Strong PMI Data Supports Dow Jones' Steady Rise

Table of Contents

Understanding the PMI and its Impact on Market Sentiment

The Purchasing Managers' Index (PMI) is a crucial leading economic indicator that tracks the prevailing direction of economic trends. It measures the activity levels of both the manufacturing and services sectors, providing a comprehensive overview of the economy's health. This index is calculated based on surveys of purchasing managers in various industries, capturing their assessments of current business conditions, new orders, production levels, employment, and supplier deliveries.

- PMI reflects the activity of manufacturing and services sectors: A robust PMI indicates strong growth across these key economic drivers.

- Strong PMI readings signal economic expansion and investor confidence: When PMI numbers are high, it suggests that businesses are experiencing increased demand, leading to higher production and employment. This positive outlook boosts investor confidence, encouraging further investment.

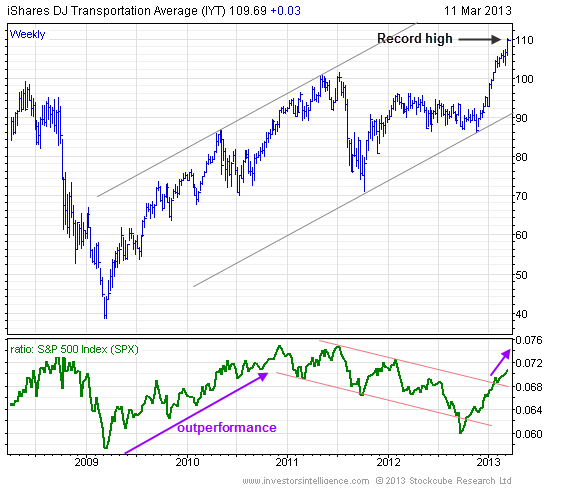

- Correlation between PMI data and stock market performance: Historically, a strong PMI has shown a positive correlation with the performance of major stock market indices like the Dow Jones.

Positive PMI readings significantly influence investor confidence and decision-making. High PMI scores suggest a healthy economy, prompting investors to allocate more capital to the stock market, thereby driving indices like the Dow Jones upward. This positive feedback loop reinforces the importance of monitoring PMI data for market insights.

Recent PMI Data and its Positive Implications for the Dow Jones

Recent PMI data paints a picture of robust economic growth, directly contributing to the Dow Jones' steady rise. For instance, the August 2024 IHS Markit PMI for the US manufacturing sector registered a reading of 55.5, exceeding expectations and indicating expansion. Simultaneously, the services PMI reached 57.2, further demonstrating strong economic activity. [Source: IHS Markit].

- Specific PMI numbers for manufacturing and services: The consistently high PMI readings across various sectors signify broad-based economic strength.

- Positive trend compared to previous months/quarters: These figures represent a significant improvement compared to the previous quarter's readings, reinforcing the positive economic momentum.

- Exceptional growth in specific industries: The technology and consumer goods sectors, in particular, displayed exceptional growth reflected in the PMI data, contributing to the overall strength of the index.

This strong PMI data directly fuels the Dow Jones' steady climb, suggesting a strong correlation between economic health and market performance. The robust economic activity portrayed by the PMI figures instills confidence in investors, leading to increased investment in the stock market.

Other Factors Contributing to the Dow Jones' Steady Rise (Beyond PMI)

While strong PMI data is a significant contributor to the Dow Jones' recent performance, it's important to acknowledge other influential factors.

- Interest rate decisions by the Federal Reserve: The Federal Reserve's monetary policy plays a pivotal role in influencing interest rates and, consequently, market sentiment.

- Corporate earnings reports: Strong corporate earnings reports instill confidence and attract investments.

- Geopolitical events: Global geopolitical stability or the absence of major disruptions contributes to positive market sentiment.

These factors, although important, do not diminish the significant contribution of strong PMI data to the Dow Jones' upward trajectory. The robust PMI readings serve as a strong foundation for this positive market trend.

Potential Risks and Future Outlook for the Dow Jones

While the current outlook is positive, it's crucial to acknowledge potential risks and challenges that could impact the Dow Jones' continued upward trend.

- Inflationary pressures: Persistently high inflation could lead to increased interest rates, potentially dampening economic growth and investor sentiment.

- Geopolitical uncertainties: Escalating geopolitical tensions or unexpected global events could negatively impact market stability.

- Shifts in consumer spending: Changes in consumer behavior and spending patterns could impact businesses and overall economic growth.

Despite these potential risks, the strong PMI data provides a degree of optimism. However, investors should remain vigilant and monitor economic indicators closely to navigate potential market fluctuations.

Conclusion: Strong PMI Data Remains a Key Driver of the Dow Jones' Steady Climb

In summary, the strong correlation between robust PMI data and the sustained growth of the Dow Jones is undeniable. The Purchasing Managers' Index serves as a vital leading economic indicator, providing valuable insights into the overall health of the economy and influencing investor sentiment. Reiterating the significance of PMI data as a key driver for the Dow Jones' performance, we conclude that understanding this indicator is crucial for investors.

Monitor PMI data for insights into the Dow Jones' future performance. Understanding strong PMI data is crucial for navigating the Dow Jones market and making informed investment decisions. The continued strength of the PMI will likely be a key factor in determining the Dow Jones' future trajectory.

