Stock Market Valuations: BofA's Reassuring Message For Investors

Table of Contents

BofA's Key Arguments Against Overvaluation

BofA's recent report offers a more optimistic perspective on current stock market valuations than some prevailing narratives suggest. Their analysis rests on several key pillars:

Moderate Price-to-Earnings Ratios

BofA's assessment focuses on price-to-earnings (P/E) ratios, a key metric for evaluating stock market valuations. They argue that current P/E ratios, while elevated compared to some historical lows, are not excessively high when considering several factors.

- Data Points: While precise figures vary depending on the specific indices and methodology used, BofA's analysis generally points to forward P/E ratios that fall within a historically reasonable range, particularly when compared to periods of similar economic uncertainty. They often emphasize the use of forward P/E ratios (based on projected future earnings) rather than trailing P/E ratios (based on past earnings), arguing that the former offers a more accurate picture of future value.

- Factors Influencing P/E Ratios: BofA's analysis acknowledges that interest rates and economic growth projections significantly influence P/E ratios. Higher interest rates tend to depress valuations, while strong economic growth can support higher P/E multiples. Their analysis incorporates these factors and attempts to project their impact on future earnings.

- Caveats: BofA likely includes caveats in their report, acknowledging the inherent uncertainties in economic forecasting. They might emphasize the importance of monitoring economic data closely and adjusting their outlook as new information emerges. Understanding these nuances is crucial for interpreting their findings accurately.

The Role of Corporate Earnings Growth

Beyond simply looking at current P/E ratios, BofA emphasizes the potential for future corporate earnings growth as a critical factor in justifying current valuations. Their optimistic outlook rests on several assumptions:

- Strong Growth Sectors: BofA likely identifies specific sectors, such as technology or healthcare, as poised for significant earnings growth. These sectors are expected to drive overall market expansion.

- Assumptions Underlying Projections: BofA's earnings projections rely on various assumptions, including continued technological innovation, a gradual global economic recovery, and improvements in supply chain efficiency. These assumptions, if incorrect, could significantly impact the accuracy of their valuations.

- Contrast with Pessimistic Outlooks: BofA's projections likely contrast with more pessimistic outlooks that predict a significant economic downturn or prolonged stagnation. By highlighting the potential for continued growth, they offer a counterpoint to these negative predictions.

Considering Inflation's Impact on Valuations

Inflation is a significant variable impacting stock market valuations. BofA's analysis likely accounts for this crucial factor:

- Inflation's Effect on Future Earnings: Inflation erodes the purchasing power of future earnings, impacting the perceived value of stocks. BofA's analysis likely adjusts for inflation when calculating P/E ratios or other valuation metrics, utilizing concepts like real earnings growth to provide a clearer picture.

- Adjustments for Inflation: They might employ various techniques to adjust for inflation, such as using inflation-adjusted earnings figures or discounting future cash flows using an inflation-adjusted discount rate.

- Inflation Scenarios: Their report probably explores different inflation scenarios and their potential impact on valuations. Sensitivity analysis demonstrates how varying inflation rates can affect their conclusions.

Alternative Perspectives and Counterarguments

While BofA offers a relatively reassuring message, it's crucial to consider alternative perspectives and potential counterarguments:

Criticisms of BofA's Optimism

Several criticisms might be leveled against BofA's analysis:

- Methodological Weaknesses: Critics might point to potential weaknesses in BofA's methodology, questioning the accuracy of their earnings projections or the assumptions underlying their valuation models.

- Dissenting Viewpoints: Other analysts or economists might hold significantly different perspectives, potentially highlighting risks or factors that BofA has underestimated.

- Underestimated Risks: BofA might have underestimated the impact of geopolitical risks, interest rate hikes, or other macroeconomic headwinds.

Factors to Consider Beyond Valuations

Investors should not rely solely on valuation metrics like P/E ratios. Other factors significantly influence stock market performance:

- Geopolitical Risks: International conflicts or political instability can significantly impact market sentiment and valuations.

- Interest Rate Hikes: Rising interest rates can make borrowing more expensive for businesses, impacting earnings and stock prices.

- Potential Recessions: The threat of a recession can significantly dampen investor confidence and lead to market declines, regardless of underlying valuations.

- Long-Term Investment Horizon: A long-term investment perspective can mitigate the impact of short-term market fluctuations. Diversification is also crucial for managing risk.

Conclusion

BofA's analysis suggests that current stock market valuations may not be as alarming as some fear, citing moderate P/E ratios, the potential for corporate earnings growth, and adjustments for inflation. However, it's crucial to acknowledge alternative perspectives and consider factors beyond pure valuation metrics. Critics might highlight methodological weaknesses, dissenting viewpoints, and underestimated risks. Understanding stock market valuations is crucial for informed investment decisions. Stay informed on the latest analyses, like BofA's report, to make strategic choices regarding your portfolio and navigate the complexities of stock market valuations effectively.

