Succeeding In The Private Credit Hiring Process: 5 Do's And Don'ts

Table of Contents

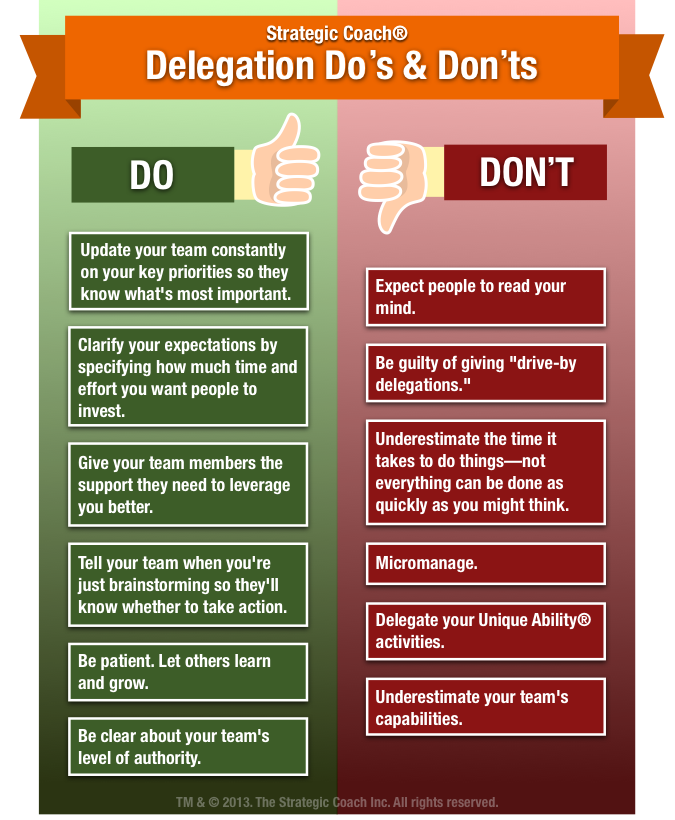

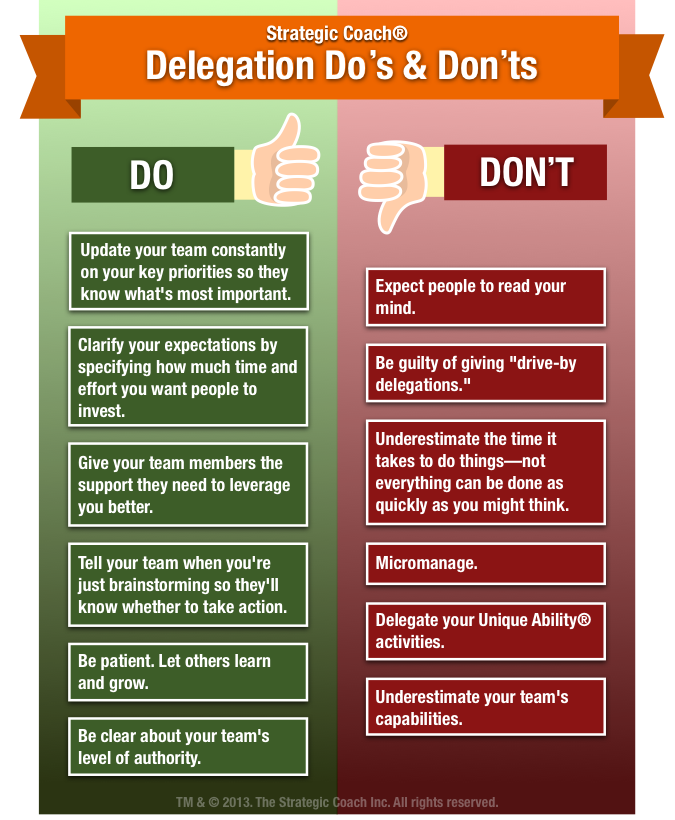

5 Do's for Success in the Private Credit Hiring Process

Do Your Research (Industry & Firm-Specific)

Thoroughly research the private credit industry, focusing on current market trends, key players, and specific firm strategies. Understanding the nuances of direct lending, mezzanine financing, and other private credit strategies will set you apart.

