Thursday's Market Activity: Why Did CoreWeave (CRWV) Stock Fall?

Table of Contents

The Impact of Broader Market Trends on CRWV Stock

Overall Market Sentiment

Thursday wasn't a stellar day for the overall market. Negative sentiment permeated various sectors, impacting even high-growth companies like CoreWeave.

- The Nasdaq Composite fell by [insert percentage]%, while the S&P 500 dipped by [insert percentage]%.

- The tech sector, which includes CRWV, experienced a particularly rough day, underperforming the broader market.

This widespread negative market sentiment likely contributed to selling pressure across the board, including for CRWV stock, as investors opted to secure profits or reduce risk in a volatile environment.

Sector-Specific Performance

The decline in CRWV wasn't entirely isolated. Other companies within the cloud computing and AI sectors also experienced losses, though the magnitude varied.

- [Company A] saw a [percentage]% decrease.

- [Company B] experienced a [percentage]% drop.

- [Company C] fell by [percentage]%.

While the overall tech sector and specifically the cloud computing and AI segments showed weakness, the severity of CRWV's drop suggests that company-specific factors also played a significant role.

Analyzing Company-Specific News and Announcements

Absence of Positive Catalysts

The lack of positive news or announcements from CoreWeave on Thursday likely contributed to the sell-off. Investors often react negatively when expected positive news fails to materialize.

- There were no significant product launches or partnerships announced.

- No major contracts or earnings pre-announcements were released.

The absence of these potential catalysts created an opportunity for profit-taking and fueled the downward trend.

Potential Negative News or Rumors

While no official negative news was released by CoreWeave itself, the market might have reacted to speculation or rumors.

- [Mention any rumors or speculation circulating about CRWV. Cite sources if possible. Example: Unconfirmed reports regarding potential delays in a key project.]

- [Mention any negative analyst comments or reports released prior to or around the day of the decline. Cite sources.]

Negative sentiment, even based on speculation, can significantly influence stock prices, particularly in a rapidly evolving market like the AI and cloud computing sector.

The Role of Analyst Ratings and Price Targets

Analyst Downgrades or Revisions

Changes in analyst ratings and price targets can significantly impact investor confidence and trading activity.

- [Analyst Name] from [Investment Bank] lowered their price target from [Previous Price Target] to [New Price Target], citing [Reason].

- [Analyst Name] from [Investment Bank] revised their rating from [Previous Rating] to [New Rating], expressing [Concerns]. (Cite Sources)

These downgrades or revisions may have prompted investors to sell their CRWV shares, further accelerating the price decline.

Investor Sentiment and Trading Volume

Analyzing trading volume can provide insights into investor behavior.

- Unusual trading volume spikes were observed on Thursday [mention if applicable and quantify].

This high volume, coupled with the negative market sentiment and potential company-specific concerns, suggests significant selling pressure.

Conclusion: Understanding CoreWeave (CRWV) Stock's Thursday Dip – Key Takeaways and Next Steps

The significant drop in CoreWeave (CRWV) stock on Thursday was likely a result of a combination of factors. Negative overall market sentiment, underperformance within the cloud computing and AI sectors, the absence of positive company news, potential negative speculation, and analyst downgrades all contributed to the sell-off. The high trading volume underscores the intensity of investor reaction. While broader market trends played a role, company-specific factors likely amplified the decline.

The key takeaway is the importance of monitoring both macro-economic factors and company-specific news when investing in volatile sectors. The AI and cloud computing landscape is dynamic, and staying informed is crucial for navigating market fluctuations.

To stay abreast of CoreWeave (CRWV)'s performance and the broader AI/cloud computing landscape, continue monitoring reputable financial news sources and analyst reports. Regularly review company statements and filings for any updates. Understanding the complexities of CRWV and the market will better equip you to make informed investment decisions in the future.

