Trump's Economic Agenda: Will His Tax Bill Overcome Divided Congress?

Table of Contents

Key Components of Trump's Economic Agenda

Trump's economic blueprint rests on three pillars: substantial tax cuts, widespread deregulation, and a massive infrastructure spending program. The success or failure of each of these components will significantly impact the overall effectiveness of his economic plan.

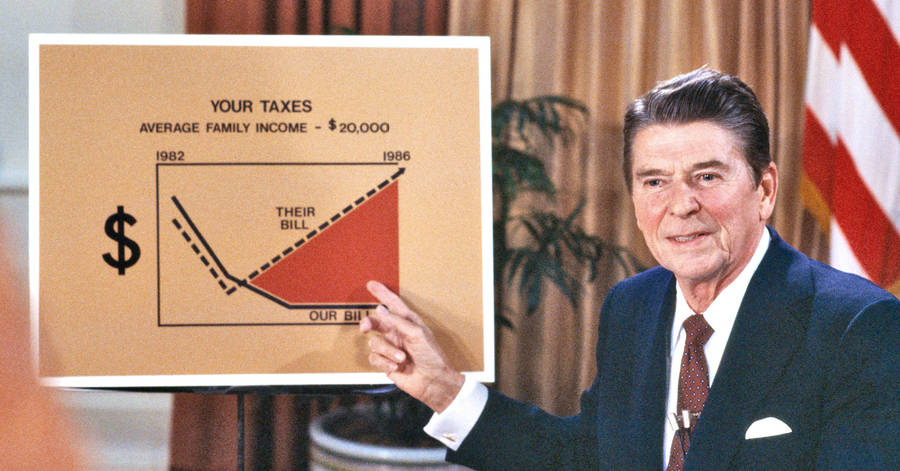

Tax Cuts and Their Impact

The proposed tax cuts form the cornerstone of Trump's economic strategy. These include significant reductions in both corporate and individual income tax rates.

- Corporate Tax Rate Reduction: The plan aimed to slash the corporate tax rate from 35% to 21%, aiming to boost business investment and job creation.

- Individual Income Tax Cuts: The proposed cuts sought to simplify the tax code and lower rates for individuals, stimulating consumer spending.

Projected Economic Effects (and Potential Downsides): Proponents argued these cuts would unleash economic growth, leading to increased job creation and higher wages. Critics, however, warned of a potential surge in the national debt and a worsening of income inequality, exacerbated by disproportionate benefits accruing to higher-income earners. Keywords associated with this section include: tax cuts, corporate tax rate, individual income tax, economic growth, national debt, and fiscal policy.

Deregulation Efforts and Business Growth

A central tenet of Trump's economic agenda is deregulation. The administration targeted numerous environmental, labor, and financial regulations, aiming to reduce the burden on businesses.

- Environmental Regulations: Rollbacks of environmental protection rules were seen as beneficial for businesses, but sparked concerns about potential environmental damage.

- Labor Regulations: Easing labor regulations aimed to increase business flexibility, but raised anxieties about worker safety and potential exploitation.

Potential Benefits and Consequences: While deregulation could potentially lead to reduced costs and increased efficiency for businesses, fostering business growth, it carries risks. Reduced environmental protection could harm the environment, while weakened worker safety regulations might jeopardize employee well-being. Keywords: deregulation, business growth, regulatory reform, environmental protection, and worker safety.

Infrastructure Spending and its Challenges

Trump's ambitious infrastructure plan promised a massive investment in roads, bridges, airports, and other crucial infrastructure.

- Job Creation and Economic Stimulus: The plan aimed to create millions of jobs and provide a significant boost to the economy through increased government spending.

- Funding Mechanisms and Obstacles: Securing funding for this ambitious project proved challenging, facing significant budget constraints and political opposition. Bipartisan support was crucial but elusive.

The potential for job creation and economic stimulus was undeniable, but the lack of a clearly defined funding mechanism and significant political hurdles hampered progress. Keywords: infrastructure spending, job creation, economic stimulus, budget deficit, and bipartisan support.

Congressional Obstacles to Trump's Economic Agenda

The path to enacting Trump's economic agenda was fraught with obstacles, primarily stemming from the deep partisan divisions within Congress.

Partisan Divisions and Legislative Gridlock

The sharp ideological divide between the Republican and Democratic parties created significant hurdles for legislative progress.

- Republican and Democratic Positions: Republicans generally supported the tax cuts and deregulation, while Democrats largely opposed them, citing concerns about income inequality and environmental damage.

