Trade War Fallout: Identifying Crypto's Potential Winners

Table of Contents

Crypto as a Safe Haven Asset During Trade Wars

Trade wars disrupt traditional financial systems, fostering distrust in fiat currencies and increasing the appeal of crypto's decentralized nature. This makes cryptocurrencies an attractive alternative investment, especially for those seeking to protect their assets from economic volatility.

Reduced Reliance on Traditional Systems

Trade wars undermine confidence in established financial systems. This leads to:

- Decreased trust in fiat currencies: Geopolitical instability and currency devaluations can erode faith in traditional currencies, driving investors towards assets perceived as less susceptible to manipulation.

- Increased demand for alternative stores of value: Cryptocurrencies, particularly Bitcoin, are often viewed as a hedge against inflation and currency devaluation.

- Potential for capital flight into crypto: Investors may move assets out of traditional markets into crypto as a safer haven during times of heightened uncertainty.

For example, investors fleeing volatile stock markets might turn to Bitcoin, a relatively less correlated asset, to preserve capital. Bitcoin's established market capitalization and first-mover advantage solidify its position as a leading safe-haven cryptocurrency.

Increased Demand for Privacy Coins

Increased government scrutiny of financial transactions during trade disputes can boost demand for privacy-focused cryptocurrencies.

- Concerns over government surveillance: Trade wars often involve increased monitoring of international transactions, leading some to seek greater anonymity.

- Increased demand for anonymity in international transactions: Privacy coins offer a way to conduct transactions with a higher degree of confidentiality, potentially shielding them from the impacts of trade restrictions.

- Potential regulatory pressure on traditional banking: Increased regulation can make it more difficult to move money across borders, increasing the attractiveness of privacy-focused crypto solutions.

Monero (XMR) and Zcash (ZEC), for example, might see increased adoption due to their enhanced privacy features. However, it's crucial to acknowledge the regulatory risks associated with privacy coins and to ensure compliance with applicable laws.

Growth of Decentralized Finance (DeFi) in Response to Trade Restrictions

Decentralized Finance (DeFi) offers solutions that bypass traditional financial institutions, which are often significantly affected by trade wars and sanctions.

Bypassing Traditional Financial Institutions

DeFi protocols can facilitate cross-border transactions and financial services independently of traditional banking systems:

- Reduced reliance on SWIFT: DeFi networks can process international payments without relying on SWIFT, a system that can be vulnerable to geopolitical pressures.

- Access to global markets for smaller businesses: DeFi platforms can level the playing field, providing access to capital and financial services for businesses that might otherwise be excluded by trade barriers.

- Potential for lower transaction fees: DeFi often offers lower transaction costs compared to traditional banking, making it a more cost-effective option for international payments.

Stablecoins like USDC and DAI could experience increased usage for international payments due to their relative stability and ease of use.

Increased Demand for DeFi Tokens

Investors seeking decentralized financial solutions unaffected by geopolitical events may drive growth in DeFi tokens:

- Increased liquidity provision in DeFi protocols: As more users turn to DeFi, liquidity provision in various protocols will increase, driving up demand for related tokens.

- Rising demand for yield farming opportunities: DeFi offers higher yield opportunities compared to traditional savings accounts, attracting investors searching for higher returns.

- Potential for higher returns: The potential for significant returns on investment in DeFi tokens can further stimulate demand.

Tokens of prominent DeFi platforms, such as Uniswap and Aave, could experience price appreciation as their utility and adoption increase.

Blockchain Technology's Role in Supply Chain Transparency

Blockchain technology can enhance transparency and traceability in international supply chains, mitigating disruptions caused by trade wars.

Tracking Goods and Reducing Disputes

Blockchain's immutable ledger can revolutionize supply chain management:

- Improved supply chain visibility: Tracking goods from origin to destination helps businesses monitor shipments and anticipate potential delays or disruptions.

- Reduced risk of counterfeiting: Blockchain's transparency helps verify the authenticity of goods, reducing the risk of counterfeit products entering the market.

- Faster dispute resolution: The transparent nature of blockchain can facilitate faster and more efficient dispute resolution.

Companies employing blockchain for supply chain management could gain a significant competitive advantage during trade wars.