- Understand the firm's investment thesis and recent transactions. Review their website, press releases, and recent portfolio company announcements to demonstrate your knowledge of their specific focus.

- Familiarize yourself with the firm's culture and values. Look at LinkedIn profiles of employees, read news articles about the firm, and analyze their online presence to understand their working environment.

- Research the interviewers – knowing their background demonstrates initiative. Use LinkedIn to understand their career trajectory and experience within private credit. This shows you've taken the time to prepare.

- Showcasing this knowledge during interviews demonstrates genuine interest and preparedness. Mention specific transactions or strategies during the interview, demonstrating your in-depth understanding of the firm and the industry. This will impress potential employers and show your passion for private credit.

Showcase Relevant Skills & Experience

Highlight experience in financial modeling, credit analysis, deal sourcing, and portfolio management. Quantify your achievements whenever possible, using concrete numbers to demonstrate your impact.

- Use the STAR method (Situation, Task, Action, Result) to structure your answers in interviews. This framework helps you clearly and concisely explain your accomplishments and contributions.

- Prepare examples that directly relate to the requirements of the role and the firm's investment strategy. Tailor your responses to align with the specific needs and focus of the firm.

- Emphasize skills transferable from other finance roles (e.g., investment banking, leveraged finance). Highlight the transferable skills you’ve gained in previous roles, such as financial modeling or due diligence.

- Don't just list responsibilities; focus on the impact you made. Use quantifiable metrics to highlight the positive results you achieved in your previous roles.

Network Strategically

Leverage your network to gain insights and make connections within the private credit industry. Attending industry events and conferences is crucial for building relationships.

- Reach out to people on LinkedIn for informational interviews. Informational interviews are a great way to learn more about the industry and make valuable connections.

- Attend industry events and networking functions to meet potential employers and build relationships. Networking events provide opportunities to meet people working in private credit firms and expand your professional network.

- Follow relevant industry publications and thought leaders on social media. Staying updated on industry news and trends demonstrates your passion for private credit.

- Networking can uncover hidden job opportunities and provide valuable advice. Many job opportunities in private credit are not publicly advertised, so networking is essential for finding them.

Master the Technical Aspects

Demonstrate a strong grasp of financial modeling, valuation techniques, credit risk assessment, and legal structures used in private credit transactions.

- Practice your financial modeling skills and be prepared to discuss your approach. Be ready to walk through your modeling process, explaining your assumptions and methodology.

- Be comfortable discussing different credit metrics (e.g., leverage ratios, coverage ratios). A deep understanding of financial ratios and metrics is essential for credit analysis.

- Understand the different types of private credit investments (e.g., direct lending, mezzanine debt). Familiarize yourself with the various types of private credit instruments and their associated risks and rewards.

- Strong technical skills are crucial for success in the private credit industry. Technical skills are paramount in the private credit industry.

Prepare Thoughtful Questions

Asking insightful questions demonstrates your interest and understanding of the role and the firm.

- Prepare questions about the firm's investment strategy, current market opportunities, and the team's dynamics. These questions show your genuine interest in the firm and its operations.

- Avoid questions easily answered through basic online research. Focus on questions that require deeper insight into the firm's operations.

- Tailor your questions to the specific firm and the interviewer's background. Personalize your questions to the specific interviewer and the firm.

- Showing genuine curiosity is highly valued by interviewers. Asking thoughtful questions demonstrates your interest and engagement.

5 Don'ts for the Private Credit Hiring Process

Don't Underestimate the Importance of Soft Skills

While technical skills are critical, strong communication, teamwork, and problem-solving skills are equally vital.

- Practice your communication skills and ensure you can articulate your thoughts clearly and concisely. Effective communication is crucial for success in any finance role.

- Demonstrate your ability to work collaboratively and contribute to a team environment. Private credit involves working closely with colleagues and other stakeholders.

- Highlight instances where you effectively solved complex problems. Demonstrate your problem-solving capabilities with real-life examples.

- Private credit requires collaboration and effective communication. Success in private credit relies heavily on teamwork and effective communication.

Don't Neglect the Cultural Fit

Research the firm's culture and ensure your personality and work style align with their values.

- Look for clues about company culture on their website, social media, and Glassdoor. Researching the company culture will help you determine if it’s a good fit for you.

