Stock Market Valuations: BofA Explains Why Investors Shouldn't Worry

Table of Contents

Recent headlines scream about record-high stock prices, leaving many investors feeling anxious. The fear is palpable: are current stock market valuations dangerously inflated, poised for a dramatic correction? Bank of America (BofA), however, offers a more nuanced perspective. This article will explore BofA's arguments against excessive worry regarding current stock market valuations and present evidence supporting their stance, helping you understand the complexities of stock market valuation and make informed decisions.

BofA's Perspective: Why Current Valuations Aren't Overvalued

BofA's analysis suggests that current stock market valuations, while seemingly high, are not necessarily overvalued when considering several crucial factors. Their perspective is grounded in a thorough examination of macroeconomic conditions and corporate performance.

The Role of Interest Rates in Valuation

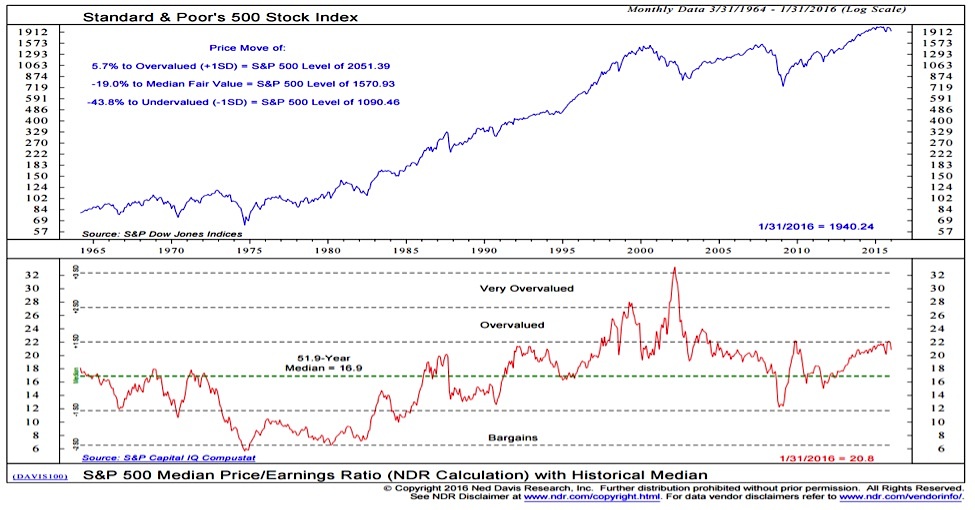

Lower interest rates significantly impact stock market valuations. Historically low interest rates, a consequence of quantitative easing (QE) and other accommodative monetary policies, directly influence price-to-earnings (P/E) ratios.

- Lower discount rates increase the present value of future earnings. When interest rates are low, the future earnings of companies are discounted less heavily, leading to higher valuations.

- Low interest rates incentivize investment in equities over bonds. With bond yields depressed, investors seek higher returns in the stock market, driving up demand and prices.

- Impact of inflation on valuations: While inflation can erode purchasing power, moderate inflation can also justify higher P/E ratios if earnings grow in line with or faster than inflation. BofA's research often incorporates inflation forecasts into their valuation models.

BofA's analysts have consistently highlighted the relationship between low interest rates and higher justified P/E ratios, arguing that this relationship needs to be considered when evaluating current market valuations. This is supported by extensive historical data demonstrating a strong inverse correlation between interest rates and equity market multiples.

Strong Corporate Earnings and Profit Growth

Another key component of BofA's argument is the robust earnings growth exhibited by many companies. This growth is driven by various factors, including technological advancements, globalization, and increased efficiency.

- Specific sectors showing strong earnings growth: Technology, healthcare, and certain consumer staples sectors have demonstrated exceptionally strong earnings growth in recent years.

- Data on year-over-year earnings growth: BofA regularly publishes reports detailing year-over-year earnings growth across various sectors, supporting their contention of healthy corporate performance.

- The impact of innovation on corporate profitability: Technological innovation fuels productivity gains, leading to higher profit margins and enhanced earnings growth, which, in turn, supports higher valuations.

Long-Term Growth Potential and Future Earnings Expectations

Current stock market valuations are significantly influenced by expectations of future earnings growth. BofA's analysis focuses on the long-term growth potential of the economy and specific sectors.

- Factors driving long-term economic growth: Technological innovation, demographic shifts, and global economic expansion are cited as key drivers of long-term growth.

- Specific industries with high growth potential: Renewable energy, artificial intelligence, and biotechnology are often highlighted as sectors with substantial future growth potential.

