Stocks Surge 8% On Euronext Amsterdam Following Trump's Tariff Pause

Table of Contents

Understanding the Impact of Trump's Tariff Pause on Euronext Amsterdam

President Trump's decision to temporarily halt the implementation of new tariffs targeted specific sectors, many of which have a strong presence on Euronext Amsterdam. This pause directly alleviated concerns about increased import costs and potential disruptions to supply chains. The sectors most affected include:

- Technology: Companies involved in semiconductor manufacturing and technology hardware experienced significant gains. The reduced uncertainty surrounding tariffs boosted investor confidence in these sectors' future growth prospects.

- Manufacturing: European manufacturers reliant on imported materials saw their stock prices rise, reflecting the potential for cost savings and increased competitiveness.

- Automotive: The automotive industry, often heavily impacted by tariffs, benefited from the pause, leading to a positive ripple effect across related companies listed on Euronext Amsterdam.

Several companies listed on Euronext Amsterdam saw exceptional gains:

- ASML Holding (ASML.AS): This semiconductor equipment manufacturer saw a 10% jump in its share price following the news, reflecting the positive impact on the technology sector.

- Philips (PHIA.AS): The healthcare technology company also experienced a notable increase, driven by reduced trade uncertainties.

- Unilever (UNA.AS): This consumer goods giant, with significant global operations, also saw a positive reaction to the tariff news.

Keywords: Euronext Amsterdam stocks, tariff impact, market reaction, affected sectors.

Market Analysis: Why the 8% Surge?

The 8% surge on Euronext Amsterdam wasn't solely a reaction to the tariff pause; it was a complex interplay of factors:

- Reduced Trade Uncertainty: The primary driver was the reduction in uncertainty surrounding future trade relations. The pause signaled a potential de-escalation of trade tensions, boosting investor confidence.

- Improved Investor Sentiment: The positive news significantly improved investor sentiment, leading to a wave of buying activity and pushing up stock prices. This was evident in increased trading volumes.

- Speculation and Market Psychology: Market psychology played a crucial role. The initial positive reaction fueled further buying, creating a self-reinforcing cycle that amplified the price surge.

- Positive Economic Indicators: While not the primary driver, some positive economic indicators in Europe may have contributed to the overall positive market sentiment.

Keywords: Market analysis, investor sentiment, stock market volatility, trade relations, speculation.

Long-Term Implications for Euronext Amsterdam and the Global Market

While the immediate impact was positive, the long-term implications remain uncertain:

- Sustainability of the Surge: The sustainability of the 8% surge depends on several factors, including whether the tariff pause is extended or becomes permanent, and the overall evolution of trade relations between the US and Europe.

- Global Market Impact: The tariff pause has broader implications for the global economy. It affects supply chains, international trade flows, and the overall confidence in global markets.

- Economic Outlook: The long-term economic outlook will significantly influence the performance of Euronext Amsterdam and other global markets. Continued uncertainty around trade policies could lead to future volatility.

- Trade Uncertainty: Even with the pause, significant trade uncertainty remains. Future trade negotiations and policy decisions could easily reverse the positive effects seen thus far.

Keywords: Long-term implications, global market impact, economic outlook, trade uncertainty, sustainable growth.

Trading Strategies Following the Euronext Amsterdam Surge

The sharp increase in stock prices on Euronext Amsterdam calls for a cautious approach:

- Risk Management: Investors should prioritize risk management strategies, including diversification across sectors and asset classes.

- Investment Opportunities: While the market presents potential opportunities, careful analysis is crucial. Investors need to assess individual company fundamentals and future prospects before making investment decisions.

- Avoid Emotional Decisions: It's vital to avoid making emotional investment decisions based solely on short-term market fluctuations.

- Stay Informed: Stay updated on global economic developments, particularly related to US trade policy, which could significantly impact Euronext Amsterdam.

Keywords: Trading strategies, risk management, investment opportunities, stock market analysis, portfolio diversification.

Conclusion: Navigating the Post-Tariff Pause Market on Euronext Amsterdam

The 8% surge on Euronext Amsterdam following Trump's tariff pause was a significant event driven by reduced trade uncertainty, improved investor sentiment, and market psychology. While the short-term outlook appears positive, the long-term implications remain uncertain, and the sustainability of this surge hinges on future developments in US trade policy and the overall global economic landscape. To successfully navigate this evolving market, stay updated on Euronext Amsterdam stocks, monitor the impact of Trump's trade policies, and analyze future market movements on Euronext Amsterdam. Careful analysis, risk management, and a long-term perspective are crucial for investors operating in this dynamic environment.

