Stock Market Today: Dow, S&P 500 Live Updates April 23rd

Table of Contents

Dow Jones Industrial Average (DJIA) Performance

Opening Bell

The Dow Jones Industrial Average opened at 33,820.12, a 0.8% increase compared to yesterday's closing value of 33,531.47. This positive opening suggests a potential recovery from recent market anxieties.

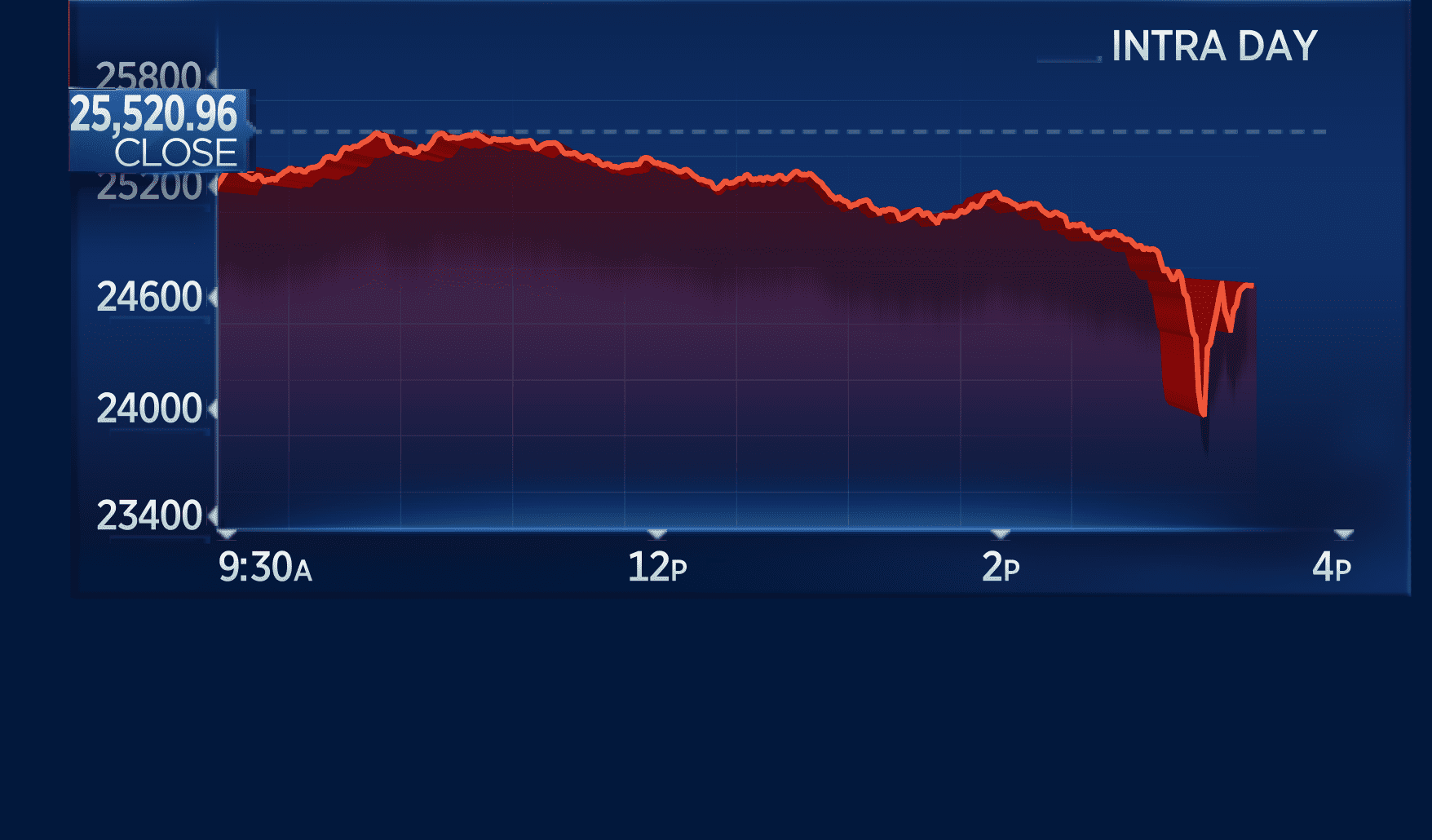

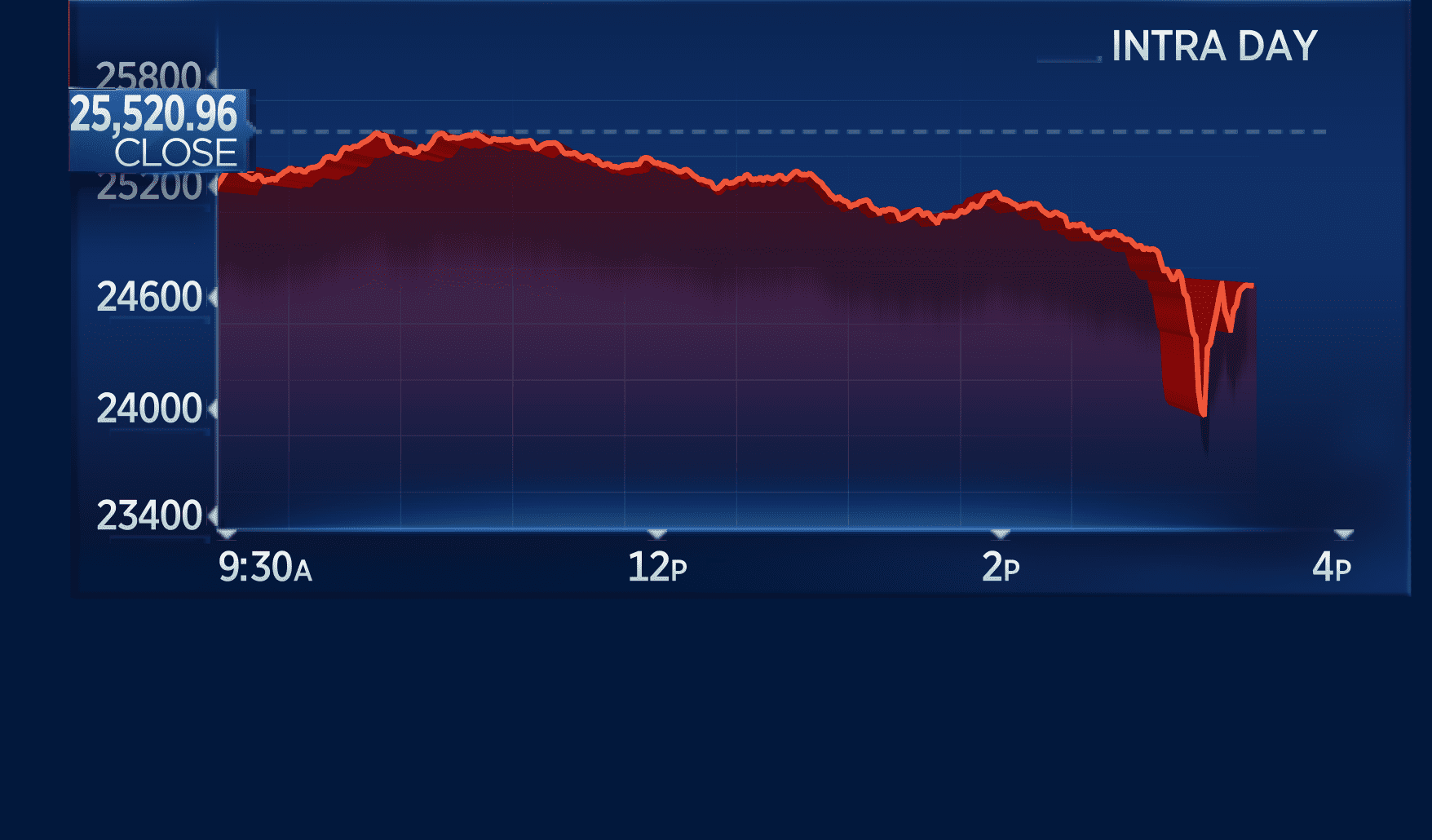

Intraday Fluctuations

Throughout the day, the Dow experienced several fluctuations. Around midday, a surge in tech stocks pushed the index up to 34,050. However, afternoon trading saw some profit-taking, leading to a slight dip before closing at 33,985.50.

- Key factors driving fluctuations:

- Release of better-than-expected Q1 earnings reports from several blue-chip companies.

- Positive sentiment following the Federal Reserve's comments on potential interest rate pauses.

- Geopolitical stability in a key trading region eased concerns about supply chain disruptions.

Sector Performance

The technology sector led the gains in the Dow today, followed by strong performances in the industrial and consumer discretionary sectors. Conversely, the energy and utility sectors experienced minor declines.

-

Top-performing sectors:

- Technology (AAPL, MSFT, NVDA showed significant gains)

- Industrials (Strong performance from companies like CAT and UNP)

- Consumer Discretionary (Retail stocks benefited from positive consumer confidence reports)

-

Bottom-performing sectors:

- Energy (Oil prices experienced a slight downturn, impacting energy company stocks)

- Utilities (Generally lower returns due to increasing interest rates)

Key Companies Driving Movement

Several companies significantly impacted the Dow's movement today. Apple (AAPL) and Microsoft (MSFT) led the technological surge, while Caterpillar (CAT) contributed to the strong industrial sector performance. Conversely, Chevron (CVX) contributed to the energy sector's slight decline.

- Key Companies and their Impact:

- Apple (AAPL): Strong Q1 earnings beat expectations, boosting the stock price and overall market sentiment.

