$254 Apple Stock Price Prediction: Investment Opportunity Or Overvalued?

Table of Contents

Apple's Current Financial Performance and Future Projections

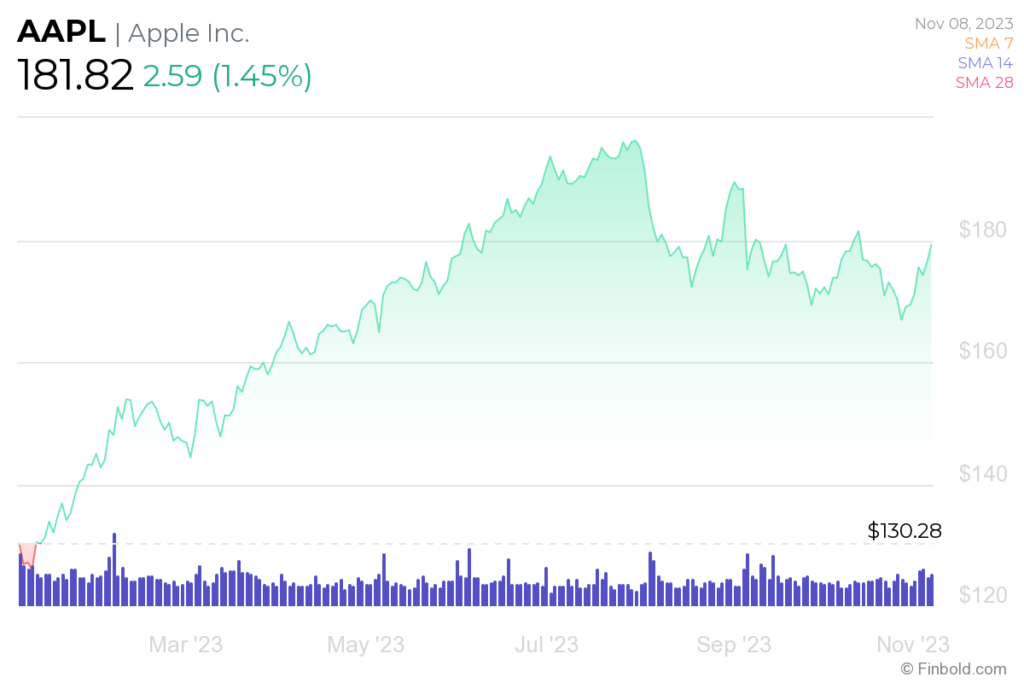

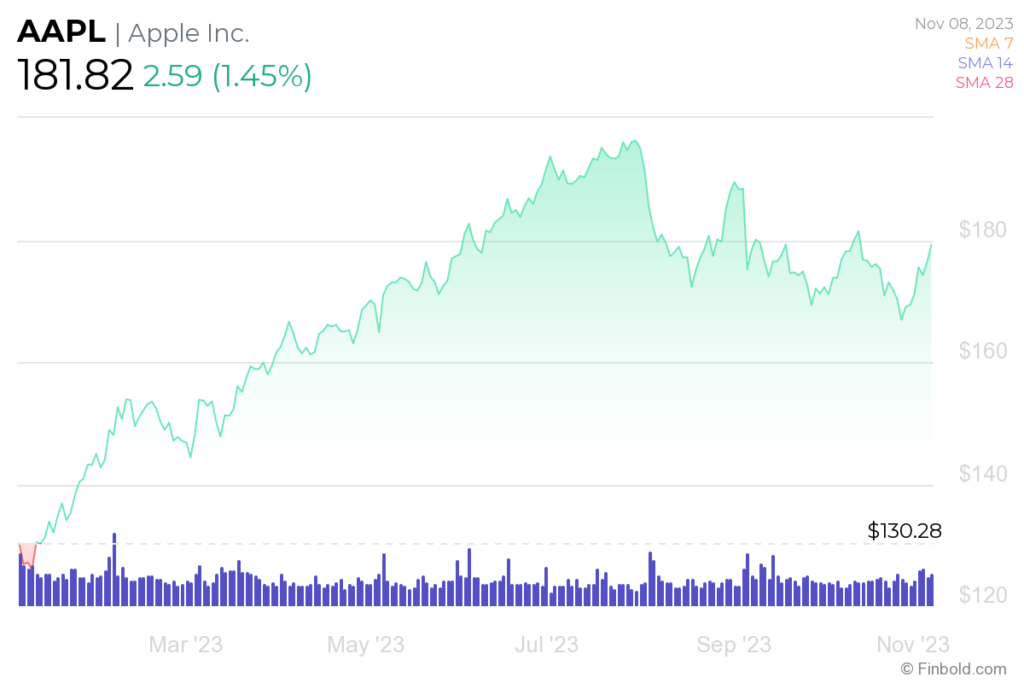

Apple's continued success hinges on its consistent financial performance and a robust product pipeline. Analyzing these key aspects is crucial for any $254 Apple stock price prediction.

Revenue Growth and Profitability

Apple's recent financial reports paint a picture of sustained growth, although at a potentially slowing pace. Key revenue streams like the iPhone, Services (including Apple Music, iCloud, and App Store), Wearables, and Mac contribute significantly to its overall profitability.

- iPhone Revenue: While still the major revenue driver, iPhone sales growth has shown signs of moderation in recent quarters, prompting investors to consider diversification across other product segments.

- Services Revenue: This segment continues to demonstrate impressive growth, highlighting the recurring revenue model's resilience and potential for future expansion.

- Wearables, Home, and Accessories Revenue: This category has consistently outperformed expectations, showcasing strong demand for Apple Watch, AirPods, and other accessories. Continued innovation in this space will be key.

- Mac Revenue: While facing some market headwinds, Mac sales remain a significant contributor, especially with the increasing popularity of the M-series chips.

Analyzing Apple's revenue, profit margin, and financial statements is critical to understanding its underlying strength and forecasting future performance. Tracking key metrics like Apple revenue growth year-over-year and comparing Apple profit margin to historical data provides valuable insights for assessing the validity of the $254 Apple stock price prediction.

Innovation and Product Pipeline

Apple's history of innovation is paramount to its success. Future product releases and technological advancements significantly influence any Apple stock price prediction, including the possibility of reaching $254.

- New iPhones: Annual iPhone releases remain a major catalyst for investor sentiment. Significant upgrades and marketing campaigns surrounding these launches drive sales and often influence stock price movements.

- AR/VR Headset: The highly anticipated Apple AR/VR headset could represent a significant new revenue stream and a potential market disruptor, though its success is yet to be determined.