Featured Posts

-

Mia Farrow Michael Caine And A Surprising On Set Encounter The Untold Story

May 24, 2025

Mia Farrow Michael Caine And A Surprising On Set Encounter The Untold Story

May 24, 2025 -

2 Lvmh Share Drop Follows Disappointing Q1 Sales Figures

May 24, 2025

2 Lvmh Share Drop Follows Disappointing Q1 Sales Figures

May 24, 2025 -

Memorial Day Air Travel 2025 When To Fly And When To Avoid The Rush

May 24, 2025

Memorial Day Air Travel 2025 When To Fly And When To Avoid The Rush

May 24, 2025 -

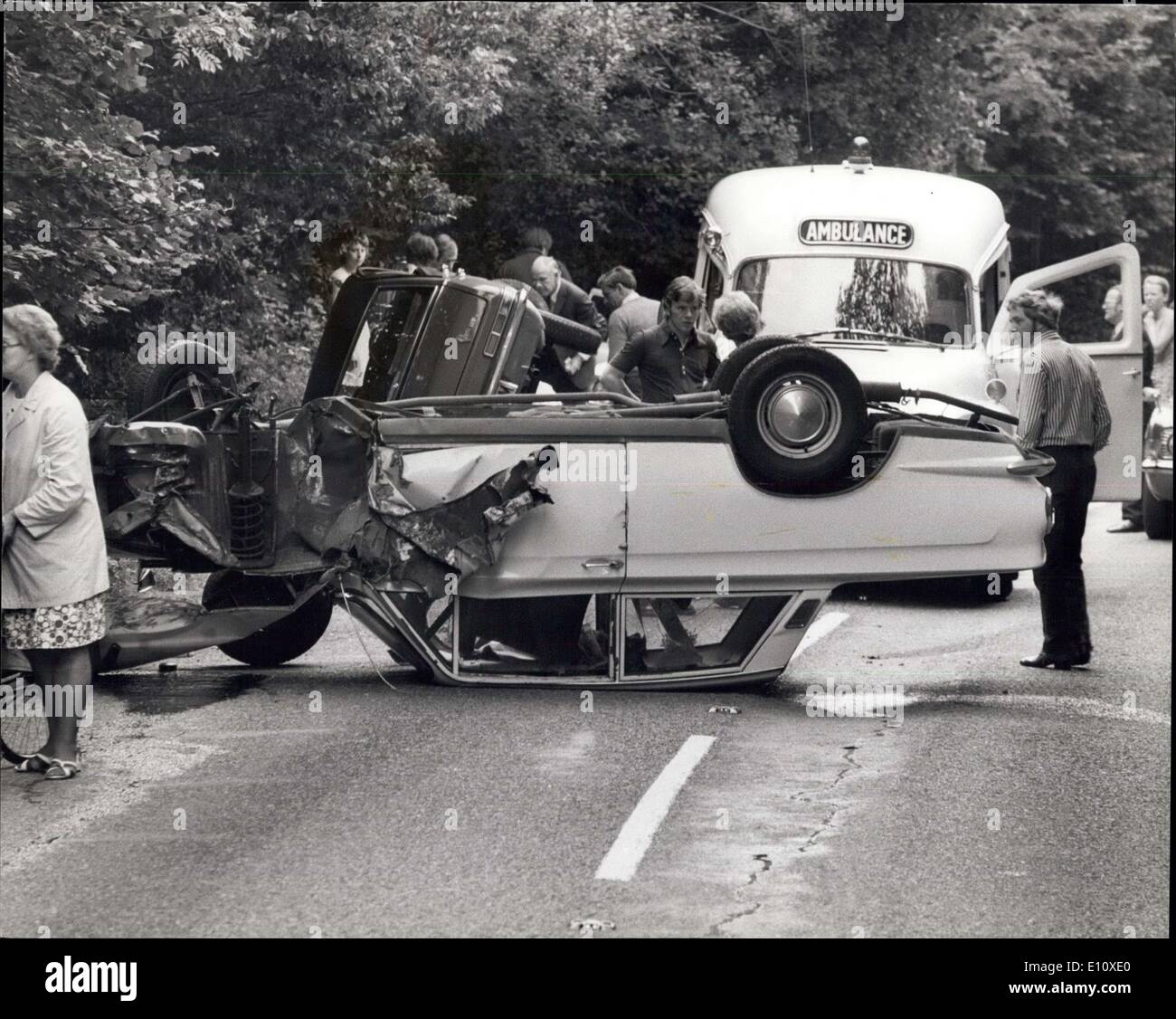

Emergency Services Respond To M56 Crash Car Overturned

May 24, 2025

Emergency Services Respond To M56 Crash Car Overturned

May 24, 2025 -

Live Euro Sterker Kapitaalmarktrentes Verhogen Analyse

May 24, 2025

Live Euro Sterker Kapitaalmarktrentes Verhogen Analyse

May 24, 2025

Latest Posts

-

Electric Vehicle Mandate Faces Renewed Opposition From Car Dealers

May 24, 2025

Electric Vehicle Mandate Faces Renewed Opposition From Car Dealers

May 24, 2025 -

Increased Opposition Car Dealers Renew Fight Against Electric Vehicle Regulations

May 24, 2025

Increased Opposition Car Dealers Renew Fight Against Electric Vehicle Regulations

May 24, 2025 -

Investigation Into Lingering Toxic Chemicals After Ohio Train Derailment

May 24, 2025

Investigation Into Lingering Toxic Chemicals After Ohio Train Derailment

May 24, 2025 -

Toxic Chemicals Lingered In Ohio Derailment Buildings For Months A Detailed Look

May 24, 2025

Toxic Chemicals Lingered In Ohio Derailment Buildings For Months A Detailed Look

May 24, 2025 -

16 Million Fine For T Mobile Details On Three Years Of Data Security Failures

May 24, 2025

16 Million Fine For T Mobile Details On Three Years Of Data Security Failures

May 24, 2025