Today's Stock Market: Dow Futures, China's Economic Stimulus, And Trade Uncertainty

Table of Contents

Dow Futures: A Leading Indicator of Market Sentiment

Dow Futures, futures contracts on the Dow Jones Industrial Average, serve as a powerful leading indicator of market sentiment. These index futures allow investors to speculate on the future direction of the Dow Jones Industrial Average without directly owning the underlying stocks. Understanding how to interpret Dow Futures is key to gauging overall market expectations.

- How Dow Futures Contracts Work: Dow Futures contracts represent an agreement to buy or sell a specific number of Dow Jones Industrial Average shares at a predetermined price on a future date.

- Relationship to the Dow Jones Industrial Average: Dow Futures prices generally track the actual Dow Jones Industrial Average, often anticipating its movements. Significant discrepancies can signal potential shifts in market sentiment.

- Recent Dow Futures Trends: Analyzing recent trends in Dow Futures, including price movements and trading volume, provides valuable insights into investor confidence and potential market corrections. For example, a consistently upward trending Dow Futures contract could suggest optimism, while sharp declines might signal growing concern.

- Using Dow Futures Data in Investment Decisions: Investors can use Dow Futures data to time their entries and exits from the market, hedge against potential losses, or speculate on short-term price fluctuations. However, it's crucial to remember that Dow Futures are a derivative instrument and carry inherent risk.

China's Economic Stimulus: Implications for Global Markets

China's recent economic stimulus packages aim to boost its slowing economy and mitigate the impact of global trade uncertainties. These measures have significant implications for global markets, including the US stock market, both positively and negatively. Understanding China's economic stimulus is vital for any global investor.

- Specific Stimulus Packages: China has announced various stimulus measures, including infrastructure spending, tax cuts, and support for small and medium-sized enterprises (SMEs).

- Impact on Chinese Economic Growth: The effectiveness of these stimulus packages in accelerating Chinese economic growth remains to be seen, but they are expected to have a considerable impact, both short-term and long-term.

- Ripple Effects on Global Supply Chains and Demand: Increased Chinese demand due to stimulus packages could boost global supply chains and positively impact companies involved in exporting to China. However, potential overcapacity in certain sectors might lead to unforeseen consequences.

- Effects on the US Stock Market: US companies heavily reliant on the Chinese market could experience significant gains or losses depending on the success of China's stimulus efforts and the resulting changes in consumer demand and trade relations.

Trade Uncertainty: A Persistent Headwind for Investors

Ongoing trade uncertainty continues to be a major source of volatility in today's stock market. Unresolved trade disputes and protectionist policies create significant risks for investors, impacting both business confidence and investment decisions.

- Key Trade Disputes: Several trade disputes remain unresolved, creating ongoing uncertainty and impacting global markets. These include ongoing tensions between the US and China, as well as disputes involving other major economies.

- Impact on Stock Market Performance: Trade tensions often lead to increased market volatility and can negatively impact stock prices, particularly for companies heavily involved in international trade.

- Mitigating Trade Uncertainty Risks: Investors can mitigate these risks through diversification, hedging strategies, and a thorough understanding of the potential impact on specific sectors.

- Vulnerable Sectors: Sectors particularly vulnerable to trade disputes include manufacturing, technology, and agriculture, among others.

Conclusion

Understanding today's stock market requires close monitoring of Dow Futures, China's economic policies, and global trade dynamics. The interplay of these factors creates a complex environment that demands careful consideration. China's economic stimulus, while potentially beneficial for global growth, also presents uncertainties. Meanwhile, persistent trade uncertainty remains a significant headwind for investors. Dow Futures provide a crucial insight into short-term market sentiment.

To make sound investment decisions, stay informed about the latest developments in today's stock market. Continue your research into specific sectors affected by these macroeconomic trends. Subscribe to our newsletter for regular updates and in-depth analysis of today's stock market – helping you navigate the complexities and capitalize on opportunities.

Featured Posts

-

World Economic Ranking Update Californias Rise To Number Four

Apr 26, 2025

World Economic Ranking Update Californias Rise To Number Four

Apr 26, 2025 -

Beyond Disney 7 Top Orlando Restaurants For 2025

Apr 26, 2025

Beyond Disney 7 Top Orlando Restaurants For 2025

Apr 26, 2025 -

Nintendos Action Forces Ryujinx Emulator To Cease Development

Apr 26, 2025

Nintendos Action Forces Ryujinx Emulator To Cease Development

Apr 26, 2025 -

Turning Poop Into Podcast Gold An Ai Powered Approach To Repetitive Scatological Documents

Apr 26, 2025

Turning Poop Into Podcast Gold An Ai Powered Approach To Repetitive Scatological Documents

Apr 26, 2025 -

Navigate The Private Credit Boom 5 Key Dos And Don Ts

Apr 26, 2025

Navigate The Private Credit Boom 5 Key Dos And Don Ts

Apr 26, 2025

Latest Posts

-

The China Factor Analyzing The Automotive Challenges Faced By Bmw Porsche And Competitors

