Tariff Uncertainty Drives U.S. Businesses To Cut Expenses

Table of Contents

Reduced Capital Expenditures (CAPEX)

Tariff uncertainty creates a climate of fear and hesitation for businesses considering capital expenditure. The unpredictable nature of import costs makes it incredibly difficult to accurately forecast return on investment (ROI). Businesses, understandably, become risk-averse. This leads to a chilling effect on investment in new equipment, technology upgrades, and expansion projects.

- Fear of fluctuating import costs impacting ROI: A sudden tariff increase on imported components can wipe out projected profits, rendering a planned investment unprofitable. This makes it extremely challenging for businesses to justify capital expenditures with any degree of certainty.

- Difficulty in forecasting future expenses due to unpredictable tariffs: The lack of transparency and predictability surrounding tariffs makes long-term financial planning nearly impossible. Businesses are forced to adopt a short-term perspective, prioritizing immediate cost savings over long-term growth initiatives.

- Shifting priorities towards short-term cost-cutting measures: Rather than investing in expansion or modernization, companies are prioritizing cost-cutting measures to ensure short-term survival in this uncertain environment. This can include delaying maintenance, reducing employee benefits, and cutting marketing budgets.

- Examples of industries significantly impacted (e.g., manufacturing, automotive): The manufacturing and automotive sectors, heavily reliant on imported parts and components, have been particularly hard hit by tariff uncertainty. The unpredictability of import costs directly impacts their production timelines and profitability. This reduction in business investment affects the entire economic uncertainty landscape.

Hiring Freezes and Reduced Workforce

The uncertainty surrounding tariffs extends beyond capital expenditures, significantly impacting hiring decisions. Companies facing unpredictable costs are less likely to expand their workforce or even maintain current staffing levels. This leads to hiring freezes and, in some cases, workforce reductions.

- Uncertainty about future demand impacting hiring decisions: With fluctuating import costs and uncertain market conditions, businesses are hesitant to commit to hiring new employees. They are reluctant to take on additional payroll expenses without a clear understanding of future demand.

- Cost-cutting measures leading to workforce reductions or hiring freezes: To mitigate the impact of tariff uncertainty, many companies resort to cost-cutting measures, and reducing labor costs is often a primary target. This results in hiring freezes, layoffs, or even broader workforce reduction strategies.

- Impact on job growth and the overall economy: Widespread hiring freezes and job cuts contribute to a slowdown in job growth and negatively impact overall economic performance. The resulting economic slowdown creates a domino effect across various sectors.

- Examples of industries experiencing hiring slowdowns: Industries such as retail, hospitality, and construction have experienced significant hiring slowdowns as businesses grapple with the uncertainties caused by tariffs.

Supply Chain Diversification and Restructuring

To mitigate the risks associated with tariff uncertainty, many companies are actively diversifying their supply chains. This involves shifting sourcing from tariff-affected countries to alternative locations, often entailing considerable costs and logistical challenges.

- Shifting sourcing from tariff-affected countries: Businesses are actively seeking alternative suppliers in countries not subject to the same tariffs, a process that requires significant time and resources. This is often referred to as import diversification.

- Increased costs associated with finding alternative suppliers: Identifying and vetting new suppliers, negotiating contracts, and establishing new logistics networks significantly increase costs for businesses.

- Potential disruptions and logistical challenges: Shifting supply chains can lead to temporary disruptions in production and delivery, potentially impacting customer satisfaction and business continuity. Effective supply chain management is crucial during this transition.

- Examples of companies successfully diversifying their supply chains: Some companies are successfully using nearshoring and offshoring strategies, bringing production closer to home or shifting it to alternative overseas locations with more favorable trade relationships.

Increased Focus on Automation and Efficiency

In response to tariff uncertainty and rising labor costs, many businesses are investing in automation to reduce their reliance on imported goods or labor. This trend presents both opportunities and challenges.

- Increased adoption of automation technologies to improve efficiency and reduce costs: Automation technologies, such as robotics and artificial intelligence, offer the potential to improve efficiency, reduce labor costs, and minimize reliance on imported components.

- Long-term implications for the job market: The widespread adoption of automation technologies may have significant long-term implications for the job market, potentially leading to job displacement in certain sectors.

- Examples of businesses successfully implementing automation: Companies across various industries are increasingly adopting automation to streamline processes, increase productivity, and reduce their vulnerability to tariff fluctuations. These technological advancements are reshaping the business landscape.

