The Extreme Cost Implications Of Broadcom's Proposed VMware Acquisition

Table of Contents

The Astronomical Acquisition Cost: A Deep Dive into the $61 Billion Deal

The sheer scale of the $61 billion price tag attached to Broadcom's VMware acquisition is unprecedented in recent tech history. This dwarfs many previous mega-mergers, highlighting its significance and potential impact. To put it in perspective, consider these points:

- Premium Paid: Broadcom paid a significant premium over VMware's market value, demonstrating their belief in the long-term potential of VMware's technologies and market position. This premium underscores the strategic importance of VMware's portfolio within Broadcom's overall vision.

- Financing the Deal: The financing mechanisms employed to fund this acquisition – likely a combination of debt and equity – will have implications for Broadcom's financial stability and future investment strategies. The interest payments alone will be substantial, potentially influencing their future business decisions.

- Comparison to Other Acquisitions: Consider the relative size compared to other major tech acquisitions like Microsoft's acquisition of Activision Blizzard or Facebook's (now Meta) acquisition of Instagram. The Broadcom-VMware deal surpasses many, establishing it as one of the largest technology mergers ever.

This massive investment reflects Broadcom's ambitious strategic objectives and their intention to solidify their position within the enterprise software and infrastructure market.

Increased Prices for VMware Products and Services: The Consumer Impact

One of the most immediate concerns surrounding Broadcom's VMware acquisition is the potential for substantial price increases for VMware's products and services. This is a valid concern due to several factors:

- Reduced Competition: With Broadcom's control over VMware, the competitive landscape shifts, potentially reducing pressure to maintain price competitiveness. This lack of competition could lead to inflated prices.

- Increased Operational Costs: Integrating two large companies inevitably involves significant operational costs. These added expenses could be passed on to consumers in the form of higher prices for software licenses, support, and services.

- Impact on SMBs: Small and medium-sized businesses (SMBs), which often rely on cost-effective solutions, are particularly vulnerable to these price hikes. The increased cost of VMware products might force them to seek less robust or more expensive alternatives.

- Finding Alternatives: Businesses may begin exploring open-source solutions or competitive offerings from companies like Citrix, Nutanix, or even cloud-native services from AWS, Azure, or Google Cloud. This could lead to a shift in the market share.

Reduced Competition and Innovation in the Enterprise Software Market

The acquisition raises significant concerns regarding reduced competition and stifled innovation within the virtualization and cloud computing markets.

- Monopolization Fears: The combined market power of Broadcom and VMware could lead to a monopolistic situation, limiting customer choice and potentially slowing down the pace of innovation. This decreased competition threatens to stifle the development of new technologies and solutions.

- Antitrust Scrutiny: Regulatory bodies worldwide are likely to scrutinize the deal intensely, examining its potential anti-competitive effects and assessing whether it violates antitrust laws. The outcome of these reviews will significantly impact the deal's final shape.

- Impact on Innovation: Reduced competition often translates to slower innovation. Without the pressure to compete, the drive to develop cutting-edge technologies might diminish, potentially hindering the advancement of virtualization and cloud computing.

Job Security and Restructuring Concerns: The Employee Perspective

The integration of VMware into Broadcom will undoubtedly lead to restructuring, raising concerns about job security for VMware employees.

- Broadcom's Track Record: Analyzing Broadcom's historical approach to mergers and acquisitions, particularly regarding cost-cutting measures and layoffs, is crucial to understanding the potential impact on VMware's workforce.

- Employee Morale: Uncertainty surrounding job security can negatively affect employee morale, productivity, and innovation within the merged entity.

- Potential Benefits: While job losses are a concern, integration into a larger organization could offer some employees new opportunities and career advancement possibilities.

The uncertainty surrounding potential layoffs and restructuring underscores the need for transparency and clear communication from Broadcom to address employee concerns.

Long-Term Strategic Implications for Broadcom and the Tech Industry

Broadcom's acquisition of VMware is a bold strategic move with far-reaching consequences.

- Broadcom's Strategic Goals: Understanding Broadcom's long-term strategic goals behind this acquisition is crucial to evaluating its ultimate impact. The acquisition could be part of a broader strategy to expand their market dominance in specific sectors.

- Market Position: This acquisition significantly strengthens Broadcom's position in the enterprise software and infrastructure market, allowing them to offer a more comprehensive suite of solutions to their clients.

- Future Acquisitions: The success or failure of this acquisition could influence the likelihood of similar large-scale mergers and acquisitions in the tech industry in the future.

The deal sets a significant precedent and will shape the competitive landscape for years to come.