Apr 27, 2025

The China Factor Analyzing The Automotive Challenges Faced By Bmw Porsche And Competitors

Apr 27, 2025 -

Chinas Auto Market The Struggles Of Bmw Porsche And Others

Apr 27, 2025

Chinas Auto Market The Struggles Of Bmw Porsche And Others

Apr 27, 2025 -

Bmw And Porsche In China Market Headwinds And Strategic Adjustments

Apr 27, 2025

Bmw And Porsche In China Market Headwinds And Strategic Adjustments

Apr 27, 2025 -

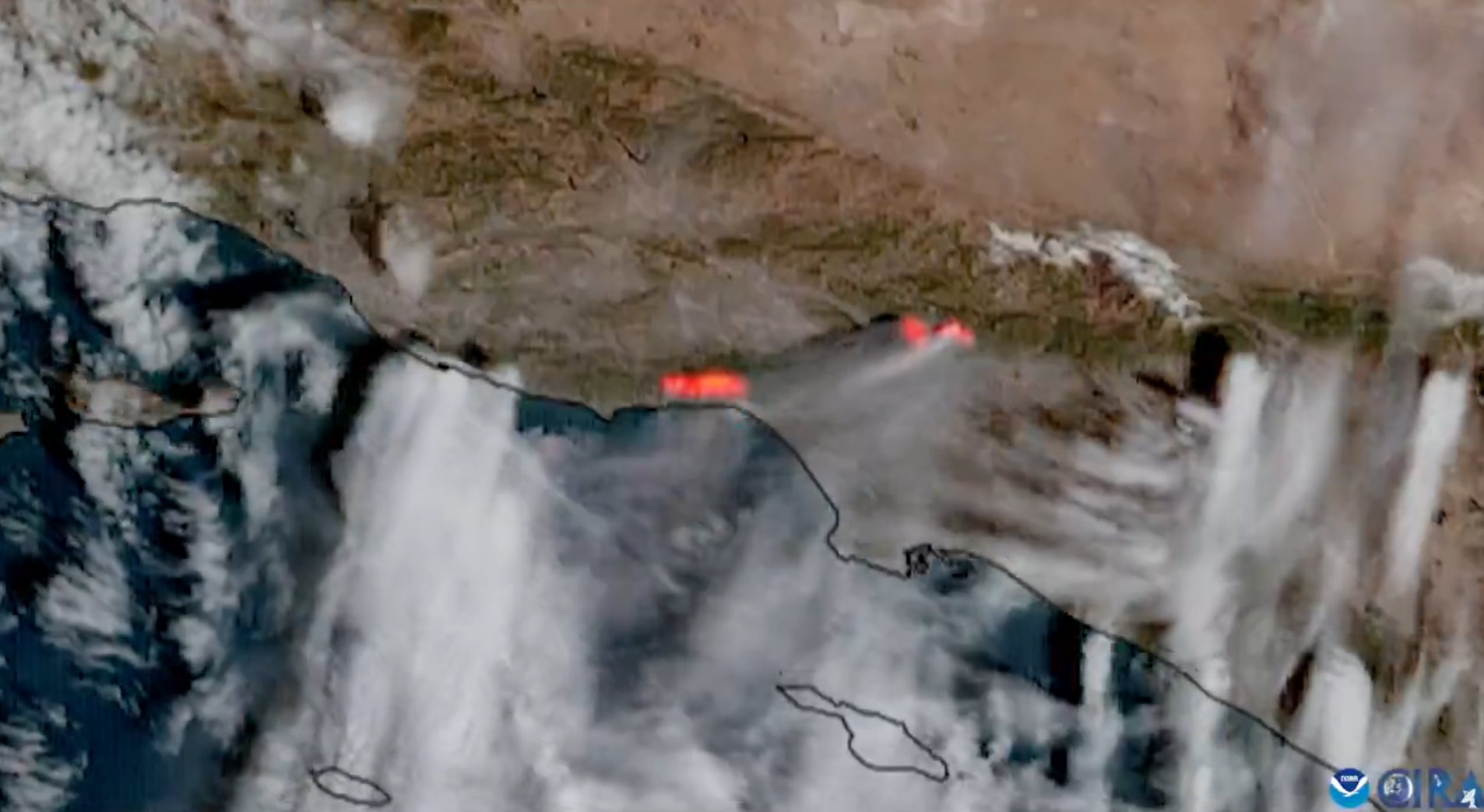

Los Angeles Wildfires A Reflection Of Our Times Through Disaster Betting

Apr 27, 2025

Los Angeles Wildfires A Reflection Of Our Times Through Disaster Betting

Apr 27, 2025 -

Wildfire Wagers Examining The Implications Of Betting On The La Fires

Apr 27, 2025

Wildfire Wagers Examining The Implications Of Betting On The La Fires

Apr 27, 2025