Trump And Oil Prices: Goldman Sachs' Interpretation Of Public Statements

Table of Contents

Goldman Sachs' Methodology for Analyzing Presidential Impact on Oil Prices

Goldman Sachs employs a sophisticated approach to analyzing the impact of political statements on oil prices, particularly those made by President Trump. Their methodology isn't simply about reading headlines; it's a multi-faceted process designed to isolate the impact of specific pronouncements from broader market forces.

- Sentiment Analysis of Speeches and Tweets: Goldman Sachs uses advanced algorithms to analyze the sentiment expressed in Trump's speeches, tweets, and other public statements related to energy policy, OPEC, and sanctions. This helps quantify the positive or negative tone toward the oil market.

- Correlation Analysis Between Statements and Subsequent Price Movements: The firm correlates specific statements with subsequent movements in crude oil prices, attempting to establish a causal link. This involves controlling for other factors that could influence prices, such as global supply and demand.

- Consideration of Broader Economic and Geopolitical Contexts: Goldman Sachs doesn't operate in a vacuum. Their analysis considers the broader economic and geopolitical landscape, acknowledging that factors beyond presidential rhetoric significantly impact oil prices. This includes global economic growth, geopolitical tensions, and OPEC decisions.

- Use of Proprietary Models to Forecast Market Reactions: Goldman Sachs leverages proprietary econometric models to forecast market reactions to specific presidential statements. These models incorporate various factors, including historical data, sentiment analysis, and geopolitical variables.

However, this methodology isn't without challenges. Interpreting political language is inherently subjective, and there's always the possibility of bias. Unforeseen events can also dramatically impact market responses, making accurate predictions difficult. The inherent uncertainty of geopolitical events introduces a significant margin of error in any predictive model.

Key Trump Statements and Their Impact According to Goldman Sachs

Several instances stand out where Goldman Sachs analyzed the market impact of specific Trump statements.

-

Statement 1: “We’re going to become energy independent.” Goldman Sachs initially interpreted this as potentially bullish for domestic oil production, predicting increased investment and higher prices. The actual market response was mixed, with prices initially rising but later leveling off due to other global factors.

-

Statement 2: Tweets criticizing OPEC's production cuts. Goldman Sachs analyzed these tweets as potentially bearish for oil prices, suggesting that the administration might take actions to counter OPEC's influence. The market responded with a slight dip in prices, aligning with the initial prediction.

-

Statement 3: Announcing sanctions against Iran. Goldman Sachs's analysis predicted a significant price increase due to reduced supply. The actual market response was initially higher, though the effect was moderated by other market forces and the complexity of global oil supply chains.

These examples showcase instances where Goldman Sachs' predictions were partially accurate, highlighting the limitations of relying solely on presidential rhetoric to forecast oil prices. The accuracy of their predictions was significantly influenced by concurrent global events and market dynamics.

The Role of OPEC in Goldman Sachs' Analysis

OPEC's actions are inextricably linked to Goldman Sachs' analysis of Trump's statements. The US, as a major oil producer, has a significant influence on global supply and demand, and Trump's pronouncements often impacted OPEC's decision-making.

-

Example 1: Trump's calls for increased OPEC production were met with varied responses, showing the complex interplay of global politics and market forces.

-

Example 2: Goldman Sachs' models incorporated instances where Trump's interactions with Saudi Arabia (a key OPEC member) influenced oil production quotas and, consequently, global prices.

Predicting market response to the interplay between US policy, OPEC actions, and global events remains exceptionally challenging, emphasizing the complexities of the global oil market.

Implications for Investors and Policymakers

Goldman Sachs' analysis carries significant implications for investors and policymakers:

-

Investment Strategies: Investors can use this type of analysis to inform their investment strategies in the energy sector, adjusting portfolios based on anticipated policy changes.

-

Risk Management: Understanding the potential impact of political uncertainty is crucial for effective risk management in the energy sector.

-

Policy Decisions: Policymakers can use such analysis to anticipate market responses to proposed energy policies and adjust their strategies accordingly.

