Tesla Q1 Profits Plunge Amidst Musk's Controversial Role

Table of Contents

Declining Profit Margins and the Impact of Price Wars

Tesla's aggressive price cuts implemented in Q1 2024 significantly impacted profitability. The company engaged in a fierce EV price war, aiming to maintain market share and boost sales volume. However, these price reductions, coupled with increased production costs, resulted in shrinking profit margins. This strategy, while potentially increasing Tesla sales, proved detrimental to the bottom line.

-

The impact of price wars: The competitive landscape is increasingly crowded with established automakers and new EV startups, leading to intense price competition. Tesla's price cuts were met with similar responses from competitors, creating a downward pressure on pricing across the EV market.

-

Sales volume vs. profit per vehicle: While Tesla likely saw a surge in sales volume due to the price cuts, the reduction in average selling price (ASP) meant that the profit generated per vehicle decreased substantially. This trade-off between volume and profitability is a key factor behind the decline in Tesla Q1 profits.

-

Statistics: (Note: Replace these with actual data from the Q1 2024 earnings report once released). For example, "The average selling price decreased by X%, while the profit margin fell from Y% to Z%."

-

Bullet Points:

- Significant reduction in average selling price (ASP).

- Increased production costs not offset by sales volume increase.

- Growing competition from established and emerging EV manufacturers like Ford, GM, and Rivian squeezing margins.

Elon Musk's Controversial Actions and Investor Sentiment

Elon Musk's various controversies during Q1 2024 significantly impacted investor sentiment and Tesla's stock price. His focus on Twitter, coupled with controversial public statements, created uncertainty and negatively affected investor confidence. This volatility highlights the direct correlation between Musk's actions and Tesla's market valuation.

-

The Twitter distraction: Musk's acquisition and management of Twitter consumed significant time and resources, potentially diverting attention and resources away from Tesla's core business.

-

Impact on investor confidence: Musk's erratic behavior and controversial tweets led to a decline in investor confidence, causing volatility in Tesla's stock price. This uncertainty made investors hesitant, impacting Tesla stock and the overall perception of the company's stability.

-

Correlation between Musk's actions and Tesla's market valuation: A direct correlation exists between negative news surrounding Musk and subsequent drops in Tesla's stock price. This indicates a strong link between the perception of Musk's leadership and investor confidence in the company's future.

-

Bullet Points:

- Negative media coverage impacting Tesla's brand image and, consequently, Tesla earnings.

- Uncertainty among investors regarding Tesla’s long-term strategic direction under Musk's leadership.

- Stock price volatility directly linked to Musk's public pronouncements and actions.

The Impact of Supply Chain Issues and Production Challenges

Tesla, like many other manufacturers, faced challenges related to supply chain disruptions and production delays. These issues impacted production costs and the company's ability to meet sales targets, further contributing to the decline in Tesla Q1 profits.

-

Raw material costs: Fluctuations in the prices of raw materials used in EV production, such as lithium and cobalt, increased production costs. This added pressure on Tesla's already tight profit margins.

-

Production bottlenecks: Tesla experienced challenges related to securing key components and managing its production process efficiently, resulting in production delays and reduced output.

-

Meeting sales targets: The combination of supply chain disruptions and production bottlenecks made it difficult for Tesla to meet its planned sales targets, further exacerbating the impact on profitability.

-

Bullet Points:

- Increased costs of raw materials like lithium and cobalt impacting profitability.

- Bottlenecks in the Tesla production process leading to delays.

- Difficulty in securing key components in a strained global supply chain.

Future Outlook and Strategies for Recovery

Despite the challenges, Tesla possesses significant potential for recovery. Strategic investments in new technologies, expansion into new markets, and the launch of new products are key elements of its potential recovery strategy. The future of Tesla's profitability hinges on its ability to successfully navigate these challenges.

-

New product launches and innovations: Tesla's ability to innovate and launch new products and features will be crucial in maintaining its competitive edge and attracting new customers.

-

Investments in battery technology and charging infrastructure: Advancements in battery technology and expansions of charging infrastructure will reduce costs and increase consumer confidence in electric vehicles.

-

Expansion into new markets: Expanding into new markets presents opportunities for growth and diversification, reducing reliance on existing markets.

-

Bullet Points:

- Potential for new model releases and advanced features to boost sales.

- Investments in cutting-edge battery technology and expanding its Supercharger network.

- Expansion into new geographical markets to tap into untapped customer bases.

Conclusion

Tesla's Q1 2024 profit plunge is a complex issue, stemming from a combination of factors: intense price competition, Elon Musk's controversial actions impacting investor confidence, and ongoing supply chain challenges. The company faces significant hurdles, but also possesses considerable potential for recovery through strategic investments and innovative product development. The future of Tesla and its impact on the broader EV market remains to be seen.

