Top 3 Financial Pitfalls For Women

Table of Contents

The Gender Pay Gap and its Long-Term Impact

Understanding the Wage Discrepancy

The gender pay gap is a persistent and complex issue stemming from various factors. Occupational segregation, where women are concentrated in lower-paying jobs, plays a significant role. Differences in negotiation skills, often due to societal conditioning, also contribute. Finally, implicit bias in hiring and promotion decisions further exacerbates the problem.

- Statistics: The gender pay gap varies across industries and demographics, but the overall disparity remains significant. Research consistently reveals that women earn less than their male counterparts for comparable work.

- Compounding Effect: This seemingly small difference in annual salary accumulates dramatically over a lifetime. The lower earnings translate to less money for savings, investments, and retirement planning.

- Impact on Retirement: The consequences of the gender pay gap are particularly pronounced in retirement. Women are more likely to experience financial insecurity in their later years due to lower lifetime earnings and reduced pension benefits.

To combat this, women need to proactively work towards bridging this gap. This involves mastering salary negotiation techniques, actively seeking career advancement opportunities, and advocating for gender pay equity within their workplaces. Resources like salary comparison websites and negotiation workshops can be invaluable. Exploring higher-paying career paths in fields with better gender pay equity is also crucial for long-term financial security.

Underestimating the Costs of Caregiving Responsibilities

The Hidden Costs of Care

Women disproportionately bear the burden of caregiving responsibilities, often for children and aging parents. These responsibilities significantly impact their financial well-being, leading to lost income, increased childcare expenses, and significant elder care costs.

- Disproportionate Burden: Societal expectations often place the primary responsibility for caregiving on women, even when both partners work.

- Unexpected Costs: Caregiving involves many unforeseen expenses, from medical bills and medication to specialized equipment and in-home assistance.

- Financial Planning & Support: Planning for these expenses requires careful budgeting and consideration of potential support systems, including government assistance programs, family support networks, and long-term care insurance.

Managing caregiving responsibilities while maintaining financial stability requires strategic planning. This includes exploring flexible work arrangements, seeking assistance from family or friends, and researching government programs and financial resources dedicated to supporting caregivers. Open communication with family members about financial contributions and responsibilities can also significantly alleviate stress and financial burdens.