Integrating political risk analysis into both investment and policy decisions is paramount given the significant impact of political rhetoric on commodity markets.

Conclusion

Goldman Sachs' analysis of the relationship between Trump's statements and oil prices offers valuable insights into the complex interplay between political rhetoric and market dynamics. While their methodology provides a sophisticated framework, the limitations inherent in predicting market reactions to political pronouncements remain. The accuracy of their forecasts is influenced by many other factors including global supply and demand, geopolitical events, and the actions of key players like OPEC.

Understanding the impact of political statements on oil prices is crucial for investors and policymakers alike. Stay informed on Goldman Sachs’ analysis and other expert opinions to navigate the complexities of the energy market and effectively manage risk related to Trump and oil prices. Further research into the intersection of political statements and commodity markets is strongly encouraged.

Featured Posts

-

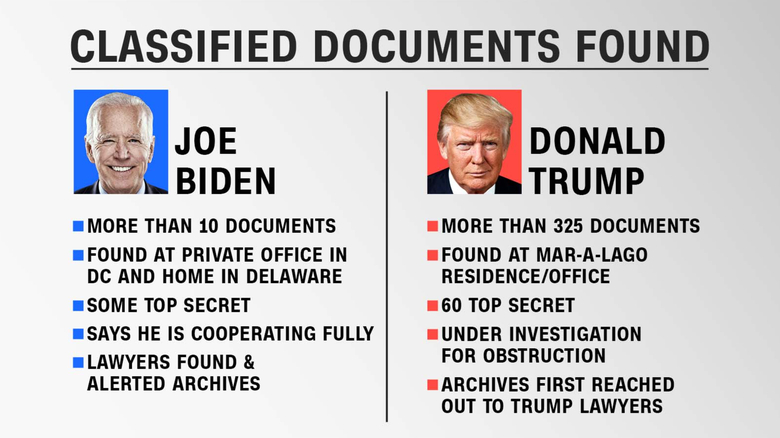

Analyzing President Bidens Denials Key Issues And Controversies

May 15, 2025

Analyzing President Bidens Denials Key Issues And Controversies

May 15, 2025 -

A Second Chance In La The Story Of A Forgotten Dodgers Signing

May 15, 2025

