CFP Board CEO Stepping Down In Early 2026

Table of Contents

Impact of the CEO's Departure on CFP Professionals

The departure of the CFP Board CEO will undoubtedly create uncertainty in the short-term and potentially lead to significant long-term changes for CFP professionals. The stability provided by consistent leadership is now disrupted, leading to several key concerns:

-

Uncertainty regarding future board direction and initiatives: The new CEO may have a different vision and prioritize different areas, potentially altering ongoing projects and future strategies. This could lead to shifts in the focus of the CFP Board's initiatives, impacting how CFP professionals engage with the organization.

-

Potential changes to CFP certification requirements or renewal processes: The incoming CEO could review and potentially revise the requirements for obtaining and maintaining the CFP certification. This could involve modifications to the exam, continuing education mandates, or ethical conduct standards.

-

Impact on CFP Board's advocacy efforts for financial planners: The CFP Board plays a crucial role in advocating for financial planners' interests on a national level. A change in leadership could affect the Board's lobbying efforts and its ability to influence policy decisions that impact the profession.

-

Possible shifts in the organization's budget allocation: Prioritization of different programs and initiatives under new leadership could result in a reallocation of budget resources, impacting the support available to CFP professionals.

Industry experts are already speculating on the potential ramifications. [Insert hypothetical quote from a financial planning expert here, linking to their website or a relevant news article]. The coming months will be crucial in understanding the extent of these impacts.

The Search for a New CFP Board CEO: What to Expect

The selection process for a new CEO at the CFP Board is likely to be rigorous and thorough. We can expect:

-

Timeline for the search and selection: A comprehensive search, involving executive search firms and a search committee, will likely take several months, potentially stretching into late 2025 or early 2026.

-

Likely qualifications and experience sought in a candidate: The CFP Board will likely seek a candidate with extensive experience in leadership roles, ideally within a professional organization or a similar regulatory environment. Strong communication and strategic planning skills will be essential.

-

Potential challenges in finding a suitable replacement: Finding a leader capable of navigating the complexities of the financial planning industry, managing stakeholder expectations, and driving the organization forward will present significant challenges.

-

Speculation on the type of leader the Board might seek: The Board might choose a leader who maintains the status quo or one who embraces innovation and change—the choice will significantly influence the future direction of the CFP Board.

The ideal candidate will possess a deep understanding of the financial planning landscape, the ability to build consensus among diverse stakeholders, and a clear vision for the future of the CFP certification.

Future of the CFP Certification Under New Leadership

The incoming CEO's vision will significantly shape the future of the CFP certification. Potential changes include:

-

Possible modifications to the exam or continuing education requirements: The exam might become more rigorous or focus on different areas of financial planning, reflecting emerging trends and technologies. Continuing education requirements could also be adjusted to better equip CFP professionals for the evolving industry.

-

Discussions regarding the future relevance of the CFP designation: The CFP Board may need to address ongoing concerns about the relevance of the CFP designation in a changing regulatory environment, ensuring it continues to represent a gold standard in financial planning.

-

Adaptation to evolving technologies and financial regulations: The CFP certification program needs to adapt to technological advancements, such as fintech and AI, and evolving financial regulations, to ensure it remains relevant and valuable.

-

Potential for increased emphasis on specific areas of financial planning: We may see a greater emphasis on areas such as sustainable investing, behavioral finance, or financial technology, reflecting changing client needs and market demands.

The new CEO's leadership will be critical in ensuring the CFP mark remains a symbol of excellence and trust in the financial planning profession.

Analyzing the CEO's Legacy and Accomplishments

The outgoing CEO’s tenure has undoubtedly been marked by both achievements and challenges. A balanced assessment of their legacy should include:

-

Significant changes implemented during their leadership: [List specific accomplishments and implemented changes during the CEO's tenure].

-

Key challenges overcome during their time at the CFP Board: [Identify and discuss notable challenges faced and how they were addressed].

-

Positive impact on the CFP profession: [Highlight the positive contributions and impact on the professional landscape].

-

Any controversies or criticisms during their tenure (if applicable): [Objectively address any controversies or criticisms, providing context and acknowledging different perspectives].

Understanding the outgoing CEO's legacy provides valuable context for assessing the future direction of the CFP Board under new leadership.