Featured Posts

-

Escape To The Country Financing Your Rural Dream

May 25, 2025

Escape To The Country Financing Your Rural Dream

May 25, 2025 -

Matt Maltese Intimacy Growth And His New Album Her In Deep

May 25, 2025

Matt Maltese Intimacy Growth And His New Album Her In Deep

May 25, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf What Is Net Asset Value And Why Does It Matter

May 25, 2025

Amundi Dow Jones Industrial Average Ucits Etf What Is Net Asset Value And Why Does It Matter

May 25, 2025 -

Net Asset Value Nav Explained Amundi Msci World Ex Us Ucits Etf Accumulation

May 25, 2025

Net Asset Value Nav Explained Amundi Msci World Ex Us Ucits Etf Accumulation

May 25, 2025 -

Dax Eroeffnung Marktlage Und Analyse Nach Futures Verfall Am 21 Maerz 2025

May 25, 2025

Dax Eroeffnung Marktlage Und Analyse Nach Futures Verfall Am 21 Maerz 2025

May 25, 2025

Latest Posts

-

Kapitaalmarktrentes Stijgen Verder Impact Op De Euro En De Markt

May 25, 2025

Kapitaalmarktrentes Stijgen Verder Impact Op De Euro En De Markt

May 25, 2025 -

Herstel Op Beurzen Aex Fondsen Stijgen Na Uitstel Trump

May 25, 2025

Herstel Op Beurzen Aex Fondsen Stijgen Na Uitstel Trump

May 25, 2025 -

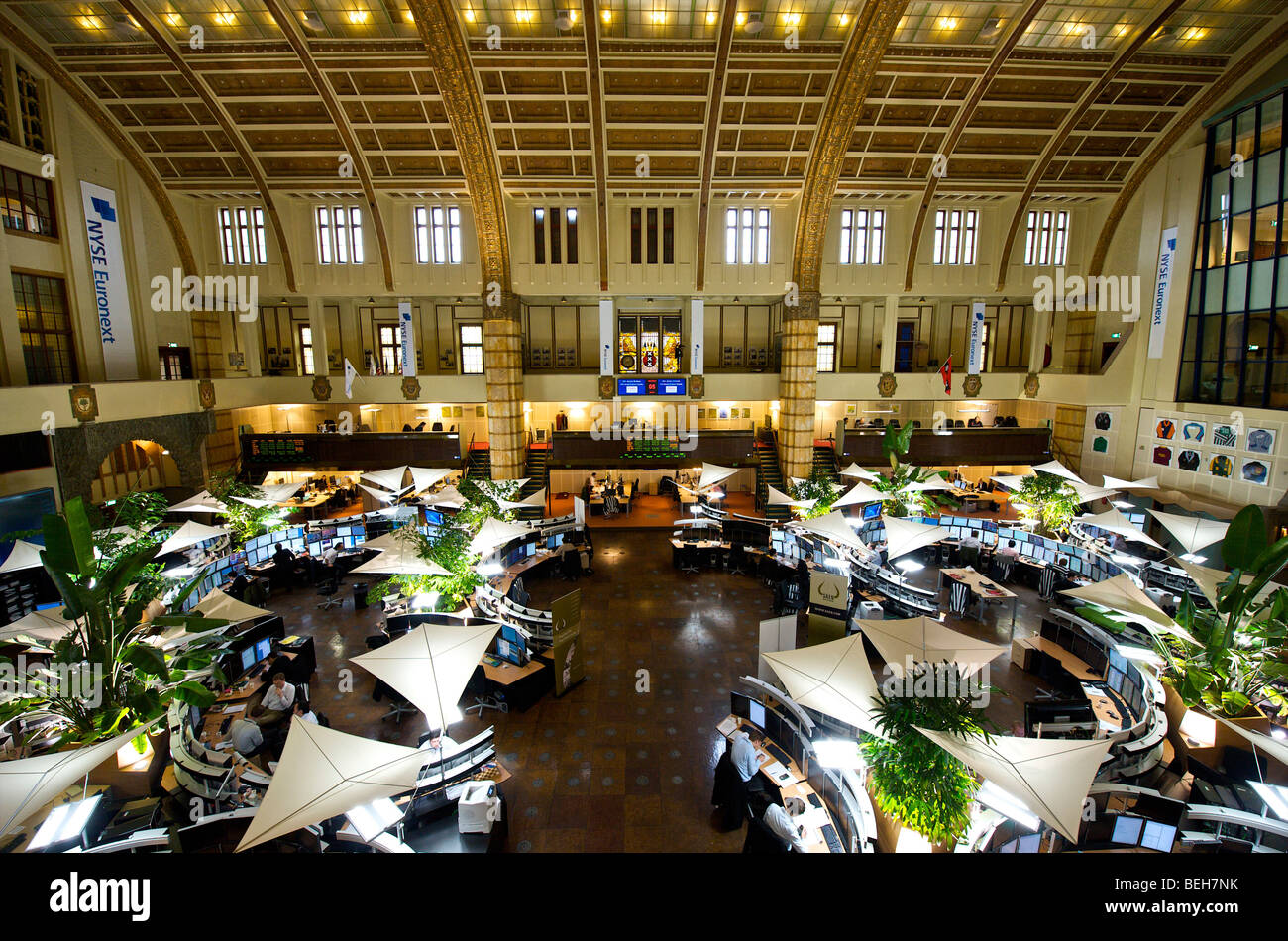

8 Stock Market Increase On Euronext Amsterdam Impact Of Trumps Tariff Plan

May 25, 2025

8 Stock Market Increase On Euronext Amsterdam Impact Of Trumps Tariff Plan

May 25, 2025 -

Stijgende Kapitaalmarktrentes Euro Boven 1 08

May 25, 2025

Stijgende Kapitaalmarktrentes Euro Boven 1 08

May 25, 2025 -

Amsterdam Snack Bar Overwhelmed Residents Sue City Over Tik Tok Influx

May 25, 2025

Amsterdam Snack Bar Overwhelmed Residents Sue City Over Tik Tok Influx

May 25, 2025