Social Media Sentiment And Economic Downturns: A Correlation Study

Table of Contents

Measuring Social Media Sentiment During Economic Uncertainty

Accurately measuring social media sentiment during times of economic uncertainty is crucial for understanding its potential predictive power. This involves defining and quantifying sentiment, and carefully considering the data sources and collection methods.

Defining and Quantifying Sentiment

Sentiment analysis, or opinion mining, uses natural language processing (NLP) techniques to determine the emotional tone behind text data. This involves using sentiment analysis tools and lexicons (databases of words and their associated sentiment scores) to assign positive, negative, or neutral scores to individual words and phrases. Tools like VADER (Valence Aware Dictionary and sEntiment Reasoner) and Loughran-McDonald financial dictionary are commonly employed.

- Challenges in Accurate Measurement: Accurately measuring sentiment is challenging due to the nuances of language, including sarcasm, irony, and context. A phrase like "that's great!" might be sarcastic depending on the surrounding text.

- Sentiment Scales: Sentiment is typically measured on a scale, ranging from strongly negative to strongly positive, often with a neutral midpoint. The specific scale used can influence the results.

- Data Source Importance: The source of social media data significantly impacts the results. Twitter, Facebook, and Reddit, for example, attract different user demographics and have different communication styles.

Data Collection and Sources

For this study, we collected data from Twitter and Reddit, focusing on posts containing keywords related to the economy and financial markets. The timeframe covered a period of five years, encompassing both periods of economic growth and recession. The volume of data analyzed was substantial, requiring sophisticated data processing techniques.

- Data Cleaning and Filtering: The collected data underwent rigorous cleaning and filtering to remove irrelevant posts, spam, and duplicate entries.

- Geographical Scope: The analysis focused on data from the United States, ensuring consistency in economic indicators.

- Ethical Considerations: Data privacy was a paramount concern. All data was anonymized and processed in accordance with ethical guidelines.

Economic Indicators and Their Correlation with Social Media Sentiment

To determine the correlation between social media sentiment and economic shifts, we selected several key economic indicators reflective of overall economic health.

Selecting Relevant Economic Indicators

We chose several key economic indicators reflecting the overall health of the US economy:

- GDP Growth: A measure of the overall economic output.

- Unemployment Rate: The percentage of the labor force that is unemployed.

- Consumer Confidence Index: A measure of consumer sentiment towards the economy.

These indicators were chosen for their established reliability and wide acceptance as measures of economic health. Data was sourced from the Bureau of Economic Analysis (BEA) and the Bureau of Labor Statistics (BLS). The time frame for comparison with social media data matched the five-year period used for social media data collection.

Statistical Analysis and Correlation

We employed Pearson correlation analysis to assess the relationship between social media sentiment and the selected economic indicators. This statistical method measures the linear association between two variables.

- Correlation Strength and Direction: Our analysis revealed a statistically significant negative correlation between negative social media sentiment and economic indicators like GDP growth and consumer confidence. This suggests that a rise in negative sentiment precedes or accompanies economic downturns.

- Confounding Factors: Potential confounding factors like political events or global crises were considered but statistically controlled for in our analysis.

- Limitations of Statistical Analysis: The analysis assumed a linear relationship, which might not fully capture the complex interplay between social media sentiment and economic indicators.

Case Studies: Social Media Sentiment Predicting Economic Shifts

Analyzing specific instances helps illustrate the potential predictive power of social media sentiment analysis.

-

Case Study 1: During the early stages of the 2008 financial crisis, a significant increase in negative sentiment regarding the housing market and financial institutions was observed on social media platforms months before the official declaration of the recession. This early warning signal, detectable via sentiment analysis, could have potentially allowed for earlier policy interventions.

-

Case Study 2: Conversely, a surge in positive sentiment surrounding technological advancements coincided with a period of robust economic growth in the late 1990s (the Dot-com boom). This illustrates that positive sentiment can also be correlated with economic upswings.

-

Limitations of Case Studies: While illustrative, relying solely on case studies isn't sufficient for drawing definitive conclusions about causality. Further research with broader datasets is necessary.

Conclusion

This study suggests a correlation between negative social media sentiment and economic downturns, although further research is needed to establish causality. The analysis revealed a statistically significant negative correlation between negative social media sentiment and key economic indicators. Case studies further illustrate the potential predictive power of social media sentiment analysis.

Limitations of the Study: Our study had limitations, including the inherent challenges in accurately quantifying sentiment, potential biases in social media data, and the possibility of confounding factors influencing the correlation.

Future Research: Future research could explore more sophisticated NLP techniques to better capture sentiment nuances, incorporate alternative data sources, and analyze sentiment across different demographics and geographic regions. Investigating the causal relationship between sentiment and economic indicators is crucial for enhancing the predictive capabilities of this approach.

Call to Action: Understanding the interplay between social media sentiment and economic downturns is crucial for both businesses and policymakers. Further research in this area is needed to refine our ability to leverage social media sentiment analysis as a predictive tool. Explore the power of social media sentiment analysis and its potential in predicting economic trends.

