The Trump-Powell Feud Intensifies: President Calls For Fed Chair's Termination

Table of Contents

The Roots of the Conflict

The Trump-Powell feud didn't erupt overnight. It's the culmination of simmering tensions stemming primarily from differing economic philosophies and approaches to monetary policy.

Trump's Criticism of Interest Rate Hikes

President Trump consistently criticized the Federal Reserve's interest rate hikes throughout his presidency, viewing them as detrimental to economic growth and the stock market. He believed these increases hampered his administration's efforts to boost economic performance and maintain a strong economy.

- June 2018: Trump publicly expressed his displeasure with the Fed's decision to raise interest rates, tweeting that they were "going too fast."

- September 2018: Following another rate hike, Trump stated the Fed was "making a mistake" and that its actions were harming economic growth.

- November 2018: He again criticized the Fed, arguing that rate increases were hurting businesses and the overall economy. These criticisms were often accompanied by statements linking interest rates to the stock market's performance.

These actions impacted economic indicators. While interest rate hikes aim to control inflation, they can also slow economic growth and potentially increase unemployment. The tension between these goals lay at the heart of the conflict.

Powell's Defense of Fed Independence

In contrast, Chairman Powell repeatedly emphasized the Federal Reserve's commitment to independence from political interference. He maintained that the Fed's primary mandate is to control inflation and maintain stable prices, regardless of political pressures or short-term economic gains.

- Multiple Public Statements: Powell consistently reiterated the importance of the Fed's independence in ensuring its effectiveness and credibility.

- Emphasis on Data-Driven Decisions: He stressed that the Fed's monetary policy decisions are based on economic data and analysis, not political considerations.

- Historical Precedent: Powell highlighted the historical importance of a politically independent central bank in maintaining economic stability. The Fed's independence is vital for preventing short-sighted political decisions from destabilizing the long-term economy.

The Political Ramifications

The Trump-Powell feud extends far beyond economic policy, carrying significant political ramifications.

Impact on the 2020 Election (and beyond)

The conflict significantly influenced the political landscape, especially the 2020 election. Trump's attacks on Powell were seen by some as an attempt to influence the election by manipulating economic indicators.

- Voter Sentiment: Trump's criticisms likely impacted voter sentiment regarding the economy and the Fed's role. Some voters may have viewed the attacks as a sign of economic mismanagement or instability.

- Campaign Strategies: The feud became a talking point in the campaign, shaping the narratives of both Trump and his opponents. Opponents used the issue to highlight concerns about political interference in independent institutions.

- Long-term Implications: Even after Trump left office, the impact of his actions on public trust in the Federal Reserve and other institutions remains a significant concern.

Erosion of Trust in Institutions

The most concerning ramification of the feud is the potential erosion of public trust in government institutions. Trump's direct attacks on the Fed challenged the very foundation of its independence, setting a concerning precedent for future administrations.

- Undermining Expertise: The conflict minimized the importance of economic expertise and independent analysis, potentially leading to less informed policy decisions.

- Political Interference: It raised concerns about the future vulnerability of the Fed to political pressures, which threatens its ability to act objectively.

- Damage to Global Reputation: The feud also damaged the international perception of the US economy and its financial institutions.

Economic Consequences

The Trump-Powell feud had profound economic consequences, creating uncertainty and potentially destabilizing the economy.

Uncertainty in the Markets

Trump's frequent criticisms of the Fed and Powell created significant volatility and uncertainty in the financial markets.

- Market Reactions: Stock markets often reacted negatively to Trump's pronouncements on the Fed, reflecting concerns about economic policy uncertainty.

- Investor Confidence: The feud eroded investor confidence, leading to increased caution and reduced investment.

- Global Impact: The uncertainty wasn't limited to the US. Global markets also reacted to the tensions, underscoring the global interconnectedness of the financial system.

Potential for Economic Instability

The prolonged conflict created a climate of uncertainty that could destabilize the economy. The risk of unpredictable monetary policy undermined investor and consumer confidence.

