Trump And Student Loan Privatization: Exploring The Potential Consequences

Table of Contents

Increased Costs for Borrowers

Privatizing the student loan system could dramatically increase costs for borrowers in several ways.

Higher Interest Rates

Private lenders, driven by profit motives, would likely charge significantly higher interest rates compared to current government-backed loans.

- Example: A government-backed loan might have a 4% interest rate, while a private loan could easily reach 8% or even higher, depending on the borrower's creditworthiness.

- Impact: This increase could lead to tens of thousands of dollars in additional interest payments over the life of the loan, making repayment significantly more difficult.

Data from the National Center for Education Statistics shows that the average interest rate on federal student loans is currently lower than those offered by private lenders. Privatization would likely exacerbate this disparity, leading to substantial added costs for borrowers.

Aggressive Collection Practices

Private lenders often employ more aggressive debt collection tactics than government agencies.

- Example: These tactics could include frequent calls, threats of legal action, wage garnishment, and damage to credit scores, even for borrowers attempting to make timely payments.

- Consequences: Such aggressive practices can cause significant financial and emotional distress, potentially leading to further financial instability for borrowers already struggling with debt.

Studies have shown a correlation between aggressive debt collection and increased financial hardship. The shift to private lenders could amplify this issue, creating a more adversarial and stressful experience for borrowers.

Reduced Access to Loans

Privatization could severely restrict access to student loans for many students.

Credit Score Requirements

Private lenders typically have stricter credit score requirements than government agencies.

- Barrier to Entry: This would disproportionately impact low-income students and those with less-than-perfect credit histories, who may not qualify for loans even if they are academically qualified for college.

- Impact on Affordability: The resulting decrease in loan accessibility would exacerbate existing inequalities in higher education access, making college unaffordable for many deserving students.

Existing data indicates a strong correlation between credit score and access to student loans. Privatization would likely tighten these requirements further, excluding many from higher education opportunities.

Increased Loan Denials

Under a privatized system, the loan denial rate could increase substantially.

- Reasons for Denial: Private lenders might deny loans based on factors not considered by government agencies, such as perceived risk, co-signer availability, and employment history.

- Impact on College Completion: This could lead to a decrease in college enrollment and completion rates, particularly among marginalized groups, perpetuating existing educational disparities.

Analyzing current loan approval rates across different lending institutions reveals a higher denial rate among private lenders. A fully privatized system would almost certainly result in an increase in these denials, making higher education even less accessible.

Potential for Systemic Risk

A privatized student loan system introduces significant risks to the overall financial stability.

Market Volatility

The student loan market's susceptibility to market volatility poses considerable risks.

- Economic Downturns: During economic downturns, private lenders may become more reluctant to lend, potentially leading to a credit crunch in the higher education sector.

- Widespread Defaults: This could result in widespread defaults, causing significant financial losses for both lenders and borrowers, leading to a ripple effect on the economy.

Historical data demonstrates how economic instability affects lending practices. The introduction of market forces into the student loan system would amplify this vulnerability.

Lack of Government Oversight

Reducing government oversight could open the door to predatory lending practices.

- Exploitation of Borrowers: Without strong regulations and oversight, unscrupulous lenders could exploit borrowers with unfair terms, high fees, and deceptive practices.

- Need for Strong Regulations: Robust government regulation is crucial to protect borrowers from these predatory practices and maintain fairness within the system.

Examples of predatory lending in the subprime mortgage crisis highlight the dangers of insufficient regulation. A privatized student loan system without adequate government oversight would significantly increase the risks to vulnerable borrowers.

Conclusion

The potential consequences of Trump and student loan privatization are far-reaching and alarming. The analysis presented here suggests a system characterized by increased costs, reduced access, and heightened systemic risk. Privatization could lead to a dramatic increase in interest rates, aggressive debt collection practices, and stricter credit score requirements, effectively barring many students from accessing higher education. Furthermore, the absence of sufficient government oversight could create opportunities for predatory lending and amplify the vulnerability of the system to market volatility. Understanding the implications of Trump and student loan privatization is crucial for protecting borrowers. Learn more about student loan reform and advocate for responsible policies that ensure equitable access to higher education and prevent the financial exploitation of students.

Featured Posts

-

Authenticating Angel Reese Quotes A Guide To Fact Checking

May 17, 2025

Authenticating Angel Reese Quotes A Guide To Fact Checking

May 17, 2025 -

Potential Wnba Strike Angel Reeses Comments On Player Compensation

May 17, 2025

Potential Wnba Strike Angel Reeses Comments On Player Compensation

May 17, 2025 -

Refinancing Federal Student Loans When It Makes Sense

May 17, 2025

Refinancing Federal Student Loans When It Makes Sense

May 17, 2025 -

Bridges Asks Thibodeau To Manage Knicks Starters Playing Time

May 17, 2025

Bridges Asks Thibodeau To Manage Knicks Starters Playing Time

May 17, 2025 -

Pistons Frustration Mounts After Game 4s Controversial Foul Call

May 17, 2025

Pistons Frustration Mounts After Game 4s Controversial Foul Call

May 17, 2025

Latest Posts

-

Laporan Keuangan Jenis Pentingnya Dan Manfaat Untuk Bisnis Anda

May 17, 2025

Laporan Keuangan Jenis Pentingnya Dan Manfaat Untuk Bisnis Anda

May 17, 2025 -

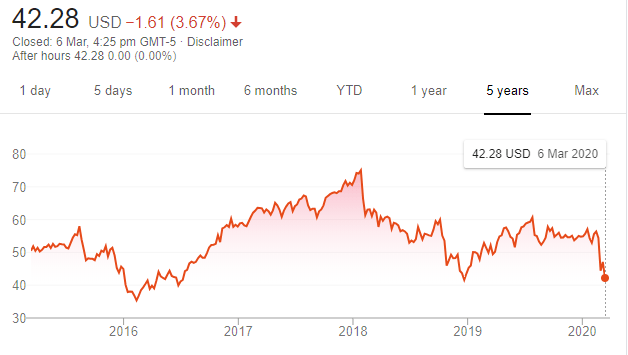

13 Analyst Opinions Evaluating Principal Financial Groups Pfg Performance

May 17, 2025

13 Analyst Opinions Evaluating Principal Financial Groups Pfg Performance

May 17, 2025 -

Understanding Principal Financial Group Pfg Key Insights From 13 Analysts

May 17, 2025

Understanding Principal Financial Group Pfg Key Insights From 13 Analysts

May 17, 2025 -

Principal Financial Group Pfg 13 Analysts Weigh In

May 17, 2025

Principal Financial Group Pfg 13 Analysts Weigh In

May 17, 2025 -

Delayed Publication Of Valerio Therapeutics S A S 2024 Financial Report

May 17, 2025

Delayed Publication Of Valerio Therapeutics S A S 2024 Financial Report

May 17, 2025