- Prepare examples that illustrate how your values align with theirs. Showcase instances where your values and work style align with the firm's culture.

- Ask questions about the team's dynamics and work environment during the interview. Gaining insight into the work environment helps assess cultural fit.

- A good cultural fit contributes significantly to job satisfaction and long-term success. Choosing a firm with a compatible culture improves job satisfaction and career longevity.

Don't Overlook the Details of Your Application

Ensure your resume and cover letter are error-free and tailored to the specific job description.

- Proofread carefully for any grammatical errors or typos. A well-written application demonstrates attention to detail.

- Customize your resume and cover letter to highlight relevant experience and skills for each application. Tailoring your application demonstrates your interest in the specific role.

- Use strong action verbs to describe your accomplishments. Strong verbs make your accomplishments stand out.

- A well-crafted application is your first impression. Your application is often the first impression you make on a potential employer.

Don't Be Afraid to Negotiate

Once you receive a job offer, don't hesitate to negotiate salary and benefits.

- Research industry salary benchmarks before negotiations. Knowing industry standards helps you make informed decisions.

- Clearly articulate your value and contributions. Highlight your skills and experience to justify your salary expectations.

- Be prepared to walk away if the offer doesn't meet your expectations. Knowing your worth and your limits ensures a fair outcome.

- Negotiating demonstrates confidence and assertiveness. Negotiation showcases your self-confidence and assertiveness.

Don't Be Discouraged by Rejection

The private credit hiring process is highly competitive. Use any rejections as opportunities for learning and improvement.

- Request feedback from interviewers to identify areas for improvement. Feedback helps you identify areas to focus on in future applications.

- Reflect on your performance and adjust your approach for future applications. Analyze your interview performance to improve your chances in the future.

- Don't give up on your goal. Persistence is key in a competitive job market.

- Perseverance is key in a competitive field. Continuing to apply and improve your application increases your chance of success.

Conclusion

Successfully navigating the private credit hiring process requires a strategic approach combining technical expertise, soft skills, and diligent preparation. By following the "dos" and avoiding the "don'ts" outlined above, you can significantly enhance your chances of landing your dream job in this dynamic and rewarding industry. Remember to thoroughly research the private credit hiring process, showcase your unique skills, and network strategically to stand out from the competition. Start preparing today, and good luck with your job search in the exciting world of private credit!

Featured Posts

-

Ealas Grand Slam Debut In Paris A Look Ahead

May 26, 2025

Ealas Grand Slam Debut In Paris A Look Ahead

May 26, 2025 -

Marine Le Pen Et La Justice Un Point De Bascule Decisif

May 26, 2025

Marine Le Pen Et La Justice Un Point De Bascule Decisif

May 26, 2025 -

L Influence D Elon Musk Sur La Propagation De L Ideologie D Extreme Droite En Europe Via X

May 26, 2025

L Influence D Elon Musk Sur La Propagation De L Ideologie D Extreme Droite En Europe Via X

May 26, 2025 -

New F1 Rules Lewis Hamiltons Key Role In Recent Regulation Changes

May 26, 2025

New F1 Rules Lewis Hamiltons Key Role In Recent Regulation Changes

May 26, 2025 -

Ccm Fest 2025 A Complete Sellout

May 26, 2025

Ccm Fest 2025 A Complete Sellout

May 26, 2025

Latest Posts

-

The Implications Of Trumps Proposed Harvard Funding Shift

May 28, 2025

The Implications Of Trumps Proposed Harvard Funding Shift

May 28, 2025 -

Analysis Trumps Threat To Harvards Funding

May 28, 2025

Analysis Trumps Threat To Harvards Funding

May 28, 2025 -

Why Current Stock Market Valuations Shouldnt Deter Investors Bof As Analysis

May 28, 2025

Why Current Stock Market Valuations Shouldnt Deter Investors Bof As Analysis

May 28, 2025 -

Trumps Plan To Divert Harvard Funds To Trade Schools Explained

May 28, 2025

Trumps Plan To Divert Harvard Funds To Trade Schools Explained

May 28, 2025 -

Will Trump Defund Harvard Trade School Funding In Focus

May 28, 2025

Will Trump Defund Harvard Trade School Funding In Focus

May 28, 2025