The Truth About Elon Musk And His Dogecoin Investments

Table of Contents

Elon Musk's Public Statements on Dogecoin: A Deep Dive

Elon Musk's pronouncements on Dogecoin have been anything but subtle. His tweets and public appearances have dramatically influenced the cryptocurrency's price, creating both immense gains and devastating losses for investors. Understanding the impact of these statements is crucial to understanding the current landscape of Dogecoin.

-

May 1, 2021 tweet about Dogecoin to the moon: This single tweet sent the Dogecoin price soaring, exemplifying the power of Musk's social media influence. The price jumped significantly in the hours following the tweet, demonstrating the extreme volatility of the cryptocurrency and the immediate impact of Musk's words. This event highlighted the susceptibility of Dogecoin to manipulation through social media, leading to discussions around market manipulation and FOMO (Fear Of Missing Out).

-

Saturday Night Live appearance and its aftermath: Musk's hosting gig on Saturday Night Live in May 2021 was highly anticipated. However, his somewhat ambivalent comments about Dogecoin during the show led to a significant price drop, showcasing the unpredictable nature of his influence. This event underscored the risks associated with investing based on celebrity endorsements and the unpredictability of Elon Musk Dogecoin tweets.

-

Musk's mentions of Dogecoin as a "people's cryptocurrency": Musk's framing of Dogecoin as a cryptocurrency for the people resonated with many, driving further investment. This narrative, while appealing to a sense of community, did little to address the inherent volatility and lack of intrinsic value. This highlights the importance of understanding the speculative nature of Dogecoin investment.

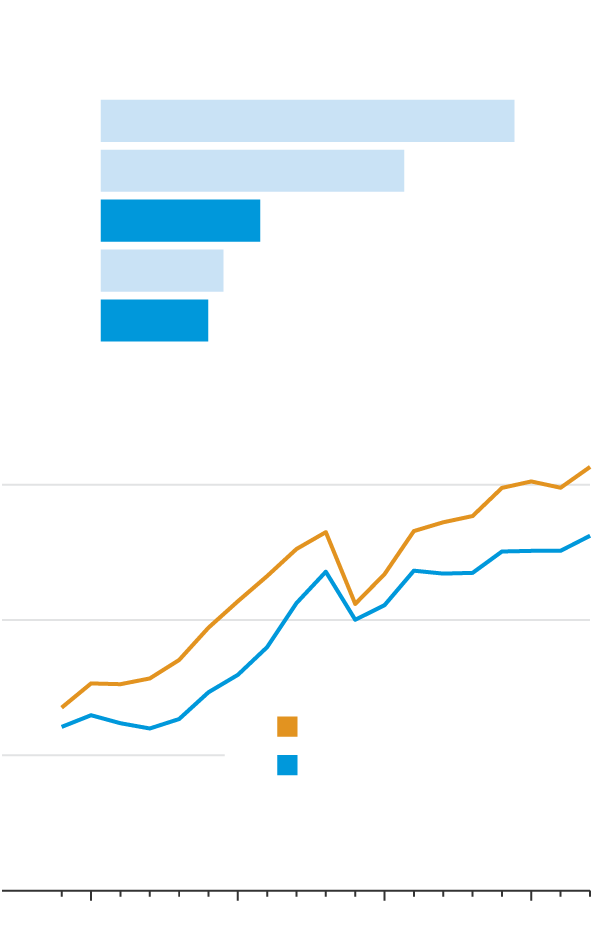

The impact of these statements on market sentiment is undeniable. Dogecoin price volatility is directly linked to Musk's pronouncements, creating both exhilarating gains and crushing losses for investors. The data clearly shows a strong correlation between his tweets and the cryptocurrency's price fluctuations. Analyzing charts of Dogecoin's price history alongside Musk's tweets provides undeniable evidence of this relationship.

The Speculative Nature of Dogecoin and Musk's Influence

Dogecoin, like many other meme coins, is inherently speculative. It lacks the underlying technology or utility of established cryptocurrencies like Bitcoin or Ethereum. Its value is largely driven by hype, social media trends, and, significantly, the influence of figures like Elon Musk. Investing in such a volatile cryptocurrency is inherently risky.

-

High volatility and potential for significant losses: Dogecoin's price can swing wildly in short periods, leading to substantial losses for investors. The extreme price swings are not only driven by Musk’s tweets but also broader market sentiment.

-

Lack of intrinsic value compared to other cryptocurrencies: Unlike cryptocurrencies with established use cases or technological underpinnings, Dogecoin’s value is primarily speculative. This makes it extremely vulnerable to shifts in market sentiment.

-

Dependence on social media trends and influencer opinions: Dogecoin's price is heavily dependent on social media trends and the opinions of prominent figures. This dependence makes it a high-risk investment vulnerable to manipulation.

