The Ripple Effect: Evaluating XRP As A Long-Term Investment Strategy

Table of Contents

Understanding XRP's Technology and Functionality

XRP, the native cryptocurrency of Ripple Labs, isn't just another digital coin; it's a crucial component of RippleNet, a global payment network designed to revolutionize cross-border transactions.

RippleNet and its Global Reach:

RippleNet boasts a significant advantage over traditional banking systems. Its innovative technology allows for faster, cheaper, and more secure international money transfers.

- Reduced Transaction Fees: RippleNet significantly cuts the costs associated with traditional SWIFT transfers.

- Faster Processing Times: Transactions are settled near-instantly, unlike traditional methods that can take days or even weeks.

- Enhanced Security: RippleNet employs robust security protocols to protect transactions from fraud and unauthorized access.

XRP's Role in RippleNet:

XRP acts as a bridge currency within RippleNet, facilitating seamless conversions between different fiat currencies. This bridging function significantly improves transaction efficiency.

- Liquidity Provision: Banks and financial institutions use XRP to maintain liquidity and execute transactions swiftly.

- Low Transaction Costs: XRP's low transaction fees make it a cost-effective solution for high-volume transactions.

Technological Advantages and Limitations:

XRP utilizes a unique consensus mechanism, known as the Ripple Protocol Consensus Algorithm (RPCA), which differs from the Proof-of-Work (PoW) or Proof-of-Stake (PoS) mechanisms used by other cryptocurrencies. While this offers speed and efficiency, it also leads to centralization concerns, as Ripple Labs has significant control over the network.

- Scalability: XRP's network is designed for high transaction throughput, making it potentially suitable for large-scale financial applications.

- Centralization Concerns: The degree of control Ripple Labs has over the XRP network is a subject of ongoing debate and criticism. This contrasts with the decentralized nature of Bitcoin and some other cryptocurrencies.

Analyzing XRP's Market Position and Volatility

Understanding XRP's market performance is crucial for assessing its long-term investment viability.

Market Capitalization and Trading Volume:

XRP consistently ranks among the top cryptocurrencies by market capitalization. However, its price has experienced significant volatility, mirroring the broader cryptocurrency market. [Insert chart showing XRP's historical price and market cap data sourced from CoinMarketCap or CoinGecko].

Risk Assessment and Volatility Factors:

Investing in XRP carries inherent risks. Its price is susceptible to various factors:

- Regulatory News: Changes in regulatory frameworks can significantly impact XRP's price.

- Adoption by Financial Institutions: Increased adoption by banks and financial institutions is a key driver of potential growth.

- Overall Cryptocurrency Market Trends: The general sentiment and performance of the broader cryptocurrency market greatly influence XRP's value.

Comparing XRP to other cryptocurrencies: Compared to Bitcoin's focus on decentralization and Ethereum's smart contract capabilities, XRP's primary strength lies in its focus on fast and efficient cross-border payments. Its long-term prospects hinge on its continued adoption by the financial sector.

Long-Term Investment Considerations for XRP

Considering XRP as a long-term investment requires careful evaluation of its potential and associated risks.

Potential for Growth and Adoption:

The increasing integration of RippleNet by financial institutions worldwide suggests a promising long-term outlook for XRP. Successful partnerships and ongoing technological improvements could drive significant growth.

- Successful Partnerships: Highlight specific examples of partnerships between Ripple and major financial institutions.

- Technological Advancements: Mention any ongoing developments or upgrades to the RippleNet platform that could boost adoption.

Diversification and Risk Management:

It's crucial to diversify your investment portfolio. Don't put all your eggs in one basket, especially in the volatile cryptocurrency market.

- Allocate a small percentage of your portfolio to XRP: This helps minimize risk while still allowing for potential gains.

- Dollar-cost averaging: Regularly investing small amounts over time can reduce the impact of volatility.

Regulatory Landscape and Future Outlook:

The regulatory environment surrounding XRP remains a significant factor. Ongoing legal battles and regulatory uncertainties could impact its long-term viability. Stay informed about developments in this area.

Conclusion:

XRP presents a unique proposition in the cryptocurrency landscape. Its technology offers a compelling solution for cross-border payments, and its adoption by financial institutions could fuel significant growth. However, the risks associated with cryptocurrency investments, coupled with regulatory uncertainties surrounding XRP, must be carefully considered. We've analyzed the "Ripple Effect" of this cryptocurrency, weighing its potential and risks. Is XRP a suitable addition to your long-term investment portfolio? Further research into XRP's potential and risk profile is crucial before making any investment decisions.

Featured Posts

-

Ethereum Cross X Signals Institutional Accumulation Analyst Predicts 4 000

May 08, 2025

Ethereum Cross X Signals Institutional Accumulation Analyst Predicts 4 000

May 08, 2025 -

Uber Autos New Payment Policy Everything You Need To Know About Upi And Other Options

May 08, 2025

Uber Autos New Payment Policy Everything You Need To Know About Upi And Other Options

May 08, 2025 -

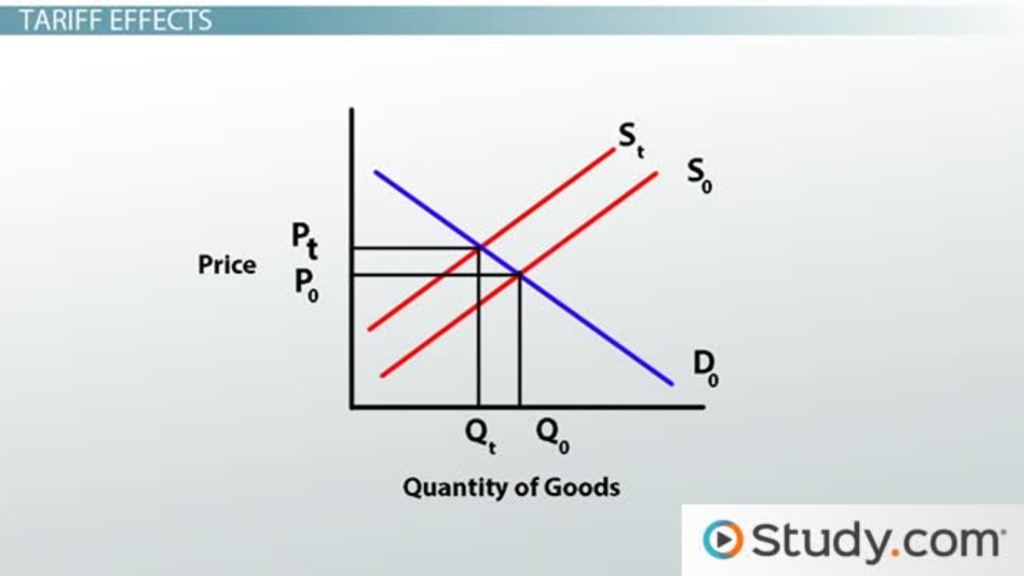

Chinas Economic Strategy Lower Rates And Increased Lending In Response To Tariffs

May 08, 2025

Chinas Economic Strategy Lower Rates And Increased Lending In Response To Tariffs

May 08, 2025 -

Lotto Jackpot Numbers Wednesday April 9th Draw Results

May 08, 2025

Lotto Jackpot Numbers Wednesday April 9th Draw Results

May 08, 2025 -

Kjoreforhold I Sor Norges Fjellomrader Tips Og Rad For Vinteren

May 08, 2025

Kjoreforhold I Sor Norges Fjellomrader Tips Og Rad For Vinteren

May 08, 2025