Is Cantor Leading A $3 Billion Crypto SPAC With Tether And SoftBank?

Table of Contents

Cantor Fitzgerald's Role and Reputation

Cantor Fitzgerald, a veteran player in global financial markets, is known for its expertise in underwriting, trading, and mergers & acquisitions. Their potential involvement in a crypto SPAC suggests a significant shift towards embracing the burgeoning digital asset landscape. Why would a firm with Cantor's history venture into the crypto sphere with such a large-scale initiative?

Several factors may motivate Cantor's potential leadership of this crypto SPAC:

- Experience in underwriting and mergers & acquisitions: Cantor's decades of experience in these areas provide invaluable expertise in navigating the complexities of a large-scale deal.

- Established network within the financial industry: Their extensive network could be crucial in attracting investors and securing favorable terms for the SPAC.

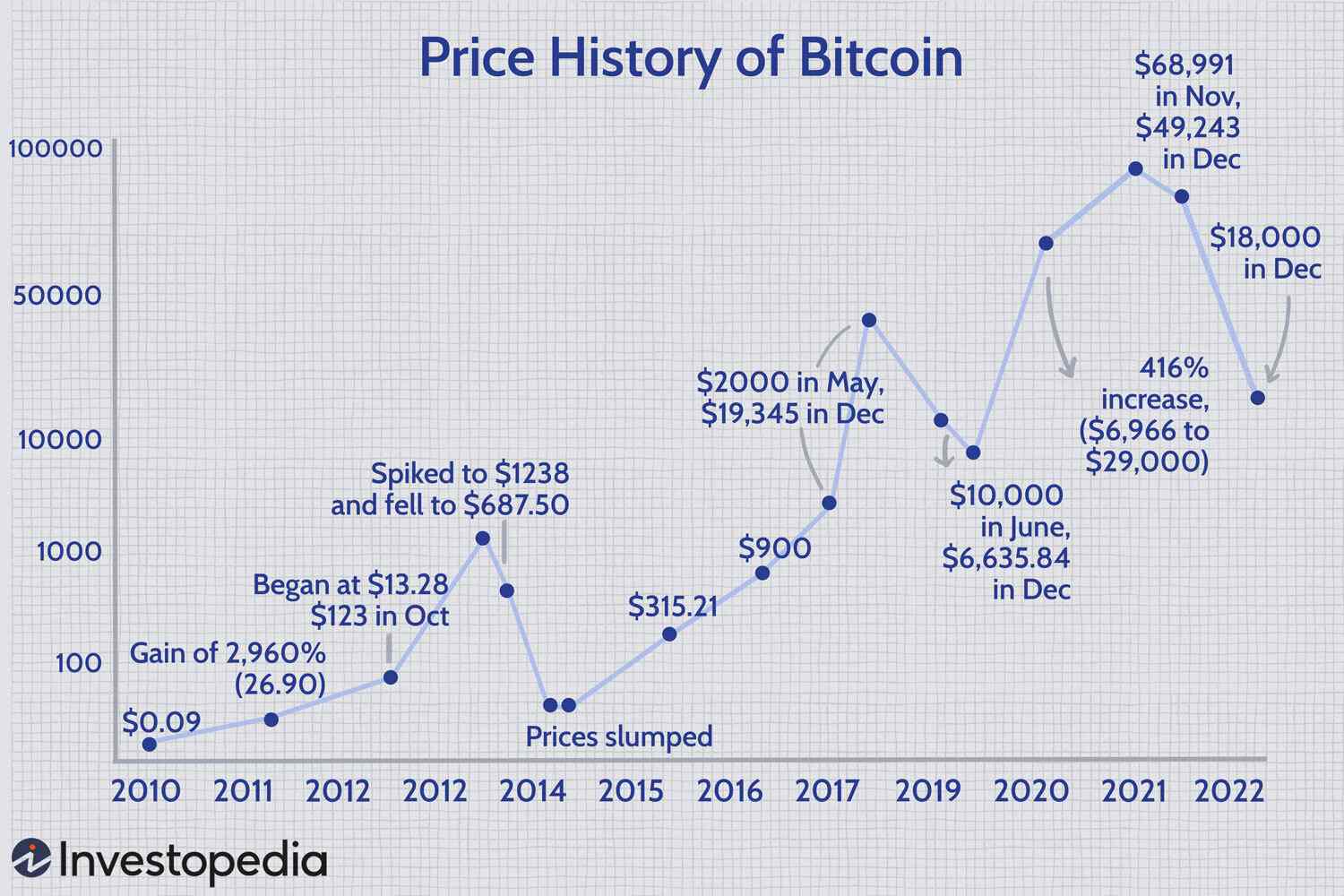

- Potential for high returns in the growing crypto market: The crypto market's explosive growth presents lucrative investment opportunities, driving established players like Cantor to participate.