Conclusion: The Lasting Effects of Broadcom's VMware Acquisition: A Call to Action

Broadcom's $61 billion acquisition of VMware presents a complex tapestry of cost implications, impacting consumers, businesses, employees, and the broader tech landscape. The potential for price increases, reduced competition, and job security concerns underscores the significance of this deal. The long-term effects remain to be seen, but the acquisition's massive scale and potential for market disruption are undeniable.

Stay informed about the ongoing developments of Broadcom's VMware acquisition. Follow regulatory reviews, analyze market reactions, and stay updated on the integration process to fully understand the ramifications of this transformative deal. The future of the enterprise software market hinges on the outcome.

Featured Posts

-

The Extreme Cost Implications Of Broadcoms Proposed V Mware Acquisition

May 06, 2025

The Extreme Cost Implications Of Broadcoms Proposed V Mware Acquisition

May 06, 2025 -

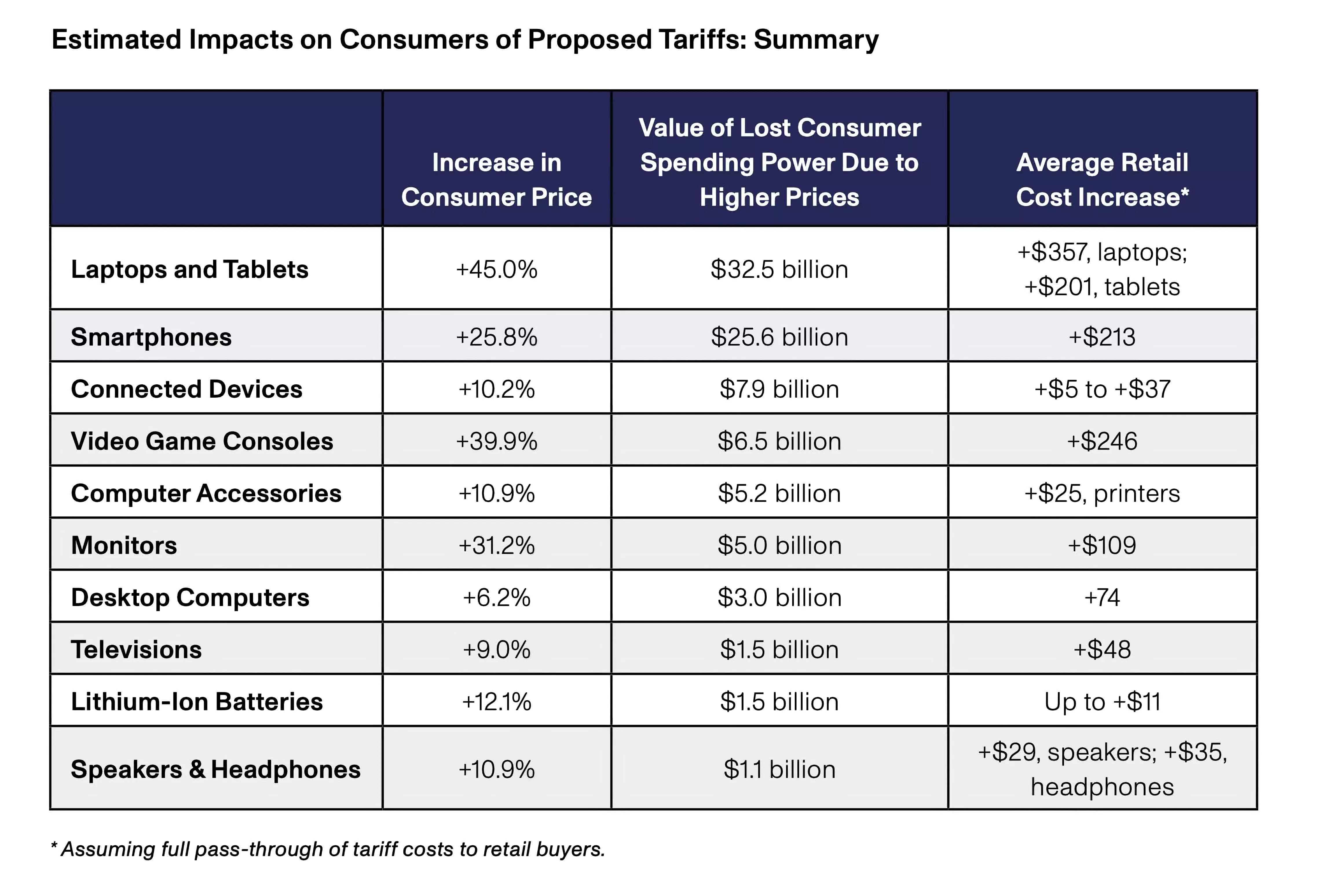

Trump Era Tariffs Winners And Losers In The Us Manufacturing Sector

May 06, 2025

Trump Era Tariffs Winners And Losers In The Us Manufacturing Sector

May 06, 2025 -

Nintendos Action Against Ryujinx Emulator Developer Statement And Future Implications

