Stock Market Valuations: BofA's Take On Investor Concerns

Table of Contents

BofA's Current Valuation Assessment

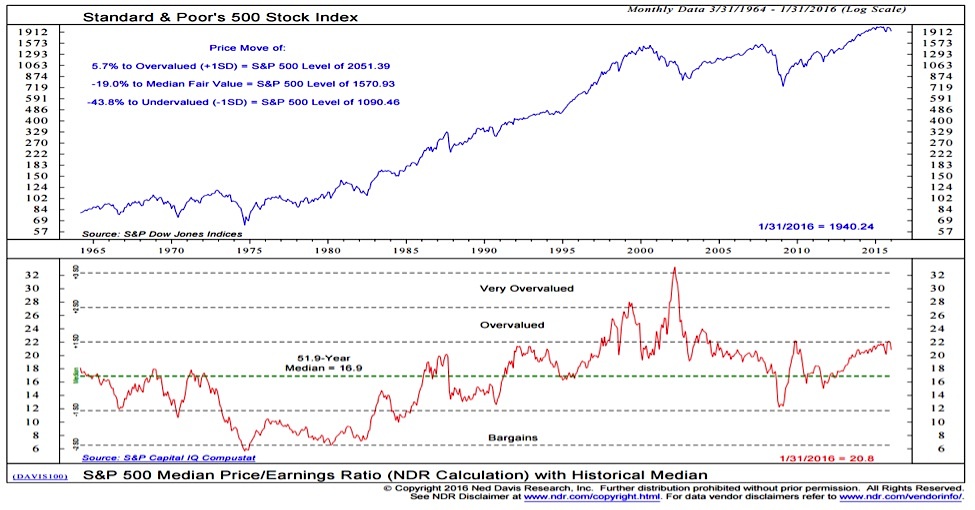

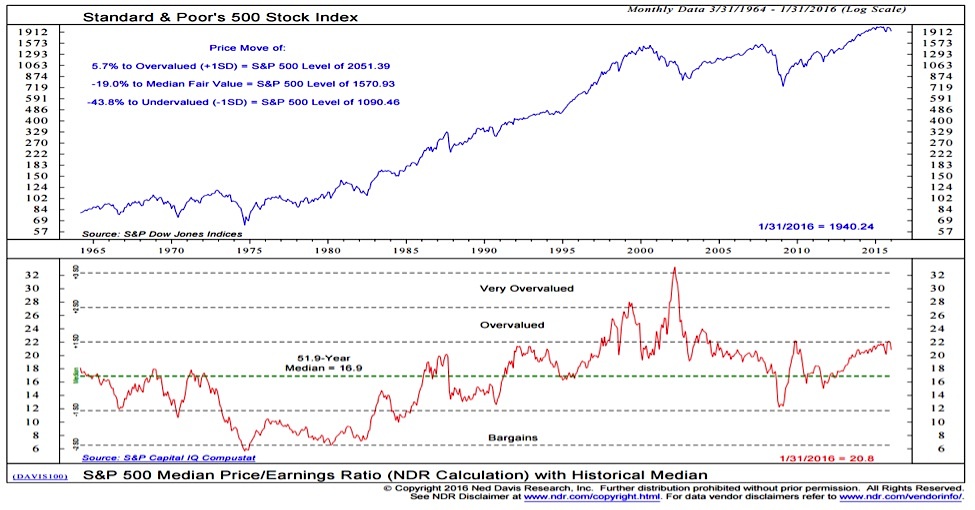

BofA's assessment of current stock market valuations often involves a nuanced approach, considering various economic indicators and long-term trends. While their specific stance may fluctuate based on the prevailing market conditions, they typically utilize a range of metrics to gauge the overall valuation. These include the widely used Price-to-Earnings ratio (P/E), the cyclically adjusted price-to-earnings ratio (Shiller PE), and other fundamental analysis tools.

- Key findings from BofA's reports on market valuations: BofA frequently publishes reports detailing their analysis of various market segments. These reports often highlight sectors they perceive as overvalued or undervalued, along with their reasoning. For example, they might point to specific industries with high growth potential but relatively low P/E ratios as attractive investment opportunities. Conversely, they may caution against sectors with inflated valuations despite sluggish growth.

- Specific sectors BofA identifies as potentially overvalued or undervalued: BofA’s sector-specific assessments change frequently depending on market dynamics. Recent reports may have highlighted technology as potentially overvalued in certain periods, while others may present opportunities within the energy or healthcare sectors. Always refer to their most recent publications for the most up-to-date insights.

- Mention any specific companies BofA highlights in their analysis: BofA's research often includes detailed analysis of individual companies, comparing their performance to industry peers and broader market trends. This granular level of analysis aids investors in identifying potentially strong or weak performers within specific sectors. However, it's crucial to remember that BofA's analysis is not a buy or sell recommendation and should be considered alongside your own research.

Addressing Key Investor Concerns

Several key concerns currently weigh heavily on investor minds regarding stock market valuations. BofA addresses these concerns within the context of their broader market analysis.

- Inflation: High inflation erodes purchasing power and impacts corporate profitability, making accurate valuation challenging. BofA's analysis likely considers inflation's impact on earnings growth and discount rates used in valuation models. Their suggested mitigation strategies might involve investing in inflation-hedged assets or companies demonstrating pricing power.

