Treasury Official Warns Of Potential US Debt Limit Crisis In August

Table of Contents

The Looming Deadline and its Implications

The US debt ceiling is the legal limit on the total amount of money the federal government can borrow to meet its existing obligations. Congress sets this limit, and if it's not raised, the government cannot borrow more money to pay its bills. This seemingly technical matter has significant real-world consequences.

Failing to raise the debt ceiling would have severe repercussions:

-

Government Shutdown: A failure to raise the debt ceiling could lead to a partial or complete government shutdown. Non-essential government services would be halted, impacting everything from national parks to passport processing and potentially causing significant disruptions to citizens' lives. This would also delay payments to government contractors and employees.

-

Economic Uncertainty: The uncertainty surrounding a potential default would severely impact financial markets. Investor confidence would plummet, leading to potential stock market declines and increased volatility. Businesses might postpone investments, and consumer spending could decrease, further exacerbating economic hardship.

-

Credit Rating Downgrade: A failure to meet the country's debt obligations could result in a credit rating downgrade from major rating agencies. This would make it more expensive for the US government to borrow money in the future, impacting future government spending and potentially leading to higher interest rates for consumers and businesses.

-

International Ramifications: A US debt default would send shockwaves through the global economy. The dollar's status as the world's reserve currency could be threatened, impacting international trade and investment. Global financial markets would experience significant volatility, potentially leading to a global recession.

A timeline of potential events leading up to August includes continued negotiations in Congress, potential warnings from the Treasury Department about approaching deadlines for extraordinary measures, and a potential escalating sense of urgency as August approaches.

Treasury Department's Actions and Strategies

The Treasury Department is actively working to manage the situation. They are employing "extraordinary measures," which are accounting maneuvers designed to temporarily avoid exceeding the debt ceiling. These measures might include suspending certain investments or delaying certain payments. However, these measures are only temporary solutions, and their effectiveness is limited. The Treasury Department is actively communicating with Congress, urging them to raise the debt ceiling to avoid a default. They are regularly releasing statements and press releases highlighting the potential severity of the situation and the urgent need for Congressional action.

Congressional Actions and Political Stalemate

Reaching a bipartisan agreement to raise the debt ceiling is proving to be extremely challenging. The current political climate is highly polarized, with differing views on government spending and the national debt. The political parties hold contrasting positions on the issue, creating a stalemate in Congress. While some lawmakers propose solutions involving spending cuts or adjustments to existing programs, finding a compromise that satisfies all sides remains a significant hurdle. Negotiations are ongoing, but the likelihood of a timely resolution remains uncertain.

Potential Economic Impacts of a Debt Ceiling Crisis

The economic consequences of a debt ceiling crisis could be severe, both in the short-term and long-term.

-

Interest Rates: A debt ceiling crisis would likely lead to increased interest rates as investors demand higher returns to compensate for increased risk. This would make borrowing more expensive for businesses and consumers, potentially slowing down economic growth.

-

Inflation: The economic uncertainty and potential government shutdown could lead to increased inflation. Supply chain disruptions and reduced consumer confidence could contribute to higher prices for goods and services.

-

Job Market: A government shutdown could result in temporary job losses for federal employees and contractors. The broader economic slowdown could also lead to job losses in the private sector as businesses respond to decreased consumer demand and increased uncertainty.

-

Consumer Confidence: The uncertainty surrounding the debt ceiling could significantly erode consumer confidence. Consumers may postpone major purchases, leading to a decrease in consumer spending and further slowing economic growth.

Impact on Global Financial Markets

A US debt ceiling crisis would not be confined to the US. Global financial markets would experience significant volatility, with potential declines in global stock markets and increased uncertainty in the international financial system. International trade and investment would be significantly impacted, leading to a potential global economic slowdown or even recession. The dollar's position as the global reserve currency could be weakened, further exacerbating the crisis.

Conclusion

The potential US debt limit crisis in August presents a significant threat to the US and global economies. The urgency of the situation cannot be overstated. Failure to raise the debt ceiling could trigger a government shutdown, economic uncertainty, credit rating downgrades, and severe international ramifications. The potential impacts on interest rates, inflation, the job market, and consumer confidence are all substantial. Understanding the implications of the US debt limit crisis is critical for individuals, businesses, and the global community.

Call to Action: Stay informed about the evolving situation surrounding the US debt limit. Follow reputable news sources for updates on Congressional negotiations and Treasury Department actions. Contact your elected officials to express your concerns and urge them to find a swift and responsible solution to avoid a US debt ceiling crisis. The consequences of inaction are too severe to ignore.