- Apple Silicon: The transition to Apple Silicon chips has been largely successful, boosting Mac performance and efficiency. Further advancements in this area could enhance future product offerings and maintain Apple's competitive advantage.

Market Factors Influencing Apple Stock Price

External factors significantly influence Apple's stock price. Understanding these dynamics is vital for a realistic $254 Apple stock price prediction.

Macroeconomic Conditions

Global economic conditions play a significant role in Apple's valuation. Factors like inflation, interest rate hikes, and recession risks all affect consumer spending and investor confidence.

- Inflation: High inflation rates can reduce consumer discretionary spending, potentially impacting iPhone and other Apple product sales.

- Interest Rate Hikes: Higher interest rates increase borrowing costs for businesses and consumers, impacting economic growth and investor sentiment.

- Recession Risk: A potential recession could severely impact demand for Apple products, leading to lower revenue and a negative impact on the stock price. Market volatility is heightened during economic uncertainty.

Industry Competition and Technological Disruption

Apple operates in a highly competitive environment. Emerging technologies and competitors pose potential threats to its market share.

- Samsung: Samsung remains a formidable competitor, particularly in the smartphone market, consistently offering strong alternatives to Apple products.

- Google: Google's Android operating system holds a significant market share, providing a powerful competitive force. Google's hardware initiatives also pose a threat to Apple's ecosystem.

- Technological Disruption: The emergence of new technologies, such as foldable phones or significant advancements in AI, could challenge Apple's dominance and potentially impact its market share.

Analyst Predictions and Expert Opinions

Financial analysts offer various forecasts for Apple's stock price. While these should be considered alongside other factors, they provide valuable insights into market sentiment. A wide range of Apple stock price targets and analyst ratings exist, reflecting differing perspectives on the potential for a $254 price point. It’s essential to consult multiple sources and consider the rationale behind each prediction. This includes examining their Apple stock forecast methodologies and understanding the underlying assumptions.

