This Week's Bitcoin Mining Boom: A Deep Dive

Table of Contents

Increased Hash Rate and Network Difficulty

What is the Hash Rate and why is it important?

The hash rate represents the total computational power dedicated to Bitcoin mining across the entire network. It's measured in hashes per second (H/s), often expressed in terahashes per second (TH/s) or petahashes per second (PH/s). A higher hash rate is crucial for Bitcoin's security because it makes it exponentially more difficult for malicious actors to perform a 51% attack – gaining control of the network and potentially reversing transactions.

- Definition of hash rate: The combined computational power of all miners working on the Bitcoin network.

- Measurement: TH/s (trillion hashes per second), PH/s (quadrillion hashes per second), EH/s (quintillion hashes per second).

- Relationship to network security: A higher hash rate strengthens the network against attacks.

- Impact of a high hash rate on 51% attacks: Makes 51% attacks computationally infeasible and highly improbable.

The Recent Surge in Hash Rate

Bitcoin's hash rate has experienced a dramatic increase in recent weeks. While precise figures fluctuate constantly, we've seen a jump of approximately X% compared to the average of the previous month. This represents a significant boost in the network's computational power.

- Specific figures on hash rate increase: (Insert actual data and charts showing the increase. Source the data appropriately).

- Comparison to previous periods: Show a graph comparing the current hash rate to previous periods (e.g., the last year) to highlight the significance of the boom.

- Possible reasons for the increase: This surge could be attributed to several factors: the entry of new miners into the market, the deployment of more efficient mining hardware, and potentially, a resurgence in investor confidence driving increased mining activity.

Impact on Mining Difficulty

This increased hash rate directly impacts Bitcoin's mining difficulty. Bitcoin's protocol automatically adjusts the mining difficulty approximately every two weeks to maintain a consistent block generation time of around 10 minutes. A higher hash rate leads to a more difficult mining process, requiring more computational power to solve the cryptographic puzzles and earn block rewards.

- Explanation of the difficulty adjustment algorithm: The algorithm dynamically adjusts the difficulty based on the average block generation time over the past two weeks.

- Its frequency: The difficulty adjusts roughly every 2016 blocks, approximately every two weeks.

- Impact on profitability: Increased difficulty can reduce profitability for individual miners unless hardware upgrades or lower energy costs compensate.

- The current difficulty level: (Include the current mining difficulty level with a source).

Price Volatility and its Influence on Mining Profitability

Bitcoin Price Trends

Bitcoin's price is a crucial determinant of mining profitability. Higher Bitcoin prices generally lead to increased mining profitability, attracting more miners and contributing to the boom. Recent price movements (insert relevant price data and charts) have shown a positive correlation with the increased mining activity.

- Recent price highs/lows: (Include specific price data points and cite the source).

- Correlation between price and mining profitability: Explain the direct relationship; higher prices mean higher rewards for successfully mined blocks.

- Consideration of transaction fees: Highlight that transaction fees also contribute to miner revenue, adding to profitability.

Energy Costs and Their Impact

Energy costs are a significant expense for Bitcoin miners. Regions with cheaper electricity are more attractive for mining operations, driving geographical distribution. The environmental impact of Bitcoin mining, heavily reliant on energy consumption, is a growing concern.

- Impact of electricity prices on mining profitability: Higher energy costs directly reduce profitability.

- Regions with cheaper electricity attracting more miners: Discuss regions known for low-cost energy and their role in the boom.

- The environmental impact of mining: Acknowledge the environmental concerns associated with Bitcoin mining and potential solutions (e.g., renewable energy sources).

Mining Hardware Advancements

The development and deployment of more efficient mining hardware (ASICs - Application-Specific Integrated Circuits) are key drivers of the Bitcoin Mining Boom. Newer ASICs offer higher hash rates and lower power consumption, increasing profitability and fueling competition.

- Examples of new ASICs: Mention specific examples of recently released ASIC miners.