- Addressing potential headwinds and their impact on valuations: BofA acknowledges potential headwinds such as geopolitical uncertainty and inflation. However, their analysis suggests that these risks are already partially priced into the market.

Addressing Common Concerns About Stock Market Valuations

Despite BofA's optimistic outlook, several concerns regarding stock market valuations persist. Let's address some of the most common ones.

High P/E Ratios

High P/E ratios are often viewed as a sign of overvaluation. However, BofA emphasizes the importance of context.

- Examples of industries with historically higher P/E ratios: Technology companies, for example, often command higher P/E ratios than more mature industries due to their high growth potential.

- Comparison of current P/E ratios to historical averages: While current P/E ratios might appear high compared to historical averages, BofA considers the impact of lower interest rates and higher future earnings expectations.

- Explanation of other relevant valuation metrics: BofA also considers other valuation metrics like Price-to-Sales (P/S) and Price-to-Book (P/B) ratios, providing a more comprehensive assessment of valuations.

Market Volatility and Correction Risks

Market volatility is inherent. BofA acknowledges the risk of market corrections but emphasizes the importance of a long-term perspective.

- BofA's outlook on market volatility: BofA regularly assesses market volatility and provides outlooks on potential corrections, often emphasizing the importance of risk management.

- Discuss risk management strategies (diversification, asset allocation): Diversification and strategic asset allocation are vital in mitigating risk.

- Explain the importance of a long-term investment strategy: BofA advises investors to focus on their long-term financial goals and avoid making impulsive decisions based on short-term market fluctuations.

Conclusion: A Balanced Perspective on Stock Market Valuations

BofA's analysis suggests that while stock market valuations may appear high, they are not necessarily overvalued when considering the impact of low interest rates, strong corporate earnings, and future growth potential. A balanced perspective necessitates considering long-term growth, diversification, and a well-defined investment strategy. Don't let unwarranted fear about stock market valuations prevent you from achieving your long-term financial goals. Continue your research on stock market valuations and related topics, and consult with financial professionals for personalized advice tailored to your specific circumstances and risk tolerance. Understanding stock market valuations is key to successful investing.