Featured Posts

-

Indonesia Arrests American Basketball Player Drug Smuggling Charges Carry Death Penalty Risk

May 18, 2025

Indonesia Arrests American Basketball Player Drug Smuggling Charges Carry Death Penalty Risk

May 18, 2025 -

Understanding Metropolis Japan Economic Powerhouse And Global Influence

May 18, 2025

Understanding Metropolis Japan Economic Powerhouse And Global Influence

May 18, 2025 -

Pet Shop Boys Fka Twigs Jorja Smith And Father John Misty Headline Meo Kalorama 2025

May 18, 2025

Pet Shop Boys Fka Twigs Jorja Smith And Father John Misty Headline Meo Kalorama 2025

May 18, 2025 -

Gop Tax Bill Conservative Demands Could Sink The Legislation

May 18, 2025

Gop Tax Bill Conservative Demands Could Sink The Legislation

May 18, 2025 -

Rekord Teylor Svift Samye Prodavaemye Vinilovye Plastinki Za Desyatiletie

May 18, 2025

Rekord Teylor Svift Samye Prodavaemye Vinilovye Plastinki Za Desyatiletie

May 18, 2025

Latest Posts

-

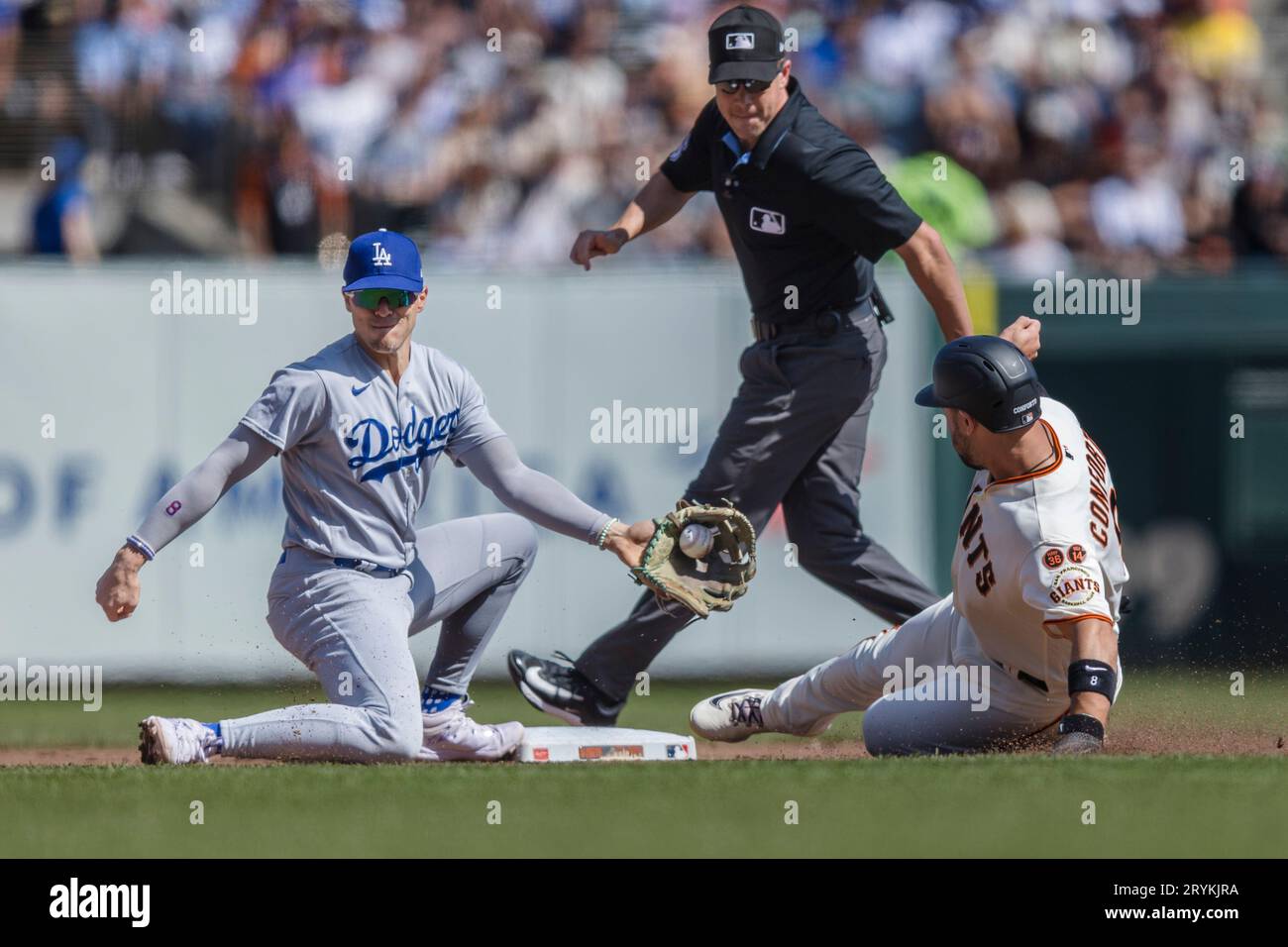

Dodgers Bet On Conforto Will He Mirror Hernandezs Impact

May 18, 2025

Dodgers Bet On Conforto Will He Mirror Hernandezs Impact

May 18, 2025 -

Los Angeles Dodgers Left Handed Bats Aim For A Rebound

May 18, 2025

Los Angeles Dodgers Left Handed Bats Aim For A Rebound

May 18, 2025 -

Can Conforto Replicate Hernandezs Success With The Dodgers

May 18, 2025

Can Conforto Replicate Hernandezs Success With The Dodgers

May 18, 2025 -

Dodgers Left Handed Hitters Can They Break Out Of Their Slump

May 18, 2025

Dodgers Left Handed Hitters Can They Break Out Of Their Slump

May 18, 2025 -

Dodgers Conforto Can He Mirror Hernandezs Impact

May 18, 2025

Dodgers Conforto Can He Mirror Hernandezs Impact

May 18, 2025