Three More Rate Cuts Predicted By Desjardins: Bank Of Canada Outlook

Table of Contents

Desjardins' Reasoning Behind the Rate Cut Prediction

Desjardins bases its prediction of three additional Bank of Canada rate cuts on a careful analysis of several key economic indicators. Their assessment points towards a more cautious approach to monetary policy, suggesting that further interest rate reductions are necessary to navigate the current economic climate. The key factors driving this forecast include:

-

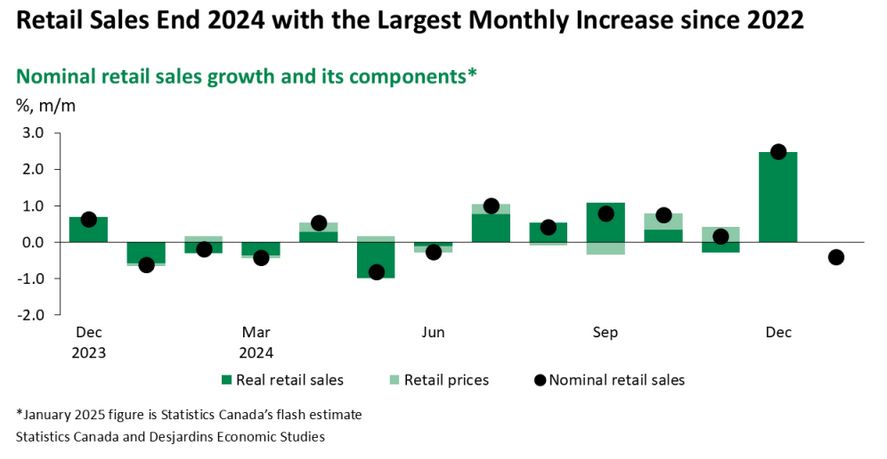

Slowing GDP Growth in Canada: Recent data reveals a slowdown in Canada's GDP growth, indicating a potential weakening of the economy. This sluggish growth signals a need for stimulus measures, such as interest rate cuts, to boost economic activity.

-

Persistently High Inflation, Despite Recent Decreases: While inflation has shown some signs of easing, it remains stubbornly high compared to the Bank of Canada's target. Desjardins believes further rate cuts are necessary to bring inflation down to the desired level without triggering a sharp economic downturn.

-

Concerns about Potential Recession: The combination of slowing GDP growth and high inflation raises concerns about the possibility of a recession. Rate cuts are seen as a proactive measure to mitigate the risk of a recession and support economic stability.

-

Unemployment Figures and Their Implications: While the unemployment rate remains relatively low, Desjardins acknowledges the potential for job losses in specific sectors if the economic slowdown persists. Rate cuts aim to prevent further job losses and support overall employment.

Desjardins' analysis concludes that these factors collectively suggest a strong case for further monetary easing through interest rate reductions. They believe these cuts are crucial to bolster economic growth and avoid a more severe economic contraction.

Impact of Predicted Rate Cuts on the Canadian Economy

The predicted Bank of Canada rate cuts are expected to have a ripple effect across the Canadian economy, impacting various sectors and individuals. The potential consequences include:

-

Lower Mortgage Rates and Their Impact on the Housing Market: Reduced interest rates will likely translate into lower mortgage rates, potentially making homeownership more accessible and stimulating activity in the housing market. This could lead to increased housing prices, although other economic factors will also influence this.

-

Reduced Borrowing Costs for Businesses and Consumers: Lower interest rates will reduce borrowing costs for businesses, encouraging investment and expansion. Consumers will also benefit from lower borrowing costs, potentially leading to increased consumer spending and economic activity.

-

Potential Stimulation of Consumer Spending and Economic Growth: Lower interest rates can boost consumer confidence, leading to increased spending on goods and services. This increased demand can stimulate economic growth and create jobs.

-

Potential Risks Associated with Further Rate Cuts (e.g., increased inflation): A key risk is the potential for further rate cuts to fuel inflation. If the economy responds strongly to the stimulus, inflation could accelerate, undermining the Bank of Canada's goal of price stability. This is a delicate balancing act for the central bank.

Alternative Perspectives and Potential Risks

While Desjardins' prediction is compelling, it's essential to acknowledge alternative perspectives and potential risks associated with further rate cuts. Not all economists agree on the necessity or efficacy of further monetary easing.

-

The Possibility of Inflation Remaining Stubbornly High: Some economists argue that inflation may be more persistent than anticipated, and further rate cuts could exacerbate this issue, potentially leading to a wage-price spiral.