- Microsoft (MSFT): Positive cloud computing revenue growth fueled its stock price increase.

- Caterpillar (CAT): Strong orders and positive outlook for infrastructure spending underpinned gains.

- Chevron (CVX): Slight decrease in oil prices and a minor profit warning impacted its stock price.

S&P 500 Index Performance

Opening and Closing Values

The S&P 500 opened at 4145.22 and closed at 4161.85, representing a 0.9% increase compared to the previous day's close. This mirrored the overall positive trend seen in the Dow.

Market Breadth

Market breadth was generally positive, with advancing stocks outnumbering declining stocks by a significant margin. This indicates a broad-based uptrend, not just driven by a few key stocks.

- Significance of breadth figures: Positive market breadth signifies strong overall market sentiment and indicates sustainable growth.

Sector-Specific Analysis (S&P 500)

Similar to the Dow, the S&P 500 saw strong performance in the technology and industrial sectors. The consumer staples sector also showed notable gains, slightly outperforming its Dow counterpart.

-

Top-performing sectors (S&P 500):

- Technology (Broad-based gains among tech giants and smaller companies)

- Industrials (Benefiting from positive economic outlook and infrastructure spending)

- Consumer Staples (Defensiveness provided support in a generally positive market)

-

Bottom-performing sectors (S&P 500):

- Utilities (Consistent with the Dow, utilities were impacted by higher interest rates)

- Materials (Moderately impacted by slight global economic uncertainty)

Impact of Economic News and Events

Economic Data Releases

The release of better-than-expected consumer confidence data this morning contributed positively to market sentiment, driving gains in both the Dow and S&P 500.

- Impact of data releases: Positive consumer confidence data indicated a robust economic outlook, which encouraged investor optimism.

Geopolitical Factors

No major geopolitical events significantly impacted the market today. The prevailing sentiment remained relatively stable.

Company-Specific News

Positive Q1 earnings from several large technology companies boosted overall market confidence and contributed to the positive performance of both the Dow and S&P 500.

- Key Company Announcements and Impact: Solid earnings reports from companies like Apple (AAPL) and Microsoft (MSFT) set a positive tone for the day's trading.

Conclusion: Stock Market Wrap-Up for April 23rd

Today's stock market saw a positive close for both the Dow Jones Industrial Average and the S&P 500, driven largely by strong Q1 earnings reports, positive economic data, and a generally stable geopolitical environment. Technology and industrial sectors led the gains, while energy and utilities showed slight declines. For continuous updates on the Dow and S&P 500, check back regularly for our daily Stock Market Today reports. Stay tuned for tomorrow's Stock Market Today update!

Featured Posts

-

Is Cantor Leading A 3 Billion Crypto Spac With Tether And Soft Bank

Apr 24, 2025

Is Cantor Leading A 3 Billion Crypto Spac With Tether And Soft Bank

Apr 24, 2025 -

Pope Francis Impact A Globalized But Fractured Catholic Church

Apr 24, 2025

Pope Francis Impact A Globalized But Fractured Catholic Church

Apr 24, 2025 -

Bold And Beautiful Hope Faces A Double Shocker Liams Pledge To Steffy Lunas Impact

Apr 24, 2025

Bold And Beautiful Hope Faces A Double Shocker Liams Pledge To Steffy Lunas Impact

Apr 24, 2025 -

Execs Office365 Accounts Targeted Crook Makes Millions Feds Say

Apr 24, 2025

Execs Office365 Accounts Targeted Crook Makes Millions Feds Say

Apr 24, 2025 -

Zuckerbergs Next Chapter Navigating The Trump Presidency

Apr 24, 2025

Zuckerbergs Next Chapter Navigating The Trump Presidency

Apr 24, 2025

Latest Posts

-

Faber Backtracks On Asylum Volunteer Awards 100 Support Confirmed

May 12, 2025

Faber Backtracks On Asylum Volunteer Awards 100 Support Confirmed

May 12, 2025 -

Calls Grow For Action Parliament Addresses Surge In Undocumented Labor Migration

May 12, 2025

Calls Grow For Action Parliament Addresses Surge In Undocumented Labor Migration

May 12, 2025 -

Fabers U Turn Full Support For Royal Distinctions For Asylum Volunteer Program

May 12, 2025

Fabers U Turn Full Support For Royal Distinctions For Asylum Volunteer Program

May 12, 2025 -

Mehr Effizienz In Asylunterkuenften Beiraete Schlagen Massnahmen Zur Kostenreduktion Vor

May 12, 2025

Mehr Effizienz In Asylunterkuenften Beiraete Schlagen Massnahmen Zur Kostenreduktion Vor

May 12, 2025 -

Stop The Influx Parliament Challenges Migration Minister On Undocumented Workers

May 12, 2025

Stop The Influx Parliament Challenges Migration Minister On Undocumented Workers

May 12, 2025