Assessing the $254 Apple Stock Price Prediction

To determine if $254 is a realistic target, we need to analyze Apple's valuation and assess potential risks.

Valuation Metrics

Using key valuation metrics such as P/E ratio, Price-to-Sales ratio, and market capitalization, we can gauge whether Apple's current stock price is overvalued, undervalued, or fairly valued relative to its historical data and industry benchmarks. Comparing these metrics to other technology companies provides context for the $254 Apple stock price prediction.

- P/E Ratio: A high P/E ratio suggests investors expect strong future growth, while a low P/E ratio could signal undervaluation or lower growth expectations.

- Price-to-Sales Ratio: This metric provides a broader measure of valuation, particularly useful for companies with inconsistent earnings.

Risk Assessment

Several risks could hinder Apple's stock from reaching $254. A comprehensive risk assessment is crucial before making any investment decisions.

- Supply Chain Disruptions: Global supply chain issues could impact Apple's production capacity and profitability.

- Geopolitical Risks: International tensions and political instability could negatively influence Apple's operations and sales in various regions.

- Regulatory Changes: Changes in regulations concerning data privacy, antitrust, or other areas could impact Apple's business model and profitability.

- Negative News: Unexpected negative news, such as product recalls or significant security breaches, could negatively impact investor sentiment and stock price.

Conclusion: $254 Apple Stock Price Prediction: The Verdict

Whether the $254 Apple stock price prediction is an opportunity or an overvaluation depends on a complex interplay of Apple's financial performance, market conditions, analyst opinions, and inherent investment risks. While Apple's strong brand, loyal customer base, and innovation capabilities suggest potential for growth, macroeconomic headwinds and competitive pressures introduce uncertainty. The valuation metrics and risk assessment are crucial to determining if this price point is justified. While this analysis provides valuable insights into the potential for a $254 Apple stock price, remember that thorough due diligence is crucial before investing. Consult a financial advisor and delve deeper into Apple's financial reports to make an informed decision about this potential $254 Apple stock price opportunity.

Featured Posts

-

Analyzing Apple Stock Before The Q2 Earnings Release

May 25, 2025

Analyzing Apple Stock Before The Q2 Earnings Release

May 25, 2025 -

Frankfurt Stock Market Update Dax At 24 000 And Below

May 25, 2025

Frankfurt Stock Market Update Dax At 24 000 And Below

May 25, 2025 -

Glastonbury Festival Unofficial Us Band Announcement Creates Frenzy

May 25, 2025

Glastonbury Festival Unofficial Us Band Announcement Creates Frenzy

May 25, 2025 -

Sse Growth Slowdown Leads To 3 Billion Spending Reduction

May 25, 2025

Sse Growth Slowdown Leads To 3 Billion Spending Reduction

May 25, 2025 -

Launch Of Ae Xplore England Airpark And Alexandria International Airports Initiative To Boost Local And International Flights

May 25, 2025

Launch Of Ae Xplore England Airpark And Alexandria International Airports Initiative To Boost Local And International Flights

May 25, 2025

Latest Posts

-

Flash Flood Warning Texas North Central Texas Braces For Severe Storms

May 25, 2025

Flash Flood Warning Texas North Central Texas Braces For Severe Storms

May 25, 2025 -

Thunderstorms Trigger Flash Flood Warning In Bradford And Wyoming Counties

May 25, 2025

Thunderstorms Trigger Flash Flood Warning In Bradford And Wyoming Counties

May 25, 2025 -

Miami Valley Under Flood Advisory Impacts And Safety Precautions

May 25, 2025

Miami Valley Under Flood Advisory Impacts And Safety Precautions

May 25, 2025 -

Urgent Coastal Flood Advisory For Southeast Pennsylvania Wednesday

May 25, 2025

Urgent Coastal Flood Advisory For Southeast Pennsylvania Wednesday

May 25, 2025 -

Flash Flood Warning Bradford And Wyoming Counties Until Tuesday

May 25, 2025

Flash Flood Warning Bradford And Wyoming Counties Until Tuesday

May 25, 2025