- Their hash rate and power consumption: Compare the specifications of newer models to older ones, highlighting efficiency improvements.

- Effects on profitability and competition: Discuss how these advancements impact profitability and intensify competition within the mining industry.

Geopolitical Factors and Regulatory Changes

Impact of Regulations

Regulatory landscapes significantly influence Bitcoin mining activity. Countries with favorable regulations attract mining operations, while stricter regulations can drive miners to relocate.

- Examples of countries with favorable and unfavorable regulations: Provide concrete examples of countries with supportive and restrictive policies towards cryptocurrency mining.

- Effects on the migration of mining operations: Discuss how regulatory changes lead to the shifting of mining operations across geographical regions.

Political Instability and its Influence

Geopolitical events and political instability can indirectly influence Bitcoin mining. Periods of uncertainty can drive investors towards Bitcoin as a safe haven asset, increasing demand and consequently mining activity.

- Examples of global events influencing cryptocurrency markets: Cite recent global events that may have affected cryptocurrency markets and Bitcoin mining.

- Potential impacts on investment and mining: Explain how these events can indirectly stimulate investment in Bitcoin and thus, the mining sector.

Conclusion

This week's Bitcoin mining boom is a complex phenomenon driven by a confluence of factors, including increased hash rate, Bitcoin price volatility, energy costs, technological advancements, and geopolitical influences. Understanding these interconnected elements is crucial for navigating the ever-evolving world of Bitcoin and cryptocurrency. Staying informed about these trends is essential for anyone involved in, or interested in, the future of Bitcoin mining. To learn more about the latest developments in the Bitcoin mining landscape, continue to follow our analyses on the Bitcoin Mining Boom and its impact on the cryptocurrency market.

Featured Posts

-

Jeanine Pirros Stock Market Forecast A Few Weeks Of Caution

May 09, 2025

Jeanine Pirros Stock Market Forecast A Few Weeks Of Caution

May 09, 2025 -

Attorney General Uses Prop Fentanyl To Illustrate Drug Crisis

May 09, 2025

Attorney General Uses Prop Fentanyl To Illustrate Drug Crisis

May 09, 2025 -

Draisaitls Absence Oilers Lineup Changes For Winnipeg Game

May 09, 2025

Draisaitls Absence Oilers Lineup Changes For Winnipeg Game

May 09, 2025 -

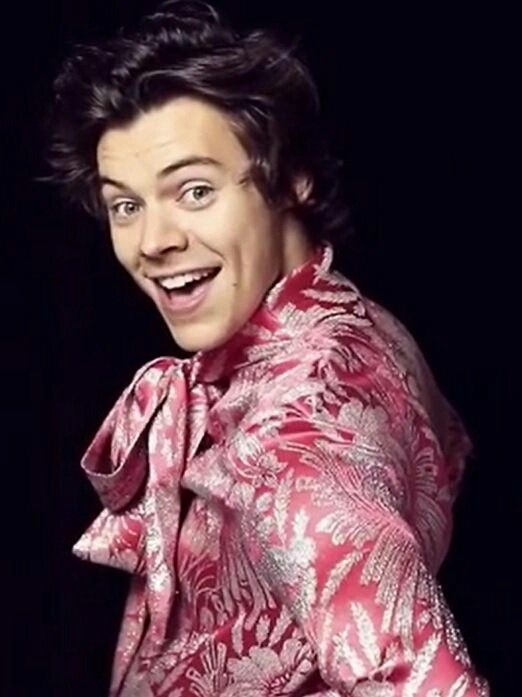

Harry Styles Reacts To A Hilariously Bad Snl Impression

May 09, 2025

Harry Styles Reacts To A Hilariously Bad Snl Impression

May 09, 2025 -

Colapintos Move From Williams To Alpine A Detailed Explanation

May 09, 2025

Colapintos Move From Williams To Alpine A Detailed Explanation

May 09, 2025