The Growing Appeal Of The Venture Capital Secondary Market

Table of Contents

Increased Liquidity for Venture Capital Investors

Traditional venture capital investments are notoriously illiquid, often locking investors into long-term commitments with limited opportunities for early exits. The wait for an IPO (Initial Public Offering) or acquisition can span several years, tying up capital and potentially hindering diversification efforts. The secondary market, however, offers a compelling solution to this liquidity challenge. It provides a pathway for investors to sell their stakes before a traditional exit event, providing much-needed flexibility.

- Faster access to capital: Investors can quickly realize returns on their investments without waiting for an IPO or acquisition.

- Reduced portfolio concentration risk: Selling some stakes allows for diversification and reduces reliance on a few key investments.

- Ability to rebalance portfolios: The secondary market enables investors to reallocate capital to more promising opportunities or adjust their risk profile.

- Crystallization of gains: Investors can lock in profits on successful investments, securing their returns even before a full exit.

Diversification Opportunities in the Secondary Market

The secondary market dramatically expands diversification options for venture capital investors. Instead of being limited to initial investments in a single fund or a small number of companies, the secondary market opens doors to a wider array of opportunities.

- Access to high-growth companies beyond initial funding rounds: Investors can access companies that have already demonstrated traction and are further along in their growth trajectory.

- Geographical diversification: The market enables investments in companies across different geographies, reducing regional concentration risk.

- Diversification across different industry sectors: Investors can spread their risk across various sectors, mitigating the impact of industry-specific downturns.

- Reduced reliance on individual fund managers' performance: The secondary market allows investors to diversify beyond specific fund managers, reducing dependence on individual performance.

