The Resurgence Of Angry Elon: A Boon For Tesla Investors?

Table of Contents

Elon Musk's recent controversial actions and outspoken nature have once again thrust him into the spotlight. This "Angry Elon" persona, while potentially damaging to his public image, has sparked a debate amongst Tesla investors: Is his aggressive leadership ultimately beneficial for Tesla's stock price and future? This article will explore the complex relationship between Musk's public behavior and Tesla's financial performance.

The "Angry Elon" Effect on Tesla Stock

Short-Term Volatility

Elon Musk's tweets and pronouncements have a demonstrable impact on Tesla's stock price. A single controversial tweet can send the stock price on a roller coaster ride. For example, his announcement regarding taking Tesla private in 2018 resulted in significant short-term volatility, followed by legal challenges and a substantial settlement. Similarly, his more recent pronouncements on various topics, including cryptocurrency and meme stocks, have triggered immediate market reactions, highlighting the profound influence of "Angry Elon" on investor sentiment. This creates a climate of fear, uncertainty, and doubt (FUD) amongst investors, impacting their decisions.

- Increased market volatility

- Short-term price drops followed by rebounds

- Speculative trading driven by Musk's pronouncements

Long-Term Implications

While short-term volatility is undeniable, the long-term impact of Musk's leadership style on investor confidence is a more nuanced question. His disruptive approach, while sometimes controversial, has undeniably pushed Tesla to the forefront of the electric vehicle revolution. This aggressive innovation might attract and retain top talent, leading to faster technological advancements. However, his unpredictable behavior also poses significant risks. Negative publicity could damage Tesla's brand image and customer loyalty, potentially impacting sales in the long run. Furthermore, his outspokenness invites increased regulatory scrutiny and legal challenges, potentially impacting the company's financial stability.

- Potential for attracting and retaining top talent

- Impact on brand perception and customer loyalty

- Risk of regulatory scrutiny and legal challenges

Analyzing Tesla's Performance Beyond the "Angry Elon" Narrative

Strong Fundamentals

Despite the "Angry Elon" headlines, Tesla's underlying financial performance remains remarkably strong. Revenue growth has been consistent, production continues to increase, and Tesla's market share in the electric vehicle sector is substantial. The company's innovative advancements in battery technology, autonomous driving capabilities, and charging infrastructure continue to drive its success.

- Growing sales figures

- Expansion of Gigafactories worldwide

- Development of new vehicle models and energy solutions (solar, energy storage)

Competition and Market Factors

It's crucial to analyze Tesla's performance within the broader context of the electric vehicle market. While Tesla remains a leader, the competitive landscape is evolving rapidly, with established automakers and new entrants launching competitive EV models. Government regulations, incentives, and subsidies also play a significant role, impacting the industry's growth trajectory. Furthermore, fluctuations in raw material prices, particularly lithium and other battery components, can impact Tesla's profitability.

- Emerging competitors in the EV market (e.g., Ford, GM, Volkswagen)

- Government regulations and incentives influencing EV adoption

- Fluctuations in raw material prices impacting manufacturing costs

The Investor's Dilemma: Risk vs. Reward

Assessing the Risk

Investing in Tesla carries inherent risks, largely stemming from the unpredictability associated with Elon Musk's leadership. The high volatility of the stock price makes significant losses a real possibility. Tesla's future success is heavily reliant on Musk's vision and execution, creating a significant concentration of risk. Furthermore, the potential for negative publicity and regulatory challenges poses a threat to the company's long-term stability.

- High volatility and risk of significant losses

- Dependence on Musk's leadership and vision

- Unpredictability of future regulatory challenges

Weighing the Reward

Despite the risks, the potential rewards of investing in Tesla are considerable. The electric vehicle market is poised for explosive growth, and Tesla's position as a market leader provides a significant first-mover advantage. The company's innovative potential extends beyond automobiles, encompassing energy storage and solar solutions, offering opportunities for diversification and further growth.

- High growth potential in the EV sector

- First-mover advantage in several key markets

- Potential for diversification into related industries

Conclusion

The "Angry Elon" narrative is undeniably a factor influencing Tesla's stock price, creating short-term volatility and long-term uncertainty. While Musk's behavior presents risks, Tesla's strong fundamentals and market position offer substantial rewards. Investors must carefully weigh these opposing forces. The question of whether the resurgence of "Angry Elon" is a boon for Tesla investors is complex and depends on individual risk tolerance. Conduct thorough research and consult a financial advisor before making investment decisions related to Tesla stock or other stocks affected by "Angry Elon Musk" news.