Featured Posts

-

Winter Storm Warning Four Inches Of Snow And Bitter Temperatures Tuesday

May 03, 2025

Winter Storm Warning Four Inches Of Snow And Bitter Temperatures Tuesday

May 03, 2025 -

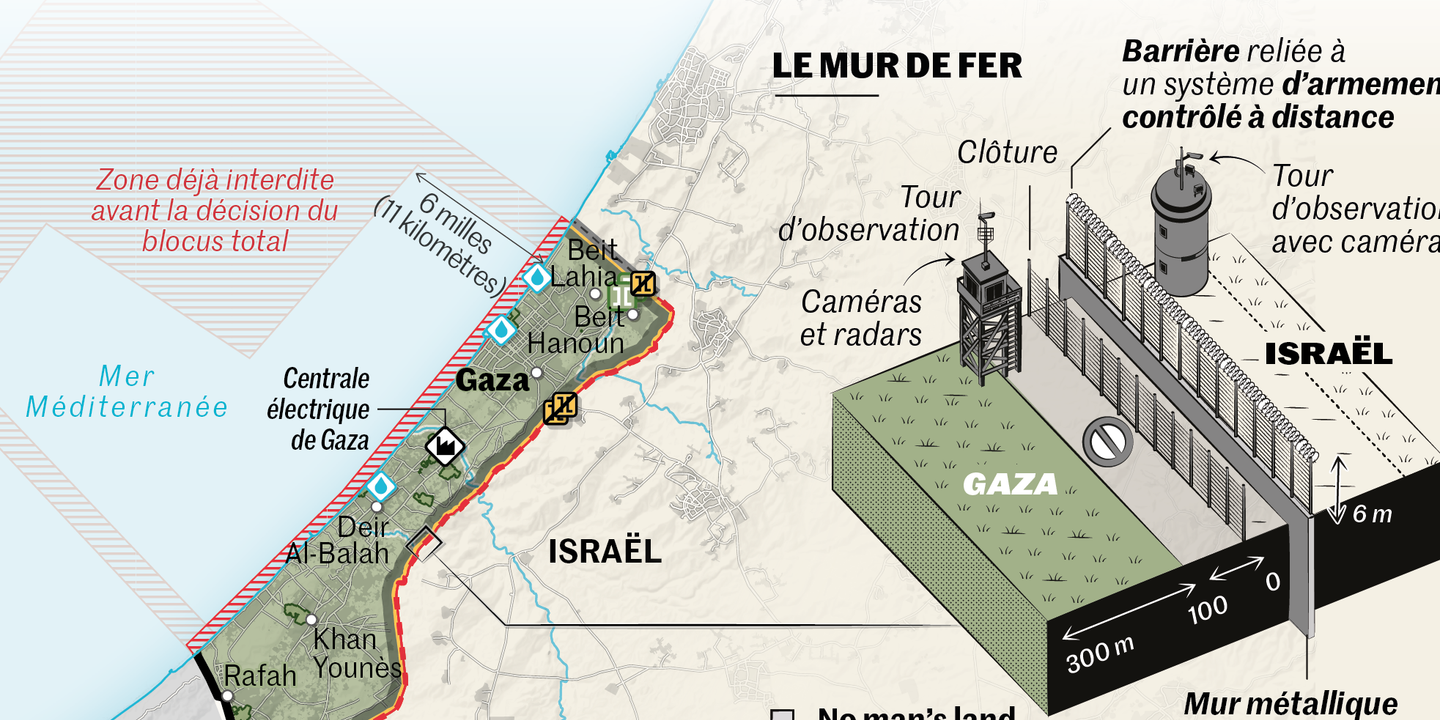

Cfp Board Ceo Stepping Down In Early 2026

May 03, 2025

Cfp Board Ceo Stepping Down In Early 2026

May 03, 2025 -

Nigel Farages Reform Party Tory Claims Of A Sham Defection Announcement

May 03, 2025

Nigel Farages Reform Party Tory Claims Of A Sham Defection Announcement

May 03, 2025 -

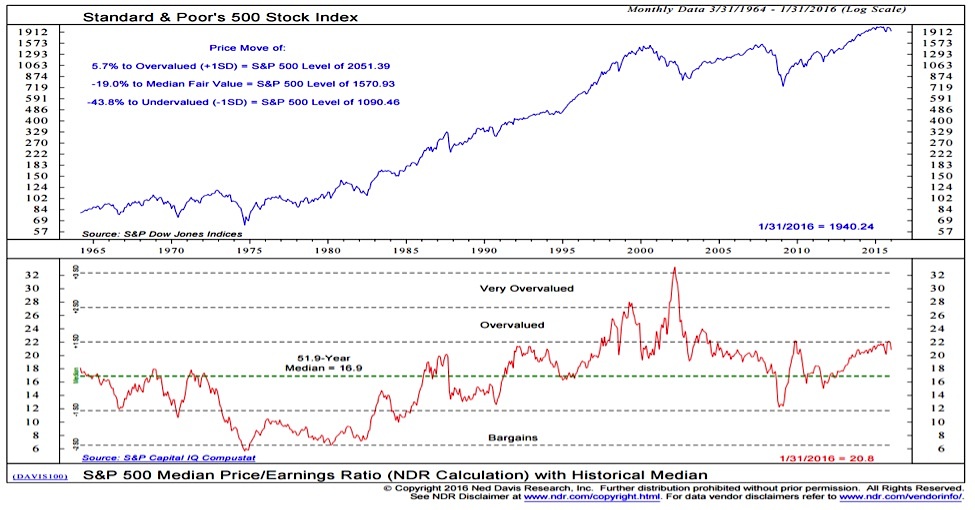

Macron Avertit Contre La Militarisation De L Aide Humanitaire A Gaza Par Israel

May 03, 2025

Macron Avertit Contre La Militarisation De L Aide Humanitaire A Gaza Par Israel

May 03, 2025 -

Financial Planning Cfp Board Ceos Retirement In 2026

May 03, 2025

Financial Planning Cfp Board Ceos Retirement In 2026

May 03, 2025

Latest Posts

-

Nc Supreme Court Election Appeal Implications Of The Gop Candidates Action

May 03, 2025

Nc Supreme Court Election Appeal Implications Of The Gop Candidates Action

May 03, 2025 -

Analyzing Voter Turnout In Florida And Wisconsin Implications For The Current Political Moment

May 03, 2025

Analyzing Voter Turnout In Florida And Wisconsin Implications For The Current Political Moment

May 03, 2025 -

North Carolina Supreme Court Race Gop Candidate Appeals Latest Orders

May 03, 2025

North Carolina Supreme Court Race Gop Candidate Appeals Latest Orders

May 03, 2025 -

Maines Post Election Audit Pilot Transparency And Accountability

May 03, 2025

Maines Post Election Audit Pilot Transparency And Accountability

May 03, 2025 -

Recent Survey 93 Of Respondents Trust South Carolina Elections

May 03, 2025

Recent Survey 93 Of Respondents Trust South Carolina Elections

May 03, 2025