The Canadian Dollar: Overvaluation And The Need For Rapid Response

Table of Contents

Factors Contributing to Canadian Dollar Overvaluation

Several interconnected factors contribute to the current concerns regarding Canadian dollar overvaluation. These include increased commodity prices, interest rate differentials, and the Canadian dollar's perceived safe-haven status.

Increased Commodity Prices

The rise in global commodity prices, particularly oil and natural gas – key Canadian exports – has significantly boosted the Canadian dollar.

- Stronger demand for Canadian resources leads to increased capital inflow. As global demand for energy increases, so does the demand for Canadian resources, attracting significant foreign investment.

- This inflow strengthens the CAD against other currencies. Increased demand for the Canadian dollar to purchase these resources pushes up its value relative to other currencies.

- Analysis of recent commodity price fluctuations and their impact on the CAD: Recent spikes in oil and gas prices directly correlate with periods of Canadian dollar appreciation, highlighting the strong link between commodity markets and the CAD exchange rate. A sustained high price environment for these commodities continues to exert upward pressure on the Canadian dollar.

Interest Rate Differentials

The Bank of Canada's interest rate hikes, relative to other major economies, have attracted foreign investment, further strengthening the Canadian dollar.

- Comparison of Canadian interest rates with those of the US, Eurozone, and other key trading partners: Currently, Canada's interest rates are relatively higher than many of its major trading partners. This difference creates an incentive for foreign investors to move their capital to Canada to earn higher returns.

- Explanation of how higher interest rates attract foreign capital: Higher interest rates offer a greater return on investment, attracting capital from countries with lower interest rates. This increased demand for Canadian dollar-denominated assets pushes up the CAD's value.

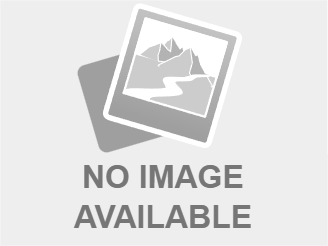

- Analysis of the impact of interest rate differentials on CAD exchange rates: Historical data clearly demonstrates a positive correlation between interest rate differentials and the Canadian dollar's exchange rate. Larger differentials tend to lead to stronger CAD values.

Safe-Haven Status

The Canadian dollar is often perceived as a safe-haven currency during times of global uncertainty, leading to increased demand.

- Discussion of geopolitical factors affecting the CAD's safe-haven status: Global instability and uncertainty often lead investors to seek refuge in perceived safe-haven assets, including the Canadian dollar, due to Canada's political stability and robust economy.

- Comparison of the CAD's performance against other safe-haven currencies during periods of market volatility: The CAD often outperforms other currencies during periods of market turmoil, solidifying its position as a safe-haven asset.

- Analysis of investor sentiment and its influence on the Canadian dollar: Investor sentiment plays a crucial role; during times of fear, the demand for the CAD as a safe haven increases, pushing its value higher.

Negative Consequences of Canadian Dollar Overvaluation

An overvalued Canadian dollar has several negative consequences for the Canadian economy.

Impact on Exports

An overvalued Canadian dollar makes Canadian goods and services more expensive for foreign buyers, reducing export competitiveness.

- Specific examples of industries affected by a strong Canadian dollar (e.g., manufacturing, agriculture): The manufacturing and agriculture sectors are particularly vulnerable, facing reduced competitiveness in international markets.

- Analysis of export data to illustrate the negative impact of overvaluation: Data reveals a clear correlation between periods of CAD overvaluation and declines in Canadian exports, indicating a direct and negative impact.

- Discussion of potential job losses and reduced economic activity in export-oriented sectors: Reduced exports lead to decreased production, potentially resulting in job losses and slower economic growth in these vital sectors.

Impact on Inflation

While a strong currency can curb import inflation, it can also lead to lower export prices and potentially deflationary pressures in certain sectors.

- Explanation of the complex relationship between exchange rates and inflation: The relationship is complex; a strong CAD reduces import costs, but also dampens export revenue, leading to potentially deflationary pressures in export-oriented sectors.

- Discussion of the potential for a strong CAD to exacerbate deflationary risks: Sustained overvaluation can contribute to deflationary spirals, particularly in sectors heavily reliant on exports.

- Analysis of the impact on consumer prices and overall economic stability: While lower import costs benefit consumers, deflationary pressures in certain sectors can negatively impact overall economic stability.

Policy Responses to Address Canadian Dollar Overvaluation

Addressing Canadian dollar overvaluation requires a coordinated approach involving monetary and fiscal policy adjustments.

Monetary Policy Adjustments

The Bank of Canada could adjust its monetary policy to manage the exchange rate, potentially through interest rate cuts or other interventions.

- Discussion of the limitations and potential risks associated with interest rate adjustments: Interest rate cuts, while potentially weakening the CAD, could also fuel inflation and impact economic stability.

- Analysis of alternative monetary policy tools that could be employed: Other tools, such as quantitative easing, could be considered, though each has potential downsides.

- Exploration of the potential impact of different policy responses on the Canadian economy: The Bank of Canada must carefully weigh the potential benefits and risks of different policy options to ensure optimal outcomes for the Canadian economy.

Fiscal Policy Measures

Government intervention, such as targeted support for export-oriented industries, could help mitigate the negative effects of overvaluation.

- Examples of potential fiscal policy measures (e.g., tax incentives, subsidies): Tax incentives for exporters or direct subsidies could help improve their competitiveness in global markets.

- Discussion of the effectiveness and potential drawbacks of fiscal policy interventions: While potentially effective, such interventions can be costly and may lead to distortions in the market.

- Analysis of the cost and benefits of such interventions: A cost-benefit analysis is crucial to ensure that any fiscal policy intervention is both effective and economically sound.

Conclusion

The overvaluation of the Canadian dollar presents significant challenges to the Canadian economy. Addressing the factors contributing to this overvaluation, including high commodity prices, interest rate differentials, and its safe-haven status, requires a multi-pronged approach involving both monetary and fiscal policy adjustments. Swift and decisive action is crucial to mitigate the negative consequences for Canadian exports, inflation, and overall economic growth. Understanding the dynamics of Canadian dollar overvaluation is paramount for businesses and policymakers alike. Staying informed about market trends and policy decisions related to the CAD exchange rate is essential for navigating this challenging economic landscape. We urge readers to continue monitoring developments in the Canadian and global economies and to engage in informed discussion on this critical issue.

Featured Posts

-

New Dystopian Horror Movie Trailer Based On A Stephen King Novel

May 08, 2025

New Dystopian Horror Movie Trailer Based On A Stephen King Novel

May 08, 2025 -

Bof As Take On High Stock Market Valuations A Reason For Investor Optimism

May 08, 2025

Bof As Take On High Stock Market Valuations A Reason For Investor Optimism

May 08, 2025 -

Conmebol Libertadores Liga De Quito Vs Flamengo Grupo C Fecha 3

May 08, 2025

Conmebol Libertadores Liga De Quito Vs Flamengo Grupo C Fecha 3

May 08, 2025 -

Lahwr Ahtsab Edaltwn Ky Tedad Myn Kmy Awr As Ke Ntayj

May 08, 2025

Lahwr Ahtsab Edaltwn Ky Tedad Myn Kmy Awr As Ke Ntayj

May 08, 2025 -

Acil Saglik Bakanligi 37 Bin Personel Aliminda Son Durum Ve Basvuru Bilgileri

May 08, 2025

Acil Saglik Bakanligi 37 Bin Personel Aliminda Son Durum Ve Basvuru Bilgileri

May 08, 2025