Temu Price Hikes: The Impact Of Trump-Era Tariffs On US Consumers

Table of Contents

Understanding the Rise of Temu and its Pricing Strategy

Temu's business model hinges on offering incredibly low prices, attracting millions of users with its seemingly unbeatable deals. This aggressive pricing strategy, coupled with a vast selection of products, forms the bedrock of its marketing and rapid growth. The company's initial success relied heavily on its reputation for offering the lowest prices across numerous product categories, effectively disrupting the established e-commerce landscape.

- Temu's aggressive pricing model compared to competitors: Temu's prices are often significantly lower than those of established retailers like Amazon or Walmart, attracting budget-conscious shoppers.

- Analysis of Temu's target demographic and their price sensitivity: Temu's target demographic is primarily price-sensitive consumers seeking value for their money, making low prices a crucial factor in their purchasing decisions.

- Mention any initial consumer satisfaction regarding pricing: Initial reviews and social media feedback frequently highlighted Temu's unbelievably low prices as a major draw.

The Impact of Trump-Era Tariffs on Imported Goods

The Trump administration's imposition of tariffs on Chinese goods significantly altered the global trade landscape. These tariffs, targeting a wide array of products, increased the cost of importing numerous goods from China, impacting manufacturers and consumers alike. The tariffs, ranging from a few percentage points to as high as 25%, added considerable expenses to the manufacturing and shipping processes.

- Specific examples of product categories affected by tariffs: These tariffs impacted a broad spectrum of goods, including electronics, clothing, furniture, and household items – many of which are commonly sold on platforms like Temu.

- Statistical data on tariff increases and their impact on import costs: Studies show that these tariffs led to a substantial increase in import costs, impacting the profitability of businesses reliant on Chinese imports.

- Discussion on the shifting global supply chain dynamics as a result: The tariffs forced many companies to re-evaluate their supply chains, seeking alternatives to sourcing from China, often leading to higher production costs.

How Tariffs Contribute to Temu Price Hikes

The increased import costs resulting from these tariffs directly correlate with the potential price increases observed on Temu. While Temu might absorb some of these increased costs initially to maintain its competitive edge, the substantial increases make it increasingly difficult to maintain the same ultra-low prices.

- Analysis of Temu's pricing strategy adjustments: Recent reports indicate that Temu has begun adjusting its pricing on various products, suggesting the company is increasingly passing on the increased costs to consumers.

- Examples of specific products with noticeable price increases: While specific examples may vary, many users have reported price increases on items like clothing, electronics, and home goods.

- Comparison of Temu prices to pre-tariff pricing (if data is available): Comparing current Temu prices to those before the tariffs would highlight the extent of the price increases.

Alternatives and Consumer Impact

The rising prices on Temu force budget-conscious consumers to explore alternative options. This situation also puts a strain on consumer spending habits, particularly impacting lower-income households who relied on Temu for affordable goods. The long-term effect could be a decrease in Temu's customer base and a shift in brand loyalty as consumers seek cheaper alternatives.

- Suggestions for finding affordable alternatives to Temu: Consumers can explore other online marketplaces, discount stores, or even secondhand shopping options to find cheaper alternatives.

- Discussion on the economic implications for lower-income consumers: Rising prices on essential goods exacerbate financial pressures on lower-income families, forcing difficult choices about their spending.

- Potential shift in consumer behavior and brand loyalty: As prices rise, consumers may shift their loyalty to other retailers offering better value, potentially impacting Temu's long-term market share.

The Future of Temu and its Pricing

Temu's future pricing strategy will likely involve a careful balancing act between maintaining affordability and profitability. The company may explore diversifying its supply chain to reduce its reliance on China and mitigate the impact of tariffs. Further price adjustments are likely as economic factors and market competition continue to evolve.

- Predictions on Temu's future pricing strategies: Temu might implement a tiered pricing system, offering a range of price points to cater to different budgets.

- Potential for Temu to diversify its supply chain: Diversification would reduce the company's reliance on any single supplier, mitigating future risks from trade policies or economic instability.

- Discussion on the company's potential response to economic pressures: Temu might need to adapt its business model to address rising costs while remaining competitive.

Conclusion

This article explored the potential connection between Temu price hikes and the ongoing effects of Trump-era tariffs on imported goods. While a definitive causal link requires further investigation, the rising costs of manufacturing and shipping from China certainly contribute to the increasing prices consumers face. The impact on consumer spending and the long-term viability of ultra-low-cost retail models remains to be seen.

Call to Action: Stay informed about the evolving landscape of online retail and the impact of global trade policies on your purchasing power. Continue to follow our coverage on Temu price hikes for future updates and analyses.