However, Cantor's reputation within the relatively young crypto community remains to be fully established. While their financial prowess is undeniable, their level of crypto-specific experience needs to be considered.

Tether's Involvement and the Stablecoin Question

Tether, the largest stablecoin by market capitalization, adds another layer of complexity to this potential $3 billion crypto SPAC. Its role remains unclear: Is Tether a significant investor, a strategic partner, or simply a tangential player?

The inclusion of Tether is particularly noteworthy given the ongoing controversies surrounding its reserves and the stability of its peg to the US dollar. This raises important questions:

- Tether's market capitalization and influence: Tether's significant market share could influence the SPAC's success, potentially attracting investors and facilitating acquisitions.

- Concerns about Tether's transparency and regulatory scrutiny: The ongoing regulatory scrutiny surrounding Tether's operations introduces significant risks.

- Potential impact of Tether's involvement on the SPAC's success: The controversies surrounding Tether could negatively impact the SPAC's ability to raise capital and attract reputable partners. The regulatory uncertainty is a significant headwind.

SoftBank's Strategic Investment and Vision

SoftBank's potential involvement in a Cantor-led $3 billion crypto SPAC aligns with its history of bold, high-risk investments in emerging technologies. Known for its significant investments in various tech sectors, SoftBank's interest highlights the growing institutional acceptance of cryptocurrency.

SoftBank's potential motives could include:

- SoftBank's track record of high-risk, high-reward investments: This strategy aligns perfectly with the volatile yet potentially lucrative cryptocurrency market.

- SoftBank's vision for the future of cryptocurrency and blockchain technology: They likely see significant long-term potential in the space.

- Potential synergies between SoftBank's portfolio companies and the SPAC's target: Integrating a new crypto company into their existing portfolio could generate substantial synergies.

Potential Target Companies and Market Impact

A $3 billion SPAC has enormous acquisition power. Potential targets for this massive deal could include leading cryptocurrency exchanges, cutting-edge blockchain infrastructure providers, or innovative decentralized finance (DeFi) projects.

The impact of such an acquisition could be significant:

- Potential for market consolidation and increased competition: The acquisition could reshape the crypto landscape, leading to increased competition or even consolidation.

- Impact on cryptocurrency adoption and mainstream acceptance: A successful acquisition could boost mainstream acceptance of cryptocurrencies.

- Possible regulatory implications of the acquisition: The acquisition would likely draw increased regulatory scrutiny, potentially influencing future regulations within the industry.

The Risks and Uncertainties of the Deal

While the potential rewards are significant, investing in a crypto SPAC, especially one of this magnitude, comes with substantial risks:

- Regulatory hurdles and compliance requirements: Navigating the complex regulatory landscape of the crypto industry poses a major challenge.

- Market volatility and potential for price fluctuations: The inherent volatility of the crypto market significantly impacts the SPAC's success.

- Difficulties in securing funding and achieving deal closure: Securing sufficient funding and successfully completing the deal will be significant undertakings.

Unraveling the Cantor-Led $3 Billion Crypto SPAC Mystery

The potential for Cantor leading a $3 billion crypto SPAC with Tether and SoftBank presents a compelling narrative, rife with both immense potential and significant risks. The involvement of such prominent players signals a growing institutional interest in the cryptocurrency space, but the uncertainties surrounding Tether's role and the overall market volatility remain significant concerns. The potential target companies and the impact on the crypto market remain to be seen.

To stay informed about the latest developments regarding Cantor leading a $3 Billion Crypto SPAC with Tether and SoftBank, subscribe to our newsletter, follow us on social media, and check back for updates on this unfolding story. The potential impact of this deal on the future of the cryptocurrency market could be profound.

