2% LVMH Share Drop Follows Disappointing Q1 Sales Figures

Table of Contents

Disappointing Q1 Sales Figures: A Detailed Analysis

The release of LVMH's Q1 2024 sales figures revealed a growth rate considerably below expectations, triggering the subsequent share price decline. Let's break down the key aspects of this disappointing performance.

Sales Growth Below Expectations:

- Specific Sales Figures: While precise figures require referencing LVMH's official report, initial reports suggest underperformance across several key brands. For example, Louis Vuitton, typically a strong performer, showed slower-than-anticipated growth, while other brands like Dior also reported less robust sales than anticipated by analysts. The exact percentage changes for each brand will need further investigation.

- Comparison to Previous Years: Compared to Q1 2023 and previous Q1 performances, the growth rate represents a significant slowdown. This deceleration is especially concerning given LVMH's historical track record of consistent growth in the luxury market. A direct comparison with industry benchmarks would further highlight the extent of the underperformance.

- Reasons for Underperformance: The disappointing sales can be attributed to a confluence of external and internal factors. External factors include the ongoing global economic slowdown, persistent inflation impacting consumer spending, and lingering geopolitical instability. Internally, potential supply chain disruptions and shifts in consumer preferences may have also played a role.

Geographic Performance Variations:

LVMH's Q1 performance wasn't uniform across all geographic regions. While some areas showed strength, others lagged considerably.

- Regional Disparities: Reports suggest strong performance in certain Asian markets, driven by robust consumer demand and a recovery in tourism. However, sales in Europe and potentially other regions appear to have been weaker, likely reflecting the impact of economic uncertainty and reduced consumer confidence in those markets.

- Reasons for Discrepancies: The contrasting regional performances highlight the sensitivity of the luxury goods sector to local economic conditions. Stronger performance in Asia could be attributed to factors such as a rebound in Chinese consumer spending and increased tourism. Conversely, weaker performance in Europe might reflect the impact of inflation and recessionary fears.

- Impact of Regional Conditions: These regional variations emphasize the importance of understanding the nuances of each market. LVMH's future strategies will likely need to adapt to these differing consumer behaviors and economic climates across its various geographical markets.

Impact on Key Product Categories:

The performance of different product categories within the LVMH portfolio varied significantly.

- Category-Specific Analysis: Further data is needed to ascertain specific performance figures for each product segment (fashion, wines and spirits, perfumes and cosmetics, watches, etc.). However, early indications suggest that some categories may have been more affected than others by the prevailing economic headwinds and shifting consumer preferences.

- Best and Worst Performers: Identifying the top and bottom-performing product categories would provide valuable insight into consumer demand and potential areas for future focus and investment. This analysis will inform LVMH's long-term product strategy and resource allocation.

- Long-Term Implications: The performance of each product category holds significant implications for LVMH’s future R&D investments and marketing efforts. Understanding these trends is crucial for adapting product lines and marketing strategies accordingly.

Investor Reaction and Market Sentiment

The disappointing Q1 results triggered a swift and negative response from investors.

Immediate Market Response:

- 2% Share Drop: The 2% immediate drop in LVMH's share price following the sales announcement reflects the market's negative reaction to the news. The timing of the drop emphasizes the market's sensitivity to these results.

- Trading Volume and Volatility: A heightened trading volume likely accompanied this price drop, indicating investor activity and uncertainty surrounding LVMH's future prospects. The volatility in the LVMH share price underscores the market’s concern.

- Analyst Reactions: Analyst ratings and forecasts likely reflected a reassessment of LVMH's growth outlook. Some analysts may have revised their price targets downward, reflecting a more cautious outlook for the company's performance in the short and medium term.

Long-Term Investor Concerns:

The Q1 performance raises concerns about LVMH's long-term growth trajectory and investor confidence.

- Future Growth Prospects: The slower-than-expected growth raises questions about LVMH's ability to maintain its strong historical growth rates, especially in a challenging global economic environment.

- Investor Confidence: The share price drop reflects a decrease in investor confidence. Future investment decisions will likely be influenced by LVMH's ability to address the underlying causes of the Q1 underperformance.

- Alternative Investment Opportunities: The underperformance might cause some investors to explore alternative opportunities within the luxury goods sector or other asset classes. This could result in a shift in capital allocation and investment strategies.

The Broader Context: Luxury Market Trends and Economic Outlook

The LVMH Q1 performance needs to be viewed within the context of broader luxury market trends and the global economic outlook.

Global Economic Slowdown and its Impact:

- Impact on Luxury Demand: The global economic slowdown, characterized by high inflation and recessionary fears, is directly impacting consumer spending, including in the luxury goods sector. High inflation reduces disposable income, thus curtailing discretionary spending on luxury items.

- Correlation with LVMH Performance: Analyzing the correlation between key economic indicators (inflation, interest rates, consumer confidence) and LVMH's sales figures would reveal the sensitivity of luxury demand to macroeconomic conditions.

- Potential for Sustained Downturn: The extent of the economic slowdown and its duration will have a significant bearing on the luxury market's recovery. The current situation signals a potential for a sustained downturn in the luxury market, but it remains to be seen how this will resolve itself.

Shifting Consumer Preferences:

Evolving consumer preferences also influence the luxury market's performance.

