The Economic Fallout Of The US-China Trade War: Beijing's Efforts At Concealment

Table of Contents

The Official Narrative vs. Reality: Unveiling China's Economic Data Manipulation

The Chinese government's official narrative regarding the economic impact of the trade war often clashes sharply with independent analyses. This discrepancy raises serious questions about the reliability of official data and suggests a deliberate effort to downplay negative economic impacts.

Data inconsistencies and discrepancies

Numerous inconsistencies exist between official Chinese economic data and independent assessments. These discrepancies cast doubt on the accuracy of reported figures.

- GDP Growth Rates: While official reports consistently showed sustained, albeit slowing, GDP growth, independent analyses using alternative indicators, such as electricity consumption and freight transport, painted a less optimistic picture. Discrepancies often emerged, especially during periods of heightened trade tensions.

- Trade Balance Figures: Reported trade surpluses often appeared inflated compared to data from trading partners, suggesting potential underreporting of imports or overreporting of exports. This is especially true for specific sectors heavily affected by the trade war.

- Unemployment Statistics: Official unemployment figures remained relatively low throughout the trade war, despite anecdotal evidence and reports from businesses suggesting significant job losses, particularly in export-oriented industries.

- Foreign Investment Data: While official data indicated continued foreign investment, independent research hinted at a decline in certain sectors, reflecting investor uncertainty caused by the trade conflict. Satellite imagery of industrial parks has also provided contradictory evidence on the ground level.

These inconsistencies suggest a systematic effort to present a rosier picture than reality warrants, obscuring the true economic fallout of the trade war.

Opacity in State-Owned Enterprises (SOEs)

The lack of transparency surrounding the financial performance of State-Owned Enterprises (SOEs) further complicates the assessment of the trade war's impact. SOEs play a crucial role in the Chinese economy, and their struggles are often not reflected accurately in official statistics.

- Lack of Transparency in SOE Finances: Many SOEs operate with limited public disclosure of their financial information, making independent auditing extremely difficult.

- Difficulties for Independent Auditing: The opacity surrounding SOE operations makes it challenging for independent analysts to verify the accuracy of reported figures. This lack of transparency makes it difficult to obtain a true measure of their contribution to the overall economy.

- Potential for Off-Balance-Sheet Accounting: There is concern that SOEs may engage in off-balance-sheet accounting practices to mask losses incurred during the trade war, further complicating efforts to gauge their true financial health.

The opacity surrounding SOEs hinders accurate assessments of the trade war's true economic impact on this vital sector of the Chinese economy.

Impact on Specific Sectors: Beyond Official Statistics

The impact of the US-China trade war extended far beyond the official statistics, significantly affecting specific sectors and businesses.

Manufacturing and Export Dependence

Industries heavily reliant on exports to the US were particularly hard hit by the imposition of tariffs.

- Examples of Industries Hit Hard: The technology sector (particularly electronics and telecommunications), agriculture (soybeans, for example), and textiles suffered significant losses.

- Job Losses: The imposition of tariffs led to widespread job losses in these sectors, with many factories forced to reduce production or close down completely.

- Factory Closures: Numerous factories, especially smaller ones, were forced to close down, leading to significant economic disruption in affected regions.

- Shifting Production Locations: Many companies shifted production to other countries to avoid tariffs, resulting in a loss of manufacturing capabilities and jobs within China. This outflow of manufacturing had cascading effects throughout the supply chain.

The official narrative often fails to capture the full extent of these challenges, which had a ripple effect throughout the broader economy.

The Ripple Effect on Small and Medium-sized Enterprises (SMEs)

SMEs, a significant driver of the Chinese economy, were disproportionately affected by the trade war, facing numerous challenges that often went undocumented in official reports.

- Challenges Faced by SMEs: SMEs struggled to access credit, adapt to changing market conditions, and compete with larger companies better equipped to absorb the shock.

- Access to Credit: The economic slowdown made it harder for SMEs to secure loans and funding, exacerbating their financial difficulties.

- Adapting to Changing Market Conditions: The rapid shift in global trade patterns necessitated costly adaptations that many SMEs could not afford.

- SME Failures and Bankruptcies: The number of SME failures and bankruptcies likely increased significantly during the trade war, a trend largely obscured by official data.

The struggles of SMEs, critical to the Chinese economy, are frequently overlooked in the official economic statistics.

International Implications: Distorting Global Economic Understanding

Beijing's data manipulation had far-reaching international implications, distorting the global economic understanding of the trade war's consequences.

Underreporting the true cost of the trade war

The underreporting of the true economic cost of the trade war impacted international economic modeling and forecasting.

- Impact on Global Trade Forecasts: Inaccurate data from China skewed global trade forecasts, leading to flawed policy recommendations and investment decisions.

- Inaccurate Assessments of China's Economic Resilience: The underreporting of negative impacts contributed to an overestimation of China's economic resilience during the trade conflict.

- Flawed Policy Recommendations by International Organizations: The use of inaccurate data in international economic modeling resulted in flawed policy recommendations by organizations like the IMF and World Bank.

This misinformation influenced global economic policy decisions and investment strategies.

Erosion of Trust and Transparency

Beijing's actions eroded international confidence in Chinese economic data, impacting global trust and cooperation.

- Reduced Credibility of Official Chinese Statistics: The inconsistencies between official data and independent analyses significantly reduced the credibility of official Chinese statistics.

- Concerns over Data Reliability for International Investors: International investors became increasingly concerned about the reliability of Chinese economic data, impacting investment decisions and capital flows.