Featured Posts

-

Ai Reporting Scandal Chicago Sun Times Accused Of Publishing Fabricated Content

May 22, 2025

Ai Reporting Scandal Chicago Sun Times Accused Of Publishing Fabricated Content

May 22, 2025 -

Analyzing The Steelers Qb Future In Light Of The Latest Stafford Update

May 22, 2025

Analyzing The Steelers Qb Future In Light Of The Latest Stafford Update

May 22, 2025 -

Gospodin Savrseni Vanja I Sime Fotografije Koje Govore Vise Od Rijeci

May 22, 2025

Gospodin Savrseni Vanja I Sime Fotografije Koje Govore Vise Od Rijeci

May 22, 2025 -

Dexter Original Sin Steelbook Blu Ray A Collectors Must Have

May 22, 2025

Dexter Original Sin Steelbook Blu Ray A Collectors Must Have

May 22, 2025 -

Core Weave Crwv And Open Ai Jim Cramers Investment Analysis

May 22, 2025

Core Weave Crwv And Open Ai Jim Cramers Investment Analysis

May 22, 2025

Latest Posts

-

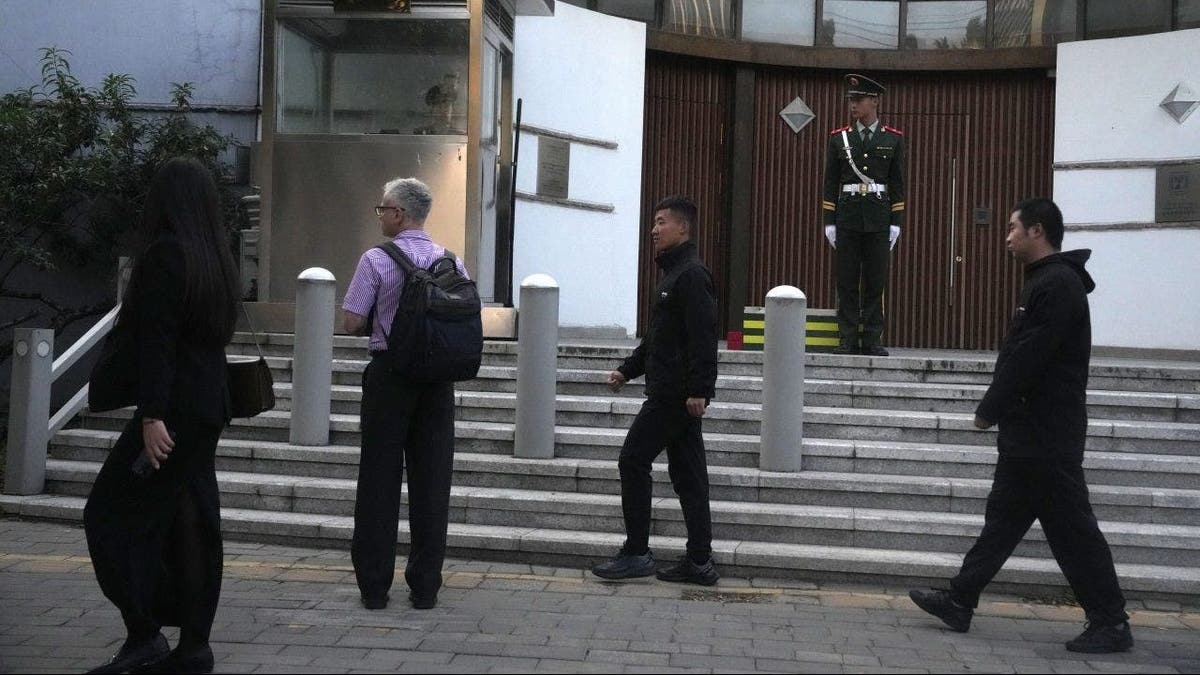

Tragedy In Dc Israeli Embassy Staff Victims Of Museum Shooting Ap Images

May 22, 2025

Tragedy In Dc Israeli Embassy Staff Victims Of Museum Shooting Ap Images

May 22, 2025 -

Understanding The Israeli Diplomat Shooting Incident In Washington

May 22, 2025

Understanding The Israeli Diplomat Shooting Incident In Washington

May 22, 2025 -

Shooting Near Dc Jewish Museum Two Israeli Embassy Employees Killed

May 22, 2025

Shooting Near Dc Jewish Museum Two Israeli Embassy Employees Killed

May 22, 2025 -

Shooting In Washington D C Israeli Embassy Names Deceased Couple

May 22, 2025

Shooting In Washington D C Israeli Embassy Names Deceased Couple

May 22, 2025 -

Israeli Embassy Attack Young Couples Names Revealed Days Before Planned Wedding

May 22, 2025

Israeli Embassy Attack Young Couples Names Revealed Days Before Planned Wedding

May 22, 2025