Potential for Blockchain-Based Tokens

Blockchain-based tokens could streamline trade finance processes and facilitate cross-border payments:

- Increased efficiency in trade finance: Tokens representing commodities or trade credits can accelerate payment processing and reduce paperwork.

- Reduced transaction costs: Blockchain-based solutions can lower the costs associated with international trade finance.

- Improved security: Blockchain's secure nature enhances the safety and reliability of trade finance transactions.

The emergence of tokens representing commodities or trade credits could create new opportunities and drive value in the blockchain space.

Conclusion

The fallout from trade wars presents both challenges and opportunities. While the overall crypto market remains volatile, certain cryptocurrencies are uniquely positioned to benefit from the increased uncertainty and disruption in traditional financial systems. By understanding the potential for cryptocurrencies to act as safe haven assets, facilitate decentralized finance, and enhance supply chain transparency, investors can better identify potential winners in this evolving landscape. Further research into specific projects within the DeFi space, privacy coins, and blockchain supply chain solutions will be crucial for navigating the complexities of this dynamic market and capitalizing on the opportunities presented by the continuing trade war fallout. Start your research today and explore the potential of cryptocurrency to thrive during times of global economic uncertainty.

Featured Posts

-

Soglashenie Frantsii I Polshi Ukreplenie Bezopasnosti V Evrope I Otvet Geopoliticheskim Vyzovam

May 09, 2025

Soglashenie Frantsii I Polshi Ukreplenie Bezopasnosti V Evrope I Otvet Geopoliticheskim Vyzovam

May 09, 2025 -

Uk Government Announces Visa Application Changes

May 09, 2025

Uk Government Announces Visa Application Changes

May 09, 2025 -

Palantir Technology Stock Should You Invest Before May 5th

May 09, 2025

Palantir Technology Stock Should You Invest Before May 5th

May 09, 2025 -

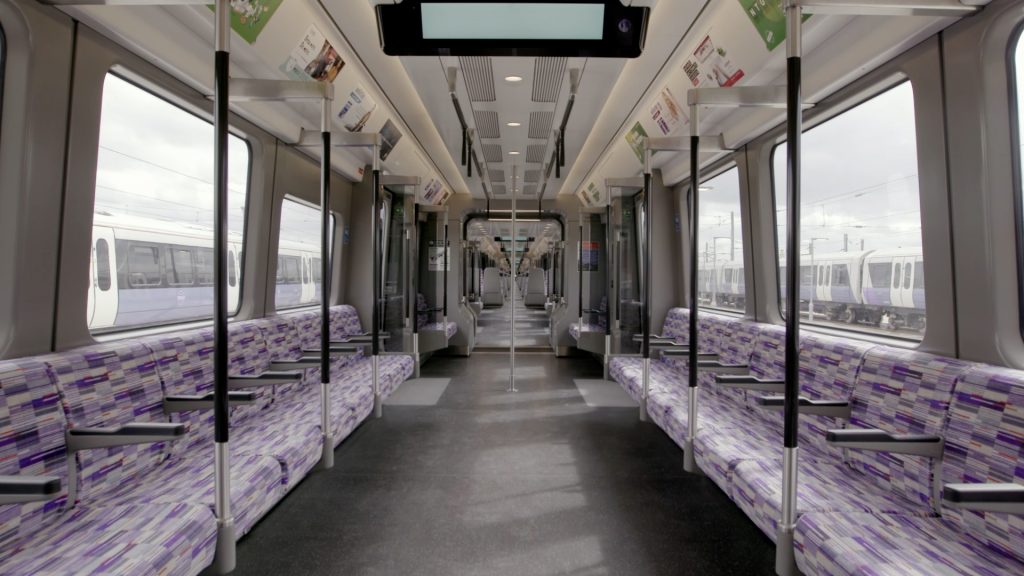

Ensuring Accessibility For Wheelchair Users On The Elizabeth Line

May 09, 2025

Ensuring Accessibility For Wheelchair Users On The Elizabeth Line

May 09, 2025 -

Nyt Strands Answers And Hints Tuesday March 4 Game 366

May 09, 2025

Nyt Strands Answers And Hints Tuesday March 4 Game 366

May 09, 2025