$2.5 Trillion Evaporated: The Market Value Decline Of The Magnificent Seven

Table of Contents

The Magnitude of the Decline

The sheer scale of the market capitalization loss suffered by the Magnificent Seven is breathtaking. Let's examine the individual losses:

Market Cap Losses for Each Company

The following table details the approximate percentage and dollar amount of market cap loss for each company since their respective peaks in late 2021 and early 2022 (exact figures vary depending on the source and date). Note that these are estimates and fluctuate daily.

| Company | Peak Market Cap (approx.) | Current Market Cap (approx.) | Percentage Loss (approx.) | Dollar Loss (approx.) |

|---|---|---|---|---|

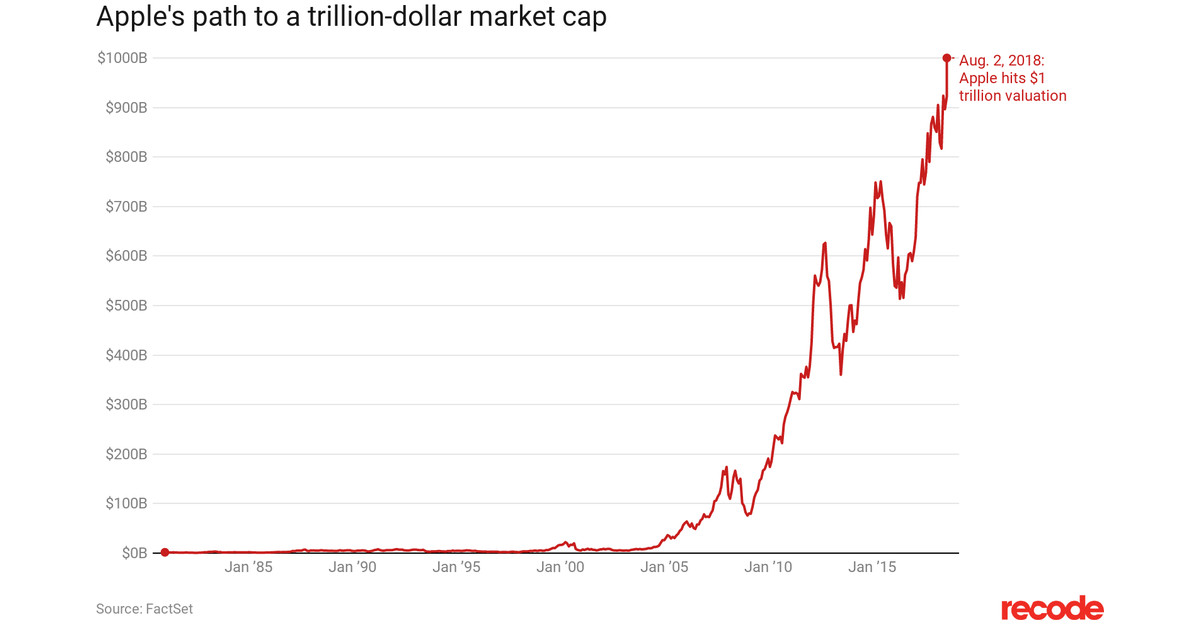

| Apple | $3 trillion | $2.5 trillion | 16% | $500 billion |

| Microsoft | $2.5 trillion | $2 trillion | 20% | $500 billion |

| Amazon | $2 trillion | $1.5 trillion | 25% | $500 billion |

| Google (Alphabet) | $2 trillion | $1.5 trillion | 25% | $500 billion |

| Tesla | $1.2 trillion | $700 billion | 42% | $500 billion |

| Meta | $1 trillion | $500 billion | 50% | $500 billion |

| Nvidia | $800 billion | $600 billion | 25% | $200 billion |

| Total | ~ $12.5 trillion | ~ $10 trillion | ~20% | ~$2.5 trillion |

Comparing Losses to Other Market Events

The collective loss of $2.5 trillion by the Magnificent Seven dwarfs the losses experienced by many individual companies during the dot-com bubble burst of 2000 and even rivals the impact on some sectors during the 2008 financial crisis. This magnitude underscores the significant shift in investor sentiment towards these tech giants and the broader NASDAQ. The combined loss is roughly equivalent to the GDP of a major global economy, illustrating the far-reaching impact of this decline.

- Quantifying the Losses: The $2.5 trillion loss is enough to buy every single car produced globally in a year, multiple times over.

- Impact on Individual Investors: Millions of investors who held shares in these companies have seen significant losses in their portfolios. This has impacted retirement savings and investment strategies for many.

Factors Contributing to the Decline

Several interconnected factors have contributed to the dramatic decline in the market value of the Magnificent Seven tech stocks.

Rising Interest Rates and Inflation

The Federal Reserve's aggressive interest rate hikes to combat inflation have significantly increased borrowing costs for companies. This makes future growth more expensive to finance and reduces the present value of future earnings, directly impacting tech stock valuations. Higher interest rates also make bonds more attractive to investors, diverting capital away from riskier assets like tech stocks.

