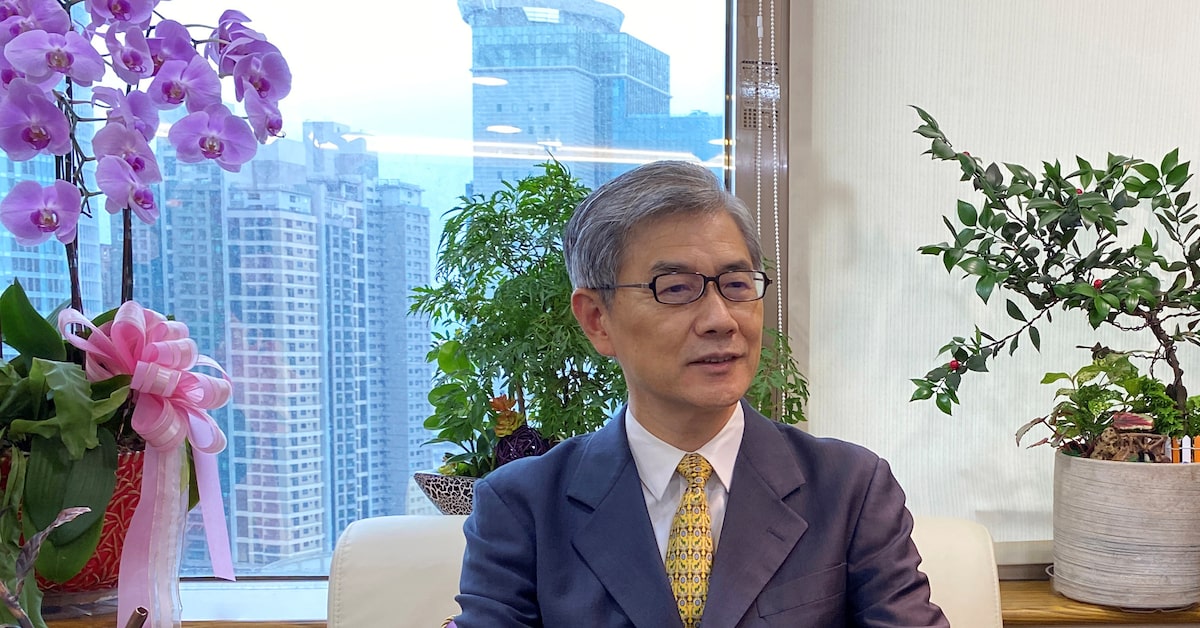

Taiwan Financial Watchdog Probes Allegations Of ETF Sales Pressure

Table of Contents

Details of the Allegations

Nature of the Sales Pressure

Allegations of sales pressure in the Taiwanese ETF market involve a range of potentially manipulative practices. The specifics are still emerging as the investigation unfolds, but early reports suggest a pattern of aggressive selling tactics employed by certain financial institutions. This may include:

- Misrepresentation of ETF performance: Overstating past returns or potential future gains, potentially omitting crucial risk factors.

- Unsuitable recommendations: Pushing ETFs onto investors whose risk profiles or investment goals didn't align with the product.

- High-pressure sales tactics: Employing coercive or misleading techniques to pressure investors into making purchases.

- Churning: Excessive trading in an investor's account to generate commissions, regardless of the investor's best interests.

The types of ETFs involved in these allegations span various sectors, and the target investor groups appear to include both retail and institutional investors. Sources for these allegations range from whistleblower accounts within financial institutions to formal complaints filed by affected investors with the regulatory authorities.

Institutions Under Scrutiny

While the investigation is ongoing, and the names of specific institutions haven't been fully released publicly, the probe involves several key players in Taiwan's ETF market. These are likely to include a mixture of:

- Brokerage firms: Companies facilitating the buying and selling of ETFs.

- Fund management companies: Entities responsible for managing and overseeing the ETFs themselves.

- Financial advisors: Individuals offering investment advice and recommending specific ETFs to clients.

The market share held by these institutions, and their past regulatory histories, will likely be a significant factor in the investigation. Potential consequences for institutions found culpable could include substantial fines, reputational damage, restrictions on their operations, and even legal action from affected investors.

The Role of the Taiwan Financial Watchdog

Investigative Powers and Procedures

The Taiwan Financial Watchdog (the specific name of the agency should be inserted here) possesses significant investigative powers to uncover the truth behind these allegations. Their authority stems from various securities laws and regulations. The investigative process likely includes:

- Subpoenas: Compelling the production of documents and records from implicated institutions.

- Interviews: Questioning individuals involved in the alleged sales pressure.