Featured Posts

-

North Koreas Ukraine Involvement Troop Deployment Confirmed To Russia

Apr 29, 2025

North Koreas Ukraine Involvement Troop Deployment Confirmed To Russia

Apr 29, 2025 -

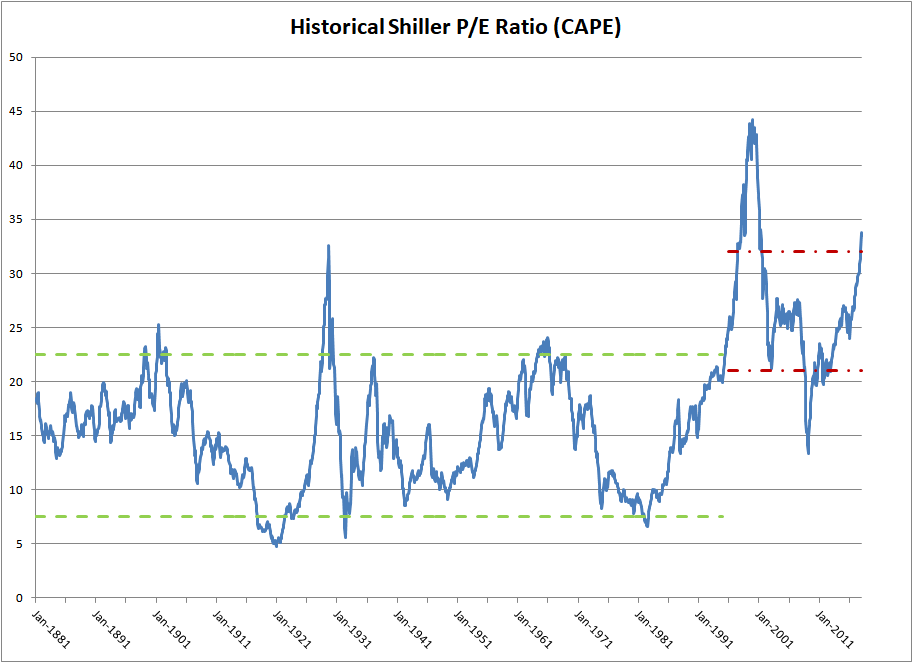

Understanding High Stock Market Valuations Bof As Take For Investors

Apr 29, 2025

Understanding High Stock Market Valuations Bof As Take For Investors

Apr 29, 2025 -

Voice Assistant Creation Revolutionized Open Ais 2024 Developer Event

Apr 29, 2025

Voice Assistant Creation Revolutionized Open Ais 2024 Developer Event

Apr 29, 2025 -

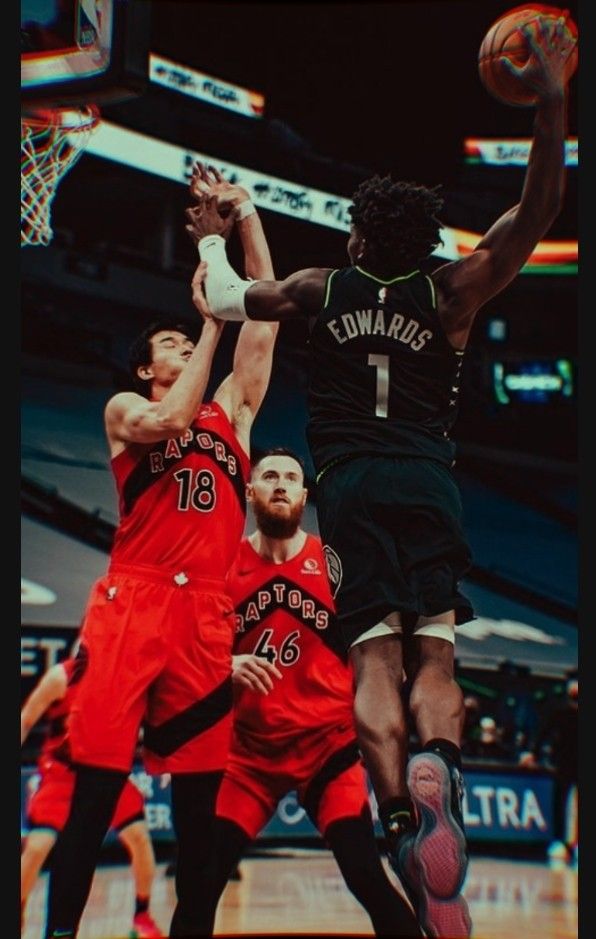

Anthony Edwards Fined 50 K By Nba Over Fan Interaction

Apr 29, 2025

Anthony Edwards Fined 50 K By Nba Over Fan Interaction

Apr 29, 2025 -

Anchor Brewing Companys Closure Whats Next For The Iconic Brewery

Apr 29, 2025

Anchor Brewing Companys Closure Whats Next For The Iconic Brewery

Apr 29, 2025

Latest Posts

-

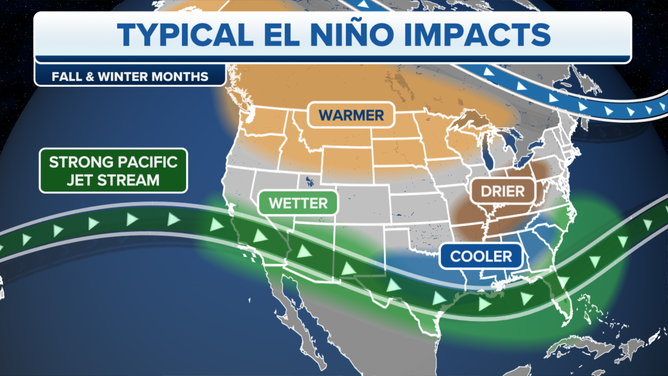

Snow Fox Weather Update Service Impacts For Tuesday February 11th

Apr 29, 2025

Snow Fox Weather Update Service Impacts For Tuesday February 11th

Apr 29, 2025 -

February 11th Snow Fox Delays Closures And Important Information

Apr 29, 2025

February 11th Snow Fox Delays Closures And Important Information

Apr 29, 2025 -

Snow Fox Service Disruptions Tuesday February 11th

Apr 29, 2025

Snow Fox Service Disruptions Tuesday February 11th

Apr 29, 2025 -

Tuesday February 11th Snow Fox School And Business Closings

Apr 29, 2025

Tuesday February 11th Snow Fox School And Business Closings

Apr 29, 2025 -

Snow Fox Delays And Closings Tuesday February 11th Updates

Apr 29, 2025

Snow Fox Delays And Closings Tuesday February 11th Updates

Apr 29, 2025