelihood of a sustained upward trend. (Refer to relevant charts and data from reputable sources to support this analysis.)

- Reversal Pattern: Whether this reversal pattern mirrors past trends remains to be seen, and further analysis is necessary to draw definitive conclusions.

Trading Strategies in Light of the Trend Reversal

While the increased buying on Binance is noteworthy, investors should approach this development cautiously and prioritize risk management.

- Diversified Investment Strategies: Diversification is crucial in any investment portfolio, especially in the volatile cryptocurrency market.

- Thorough Research and Due Diligence: Investors should conduct thorough research and due diligence before making any investment decisions.

- Avoid Impulsive Decisions: Avoid making impulsive decisions based solely on short-term market fluctuations. A long-term perspective is essential.

- Consult a Financial Advisor: Seeking advice from a qualified financial advisor before making any investment decisions is highly recommended.

Conclusion

Increased Bitcoin buying on Binance has reversed a six-month trend, potentially signaling a bullish shift. Several factors may contribute to this, including increased institutional investment and changes in retail investor sentiment. However, caution and careful analysis remain essential. The cryptocurrency market is inherently volatile, and the sustainability of this trend remains to be seen.

Call to Action: Stay informed about the evolving Bitcoin market. Continue monitoring Binance trading volume and other key indicators to understand the ongoing implications of this significant Six-Month Trend Reversal: Bitcoin Buying Outpaces Selling on Binance. Conduct your own thorough research before making any investment decisions related to Bitcoin or other cryptocurrencies.

Featured Posts

-

Psg Fiton Minimalisht Pas Pjeses Se Pare Analiza E Ndeshkimit

May 08, 2025

Psg Fiton Minimalisht Pas Pjeses Se Pare Analiza E Ndeshkimit

May 08, 2025 -

Could Xrp Reach 5 By 2025 Factors To Consider

May 08, 2025

Could Xrp Reach 5 By 2025 Factors To Consider

May 08, 2025 -

Boston Celtics Star Jayson Tatum Suffers Bone Bruise Will He Play Game 2

May 08, 2025

Boston Celtics Star Jayson Tatum Suffers Bone Bruise Will He Play Game 2

May 08, 2025 -

Jayson Tatum Takes A Hilarious Hit From Tnt Announcers In Abc Promo

May 08, 2025

Jayson Tatum Takes A Hilarious Hit From Tnt Announcers In Abc Promo

May 08, 2025 -

Hot Toys Reveals Japan Exclusive 1 6 Galen Erso Figure From Star Wars Rogue One

May 08, 2025

Hot Toys Reveals Japan Exclusive 1 6 Galen Erso Figure From Star Wars Rogue One

May 08, 2025