- Challenges for Collaboration on Global Economic Issues: The lack of transparency and trust undermined international collaboration on global economic issues.

This erosion of trust damaged China's reputation as a reliable economic partner.

Conclusion

The US-China trade war had a significant and complex economic impact on China. Beijing's efforts to conceal the true extent of the fallout, through data manipulation and opacity, have hindered accurate assessment and hampered international cooperation. Understanding the true Economic Fallout of the US-China Trade War requires a deeper investigation beyond the official narrative. We urge readers to consult independent sources, critically analyze official data, and continue to explore this crucial aspect of contemporary global economics.

Featured Posts

-

This Country Unveiling Its Landscapes And People

May 02, 2025

This Country Unveiling Its Landscapes And People

May 02, 2025 -

This Country A Regional Overview

May 02, 2025

This Country A Regional Overview

May 02, 2025 -

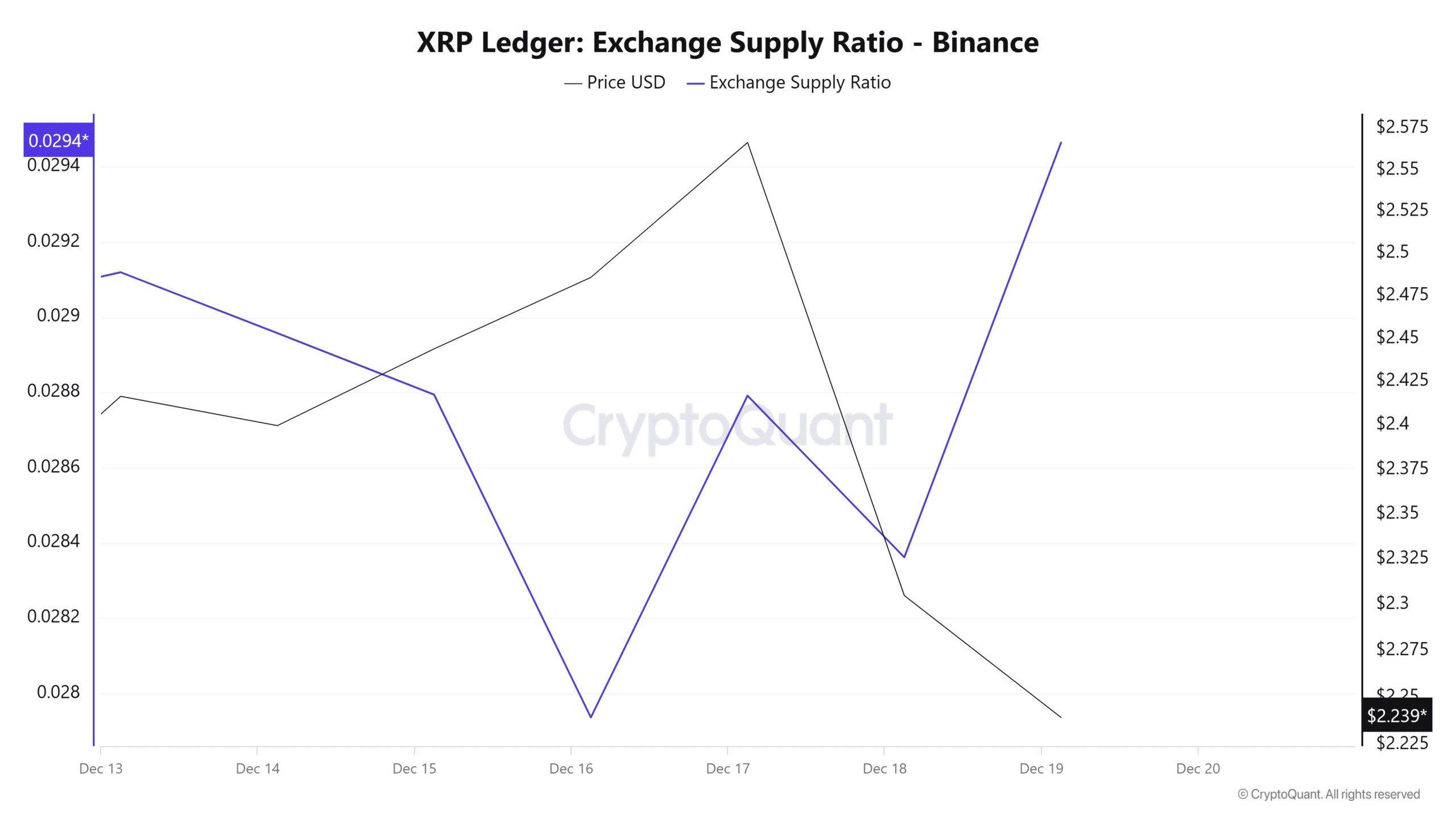

Ripple Xrp And The Sec Analyzing The Impact Of Recent Developments And Etf Potential

May 02, 2025

Ripple Xrp And The Sec Analyzing The Impact Of Recent Developments And Etf Potential

May 02, 2025 -

Fortnite Cosmetic Item Refunds A Sign Of Future Updates

May 02, 2025

Fortnite Cosmetic Item Refunds A Sign Of Future Updates

May 02, 2025 -

Nea Ethniki Stratigiki P Syxikis Ygeias 2025 2028 Odigos Gia Tin Ylopoiisi

May 02, 2025

Nea Ethniki Stratigiki P Syxikis Ygeias 2025 2028 Odigos Gia Tin Ylopoiisi

May 02, 2025