Featured Posts

-

Hampshire And Worcester Counties Prepare For Flash Flooding Thursday Night

May 25, 2025

Hampshire And Worcester Counties Prepare For Flash Flooding Thursday Night

May 25, 2025 -

Tracking The Net Asset Value Nav For Amundi Msci World Catholic Principles Ucits Etf Acc

May 25, 2025

Tracking The Net Asset Value Nav For Amundi Msci World Catholic Principles Ucits Etf Acc

May 25, 2025 -

The Future Of Healthcare Philips Future Health Index 2025 On Ais Role

May 25, 2025

The Future Of Healthcare Philips Future Health Index 2025 On Ais Role

May 25, 2025 -

The Threat Of A Canada Post Strike Protecting Your Mail And Packages

May 25, 2025

The Threat Of A Canada Post Strike Protecting Your Mail And Packages

May 25, 2025 -

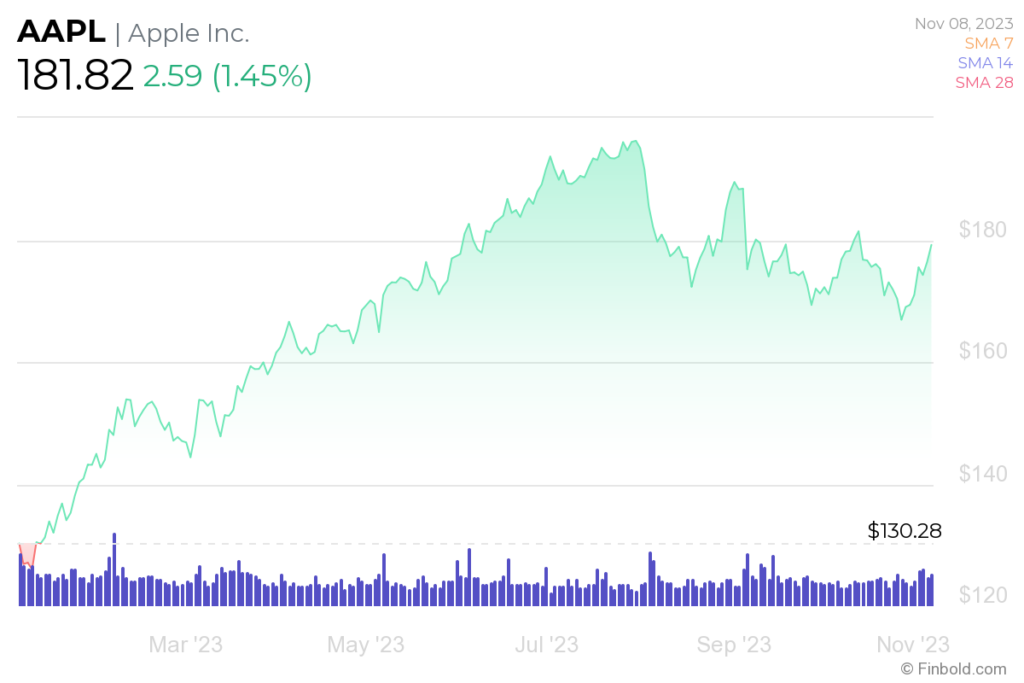

254 Apple Stock Price Prediction Investment Opportunity Or Overvalued

May 25, 2025

254 Apple Stock Price Prediction Investment Opportunity Or Overvalued

May 25, 2025

Latest Posts

-

Naomi Kempbell Otkrovennye Obrazy Dlya Glyantsa

May 25, 2025

Naomi Kempbell Otkrovennye Obrazy Dlya Glyantsa

May 25, 2025 -

Zirkovi Foto Naomi Kempbell Svyatkuye 55 Rokiv

May 25, 2025

Zirkovi Foto Naomi Kempbell Svyatkuye 55 Rokiv

May 25, 2025 -

Garyachi Foto Naomi Kempbell Z Nagodi 55 Richchya

May 25, 2025

Garyachi Foto Naomi Kempbell Z Nagodi 55 Richchya

May 25, 2025 -

Naomi Kempbell Vidznachaye Yuviley Divitsya Novi Foto

May 25, 2025

Naomi Kempbell Vidznachaye Yuviley Divitsya Novi Foto

May 25, 2025 -

Naomi Kempbell Bila Tunika Ta Londonskiy Zakhid

May 25, 2025

Naomi Kempbell Bila Tunika Ta Londonskiy Zakhid

May 25, 2025