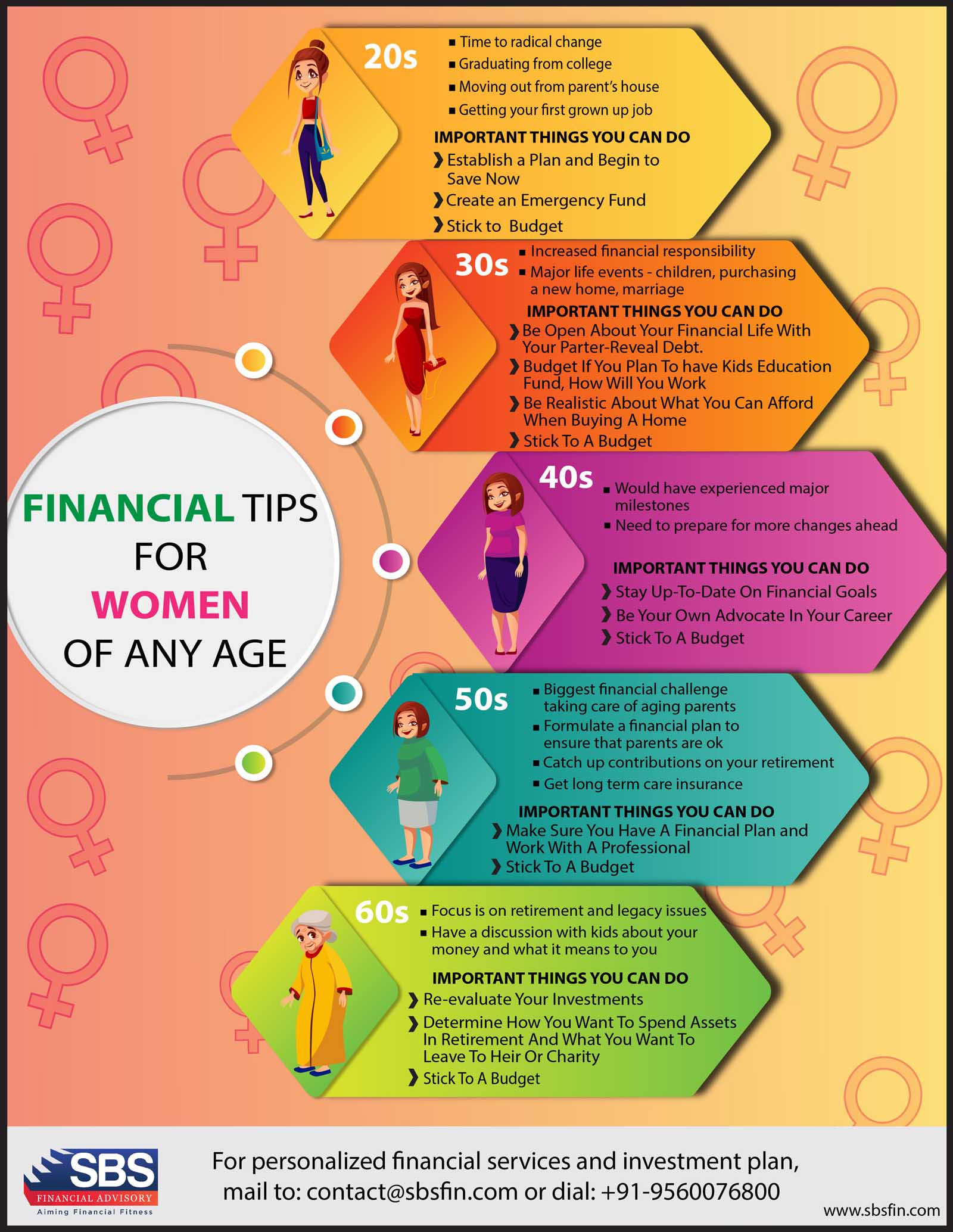

Lack of Financial Literacy and Investment Knowledge

The Importance of Financial Education

Many women lack access to or opportunities for financial education, leading to a knowledge gap that can hinder their ability to make informed financial decisions. This lack of understanding can lead to poor financial habits and missed opportunities for wealth building.

- Common Misconceptions: Many misconceptions surround investing, budgeting, and debt management, particularly among women who may have less exposure to these topics.

- Importance of Budgeting, Saving, and Investing: A solid foundation in personal finance is essential. This includes creating a budget, consistently saving, and understanding basic investment principles.

- Seeking Professional Advice: Don't hesitate to seek professional financial advice from a qualified advisor who can tailor a financial plan to your specific needs and goals.

Empowering yourself with financial literacy is a crucial step towards securing your financial future. Start by learning about budgeting techniques, exploring different investment options suited for beginners, and understanding strategies for effective debt management. Many online resources, books, and courses offer valuable financial education specifically designed for women. Taking control of your finances and seeking professional guidance will empower you to make informed decisions and achieve your financial goals.

Conclusion

The three key financial pitfalls for women – the gender pay gap, the costs of caregiving, and a lack of financial literacy – can significantly impact long-term financial well-being. However, by understanding these challenges and proactively implementing strategies to address them, women can build financial resilience and security. Taking control of your finances, seeking professional advice when needed, and investing in your financial education are crucial steps towards avoiding these financial pitfalls and securing a prosperous future. Start improving your financial health today by exploring resources like [link to a relevant financial planning website or budgeting tool].

Featured Posts

-

Van Rekening Naar Tikkie Eenvoudig En Snel Geld Overmaken In Nederland

May 22, 2025

Van Rekening Naar Tikkie Eenvoudig En Snel Geld Overmaken In Nederland

May 22, 2025 -

Concert Hellfest Noumatrouff Mulhouse

May 22, 2025

Concert Hellfest Noumatrouff Mulhouse

May 22, 2025 -

Thuc Day Phat Trien 7 Vi Tri Ket Noi Khan Cap Tp Hcm Long An

May 22, 2025

Thuc Day Phat Trien 7 Vi Tri Ket Noi Khan Cap Tp Hcm Long An

May 22, 2025 -

The Fate Of Trumps Tax Cuts Challenges And Potential For Success

May 22, 2025

The Fate Of Trumps Tax Cuts Challenges And Potential For Success

May 22, 2025 -

Wyoming Otter Management A Pivotal Moment

May 22, 2025

Wyoming Otter Management A Pivotal Moment

May 22, 2025

Latest Posts

-

Significant Route 581 Traffic Disruption Due To Box Truck Crash

May 22, 2025

Significant Route 581 Traffic Disruption Due To Box Truck Crash

May 22, 2025 -

Route 581 Traffic Stopped After Box Truck Collision

May 22, 2025

Route 581 Traffic Stopped After Box Truck Collision

May 22, 2025 -

Box Truck Accident Shuts Down Section Of Route 581

May 22, 2025

Box Truck Accident Shuts Down Section Of Route 581

May 22, 2025 -

Large Fire Engulfs Used Car Sales Lot Crews On Scene

May 22, 2025

Large Fire Engulfs Used Car Sales Lot Crews On Scene

May 22, 2025 -

Route 581 Closure Box Truck Crash Causes Major Delays

May 22, 2025

Route 581 Closure Box Truck Crash Causes Major Delays

May 22, 2025