Investing in meme coins like Dogecoin is akin to high-risk investment in a highly speculative market. Understanding cryptocurrency speculation and Dogecoin volatility is paramount before considering participation.

The Potential for Market Manipulation and Regulatory Scrutiny

Elon Musk's influence on Dogecoin's price raises significant ethical and legal questions. Accusations of market manipulation have been leveled against him, given the demonstrable impact his tweets have on the cryptocurrency's price. The regulatory landscape for cryptocurrencies is still evolving, but the potential for legal repercussions is substantial.

-

SEC investigations and potential penalties: The Securities and Exchange Commission (SEC) is closely monitoring the cryptocurrency market and has shown an increasing interest in investigating potential instances of market manipulation. Musk’s actions with Dogecoin are under scrutiny, and potential penalties are significant.

-

Arguments for and against market manipulation: While some argue that Musk's actions constitute market manipulation, others maintain that his tweets are simply expressions of opinion. The line between expressing an opinion and manipulating a market is blurred, especially in the context of social media and volatile assets.

-

The evolving regulatory framework for cryptocurrencies: The regulatory framework for cryptocurrencies is still developing. As regulators gain a clearer understanding of the market, stricter rules and enforcement are likely to follow. This poses both challenges and opportunities for investors in the space.

The ongoing discussion surrounding cryptocurrency regulation, Elon Musk legal issues and the SEC investigation highlights the need for increased transparency and accountability within the crypto market.

Separating Fact from Fiction: Analyzing Musk's Actual Investments

While Elon Musk's public pronouncements regarding Dogecoin are readily available, verifying the extent of his personal holdings remains challenging. The decentralized and pseudonymous nature of cryptocurrency transactions makes it difficult to definitively confirm individual ownership. Determining Elon Musk Dogecoin holdings requires access to private information that is not publicly available. The lack of transparent investments in the cryptocurrency space is a major issue that needs addressing. Efforts to verify cryptocurrency ownership verification are ongoing but face significant obstacles.

Conclusion: Understanding the Complex Relationship Between Elon Musk and Dogecoin

Elon Musk's influence on Dogecoin is undeniable. His public statements have significantly impacted the cryptocurrency's price, creating both enormous gains and significant losses for investors. However, investing in Dogecoin, or any cryptocurrency heavily influenced by social media trends and celebrity endorsements, is inherently risky. The speculative nature of Dogecoin and its high volatility mean significant losses are possible. The potential for market manipulation and the evolving regulatory environment further complicate the picture.

The key takeaway is that while understanding Elon Musk's Dogecoin influence is important, informed Dogecoin investment decisions require thorough research and a realistic assessment of the inherent risks. Responsible cryptocurrency investing necessitates a deep understanding of the market, the technology, and the regulatory landscape. Before investing in any cryptocurrency, particularly those susceptible to significant price swings, conduct comprehensive research and carefully consider your risk tolerance. Make informed Dogecoin investment decisions to protect your financial well-being.

Featured Posts

-

Analyzing Trumps Aggressive Trade Stance Against Europe

May 26, 2025

Analyzing Trumps Aggressive Trade Stance Against Europe

May 26, 2025 -

Klasemen Moto Gp Terbaru Jadwal Balapan Silverstone And Performa Marquez

May 26, 2025

Klasemen Moto Gp Terbaru Jadwal Balapan Silverstone And Performa Marquez

May 26, 2025 -

Find Your Tranquility An Andalusian Farm Stay Getaway

May 26, 2025

Find Your Tranquility An Andalusian Farm Stay Getaway

May 26, 2025 -

Manuel Neuer Injury Impact On Bayerns Upcoming Fixtures

May 26, 2025

Manuel Neuer Injury Impact On Bayerns Upcoming Fixtures

May 26, 2025 -

Southern Vacation Hot Spot Disputes Safety Rating After Shooting Incident

May 26, 2025

Southern Vacation Hot Spot Disputes Safety Rating After Shooting Incident

May 26, 2025

Latest Posts

-

The Implications Of Trumps Proposed Harvard Funding Shift

May 28, 2025

The Implications Of Trumps Proposed Harvard Funding Shift

May 28, 2025 -

Analysis Trumps Threat To Harvards Funding

May 28, 2025

Analysis Trumps Threat To Harvards Funding

May 28, 2025 -

Why Current Stock Market Valuations Shouldnt Deter Investors Bof As Analysis

May 28, 2025

Why Current Stock Market Valuations Shouldnt Deter Investors Bof As Analysis

May 28, 2025 -

Trumps Plan To Divert Harvard Funds To Trade Schools Explained

May 28, 2025

Trumps Plan To Divert Harvard Funds To Trade Schools Explained

May 28, 2025 -

Will Trump Defund Harvard Trade School Funding In Focus

May 28, 2025

Will Trump Defund Harvard Trade School Funding In Focus

May 28, 2025