- Changing Consumer Behavior: Factors such as increased focus on sustainability, evolving brand loyalty, and the influence of social media are reshaping the consumer landscape, requiring LVMH to adapt.

- Rise of Sustainable Luxury: Growing demand for sustainable and ethically sourced luxury products requires LVMH to align its practices and offerings with these changing consumer preferences.

- Influence of Social Media and Brand Perception: Social media is becoming increasingly important in shaping brand image and influencing purchasing decisions. LVMH needs to effectively navigate the social media landscape to maintain a positive brand perception.

Conclusion

The 2% LVMH share drop following disappointing Q1 sales figures underscores the vulnerability of even leading luxury brands to economic downturns and shifts in consumer behavior. The underperformance across various product categories and geographical regions highlights the necessity for LVMH to adapt its strategies to address the challenges presented by a changing global landscape.

Call to Action: Stay abreast of the evolving situation with LVMH and the wider luxury goods market. Closely monitor future LVMH financial reports and independent analyses to fully assess the long-term ramifications of these Q1 sales figures on the LVMH share price and investment prospects within the luxury sector. Understanding these trends is essential for making well-informed investment decisions concerning LVMH stock and other luxury investments.

Featured Posts

-

Escape To The Country How Nicki Chapman Made 700 000 On A Property Investment

May 24, 2025

Escape To The Country How Nicki Chapman Made 700 000 On A Property Investment

May 24, 2025 -

Najvaecsie Nemecke Spolocnosti Vlna Prepustania Tisicok Zamestnancov

May 24, 2025

Najvaecsie Nemecke Spolocnosti Vlna Prepustania Tisicok Zamestnancov

May 24, 2025 -

A Tour Of Nicki Chapmans Garden Escape To The Country Style

May 24, 2025

A Tour Of Nicki Chapmans Garden Escape To The Country Style

May 24, 2025 -

Dreyfus Affair Renewed Calls For Posthumous Promotion

May 24, 2025

Dreyfus Affair Renewed Calls For Posthumous Promotion

May 24, 2025 -

Esc 2025 Eurovision Village Conchita Wurst And Jj On Stage

May 24, 2025

Esc 2025 Eurovision Village Conchita Wurst And Jj On Stage

May 24, 2025

Latest Posts

-

Mia Farrow And Sadie Sink Broadway Reunion Captured In Photo 5162787

May 24, 2025

Mia Farrow And Sadie Sink Broadway Reunion Captured In Photo 5162787

May 24, 2025 -

Mia Farrows Warning Trump Congress And The Fate Of American Democracy

May 24, 2025

Mia Farrows Warning Trump Congress And The Fate Of American Democracy

May 24, 2025 -

Mia Farrow Visits Sadie Sink On Broadway A Photo 5162787 Moment

May 24, 2025

Mia Farrow Visits Sadie Sink On Broadway A Photo 5162787 Moment

May 24, 2025 -

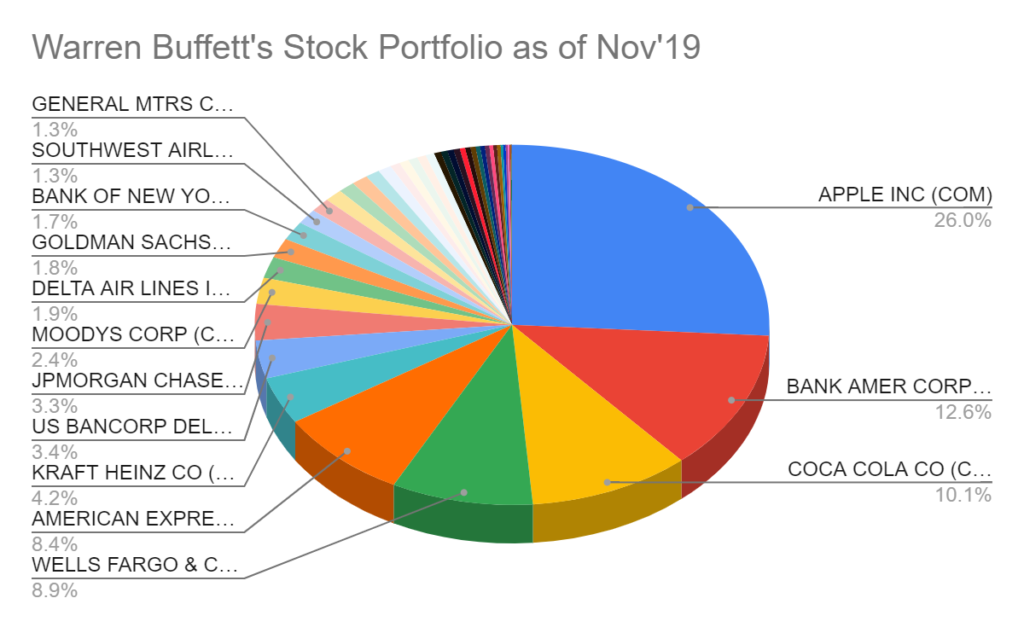

Apple Stock Price How Tariffs Affected Buffetts Investment

May 24, 2025

Apple Stock Price How Tariffs Affected Buffetts Investment

May 24, 2025 -

Buffetts Apple Holdings A Post Trump Tariff Analysis

May 24, 2025

Buffetts Apple Holdings A Post Trump Tariff Analysis

May 24, 2025