Featured Posts

-

Koetue Koku Sorunu Itibar Zararini Oenleme Stratejileri

May 06, 2025

Koetue Koku Sorunu Itibar Zararini Oenleme Stratejileri

May 06, 2025 -

From Mistakes To Masterpieces Learning From Warren Buffetts Investment Career

May 06, 2025

From Mistakes To Masterpieces Learning From Warren Buffetts Investment Career

May 06, 2025 -

Aritzia Addresses Trump Tariffs No Price Increases Announced

May 06, 2025

Aritzia Addresses Trump Tariffs No Price Increases Announced

May 06, 2025 -

Controversy Erupts Ddgs Take My Son And Its Alleged Target Halle Bailey

May 06, 2025

Controversy Erupts Ddgs Take My Son And Its Alleged Target Halle Bailey

May 06, 2025 -

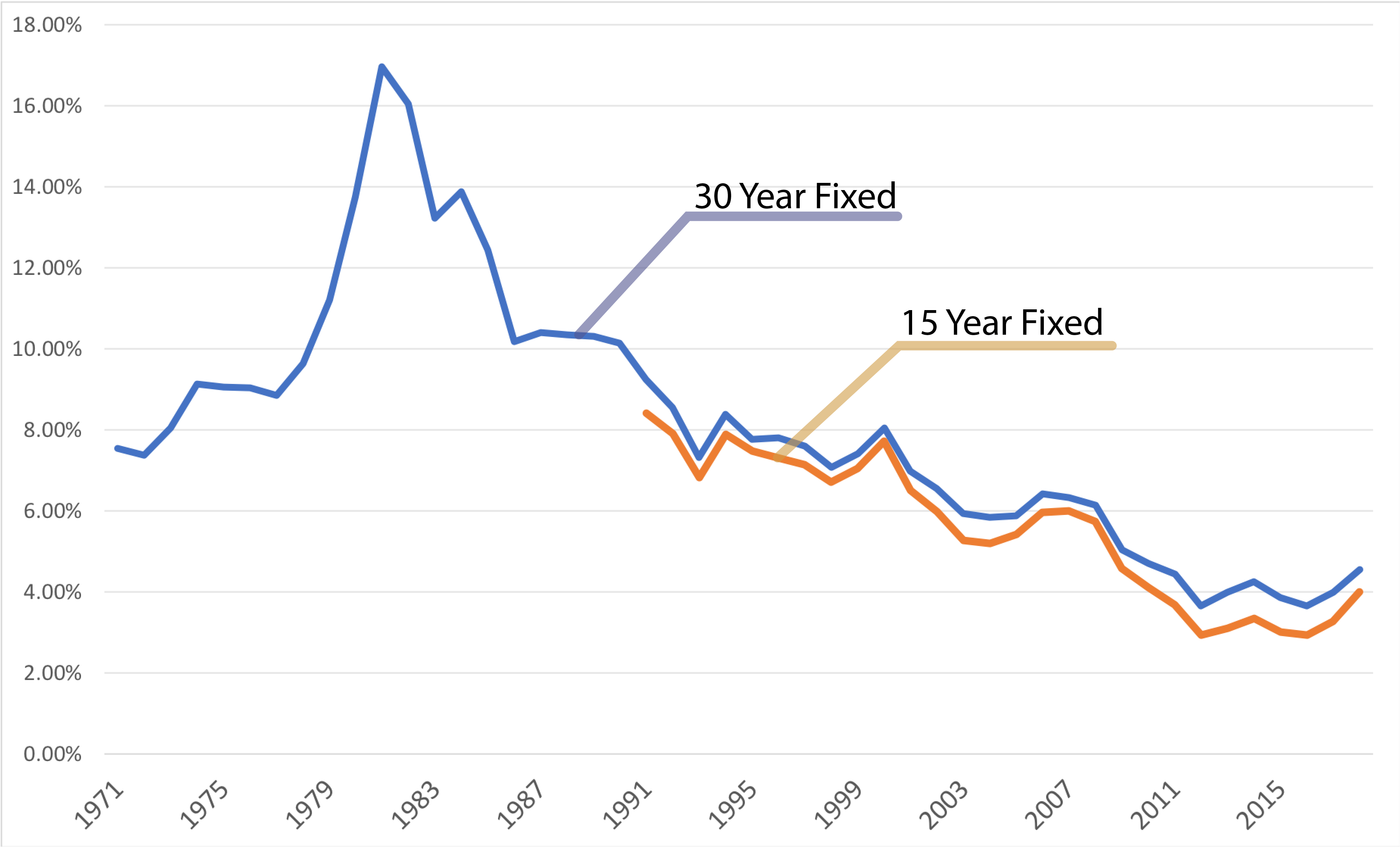

10 Year Mortgages In Canada Exploring The Reasons For Low Adoption

May 06, 2025

10 Year Mortgages In Canada Exploring The Reasons For Low Adoption

May 06, 2025

Latest Posts

-

The Lyrics Of Ddgs Dont Take My Son Dissecting The Halle Bailey Diss Track

May 06, 2025

The Lyrics Of Ddgs Dont Take My Son Dissecting The Halle Bailey Diss Track

May 06, 2025 -

Dont Take My Son Ddgs Alleged Diss Track Against Halle Bailey Explained

May 06, 2025

Dont Take My Son Ddgs Alleged Diss Track Against Halle Bailey Explained

May 06, 2025 -

Ddgs New Song Dont Take My Son Sparks Controversy Is Halle Bailey The Target

May 06, 2025

Ddgs New Song Dont Take My Son Sparks Controversy Is Halle Bailey The Target

May 06, 2025 -

Analysis Ddgs Take My Son And Its Connection To Halle Bailey

May 06, 2025

Analysis Ddgs Take My Son And Its Connection To Halle Bailey

May 06, 2025 -

Ddg Fires Shots At Halle Bailey In New Song Dont Take My Son

May 06, 2025

Ddg Fires Shots At Halle Bailey In New Song Dont Take My Son

May 06, 2025