Conclusion: Looking Ahead After the CFP Board CEO Stepping Down

The CFP Board CEO stepping down marks a pivotal moment for the financial planning profession. The transition will bring both uncertainty and opportunities. The search for a new CEO will be crucial in shaping the future direction of the CFP Board and the value of the CFP certification. It's important for all CFP professionals to stay informed about the ongoing developments. Follow the CFP Board's updates on the transition, stay informed about the new CFP Board CEO search, and learn more about the future of the CFP designation. Your active participation and engagement will be critical as the industry navigates this period of change. Share your thoughts and engage in the conversation below!

Featured Posts

-

Macron Remonte Par Sardou Le Diner Tendu

May 03, 2025

Macron Remonte Par Sardou Le Diner Tendu

May 03, 2025 -

Tesla Board Denies Plan To Replace Elon Musk

May 03, 2025

Tesla Board Denies Plan To Replace Elon Musk

May 03, 2025 -

More School Desegregation Orders Expected To Follow A Legal Analysis

May 03, 2025

More School Desegregation Orders Expected To Follow A Legal Analysis

May 03, 2025 -

The Farage Teaching Union Clash A Dispute Over Far Right Allegations

May 03, 2025

The Farage Teaching Union Clash A Dispute Over Far Right Allegations

May 03, 2025 -

Zakharova O Makronakh Poslednie Novosti I Kommentarii

May 03, 2025

Zakharova O Makronakh Poslednie Novosti I Kommentarii

May 03, 2025

Latest Posts

-

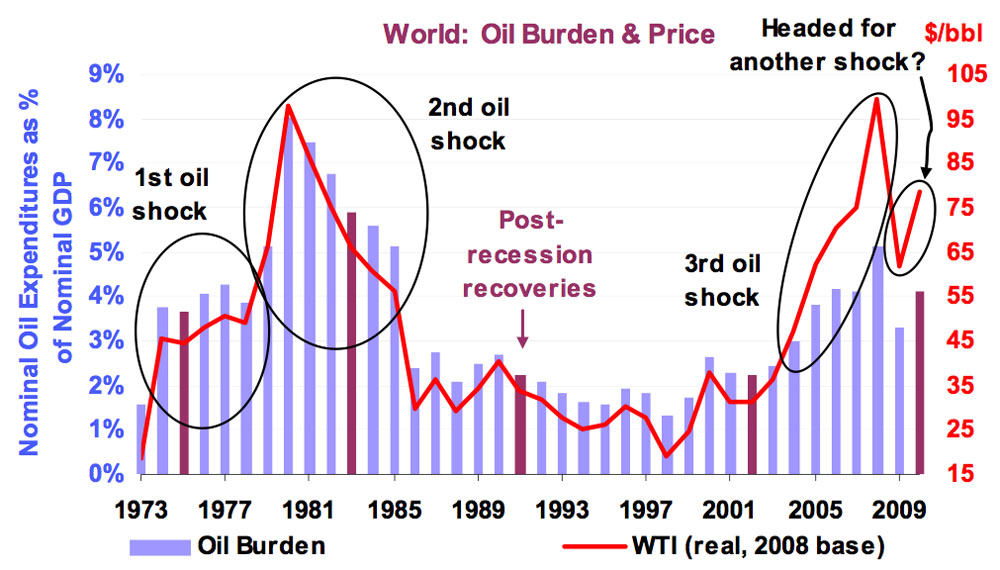

The Airline Industrys Vulnerability To Oil Supply Chain Instability

May 04, 2025

The Airline Industrys Vulnerability To Oil Supply Chain Instability

May 04, 2025 -

Oil Price Volatility And Its Effect On Airline Profitability

May 04, 2025

Oil Price Volatility And Its Effect On Airline Profitability

May 04, 2025 -

Soaring Fuel Costs The Airline Industrys Response To Oil Supply Shocks

May 04, 2025

Soaring Fuel Costs The Airline Industrys Response To Oil Supply Shocks

May 04, 2025 -

Tomatin Affordable Housing Strathdearn Community Project Marks Significant Progress

May 04, 2025

Tomatin Affordable Housing Strathdearn Community Project Marks Significant Progress

May 04, 2025 -

Pupils Celebrate Groundbreaking Of New Tomatin Affordable Housing In Strathdearn

May 04, 2025

Pupils Celebrate Groundbreaking Of New Tomatin Affordable Housing In Strathdearn

May 04, 2025