Stock Market Valuation Anxiety? BofA Offers Reassurance

Table of Contents

BofA's Key Arguments for a Less Bearish Outlook

BofA's analysis suggests a less pessimistic outlook on stock market valuations than some other analysts predict. Their conclusions are based on a detailed assessment of various market indicators and a consideration of macroeconomic factors.

Assessing Current Valuation Metrics

BofA employs a multi-faceted approach to evaluating current market valuations, going beyond simple price-to-earnings ratios (P/E). They incorporate metrics like the cyclically adjusted price-to-earnings ratio (CAPE), which smooths out earnings fluctuations over a longer period, providing a more stable valuation benchmark. Their analysis also considers other key valuation metrics, adjusting them for the current economic climate.

- BofA's findings: While acknowledging elevated P/E ratios in some sectors, BofA's analysis suggests that when considering factors like interest rates and future earnings growth, the overall market isn't as overvalued as some fear. Their report cites a projected moderate earnings growth that helps offset current high valuations.

- Adjustments for economic conditions: BofA's models account for anticipated inflation and interest rate changes, predicting a gradual slowdown in inflation and a potential plateauing of interest rate hikes. This significantly impacts their valuation calculations. They adjust traditional valuation metrics to reflect these anticipated changes, providing a more forward-looking assessment.

The Role of Interest Rates and Inflation

Interest rate hikes and persistent inflation are major factors influencing stock market valuations. BofA's analysis carefully considers these factors.

- BofA's approach: Their models incorporate projected interest rate paths and inflation forecasts to determine their impact on future corporate earnings and discount rates used in valuation calculations. They've built scenarios encompassing varying inflation and interest rate trajectories.

- Differing predictions: Unlike some analysts who predict a sharp economic downturn leading to significantly lower valuations, BofA anticipates a more moderate slowdown, allowing for continued, albeit slower, earnings growth. This distinction explains their more optimistic outlook on stock market valuations.

Sector-Specific Analysis and Opportunities

BofA's analysis doesn't focus solely on overall market valuation. They also provide sector-specific insights, identifying potential opportunities.

- Undervalued sectors: Their report highlights sectors like energy and certain segments of the technology sector as potentially undervalued, given their strong growth prospects and resilience against economic headwinds.

- Rationale and projections: BofA supports these claims with detailed data, including projected earnings growth and industry-specific analyses. They emphasize the long-term growth potential of these sectors, minimizing near-term valuation concerns. For example, they cite the sustained demand for energy transition technologies as a driver of growth in certain energy sub-sectors.

Addressing Investor Concerns About Stock Market Valuation Anxiety

Many investors are understandably anxious about market valuations. Let's address some common concerns.

Common Misconceptions About Market Valuation

Several misconceptions contribute to stock market valuation anxiety.

- Fear of a market crash: While market corrections are inevitable, BofA's analysis suggests a moderate slowdown rather than a catastrophic crash, provided that inflation and interest rates behave as projected.

- Concerns about high P/E ratios: High P/E ratios alone don't necessarily indicate an overvalued market. BofA stresses the importance of examining other valuation metrics and considering future earnings growth.

The Importance of Long-Term Investing

Short-term market fluctuations are a normal part of investing.

- Benefits of long-term investing: A long-term perspective mitigates the impact of short-term volatility. Historically, the market has consistently rewarded patient investors over the long term.

- Historical examples: Numerous historical examples demonstrate that market downturns are eventually followed by periods of significant growth. Holding investments during these periods is crucial for maximizing returns.

Diversification and Risk Management Strategies

Effective diversification and risk management are critical for navigating market uncertainty.

- Diversification: Spreading investments across different asset classes and sectors reduces exposure to any single market segment's volatility.

- Risk management: Employing strategies such as dollar-cost averaging and setting stop-loss orders can help mitigate potential losses and manage risk effectively.

Conclusion

BofA's analysis offers reassurance to investors concerned about stock market valuations. While acknowledging elevated valuations in certain sectors, their comprehensive assessment, considering factors like interest rates, inflation, and future earnings growth, paints a less bearish picture. Understanding valuation metrics, adopting a long-term investment strategy, and employing effective diversification and risk management are crucial for navigating market uncertainty and alleviating stock market valuation anxiety. Don't let stock market valuation anxiety control your investments. Learn more about BofA's insights and take control of your financial future! [Link to BofA report/relevant resources].

Featured Posts

-

Russias Victory Day Ceasefire A Look At The Details

May 09, 2025

Russias Victory Day Ceasefire A Look At The Details

May 09, 2025 -

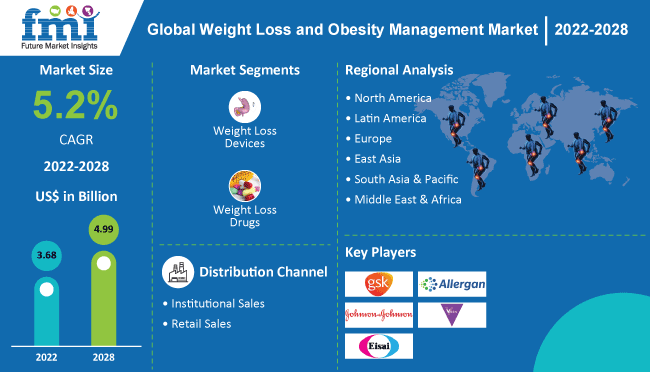

Weight Watchers Bankruptcy Impact Of The Weight Loss Drug Market

May 09, 2025

Weight Watchers Bankruptcy Impact Of The Weight Loss Drug Market

May 09, 2025 -

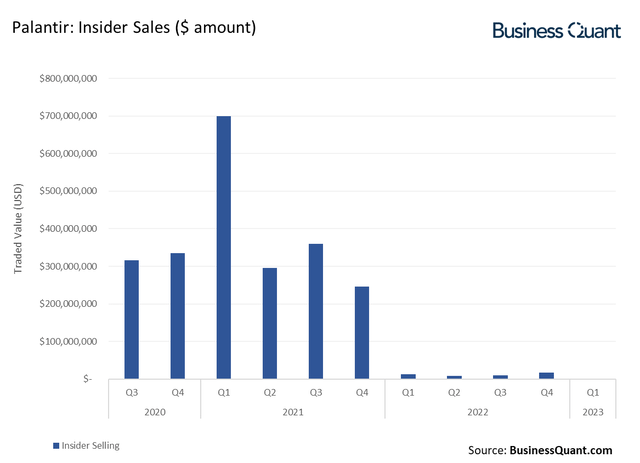

Should You Buy Palantir Stock After Its 30 Fall

May 09, 2025

Should You Buy Palantir Stock After Its 30 Fall

May 09, 2025 -

Mariah The Scientists Burning Blue Song Breakdown And Review

May 09, 2025

Mariah The Scientists Burning Blue Song Breakdown And Review

May 09, 2025 -

Stephen Kings Best Short Tv Series A Binge Worthy 5 Hour Watch

May 09, 2025

Stephen Kings Best Short Tv Series A Binge Worthy 5 Hour Watch

May 09, 2025