- Unforeseen Policy Shifts: The potential for politically influenced monetary policy decisions increased the risk of destabilizing economic shocks.

- Increased Volatility: The conflict exacerbated already existing market volatility, making accurate economic forecasting difficult.

- Difficulty in Mitigating Risks: The uncertain political environment made it harder to effectively address potential economic crises.

Conclusion

The escalating Trump-Powell feud presents a significant threat to the stability of the US economy and the integrity of its institutions. The President's repeated attacks on the Fed's independence have created uncertainty in the markets and raised serious questions about the future of monetary policy. Understanding the intricacies of this Trump-Powell feud is crucial for navigating the economic and political landscape in the coming years. Stay informed about this crucial development and its ongoing impact by continuing to follow reputable news sources and analyses on the Trump-Powell feud. Understanding the Trump-Powell feud is key to understanding the future trajectory of the American economy.

Featured Posts

-

Building Voice Assistants Made Easy Open Ais 2024 Developer Announcements

Apr 23, 2025

Building Voice Assistants Made Easy Open Ais 2024 Developer Announcements

Apr 23, 2025 -

Goldman Sachs Compensation Controversy Is David Solomon Banker Or Private Equity Leader

Apr 23, 2025

Goldman Sachs Compensation Controversy Is David Solomon Banker Or Private Equity Leader

Apr 23, 2025 -

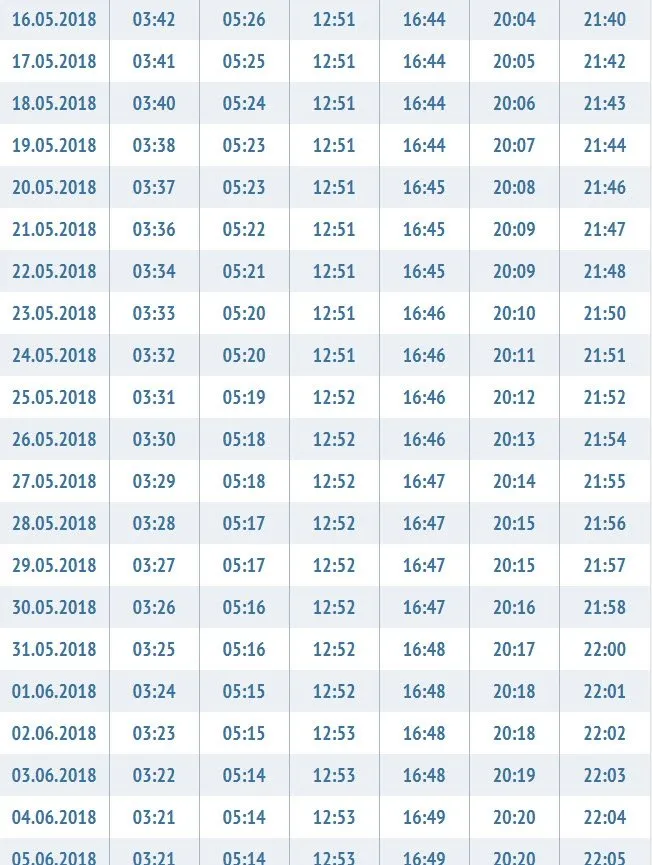

Ankara Da 10 Mart 2025 Pazartesi Iftar Ve Sahur Vakitleri

Apr 23, 2025

Ankara Da 10 Mart 2025 Pazartesi Iftar Ve Sahur Vakitleri

Apr 23, 2025 -

Another 1 0 Defeat Reds Tie Peculiar Mlb Record For Losses

Apr 23, 2025

Another 1 0 Defeat Reds Tie Peculiar Mlb Record For Losses

Apr 23, 2025 -

Chalet Girls Unveiling The Reality Of Luxury Ski Resort Life

Apr 23, 2025

Chalet Girls Unveiling The Reality Of Luxury Ski Resort Life

Apr 23, 2025