Trump's 100-Day Plan And Bitcoin's Potential: A Price Prediction Analysis

Table of Contents

Understanding Trump's 100-Day Plan and its Economic Implications

Trump's 100-day plan, while ambitious, aimed to rapidly reshape the US economy. Understanding its potential impact on Bitcoin requires analyzing its core tenets.

Key Policies and their Potential Effects on the US Economy:

The plan encompassed several key areas, each with potential ramifications for Bitcoin:

- Tax Cuts: Significant tax cuts could stimulate economic growth but potentially increase the national debt and inflation. High inflation often pushes investors towards alternative assets like Bitcoin as a hedge against devaluation.

- Deregulation: Easing regulations across various sectors could boost business activity but might also increase economic instability. This instability could either drive investors towards Bitcoin's perceived safety or lead to a risk-off sentiment, negatively affecting its price.

- Infrastructure Spending: Massive infrastructure investment could boost economic growth and create jobs, potentially positively impacting investor sentiment and indirectly influencing Bitcoin's price. However, increased government spending might also lead to inflation.

These economic shifts could significantly affect the value of the US dollar. A weakening dollar, historically, has often been correlated with Bitcoin price increases, as investors seek alternative stores of value. Key economic indicators like inflation rates (CPI), GDP growth, and the unemployment rate will play crucial roles in shaping the overall economic landscape and, consequently, Bitcoin's performance.

Bitcoin's Historical Response to Political Uncertainty

Analyzing Bitcoin's past behavior during periods of political upheaval provides valuable insights.

Analyzing Past Price Fluctuations during Periods of Political Upheaval:

Historical data reveals a complex relationship. While some major political events have coincided with Bitcoin price surges (often attributed to investors seeking safe havens), others have resulted in dips. For example, Brexit initially caused a Bitcoin price drop, but the subsequent uncertainty led to a surge in demand. The 2016 US Presidential election also saw significant price fluctuations, highlighting Bitcoin's sensitivity to political uncertainty. Note: Including charts and graphs visually representing historical correlations would strengthen this section.

Technical and Fundamental Analysis of Bitcoin's Price

To form a comprehensive Bitcoin price prediction, both technical and fundamental analyses are vital.

Technical Indicators Predicting Future Price Movements:

Technical analysis uses charts and indicators to predict price trends. Key indicators like moving averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD) can help assess potential price reactions to Trump's policies. For instance, a strong uptrend in moving averages, coupled with a bullish RSI, could suggest a positive outlook for Bitcoin after the implementation of certain policies.

Fundamental Factors Influencing Bitcoin's Value:

Beyond technical indicators, fundamental factors are critical. These include:

- Adoption Rate: Widespread adoption by businesses and individuals strengthens Bitcoin's value proposition.

- Regulatory Changes: Favorable regulations (or lack of stringent regulations) can boost investor confidence and attract larger investments. Trump's administration's approach to cryptocurrency regulation would be a key factor.

- Technological Advancements: Improvements in scalability and security enhance Bitcoin's appeal and long-term viability.

Trump's policies could influence each of these factors. For example, increased regulatory uncertainty might hinder adoption, while pro-growth policies could inadvertently boost Bitcoin's appeal as an inflation hedge.

Potential Bitcoin Price Scenarios Based on Trump's 100-Day Plan

Based on our analysis, several price scenarios are plausible:

Bullish Scenarios:

- High Inflation: If Trump's policies lead to significant inflation, Bitcoin could benefit as investors seek an inflation hedge.

- Increased Financial Instability: If Trump's policies lead to significant market uncertainty, investors might flock to Bitcoin as a safer asset, driving up demand.

Bearish Scenarios:

- Increased Regulation: Stringent cryptocurrency regulations introduced under Trump could dampen investor enthusiasm and negatively impact Bitcoin's price.

- Strong Dollar: If Trump's economic policies strengthen the dollar, Bitcoin might lose some of its appeal as an alternative investment.

Neutral Scenarios:

- Minimal Economic Impact: Trump's policies might have a limited effect on the broader economy and, consequently, Bitcoin's price.

- Market Self-Correction: The cryptocurrency market is inherently volatile and could experience fluctuations independently of Trump's policies.

Conclusion: Trump's Policies, Bitcoin's Future: A Final Prediction Analysis

Analyzing the potential impact of Trump's 100-day plan on Bitcoin's price reveals a complex interplay of economic factors and market sentiment. While bullish scenarios—driven by inflation or market uncertainty—are possible, bearish scenarios—caused by increased regulation or a strong dollar—cannot be ruled out. Neutral scenarios, where Trump's policies have minimal influence, are also plausible.

Given the interplay of these variables, providing a definitive Bitcoin price prediction is highly speculative. However, based on our analysis, a moderate price increase or sideways movement appears more likely than a dramatic collapse or exponential rise in the short term. Remember, the cryptocurrency market is inherently volatile, and unforeseen events can significantly alter price trajectories.

To further your understanding of Bitcoin price analysis and Trump's impact on Bitcoin, conduct your own research, diversify your investments, and stay updated on both political and economic developments. Engage with this analysis by leaving your thoughts in the comments below and sharing this insightful Bitcoin price prediction analysis with your network!

Featured Posts

-

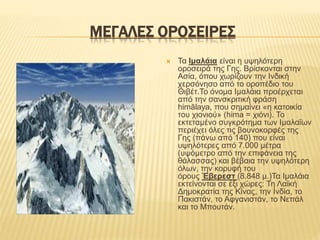

Sta Xamilotera Epipeda 23 Eton Ta Xionia Ton Imalaion Anisyxia Gia Tis Epiptoseis

May 09, 2025

Sta Xamilotera Epipeda 23 Eton Ta Xionia Ton Imalaion Anisyxia Gia Tis Epiptoseis

May 09, 2025 -

Blue Origins Rocket Launch Postponed Details On Subsystem Failure

May 09, 2025

Blue Origins Rocket Launch Postponed Details On Subsystem Failure

May 09, 2025 -

150 Million Settlement For Credit Suisse Whistleblowers

May 09, 2025

150 Million Settlement For Credit Suisse Whistleblowers

May 09, 2025 -

Bondi Announces Historic Fentanyl Seizure Impact On The Opioid Epidemic

May 09, 2025

Bondi Announces Historic Fentanyl Seizure Impact On The Opioid Epidemic

May 09, 2025 -

Su That Ve Loi Khai Bao Mau Danh Tre Tai Tien Giang

May 09, 2025

Su That Ve Loi Khai Bao Mau Danh Tre Tai Tien Giang

May 09, 2025