Conclusion: Tariff Uncertainty's Lingering Impact on U.S. Business Spending

Tariff uncertainty has a profound and multifaceted impact on U.S. business spending. It leads to reduced capital expenditures, hiring freezes, supply chain restructuring, and an increased focus on automation. These effects ripple through the economy, impacting job growth and overall economic performance. Understanding the impact of tariff uncertainty on business spending is crucial for effective financial planning. Stay updated on the latest developments and implement strategies to minimize the negative effects on your company's bottom line. Developing robust business strategies for risk mitigation given the current economic outlook is essential for survival and growth.

Featured Posts

-

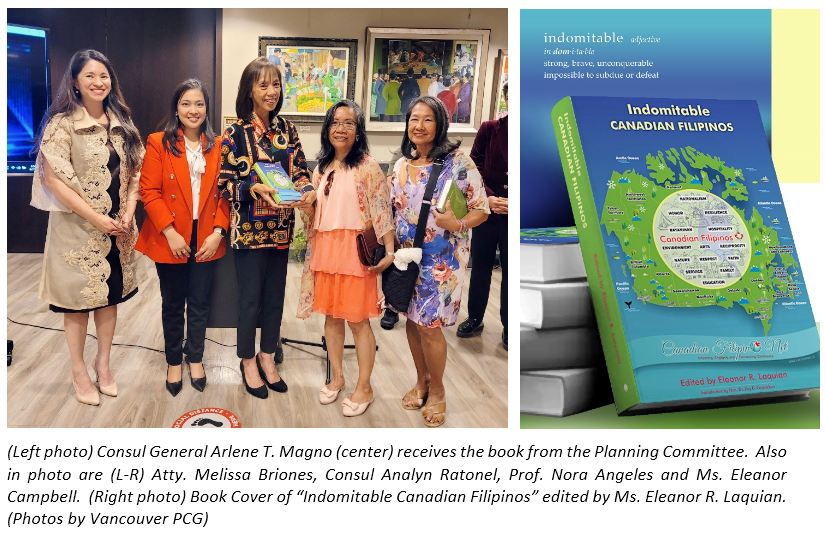

Update Investigation Into Car Attack Targeting Canadian Filipinos

Apr 29, 2025

Update Investigation Into Car Attack Targeting Canadian Filipinos

Apr 29, 2025 -

Exploring The Cognitive Capacity Of Ai Beyond The Hype

Apr 29, 2025

Exploring The Cognitive Capacity Of Ai Beyond The Hype

Apr 29, 2025 -

From Humble Beginnings The Story Of Macario Martinezs Rise To National Prominence

Apr 29, 2025

From Humble Beginnings The Story Of Macario Martinezs Rise To National Prominence

Apr 29, 2025 -

50 000 Fine For Anthony Edwards Nba Addresses Fan Incident

Apr 29, 2025

50 000 Fine For Anthony Edwards Nba Addresses Fan Incident

Apr 29, 2025 -

Over The Counter Birth Control Implications For Reproductive Rights After Roe V Wade

Apr 29, 2025

Over The Counter Birth Control Implications For Reproductive Rights After Roe V Wade

Apr 29, 2025

Latest Posts

-

Investigation Reveals Months Of Toxic Chemical Presence In Buildings After Ohio Derailment

Apr 29, 2025

Investigation Reveals Months Of Toxic Chemical Presence In Buildings After Ohio Derailment

Apr 29, 2025 -

Ohio Train Derailment Aftermath Prolonged Toxic Chemical Contamination Of Buildings

Apr 29, 2025

Ohio Train Derailment Aftermath Prolonged Toxic Chemical Contamination Of Buildings

Apr 29, 2025 -

Office365 Security Failure Costs Millions Federal Investigation Reveals Extent Of Damage

Apr 29, 2025

Office365 Security Failure Costs Millions Federal Investigation Reveals Extent Of Damage

Apr 29, 2025 -

Data Breach Exposes Millions In Losses From Compromised Office365 Accounts

Apr 29, 2025

Data Breach Exposes Millions In Losses From Compromised Office365 Accounts

Apr 29, 2025 -

T Mobile Data Breaches Result In 16 Million Fine A Comprehensive Overview

Apr 29, 2025

T Mobile Data Breaches Result In 16 Million Fine A Comprehensive Overview

Apr 29, 2025