Call to Action: Stay informed on the evolving situation with Tesla and its impact on the electric vehicle market. Continue to follow our updates on Tesla Q1 profits and Elon Musk's influence on the company's future. Keep reading for more in-depth analysis of Tesla's performance and the future of the electric vehicle industry.

Featured Posts

-

Bold And The Beautiful Spoilers Wednesday April 23 Finns Pledge To Liam

Apr 24, 2025

Bold And The Beautiful Spoilers Wednesday April 23 Finns Pledge To Liam

Apr 24, 2025 -

Upcoming Bold And The Beautiful Liams Promise Hopes Crisis And Lunas Rising Stakes

Apr 24, 2025

Upcoming Bold And The Beautiful Liams Promise Hopes Crisis And Lunas Rising Stakes

Apr 24, 2025 -

Open Ais 2024 Developer Event Easier Voice Assistant Creation

Apr 24, 2025

Open Ais 2024 Developer Event Easier Voice Assistant Creation

Apr 24, 2025 -

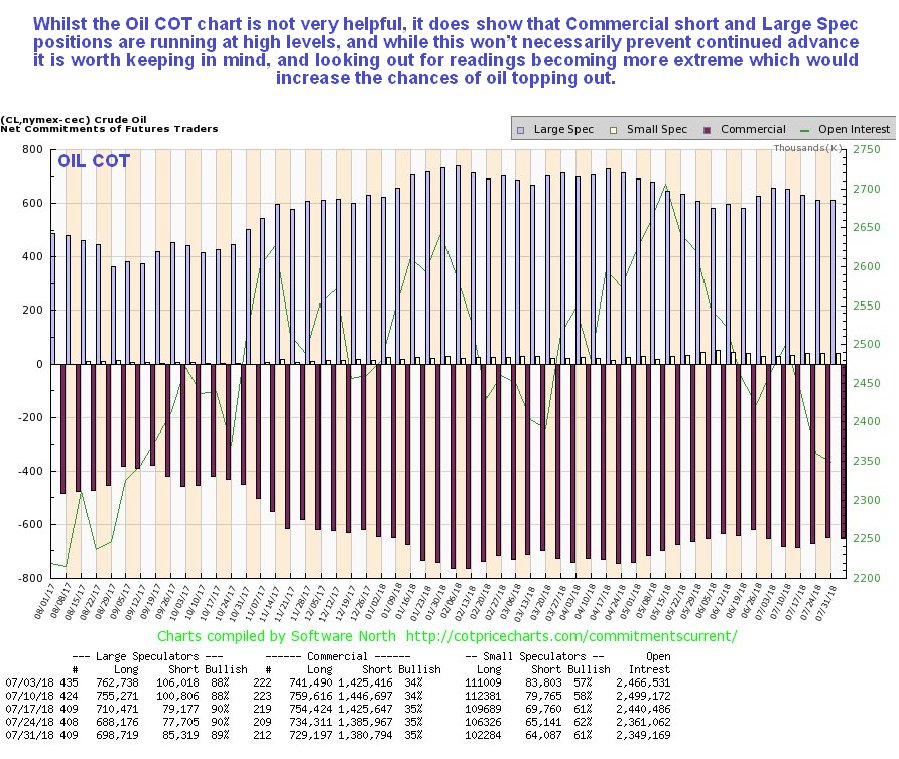

Oil Market Update April 23 Price Trends And Analysis

Apr 24, 2025

Oil Market Update April 23 Price Trends And Analysis

Apr 24, 2025 -

Pandemic Fraud Lab Owner Convicted Of Falsifying Covid Test Results

Apr 24, 2025

Pandemic Fraud Lab Owner Convicted Of Falsifying Covid Test Results

Apr 24, 2025

Latest Posts

-

Atelier D Artiste Rencontre Exceptionnelle Avec Sylvester Stallone

May 12, 2025

Atelier D Artiste Rencontre Exceptionnelle Avec Sylvester Stallone

May 12, 2025 -

Beeldschone Foto Van Sylvester Stallones Dochter

May 12, 2025

Beeldschone Foto Van Sylvester Stallones Dochter

May 12, 2025 -

Mon Exposition D Art Une Visite Memorable De Sylvester Stallone

May 12, 2025

Mon Exposition D Art Une Visite Memorable De Sylvester Stallone

May 12, 2025 -

Sylvester Stallones Dochter Foto Lokt Bewondering Uit

May 12, 2025

Sylvester Stallones Dochter Foto Lokt Bewondering Uit

May 12, 2025 -

Desvendando A Adaptacao Em Quadrinhos De Sylvester Stallone

May 12, 2025

Desvendando A Adaptacao Em Quadrinhos De Sylvester Stallone

May 12, 2025