Suncor's Record Production: Inventory Build Impacts Sales Volumes

Table of Contents

Suncor Energy, a major Canadian oil sands producer, recently announced record production levels. This impressive achievement, however, is tempered by a significant build-up of oil inventory, leading to a decline in sales volumes. This presents a paradox: how can record production negatively impact sales? This article will delve into the complexities of Suncor's situation, exploring the factors contributing to this imbalance and outlining potential strategies for addressing the inventory surplus.

H2: Record Production Levels at Suncor

Suncor's record production is a result of strategic investments and operational improvements.

H3: Increased Production Capacity

Suncor has significantly increased its production capacity through substantial investments in new projects and technological advancements.

- Example Projects: The expansion of the Fort Hills oil sands mine and the continued development of the Voyageur upgrader have significantly boosted production capabilities.

- Improved Extraction Techniques: Suncor has implemented advanced extraction technologies, leading to greater efficiency and higher recovery rates from oil sands deposits. These include improved steam-assisted gravity drainage (SAGD) methods and the optimization of in-situ recovery processes.

- Quantifiable Data: Suncor's production has increased by X% year-over-year, exceeding previous records set in [Year]. This represents a significant increase in daily/annual oil production.

H3: Operational Efficiency Improvements

Beyond capacity expansion, Suncor's operational efficiency improvements have contributed significantly to higher output.

- Improved Processes: Streamlining operational processes, reducing downtime through predictive maintenance, and optimizing resource allocation have all yielded substantial gains in efficiency.

- Reduced Downtime: Implementing advanced monitoring systems and predictive maintenance programs has significantly reduced unplanned downtime, maximizing production uptime.

- Specific Technologies: The implementation of [mention specific technologies used for efficiency gains, e.g., advanced automation systems, data analytics platforms] has demonstrably improved operational efficiency.

H2: The Impact of Inventory Build-up

Despite record production, Suncor faces challenges translating this output into increased sales volumes.

H3: Global Market Dynamics

Global market dynamics significantly impact Suncor's sales.

- Fluctuating Oil Prices: Volatile oil prices, influenced by geopolitical events and global economic conditions, create uncertainty and impact demand.

- Global Demand: While global demand for oil remains substantial, competition from other oil-producing nations and the growth of renewable energy sources affect market share.

- Geopolitical Factors: Events such as the ongoing conflict in Ukraine or OPEC+ decisions have a direct impact on global oil prices and consequently Suncor’s sales volumes.

H3: Supply Chain Constraints

Suncor's increased production capacity faces limitations in transporting and selling its product.

- Pipeline Capacity Limitations: Existing pipeline infrastructure often lacks the capacity to handle Suncor’s increased production, leading to bottlenecks and delays.

- Transportation Costs: The cost of transporting oil to refineries and markets is significant and fluctuates based on market conditions and available infrastructure.

- Rail Transportation Reliance: Increased reliance on rail transportation as a supplementary method of oil delivery increases costs and potentially adds to delivery times.

H3: Refining Capacity Limitations

The capacity to refine Suncor’s increased crude oil production is another bottleneck.

- Limited Refinery Capacity: Suncor's own refining capacity, as well as that of third-party refineries, may not be sufficient to process the increased crude oil production.

- Refinery Upgrader Reliance: Suncor's reliance on upgraders to transform its bitumen into marketable synthetic crude oil creates a potential bottleneck impacting its overall refining capacity.

- Cost of Refining: The cost of refining crude oil into usable products adds to the overall cost of production, affecting profitability.

H2: Strategies for Addressing the Inventory Surplus

Suncor needs to implement effective strategies to address the inventory surplus and optimize sales.

H3: Price Adjustments & Marketing Strategies

Adjusting prices and implementing strategic marketing campaigns are crucial.

- Price Reductions: Strategic price reductions, timed to market fluctuations, could stimulate demand.

- Targeted Marketing: Focusing marketing efforts on specific markets or product types could improve sales.

- New Market Exploration: Expanding into new markets or product segments could help alleviate inventory build-up.

H3: Expansion of Refining and Transportation Infrastructure

Investing in refining and transportation infrastructure is a long-term solution.

- New Refinery Projects: Building new refineries or expanding existing ones would significantly increase processing capacity.

- Pipeline Expansions: Investing in new pipeline capacity is crucial to improve transportation efficiency and reduce reliance on more expensive alternatives.

- Alternative Transportation Methods: Exploring alternative transportation methods, such as improved rail transport or the use of more efficient tankers, may be considered to ensure the timely delivery of products to markets.

H3: Collaboration and Partnerships

Strategic partnerships can offer synergies and reduce costs.

- Joint Ventures: Collaborating with other energy companies on refining or pipeline projects could share costs and risks.

- Strategic Alliances: Strategic alliances could provide access to new markets or technologies.