- Data analysis: Examining trading records and other data to identify patterns of manipulative behavior.

The watchdog's past performance in similar investigations will be a factor in assessing the likelihood of a successful outcome. Adequate resources and experienced investigators are crucial for conducting a thorough and impartial probe.

Potential Regulatory Changes

This investigation could trigger significant changes in the regulatory landscape governing ETFs in Taiwan. Potential reforms may include:

- Stricter sales practice guidelines: Imposing clearer rules on how ETFs can be marketed and sold to investors.

- Enhanced investor protection measures: Strengthening regulations to better safeguard investors from manipulative sales practices.

- Increased penalties for misconduct: Raising the fines and other penalties for violations to deter future offenses.

The current regulatory framework governing ETF sales in Taiwan will be thoroughly reviewed. Improvements could draw from international best practices to ensure investor protection and market fairness.

Impact on the Taiwan ETF Market

Investor Confidence and Market Volatility

The allegations of sales pressure and the ongoing investigation have already had a noticeable impact on investor confidence and market volatility. We can expect to see:

- Decreased ETF trading volume: Investors may become hesitant to trade ETFs due to uncertainty and concerns about market integrity.

- Increased price fluctuations: Market volatility can be amplified by a decline in investor confidence.

- Potential investor withdrawals: Investors might withdraw their investments from ETFs, leading to decreased market liquidity.

The long-term effects on the Taiwanese ETF market will depend on the outcome of the investigation and the subsequent regulatory response. Expert opinions vary, but a swift and decisive response from the authorities could help mitigate the negative impact.

Global Implications

The implications of this investigation extend beyond Taiwan's borders. If the allegations involve cross-border transactions or international financial institutions, then:

- Global investor sentiment towards Taiwanese ETFs could be negatively affected, impacting investment flows.

- International regulatory bodies might take notice, potentially leading to increased scrutiny of similar practices in other jurisdictions.

The investigation serves as a reminder of the interconnectedness of global financial markets and the importance of robust regulatory frameworks to maintain investor confidence and prevent market manipulation.

Conclusion

The investigation into allegations of ETF sales pressure in Taiwan highlights crucial issues of market integrity and investor protection. The Taiwan Financial Watchdog’s response and the potential for regulatory changes will significantly shape the future of ETF trading in the country. The impact extends to investor confidence and may even have global implications. Stay informed about the ongoing investigation into Taiwan ETF sales pressure and its implications for investors. Follow reputable financial news sources for updates on the regulatory response and potential changes in market practices. Understanding the intricacies of ETF investment in Taiwan is crucial for navigating the evolving regulatory landscape and protecting your investments.

Featured Posts

-

Cronica Del Empate Everton Vina 0 0 Coquimbo Unido

May 16, 2025

Cronica Del Empate Everton Vina 0 0 Coquimbo Unido

May 16, 2025 -

Save Big On Sneakers Nike Air Dunks Jordans Sale At Foot Locker

May 16, 2025

Save Big On Sneakers Nike Air Dunks Jordans Sale At Foot Locker

May 16, 2025 -

Miss Joe And Jill Biden On The View Full Interview

May 16, 2025

Miss Joe And Jill Biden On The View Full Interview

May 16, 2025 -

Tampa Bay Rays Sweep Padres In Commanding Series Win

May 16, 2025

Tampa Bay Rays Sweep Padres In Commanding Series Win

May 16, 2025 -

Canadas Resource Sector Seeks Salvation A Bulldog Bankers Approach

May 16, 2025

Canadas Resource Sector Seeks Salvation A Bulldog Bankers Approach

May 16, 2025

Latest Posts

-

Thibodeau Cracks Joke Hints At Surprising Knicks Pope Connection

May 17, 2025

Thibodeau Cracks Joke Hints At Surprising Knicks Pope Connection

May 17, 2025 -

Tom Thibodeaus Pope Joke Unlikely Knicks Connection Explained

May 17, 2025

Tom Thibodeaus Pope Joke Unlikely Knicks Connection Explained

May 17, 2025 -

Knicks Mitchell Robinson Injury Update And Implications For Upcoming Games

May 17, 2025

Knicks Mitchell Robinson Injury Update And Implications For Upcoming Games

May 17, 2025 -

Mitchell Robinson Injury Update Good News For The Knicks

May 17, 2025

Mitchell Robinson Injury Update Good News For The Knicks

May 17, 2025 -

Knicks Game 2 Defeat Thibodeau Calls Out The Officials

May 17, 2025

Knicks Game 2 Defeat Thibodeau Calls Out The Officials

May 17, 2025