The Economic Impact Of Trump's Tariffs: A Look At Billionaire Losses Post-Liberation Day

Table of Contents

The Target Industries: Assessing the Tariff's Impact on Billionaires' Portfolios

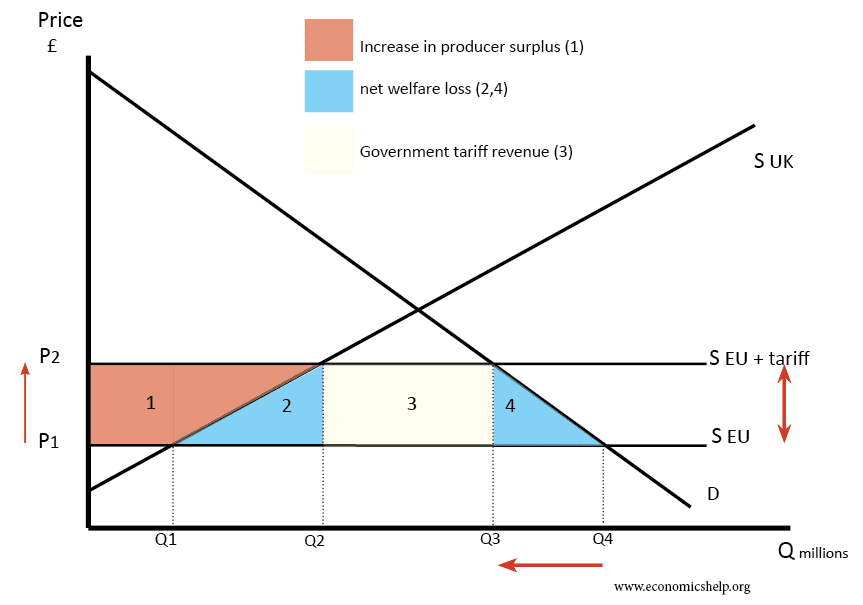

Trump's tariffs targeted specific industries, creating a ripple effect that significantly impacted billionaires with investments in those sectors.

The Steel and Aluminum Sectors

The steel and aluminum tariffs, implemented in 2018, aimed to protect domestic producers. However, they led to increased prices for downstream industries and retaliatory tariffs from other countries. This resulted in significant losses for some billionaires with substantial holdings in these sectors.

- Example 1: [Insert name of billionaire with steel holdings] saw a [percentage]% decrease in their net worth due to decreased profitability and stock market fluctuations in the steel industry following the tariff implementation. (Source: [Cite reputable financial news source]).

- Example 2: The reduced competitiveness of American steel manufacturers, driven by tariffs, also led to job losses, indirectly impacting the wealth of billionaires invested in related businesses. (Source: [Cite Bureau of Labor Statistics or similar]).

- The increased costs associated with imported steel and aluminum affected various industries, further impacting the portfolios of billionaires with investments across the broader manufacturing sector.

The Agricultural Sector

The agricultural sector suffered greatly from retaliatory tariffs imposed by China and other trading partners. Billionaires with significant investments in agriculture, particularly soybeans, experienced substantial losses.

- Reduced Exports: Chinese tariffs on American soybeans drastically reduced exports, leading to lower prices and decreased profits for American farmers and related businesses. (Source: [Cite USDA data or relevant report]).

- Government Subsidies: While the government offered subsidies to mitigate some losses, these didn't fully compensate for the significant drop in export revenue, impacting the net worth of billionaires with agricultural holdings. (Source: [Cite relevant government report on agricultural subsidies]).

- Example: [Insert name of billionaire with agricultural holdings], who holds a significant stake in [agricultural company], experienced a [quantifiable loss] due to the decreased demand for soybeans. (Source: [Cite reputable financial news source]).

The Retail Sector

Tariffs on imported goods increased the prices of consumer products, leading to reduced consumer spending and impacting billionaires with investments in the retail sector.

- Increased Prices: Higher tariffs on imported goods resulted in increased prices for consumers, leading to decreased purchasing power and lower sales for retailers. (Source: [Cite Consumer Price Index data or relevant economic report]).

- Supply Chain Disruptions: Tariffs disrupted global supply chains, leading to delays, increased costs, and reduced profitability for retail businesses. (Source: [Cite industry reports on supply chain disruptions]).

- Example: [Insert name of billionaire with retail holdings] reported a decline in profits due to reduced consumer spending and increased costs associated with tariffs on imported goods. (Source: [Cite company financial reports or news articles]).

Analyzing the Ripple Effect: Beyond Direct Investments

The economic impact of Trump's tariffs extended beyond the directly targeted industries, impacting billionaire wealth through indirect channels.

Decreased Consumer Confidence and Spending

The uncertainty created by the trade wars and the resulting price increases eroded consumer confidence and decreased spending. This slowdown in consumer spending negatively impacted the overall economy and, consequently, the portfolios of billionaires whose wealth is tied to consumer demand.

- Correlation between consumer spending and billionaire portfolios: A decrease in consumer spending generally leads to lower profits for companies and reduced valuations for publicly traded companies, ultimately affecting billionaire wealth. (Source: [Cite economic research linking consumer spending to stock market performance]).