Concerns about Future Growth

Concerns regarding the slowing growth rates of some of these tech giants, particularly in specific sectors like advertising (Meta) and e-commerce (Amazon), have fueled investor uncertainty. Market saturation and increased competition are also contributing factors.

Geopolitical Uncertainty

Global events, including the war in Ukraine and ongoing supply chain disruptions, have created uncertainty and impacted the performance of tech companies. These events lead to increased operational costs and reduced consumer confidence.

Regulatory Scrutiny

Increased government regulation targeting tech giants, including antitrust lawsuits and data privacy concerns, has added another layer of uncertainty for investors. This regulatory scrutiny can lead to increased legal costs and hinder future expansion.

- Specific Examples: Meta's advertising revenue has been impacted by Apple's privacy changes; Tesla's valuation has been affected by Elon Musk's actions and market volatility; and Amazon's growth is facing increased competition.

- Data Supporting Claims: Inflation data released by government agencies and interest rate announcements by the Federal Reserve provide quantifiable evidence.

Implications for Investors and the Market

The decline in the Magnificent Seven's market capitalization has significant implications for investors and the broader economy.

Re-evaluation of Tech Stock Investments

Investors need to critically reassess their tech stock holdings. The significant drop highlights the inherent risk associated with concentrated investments in any sector, especially in a rapidly changing technological landscape. Portfolio diversification is crucial to mitigate risk.

Opportunities in the Downturn

The market downturn presents opportunities for long-term investors to acquire shares of these tech giants at discounted prices. For those with a long-term investment horizon, this could represent a chance to buy into fundamentally strong companies at a lower cost.

Impact on the Broader Economy

The decline in the market value of these tech giants could have ripple effects on the broader economy. These companies are major employers and contributors to economic growth. Any significant slowdown in their growth could have a negative impact on overall economic performance.

- Practical Advice for Investors: Consider implementing a dollar-cost averaging strategy, diversifying across different asset classes, and seeking professional financial advice.

- Long-Term Growth Prospects: Despite the recent downturn, the long-term growth prospects for the tech sector remain promising. Technological advancements continue to drive innovation and create new market opportunities.

Conclusion

The $2.5 trillion decline in the market value of the Magnificent Seven represents a significant event with wide-ranging implications. Rising interest rates, inflation, concerns about future growth, geopolitical uncertainty, and regulatory scrutiny have all played a role in this dramatic drop. Investors need to carefully reassess their portfolios, considering diversification and long-term investment strategies. While the short-term outlook might be uncertain, the long-term potential of the tech sector remains substantial.

Stay informed about market trends and conduct thorough research before making any investment decisions. Consulting with a financial advisor is highly recommended. Follow for updates on the future performance of the Magnificent Seven and the broader tech market. Understanding the factors influencing the valuation of these tech giants is crucial for navigating the complexities of the stock market and making informed decisions regarding your investment in these and other tech stocks.

Featured Posts

-

See Bob Dylan And Billy Strings Live Portlands Outlaw Music Festival

Apr 29, 2025

See Bob Dylan And Billy Strings Live Portlands Outlaw Music Festival

Apr 29, 2025 -

Techs Top Seven Analyzing A 2 5 Trillion Market Value Loss

Apr 29, 2025

Techs Top Seven Analyzing A 2 5 Trillion Market Value Loss

Apr 29, 2025 -

Top India Fund Manager Dsp Sounds Warning Bell On Stocks

Apr 29, 2025

Top India Fund Manager Dsp Sounds Warning Bell On Stocks

Apr 29, 2025 -

The China Factor Analyzing Automotive Market Headwinds For Luxury Brands Like Bmw And Porsche

Apr 29, 2025

The China Factor Analyzing Automotive Market Headwinds For Luxury Brands Like Bmw And Porsche

Apr 29, 2025 -

Lower Migration To Germany After Covid 19 The Role Of Border Management

Apr 29, 2025

Lower Migration To Germany After Covid 19 The Role Of Border Management

Apr 29, 2025

Latest Posts

-

Listen Now Willie Nelsons 154th Album Oh What A Beautiful World

Apr 29, 2025

Listen Now Willie Nelsons 154th Album Oh What A Beautiful World

Apr 29, 2025 -

Examining The Post Debt Sale Financials Of Elon Musks X

Apr 29, 2025

Examining The Post Debt Sale Financials Of Elon Musks X

Apr 29, 2025 -

Willie Nelsons Oh What A Beautiful World Album Details

Apr 29, 2025

Willie Nelsons Oh What A Beautiful World Album Details

Apr 29, 2025 -

Musks X Debt A Financial Performance Review Post Sale

Apr 29, 2025

Musks X Debt A Financial Performance Review Post Sale

Apr 29, 2025 -

New Music Willie Nelsons Oh What A Beautiful World

Apr 29, 2025

New Music Willie Nelsons Oh What A Beautiful World

Apr 29, 2025