-

Uncertainty Surrounding Global Economic Conditions: Global economic uncertainties, such as geopolitical instability and supply chain disruptions, could significantly impact the effectiveness of rate cuts and introduce unpredictable consequences.

-

Differing Opinions Among Economists Regarding the Bank of Canada's Next Moves: There's a divergence of opinion among economic experts regarding the optimal monetary policy response to the current economic situation. Some advocate for a more cautious approach, while others support more aggressive rate cuts.

-

The Potential for Unintended Consequences from Aggressive Rate Cuts: Aggressive rate cuts could lead to unintended consequences, such as asset bubbles in certain sectors and increased financial instability.

Conclusion

Desjardins' prediction of three more Bank of Canada rate cuts presents a significant development for the Canadian economy. While the potential benefits, such as lower borrowing costs and increased economic activity, are substantial, it's crucial to acknowledge the potential risks, including persistent inflation and global economic uncertainties. The Bank of Canada's upcoming announcements regarding interest rates will be closely watched. Desjardins' forecast underscores the importance of staying informed about the evolving economic landscape and consulting with financial professionals for personalized advice regarding your financial situation in light of these predicted Bank of Canada rate cuts. For further insights into the Canadian economy and monetary policy, consider exploring resources from the Bank of Canada directly. Understanding the implications of Bank of Canada interest rate changes is crucial for navigating your financial future effectively.

Featured Posts

-

Znatok Kino Proydite Test Po Rolyam Olega Basilashvili

May 24, 2025

Znatok Kino Proydite Test Po Rolyam Olega Basilashvili

May 24, 2025 -

Pobediteli Evrovideniya 2025 Prognoz Konchity Vurst

May 24, 2025

Pobediteli Evrovideniya 2025 Prognoz Konchity Vurst

May 24, 2025 -

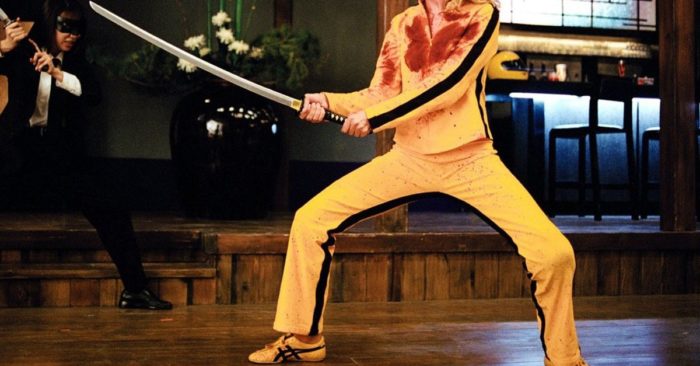

Will A Resurgent Wall Street Undermine The German Daxs Rise

May 24, 2025

Will A Resurgent Wall Street Undermine The German Daxs Rise

May 24, 2025 -

The Importance Of Net Asset Value Nav For Amundi Dow Jones Industrial Average Ucits Etf Investors

May 24, 2025

The Importance Of Net Asset Value Nav For Amundi Dow Jones Industrial Average Ucits Etf Investors

May 24, 2025 -

The Dylan Farrow Case Sean Penn Casts Doubt On Accusations Against Woody Allen

May 24, 2025

The Dylan Farrow Case Sean Penn Casts Doubt On Accusations Against Woody Allen

May 24, 2025

Latest Posts

-

Etoile A Spring Awakening Reunion Brings Laughter With Gideon Glick And Jonathan Groff

May 24, 2025

Etoile A Spring Awakening Reunion Brings Laughter With Gideon Glick And Jonathan Groff

May 24, 2025 -

Hilarious Etoile Scene A Spring Awakening Reunion For Gideon Glick And Jonathan Groff

May 24, 2025

Hilarious Etoile Scene A Spring Awakening Reunion For Gideon Glick And Jonathan Groff

May 24, 2025 -

Jonathan Groffs Just In Time Celebrity Support At Broadway Opening

May 24, 2025

Jonathan Groffs Just In Time Celebrity Support At Broadway Opening

May 24, 2025 -

Jonathan Groffs Broadway Opening Lea Michele And Co Stars Show Support

May 24, 2025

Jonathan Groffs Broadway Opening Lea Michele And Co Stars Show Support

May 24, 2025 -

Jonathan Groffs Just In Time Broadway Show A Night Of Support From Famous Friends

May 24, 2025

Jonathan Groffs Just In Time Broadway Show A Night Of Support From Famous Friends

May 24, 2025