Featured Posts

-

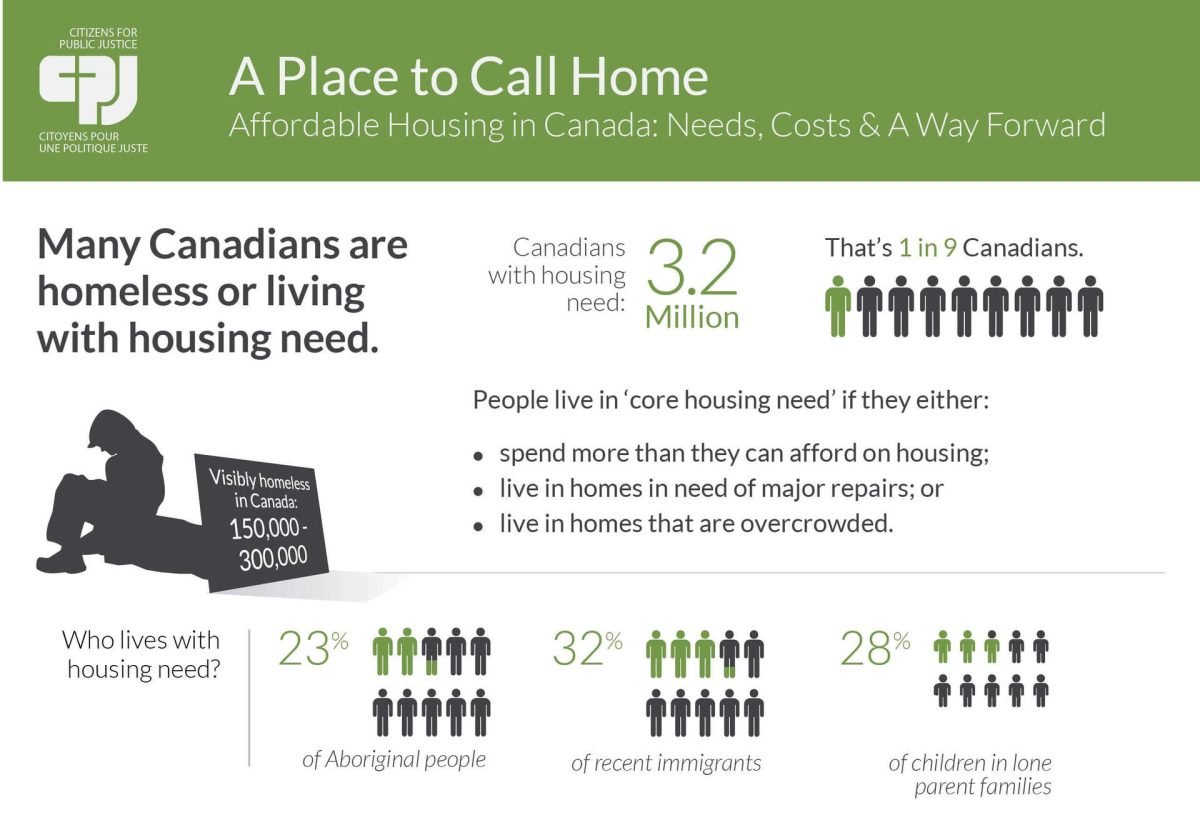

Is Homeownership In Canada Out Of Reach The Role Of High Down Payments

May 10, 2025

Is Homeownership In Canada Out Of Reach The Role Of High Down Payments

May 10, 2025 -

Wynne Evans Health Scare Illness Details And Potential Showbiz Comeback

May 10, 2025

Wynne Evans Health Scare Illness Details And Potential Showbiz Comeback

May 10, 2025 -

Largest Fentanyl Seizure In Us History Pam Bondis Announcement

May 10, 2025

Largest Fentanyl Seizure In Us History Pam Bondis Announcement

May 10, 2025 -

Investigation Launched Senate Democrats Accuse Pam Bondi Of Hiding Epstein Files

May 10, 2025

Investigation Launched Senate Democrats Accuse Pam Bondi Of Hiding Epstein Files

May 10, 2025 -

Ray Epps Sues Fox News For Defamation Over January 6th Coverage

May 10, 2025

Ray Epps Sues Fox News For Defamation Over January 6th Coverage

May 10, 2025