Featured Posts

-

Trumps Trade Policy And The Fed How They Affect Bitcoins Value

Apr 24, 2025

Trumps Trade Policy And The Fed How They Affect Bitcoins Value

Apr 24, 2025 -

La Palisades Fire Which Celebrities Lost Their Homes

Apr 24, 2025

La Palisades Fire Which Celebrities Lost Their Homes

Apr 24, 2025 -

Zuckerbergs Next Chapter Navigating The Trump Presidency

Apr 24, 2025

Zuckerbergs Next Chapter Navigating The Trump Presidency

Apr 24, 2025 -

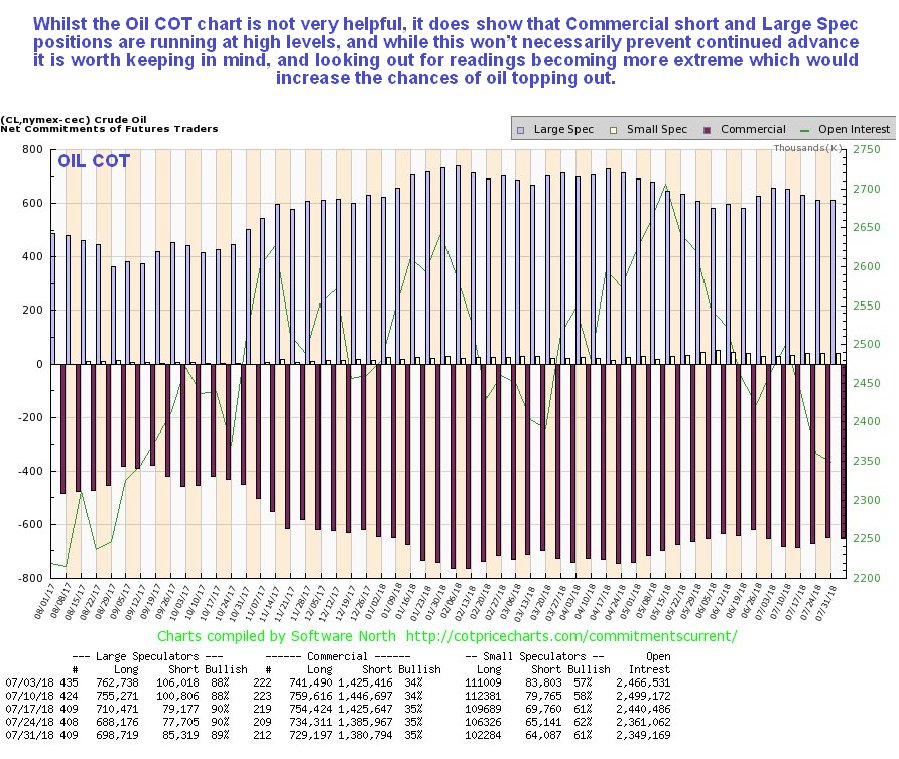

Oil Market Update April 23 Price Trends And Analysis

Apr 24, 2025

Oil Market Update April 23 Price Trends And Analysis

Apr 24, 2025 -

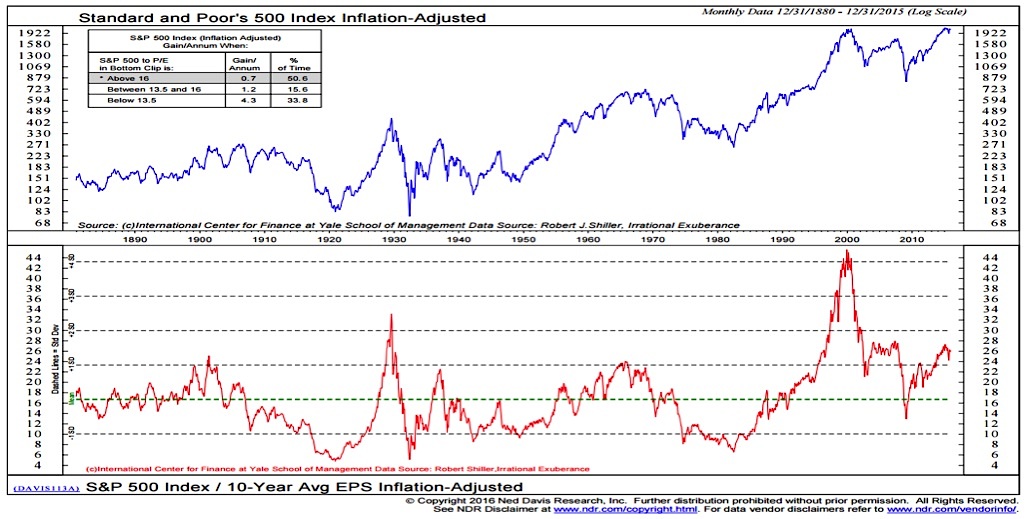

Addressing Investor Concerns Bof A On Elevated Stock Market Valuations

Apr 24, 2025

Addressing Investor Concerns Bof A On Elevated Stock Market Valuations

Apr 24, 2025

Latest Posts

-

Ufcs Biggest Surprise Jeremy Stephens Unexpected Return

May 12, 2025

Ufcs Biggest Surprise Jeremy Stephens Unexpected Return

May 12, 2025 -

Freire Ready For Aldo Bellator Champion Eyes Next Challenge

May 12, 2025

Freire Ready For Aldo Bellator Champion Eyes Next Challenge

May 12, 2025 -

Shane Lowry And Rory Mc Ilroy To Play Zurich Classic

May 12, 2025

Shane Lowry And Rory Mc Ilroy To Play Zurich Classic

May 12, 2025 -

The Masters Aftermath Shane Lowrys Message Of Support For Rory Mc Ilroy

May 12, 2025

The Masters Aftermath Shane Lowrys Message Of Support For Rory Mc Ilroy

May 12, 2025 -

Lowrys Encouraging Words For Mc Ilroy Post Masters Highlight Their Strong Bond

May 12, 2025

Lowrys Encouraging Words For Mc Ilroy Post Masters Highlight Their Strong Bond

May 12, 2025