A Second Chance In La The Story Of A Forgotten Dodgers Signing

May 15, 2025 -

Earthquakes 4 1 Victory Over Timbers Moras Goal In Losing Effort

May 15, 2025

Earthquakes 4 1 Victory Over Timbers Moras Goal In Losing Effort

May 15, 2025 -

Gop Mega Bill Unveiled Whats Inside And Whats Next

May 15, 2025

Gop Mega Bill Unveiled Whats Inside And Whats Next

May 15, 2025 -

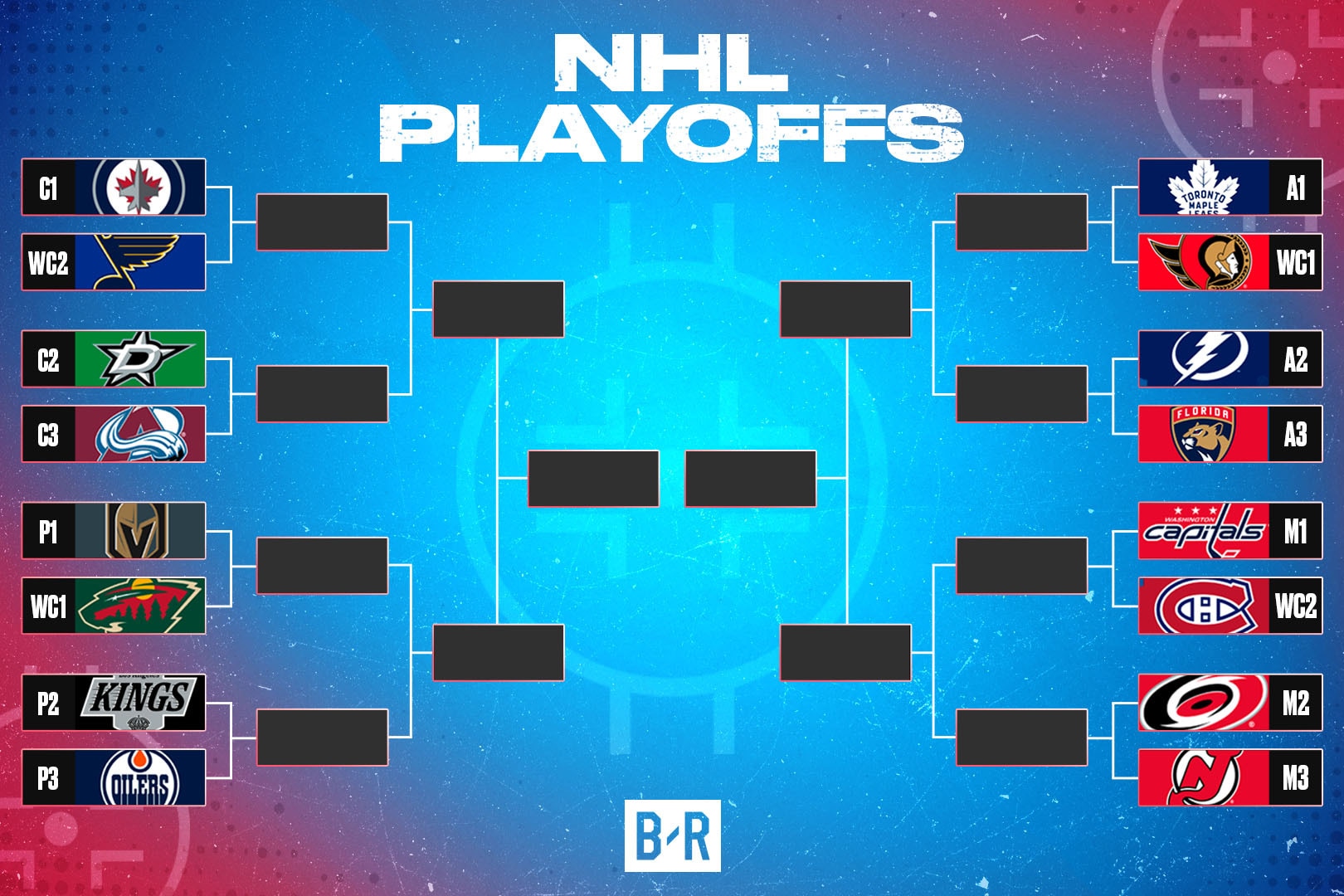

Smart Bets Nba And Nhl Playoffs Round 2

May 15, 2025

Smart Bets Nba And Nhl Playoffs Round 2

May 15, 2025

Latest Posts

-

Nba Playoffs Celtics Vs Magic Game 1 Live Stream Tv Schedule And Viewing Guide

May 15, 2025

Nba Playoffs Celtics Vs Magic Game 1 Live Stream Tv Schedule And Viewing Guide

May 15, 2025 -

How To Watch Celtics Vs Magic Nba Playoffs Game 1 Time Tv Channel And Live Stream

May 15, 2025

How To Watch Celtics Vs Magic Nba Playoffs Game 1 Time Tv Channel And Live Stream

May 15, 2025 -

Celtics Vs Magic Game 1 How To Watch The Nba Playoffs Live

May 15, 2025

Celtics Vs Magic Game 1 How To Watch The Nba Playoffs Live

May 15, 2025 -

Celtics Sale To Private Equity A 6 1 Billion Deal And Fan Concerns

May 15, 2025

Celtics Sale To Private Equity A 6 1 Billion Deal And Fan Concerns

May 15, 2025 -

Boston Celtics Sold Fans React To 6 1 B Private Equity Sale

May 15, 2025

Boston Celtics Sold Fans React To 6 1 B Private Equity Sale

May 15, 2025