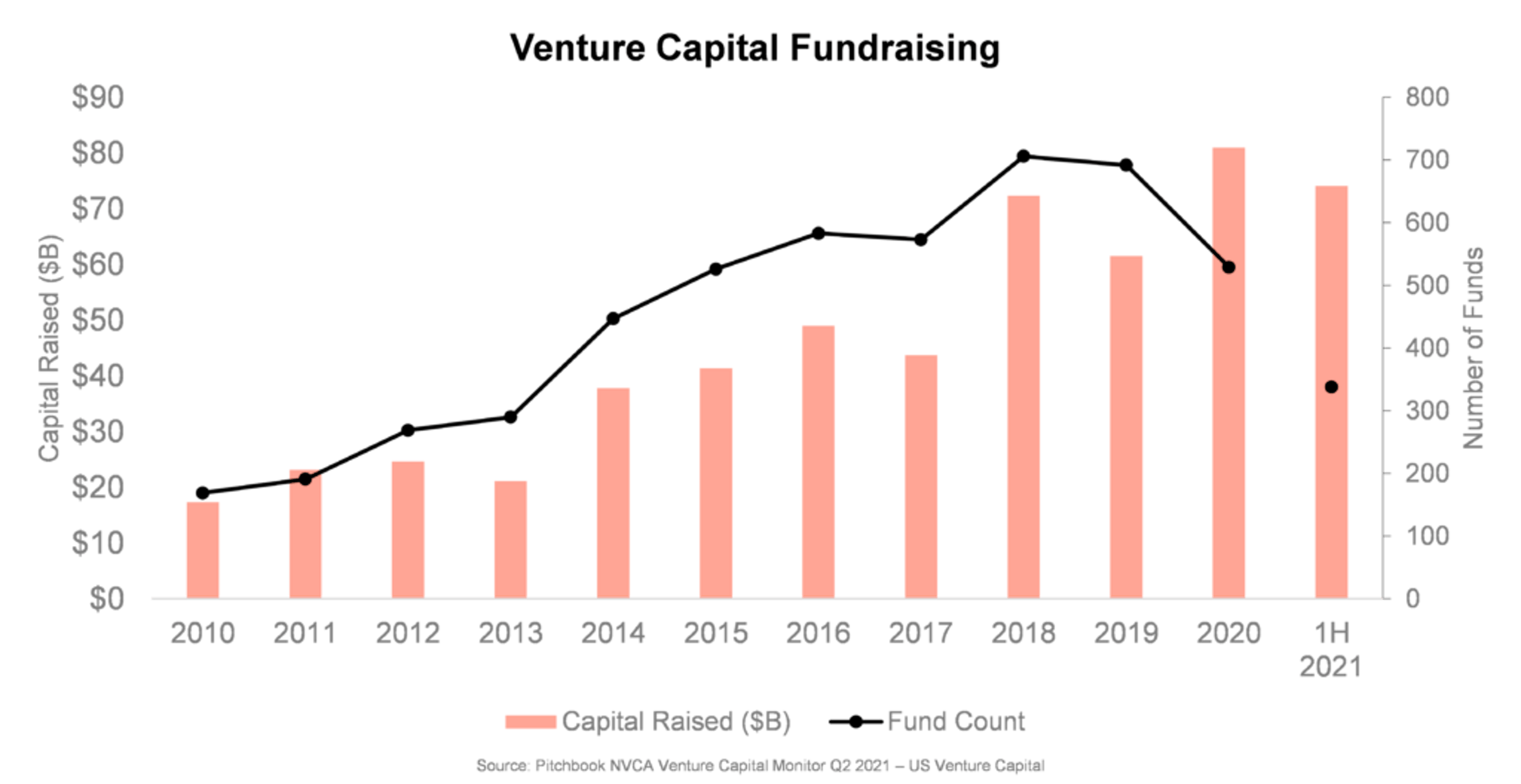

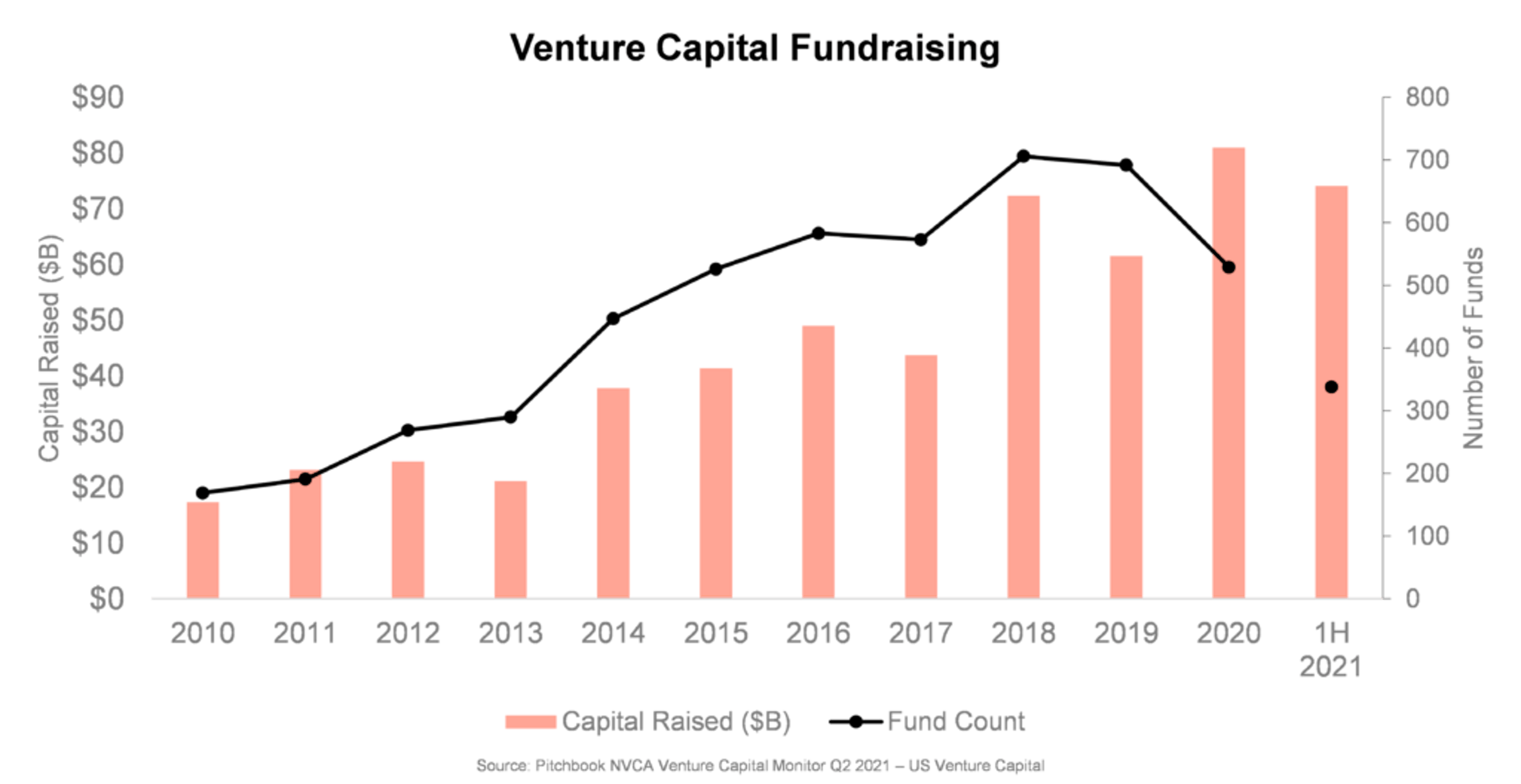

Sophisticated Investors and Institutional Participation

The venture capital secondary market is experiencing a surge in participation from sophisticated investors, including pension funds, endowments, and family offices. This institutional interest is driven by several factors:

- Risk mitigation: Secondary market investments often offer a lower risk profile compared to primary investments, as the underlying companies have already demonstrated some level of success.