- Senate Filibusters and Legislative Hurdles: The Senate's filibuster rule, requiring 60 votes to overcome a procedural roadblock, frequently prevented the passage of legislation, particularly on controversial issues.

The deep partisan divide and the use of procedural tactics like the filibuster created significant legislative gridlock, making the passage of any significant legislation, including the tax bill, incredibly difficult. Keywords: partisan politics, legislative gridlock, Senate filibuster, political compromise, and bipartisan cooperation.

Public Opinion and Political Pressure

Public opinion and political pressure played a significant role in shaping the legislative process surrounding Trump's economic agenda.

- Public Opinion Polls and Sentiment: Public opinion polls revealed varied responses to Trump's proposals, with significant partisan differences.

- Influence of Lobbying Groups and Special Interests: Powerful lobbying groups and special interests exerted considerable influence, advocating for or against specific aspects of the agenda.

- Media Coverage and Public Perception: Media coverage played a crucial role in shaping public perception, often amplifying partisan divisions and debates.

The interplay of public opinion, lobbying efforts, and media coverage created a complex political environment, influencing legislative outcomes and adding further obstacles. Keywords: public opinion, political pressure, lobbying, media influence, and political polarization.

Predicting the Fate of Trump's Tax Bill

The ultimate success or failure of Trump's tax bill hinged on a number of factors, resulting in several potential scenarios.

Analysis of Potential Outcomes

- Passage with Amendments: The tax bill could have passed Congress with significant amendments, reflecting compromises between Republicans and potentially some Democrats.

- Complete Failure: Alternatively, the bill could have failed to garner enough support and been defeated altogether.

The long-term economic and social consequences of each outcome varied significantly. Passage, even with amendments, could have stimulated economic growth but also potentially worsened income inequality. Failure would have dealt a significant blow to Trump's economic agenda and potentially hampered economic recovery. Keywords: tax bill passage, legislative success, economic consequences, and political ramifications.

Conclusion: The Future of Trump's Economic Agenda

Trump's economic agenda, particularly the fate of his tax bill, faced significant challenges due to the deep partisan divisions within Congress and the complexities of public opinion. The central question—would the tax bill succeed in a divided Congress?—remained unanswered for a considerable time, its outcome significantly shaping the trajectory of his overall economic vision. The analysis presented highlights the complex interplay of political forces and economic realities that determined the final outcome. To stay informed about the ongoing evolution of Trump's economic policies and the ongoing impact of the tax bill's legislative journey, continue to follow reputable news sources and engage in informed discussions. Share your insights and perspectives in the comments below, and let's continue this crucial conversation about the future of the American economy.

Featured Posts

-

A Practical Review Of Googles Ai Smart Glasses Prototype

May 22, 2025

A Practical Review Of Googles Ai Smart Glasses Prototype

May 22, 2025 -

Return Of John Lithgow And Jimmy Smits In Dexter Resurrection

May 22, 2025

Return Of John Lithgow And Jimmy Smits In Dexter Resurrection

May 22, 2025 -

Antiques Roadshow Couple Arrested After Jaw Dropping Appraisal Reveals National Treasure Trafficking

May 22, 2025

Antiques Roadshow Couple Arrested After Jaw Dropping Appraisal Reveals National Treasure Trafficking

May 22, 2025 -

High Stock Valuations And Investor Concerns Bof As Analysis

May 22, 2025

High Stock Valuations And Investor Concerns Bof As Analysis

May 22, 2025 -

Siren A Review Of Julianne Moore Meghann Fahy And Milly Alcocks Performances

May 22, 2025

Siren A Review Of Julianne Moore Meghann Fahy And Milly Alcocks Performances

May 22, 2025

Latest Posts

-

Cobra Kais Hurwitz Shares His Initial Series Pitch Trailer

May 23, 2025

Cobra Kais Hurwitz Shares His Initial Series Pitch Trailer

May 23, 2025 -

Cobra Kai Ep Hurwitz Reveals Original Series Pitch Trailer

May 23, 2025

Cobra Kai Ep Hurwitz Reveals Original Series Pitch Trailer

May 23, 2025 -

Is Ralph Macchio Reviving Another Famous Film After Karate Kid 6

May 23, 2025

Is Ralph Macchio Reviving Another Famous Film After Karate Kid 6

May 23, 2025 -

The Karate Kid Franchise A Comprehensive Look At Legend Of Miyagis Role

May 23, 2025

The Karate Kid Franchise A Comprehensive Look At Legend Of Miyagis Role

May 23, 2025 -

Karate Kid 6 And Beyond Ralph Macchios Film Choices

May 23, 2025

Karate Kid 6 And Beyond Ralph Macchios Film Choices

May 23, 2025