The Future Of Canada's Economy: Lessening U.S. Investor Control

Table of Contents

Diversifying Foreign Investment Sources

Over-dependence on any single source of foreign investment creates economic fragility. To mitigate this risk, Canada must actively pursue a more diversified portfolio of international investors.

Attracting Investment from Asia and Europe

Significant opportunities exist for attracting foreign direct investment from rapidly growing economies in Asia and established markets in Europe. Countries like China, India, Japan, the UK, and Germany represent substantial pools of capital seeking attractive investment opportunities.

- Technology: These countries are leaders in technological innovation and actively seek partnerships with Canadian companies in sectors like artificial intelligence, software development, and clean technology.

- Renewable Energy: Canada’s abundant renewable resources and commitment to sustainable development make it a prime destination for investment in green energy projects.

- Natural Resources: While Canada's natural resources sector has historically attracted significant U.S. investment, there's room for diversification with Asian countries eager to secure reliable sources of raw materials.

Examples of successful investment attraction strategies:

- Targeted marketing campaigns highlighting Canada's competitive advantages.

- Streamlined regulatory processes to expedite investment approvals.

- Incentive programs offering tax breaks and other benefits to foreign investors.

Strengthening Canadian Businesses for Global Competition

Attracting foreign investment also requires fostering a vibrant and competitive domestic business landscape. Supporting Canadian companies in expanding internationally enhances their attractiveness to foreign investors.

- Government initiatives focused on innovation and entrepreneurship, such as funding for research and development and tax credits for small and medium-sized enterprises (SMEs).

- Investment in education and skills development to ensure a highly skilled workforce.

- Developing robust infrastructure to support business growth and facilitate trade.

Examples of successful Canadian businesses attracting foreign investment:

- Shopify's global e-commerce platform attracting international investors.

- Canadian technology firms partnering with international companies on research and development projects.

Promoting Canadian Ownership and Control

Strengthening Canadian ownership and control is paramount to reducing reliance on foreign capital and ensuring national interests are prioritized.

Strengthening Regulations to Protect National Interests

Canada's current regulatory framework concerning foreign investment needs review to better protect national security and economic interests.

- Implementing stricter scrutiny of foreign acquisitions, particularly in strategic sectors such as energy, telecommunications, and defense.

- Establishing clearer guidelines for investment screening to ensure transparency and accountability.

- Strengthening the role of government agencies in overseeing foreign investment to ensure compliance with national interests.

Examples of successful regulatory frameworks:

- The Committee on Foreign Investment in the United States (CFIUS) model, which allows for the review and blocking of foreign investments deemed detrimental to U.S. national security.

Encouraging Domestic Savings and Investment

Reducing reliance on foreign capital requires stimulating domestic savings and investment.

- Tax policies that incentivize Canadians to invest in Canadian companies and assets.

- Encouraging greater participation in retirement savings plans and pension funds to increase the pool of domestic capital.

- Developing a more sophisticated and efficient capital market to facilitate domestic investment.

Examples of successful domestic investment initiatives:

- Government-sponsored investment funds focused on supporting specific sectors or regions.

Developing a Robust and Independent Canadian Economy

Building a strong and independent Canadian economy requires a long-term vision focused on human capital development and sustainable growth.

Investing in Human Capital and Infrastructure

Investing in education, skills training, and modern infrastructure are fundamental for long-term economic prosperity.

- Addressing the skills gap by investing in vocational training and higher education.

- Modernizing infrastructure – transportation networks, digital connectivity, and energy grids – to enhance productivity and competitiveness.

Examples of successful human capital development and infrastructure programs:

- Germany's apprenticeship system.

- Singapore's investment in high-speed rail and digital infrastructure.

Promoting Sustainable and Inclusive Growth

Sustainable and inclusive economic growth ensures long-term prosperity while minimizing environmental impacts and promoting social equity.

- Investing in green technologies and sustainable practices to reduce Canada's carbon footprint.

- Implementing policies that promote economic equity and regional development.

Examples of sustainable economic policies and initiatives:

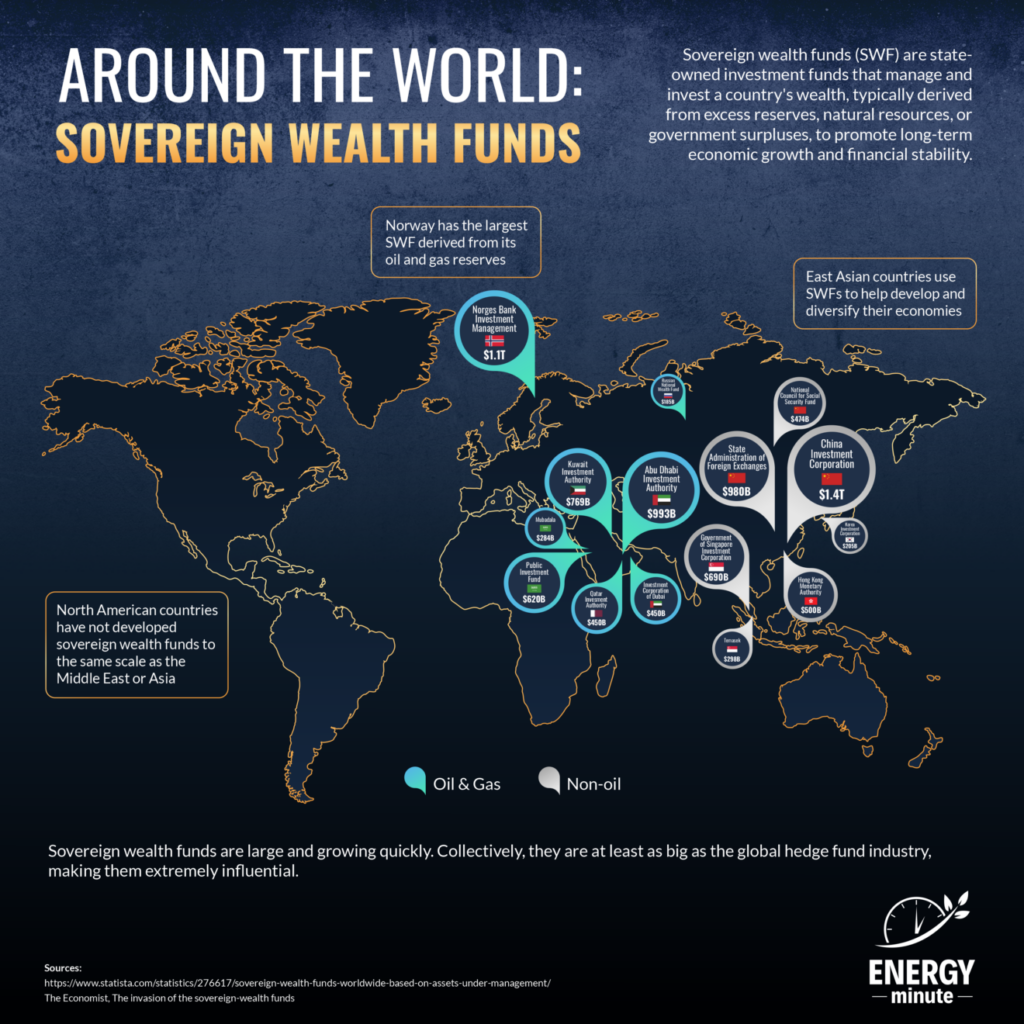

- Norway's sovereign wealth fund, which invests in sustainable projects globally.

Conclusion: The Future of Canada's Economy: A Path Towards Less U.S. Investor Control

Lessening U.S. investor control in the Canadian economy necessitates a multi-pronged approach. Diversifying foreign investment sources, strengthening Canadian businesses' global competitiveness, promoting domestic ownership, and building a robust and resilient domestic economy are crucial steps. By actively pursuing these strategies, Canada can secure a more independent and prosperous future, less vulnerable to external economic shocks. We encourage you to learn more about Canadian economic policy, participate in public discussions, and advocate for policies that support a more independent and prosperous Canadian economy, less reliant on U.S. investor control. Support Canadian businesses and engage with government initiatives to help build a stronger, more diverse Canadian economy.

Featured Posts

-

Enhanced Partnership Starboard And Tui Cruises Announce Expanded Collaboration

May 29, 2025

Enhanced Partnership Starboard And Tui Cruises Announce Expanded Collaboration

May 29, 2025 -

Dont Miss Out Huge Nike Dunk Discounts At Revolve

May 29, 2025

Dont Miss Out Huge Nike Dunk Discounts At Revolve

May 29, 2025 -

Inter Rent Reit Acquisition Details Of The Offer From Executive Chair And Sovereign Wealth Fund

May 29, 2025

Inter Rent Reit Acquisition Details Of The Offer From Executive Chair And Sovereign Wealth Fund

May 29, 2025 -

Las Sorprendentes Paradas De Mamardashvili Un Futuro Brillante

May 29, 2025

Las Sorprendentes Paradas De Mamardashvili Un Futuro Brillante

May 29, 2025 -

Marilly Named New Ceo Of Remy Cointreau Following Vallats Departure

May 29, 2025

Marilly Named New Ceo Of Remy Cointreau Following Vallats Departure

May 29, 2025

Latest Posts

-

Alcaraz Begins Barcelona Open With Straight Sets Victory

May 31, 2025

Alcaraz Begins Barcelona Open With Straight Sets Victory

May 31, 2025 -

Sage Hill Volleyball Returns To Cif Ss Finals After Sweeping Crean Lutheran

May 31, 2025

Sage Hill Volleyball Returns To Cif Ss Finals After Sweeping Crean Lutheran

May 31, 2025 -

Beatles Casting Announcement Controversy Over White Boy Of The Month Selection

May 31, 2025

Beatles Casting Announcement Controversy Over White Boy Of The Month Selection

May 31, 2025 -

Posledni Novini Za Kontuziyata Na Grigor Dimitrov

May 31, 2025

Posledni Novini Za Kontuziyata Na Grigor Dimitrov

May 31, 2025 -

Trump And Musk A New Era Of Collaboration

May 31, 2025

Trump And Musk A New Era Of Collaboration

May 31, 2025