- Economic Indicators: The decline in GDP growth and consumer confidence indices during the period of tariff implementation underscores the negative impact on the broader economy. (Source: [Cite relevant economic data from sources like the Federal Reserve]).

International Trade Relations and Global Market Instability

Trump's tariffs triggered retaliatory tariffs from other countries, creating a volatile global trading environment. This market instability directly impacted billionaire assets.

- Retaliatory Tariffs: Retaliatory tariffs from trading partners decreased export opportunities for American companies and further dampened economic growth, reducing the overall value of assets held by many billionaires. (Source: [Cite reports on retaliatory tariffs and their impact on trade]).

- Market Volatility: The uncertainty caused by the trade war led to increased market volatility, negatively impacting the value of various investments held by billionaires. (Source: [Cite analysis of stock market volatility during the period of tariff implementation]).

Long-Term Economic Consequences and the Path Forward

The long-term effects of Trump's tariffs are still unfolding.

The Lasting Impact on Specific Industries

Certain industries, particularly agriculture and manufacturing, continue to grapple with the aftereffects of the tariffs. The extent of the long-term recovery varies widely based on industry resilience and adaptation strategies.

Policy Implications and Lessons Learned

The experience with Trump's tariffs highlights the complexities of trade policy and the need for careful consideration of potential unintended consequences, both domestically and internationally.

Future Economic Forecasting Based on the Current Data

While the immediate fallout from the tariffs is largely understood, predicting the long-term effects remains challenging. Further research is crucial to fully grasp the ongoing implications of these policies on different aspects of the global economy, and even more so on the wealth distribution.

Conclusion

The economic impact of Trump's tariffs on billionaires is multifaceted. While some experienced direct losses in their specific industry investments, others faced indirect consequences through decreased consumer spending, global market instability, and retaliatory tariffs. Analyzing these losses reveals the interconnected nature of the global economy and the ripple effects of protectionist trade policies. Understanding the economic impact of Trump's tariffs requires considering the complexities of these interconnected effects. To delve deeper into this critical issue, explore resources from the Congressional Research Service, the Federal Reserve, and reputable financial news outlets. Contact your legislators to express your concern and encourage informed policy making regarding trade relations—this is crucial for building a more stable and prosperous future.

Featured Posts

-

Dijon Les Ecologistes Se Preparent Pour Les Municipales 2026

May 10, 2025

Dijon Les Ecologistes Se Preparent Pour Les Municipales 2026

May 10, 2025 -

Kritiki Treiler Materialists I Nea Romantiki Komodia Me Ntakota Tzonson

May 10, 2025

Kritiki Treiler Materialists I Nea Romantiki Komodia Me Ntakota Tzonson

May 10, 2025 -

Why Apple Might Be Saving Google From Itself

May 10, 2025

Why Apple Might Be Saving Google From Itself

May 10, 2025 -

Elizabeth Hurleys Most Daring Cleavage Photos And Appearances

May 10, 2025

Elizabeth Hurleys Most Daring Cleavage Photos And Appearances

May 10, 2025 -

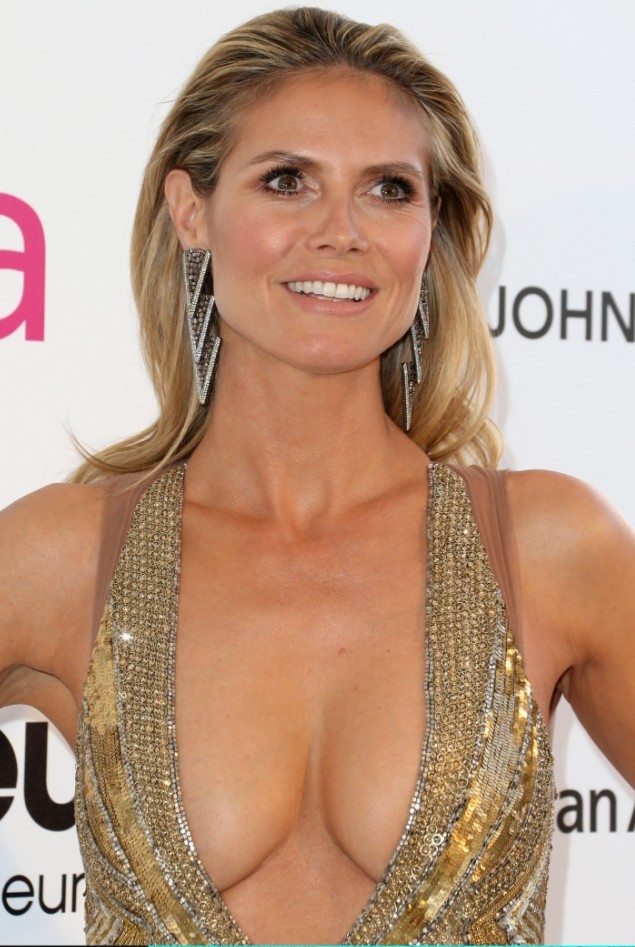

Prediction 2 Stocks Poised To Outperform Palantir In 3 Years

May 10, 2025

Prediction 2 Stocks Poised To Outperform Palantir In 3 Years

May 10, 2025