- Improved returns: While not guaranteed, the secondary market can offer attractive returns, especially for seasoned investors capable of identifying undervalued assets.

- Portfolio optimization: The secondary market enables institutional investors to fine-tune their portfolios, enhance liquidity, and improve overall risk-adjusted returns.

This significant influx of institutional capital is a key driver of the market's growth, fueling further development and liquidity. The creation of more sophisticated trading platforms and the standardization of valuation methods further enhance institutional confidence.

Technological Advancements and Market Efficiency

Technological advancements have played a crucial role in enhancing the efficiency and transparency of the venture capital secondary market. Online platforms now facilitate direct trading, connecting buyers and sellers efficiently. Data analytics and improved valuation models provide a more robust basis for pricing and risk assessment.

- Improved data availability and valuation models: Sophisticated algorithms and data analysis improve the accuracy of company valuations.

- Streamlined transaction processes: Online platforms reduce administrative burdens and speed up the execution of transactions.

- Increased market liquidity due to better matching of buyers and sellers: Technology improves the efficiency of the matching process, leading to higher liquidity.

Challenges and Risks in the Venture Capital Secondary Market

While the venture capital secondary market offers significant advantages, it is crucial to acknowledge potential challenges. Valuation discrepancies can arise, particularly for companies with limited publicly available information. Illiquidity can persist in certain situations, especially for less-liquid assets. Transaction costs, including fees and commissions, should also be carefully considered. Thorough due diligence and appropriate risk management strategies are essential for investors navigating this market.

Harnessing the Potential of the Venture Capital Secondary Market

The venture capital secondary market presents a compelling opportunity for investors seeking increased liquidity, enhanced diversification, and access to a broader range of high-growth companies. The growing participation of sophisticated investors and technological advancements are further driving market development. While risks exist, careful due diligence and risk management can mitigate potential downsides. Understanding the intricacies of the venture capital secondary market can unlock significant opportunities for investors. Learn more and explore your investment options today!

Featured Posts

-

Negeri Sembilan A Strategic Location For Data Centers In Southeast Asia

Apr 29, 2025

Negeri Sembilan A Strategic Location For Data Centers In Southeast Asia

Apr 29, 2025 -

Sud Rozhodne O Obnove Konania V Unose Studentky Sone

Apr 29, 2025

Sud Rozhodne O Obnove Konania V Unose Studentky Sone

Apr 29, 2025 -

Will Pete Rose Receive A Posthumous Pardon From Trump

Apr 29, 2025

Will Pete Rose Receive A Posthumous Pardon From Trump

Apr 29, 2025 -

Your Guide To Capital Summertime Ball 2025 Tickets

Apr 29, 2025

Your Guide To Capital Summertime Ball 2025 Tickets

Apr 29, 2025 -

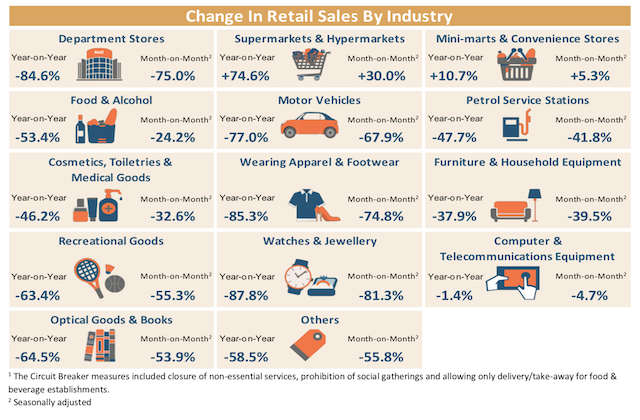

Retail Sales Slump Could The Bank Of Canada Reverse Course On Rates

Apr 29, 2025

Retail Sales Slump Could The Bank Of Canada Reverse Course On Rates

Apr 29, 2025

Latest Posts

-

Analyse Du Communique De Presse Amf Seb Sa Cp 2025 E1021792

Apr 30, 2025

Analyse Du Communique De Presse Amf Seb Sa Cp 2025 E1021792

Apr 30, 2025 -

Informations Financieres Seb Sa Document Amf Cp 2025 E1021792

Apr 30, 2025

Informations Financieres Seb Sa Document Amf Cp 2025 E1021792

Apr 30, 2025 -

Another Sustainability Win For Schneider Electric

Apr 30, 2025

Another Sustainability Win For Schneider Electric

Apr 30, 2025 -

Dance Company Changes Marchs Roster Review

Apr 30, 2025

Dance Company Changes Marchs Roster Review

Apr 30, 2025 -

Worlds Most Sustainable Corporation Schneider Electric Wins Again

Apr 30, 2025

Worlds Most Sustainable Corporation Schneider Electric Wins Again

Apr 30, 2025