May 06, 2025

Nintendos Action Against Ryujinx Emulator Developer Statement And Future Implications

May 06, 2025 -

Patrick Schwarzenegger Addresses Nepotism Claims Following White Lotus Casting

May 06, 2025

Patrick Schwarzenegger Addresses Nepotism Claims Following White Lotus Casting

May 06, 2025 -

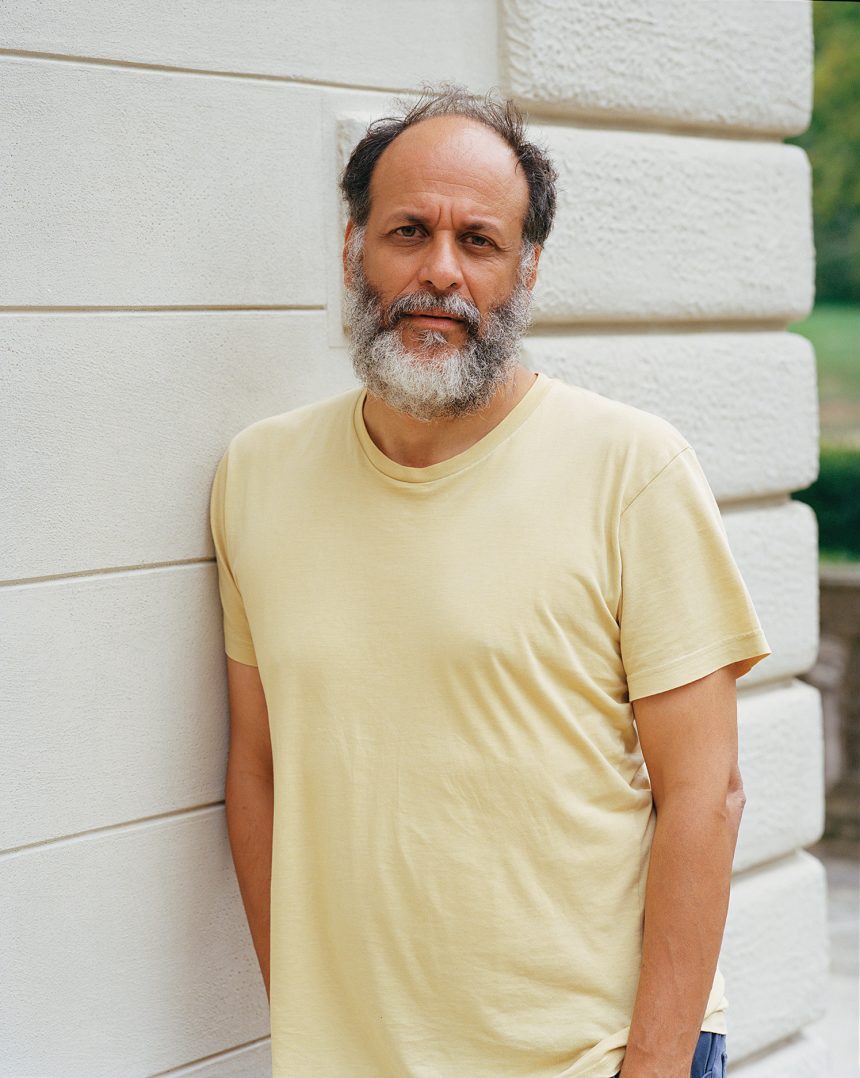

Patrick Schwarzenegger Lands Key Role In Luca Guadagninos New Film

May 06, 2025

Patrick Schwarzenegger Lands Key Role In Luca Guadagninos New Film

May 06, 2025

Latest Posts

-

Analysis Of Ddgs Dont Take My Son Diss Track Targeting Halle Bailey

May 06, 2025

Analysis Of Ddgs Dont Take My Son Diss Track Targeting Halle Bailey

May 06, 2025 -

Ddg And Halle Bailey Feud Escalates With New Diss Track Dont Take My Son

May 06, 2025

Ddg And Halle Bailey Feud Escalates With New Diss Track Dont Take My Son

May 06, 2025 -

Ddg Fires Shots At Halle Bailey With Dont Take My Son Diss Track

May 06, 2025

Ddg Fires Shots At Halle Bailey With Dont Take My Son Diss Track

May 06, 2025 -

Ddgs Dont Take My Son Is This A Diss Track Aimed At Halle Bailey

May 06, 2025

Ddgs Dont Take My Son Is This A Diss Track Aimed At Halle Bailey

May 06, 2025 -

Ddgs Dont Take My Son A Response To Halle Bailey

May 06, 2025

Ddgs Dont Take My Son A Response To Halle Bailey

May 06, 2025