- BofA's perspective: BofA typically emphasizes the importance of monitoring inflation data and adjusting investment strategies accordingly. They might suggest adjusting portfolio allocations towards assets that historically perform well during inflationary periods.

- Mitigation Strategies: BofA might recommend diversifying into real estate, commodities, or inflation-protected securities (TIPS).

- Interest Rates: Rising interest rates increase borrowing costs for companies and investors, impacting profitability and valuation multiples. BofA's analysis accounts for the interest rate sensitivity of different asset classes and sectors.

- BofA's perspective: BofA's analysis likely considers the impact of rising interest rates on discount rates used in valuation models. They might highlight the importance of assessing a company's debt levels and its ability to manage rising interest expenses.

- Mitigation Strategies: BofA may advocate for a more conservative investment approach, focusing on high-quality, low-debt companies with consistent dividend payouts.

- Geopolitical Risks: Geopolitical uncertainty introduces significant volatility into the market, complicating valuation assessments. BofA's analysis considers the potential impact of geopolitical events on specific sectors and global economic growth.

- BofA's perspective: BofA's analysis likely stresses the importance of diversification to mitigate geopolitical risk. Specific sectors may be more or less vulnerable depending on the nature of the geopolitical event.

- Mitigation Strategies: BofA may suggest diversifying geographically, investing in defensive sectors less sensitive to global events, or utilizing hedging strategies.

BofA's Investment Strategy Recommendations

Based on their valuation assessments and the identified investor concerns, BofA provides recommendations for investment strategies. These recommendations emphasize the importance of diversification and risk management.

- Specific investment recommendations: BofA may recommend sector rotation, shifting investments towards undervalued sectors while reducing exposure to overvalued ones. Defensive investment strategies, focused on stability rather than high growth, might also be suggested during periods of uncertainty.

- Guidance on portfolio allocation based on risk tolerance: BofA likely emphasizes tailoring investment strategies to individual risk profiles. Conservative investors might be advised to increase their holdings in bonds or other low-risk assets, while more aggressive investors might consider allocating more to equities.

- Mention any specific investment products or strategies BofA promotes (if applicable): BofA may promote specific investment products or strategies aligned with their recommendations, but it is crucial to remember that these are not necessarily the only options available and should always be evaluated with independent research and advice.

Alternative Perspectives and Considerations

It's important to acknowledge that alternative perspectives on stock market valuations exist. Some analysts may hold more optimistic or pessimistic views than BofA, using different methodologies and focusing on different aspects of the market. BofA's analysis, like any other, has limitations. Their research might not fully capture all market dynamics or future unforeseen events.

- Contrasting viewpoints: Other analysts might focus more on technical analysis, emphasizing chart patterns and momentum indicators, potentially leading to different conclusions regarding market valuations. Some might give more weight to qualitative factors like management quality or technological innovation.

- Potential biases: BofA, as a financial institution, may have inherent biases influencing their analysis. These biases might stem from their own investment positions or the interests of their clients.

- Relevant factors not explicitly addressed: Factors like technological disruptions, regulatory changes, or unforeseen global events can significantly impact stock market valuations and may not always be fully incorporated into initial assessments.

Stock Market Valuations: Next Steps for Investors

BofA's analysis of stock market valuations provides valuable insights into current market conditions and potential risks. While their recommendations can inform your investment decisions, remember that the key investor concerns—inflation, interest rates, and geopolitical risks—require careful consideration. BofA suggests diversification and a strategy aligned with your risk tolerance. Thorough research and seeking professional financial advice are crucial before making any investment decisions. Stay informed on current stock market valuations by exploring BofA's comprehensive analysis and develop a robust investment strategy to navigate the complexities of the market. [Link to BofA's relevant research].

Featured Posts

-

Japans Economic Performance Q1 2023 Contraction And Tariff Concerns

May 17, 2025

Japans Economic Performance Q1 2023 Contraction And Tariff Concerns

May 17, 2025 -

Tom Thibodeaus Pope Joke Unlikely Knicks Connection Explained

May 17, 2025

Tom Thibodeaus Pope Joke Unlikely Knicks Connection Explained

May 17, 2025 -

Angel Reese Silences Question About Caitlin Clark

May 17, 2025

Angel Reese Silences Question About Caitlin Clark

May 17, 2025 -

University Of Utah To Build Major Medical Complex In West Valley City

May 17, 2025

University Of Utah To Build Major Medical Complex In West Valley City

May 17, 2025 -

Mariners And Tigers Injured Players For The Weekend Series March 31 April 2

May 17, 2025

Mariners And Tigers Injured Players For The Weekend Series March 31 April 2

May 17, 2025

Latest Posts

-

112

May 17, 2025

112

May 17, 2025 -

40

May 17, 2025

40

May 17, 2025 -

Valerio Therapeutics Update On 2024 Financial Statement Approval

May 17, 2025

Valerio Therapeutics Update On 2024 Financial Statement Approval

May 17, 2025 -

13 Analysts Weigh In A Comprehensive Look At Principal Financial Group Pfg

May 17, 2025

13 Analysts Weigh In A Comprehensive Look At Principal Financial Group Pfg

May 17, 2025 -

Valerio Therapeutics 2024 Annual Financial Report Publication Delayed

May 17, 2025

Valerio Therapeutics 2024 Annual Financial Report Publication Delayed

May 17, 2025