- Technology Sharing: Partnering with innovative companies to improve extraction and refining technologies could enhance efficiency and reduce costs.

3. Conclusion:

Suncor's record production highlights the intricate interplay between operational excellence, market dynamics, and infrastructure limitations within the energy sector. The current inventory surplus underscores the need for a flexible and adaptive approach to production and sales management. Successfully navigating this challenge requires a multifaceted response, incorporating price strategies, infrastructure investments, and strategic partnerships. By addressing these issues proactively, Suncor can effectively manage its inventory levels, improve sales volumes, and secure its position as a leading player in the oil sands industry. To stay updated on Suncor's progress and the broader dynamics of the Canadian energy market, continue to follow our analysis of Suncor oil production and the evolving challenges and opportunities in this crucial sector.

Featured Posts

-

Palantir Stock A Pre May 5th Earnings Investment Analysis

May 10, 2025

Palantir Stock A Pre May 5th Earnings Investment Analysis

May 10, 2025 -

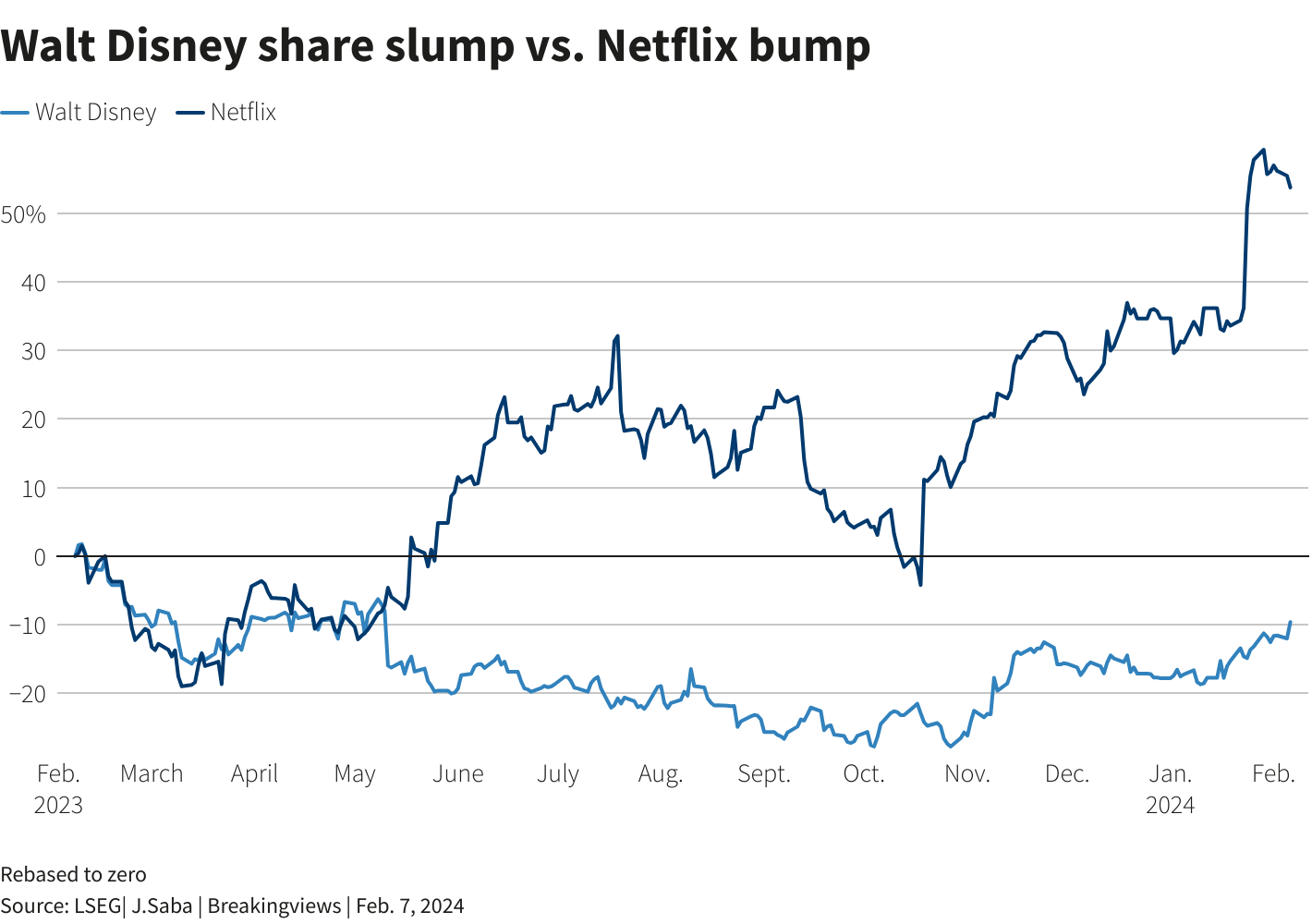

Strong Parks And Streaming Performance Boost Disneys Profit Forecast

May 10, 2025

Strong Parks And Streaming Performance Boost Disneys Profit Forecast

May 10, 2025 -

Whoops Broken Promises User Anger Over Free Upgrades

May 10, 2025

Whoops Broken Promises User Anger Over Free Upgrades

May 10, 2025 -

Joanna Page And Wynne Evans Clash On Bbc Show The Full Story

May 10, 2025

Joanna Page And Wynne Evans Clash On Bbc Show The Full Story

May 10, 2025 -

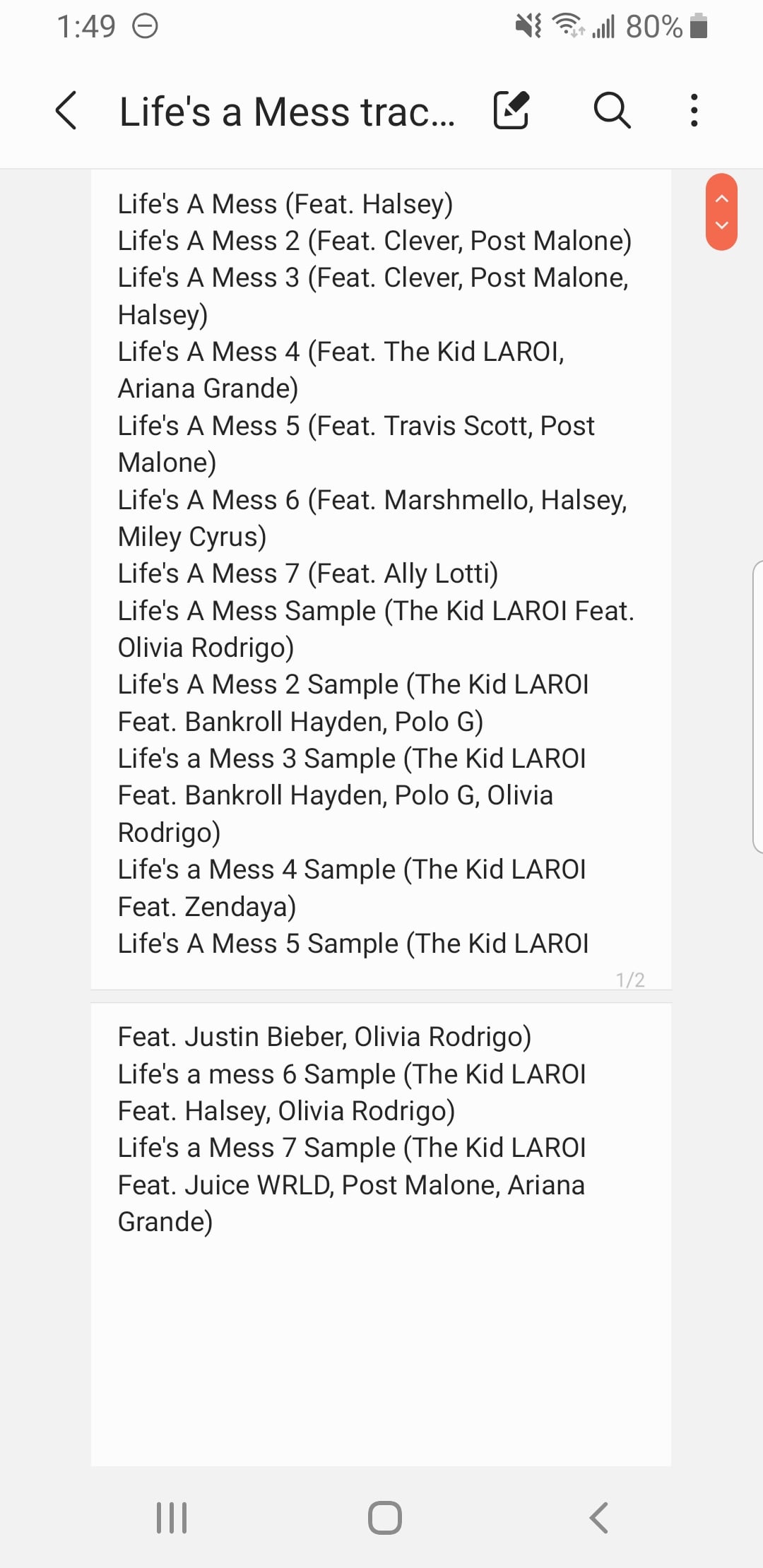

Young Thugs Back Outside Tracklist Predictions And Anticipation

May 10, 2025

Young Thugs Back Outside Tracklist Predictions And Anticipation

May 10, 2025