Trump's Endorsement: How The Nippon-U.S. Steel Deal Reshapes The Steel Market

Table of Contents

The Political Landscape: Trump's Role in Shaping the Deal

Trump's "America First" policy significantly influenced the negotiation and ultimate success of the Nippon-U.S. Steel deal. His administration's focus on protecting American industries and jobs heavily shaped the political climate surrounding the merger.

Trump's "America First" Policy and its Impact on Steel Tariffs

Trump's administration implemented several protectionist measures aimed at bolstering the American steel industry. These included:

- Section 232 tariffs: These tariffs, imposed on imported steel, aimed to increase the competitiveness of domestic steel producers by raising the price of foreign steel.

- Specific tariffs on Chinese steel: Targeted tariffs against China aimed to counter what the administration viewed as unfair trade practices.

These tariffs had a direct impact on global steel prices. While they aimed to protect American steelworkers, they also led to increased costs for steel consumers and potential retaliatory tariffs from other countries. Trump's support for the Nippon-U.S. Steel deal could be interpreted as a way to strengthen the domestic steel industry while potentially mitigating some of the negative consequences of his protectionist policies. His endorsement undoubtedly influenced negotiations, signaling a favorable political environment for the merger to proceed.

Lobbying Efforts and the Influence of Steel Industry Stakeholders

The deal wasn't solely driven by Trump's policies; intense lobbying efforts played a crucial role. Key players, including executives from both Nippon Steel and U.S. Steel, as well as powerful lobbying firms, exerted significant influence.

- Strategic communication: Lobbyists framed the merger as a way to create a more competitive and resilient American steel industry, thus aligning with Trump's "America First" narrative.

- Emphasis on job creation: Arguments focused on the potential for job creation and economic growth in the U.S. through the combined entity's operations.

- Countering China's influence: The merger was presented as a way to counter China's growing dominance in the global steel market, a key concern for the Trump administration.

The effectiveness of these lobbying efforts is undeniable; Trump's endorsement indicates their success in securing political support for the deal.

Economic Implications: Analyzing the Restructuring of the Steel Market

The Nippon-U.S. Steel deal had profound economic consequences, impacting global steel production, pricing, and the livelihoods of steelworkers.

Impact on Global Steel Production and Pricing

The merger created a steel giant with significantly increased production capacity. This consolidation had a ripple effect across the global steel market:

- Increased market share: The combined entity commanded a larger share of the global steel market, impacting competition and pricing.

- Price fluctuations: The merger could lead to both increased prices (due to reduced competition) and decreased prices (due to increased efficiency and economies of scale), depending on market dynamics.

- Shifting competitive landscape: Other steel producers faced increased pressure to compete with the newly formed giant.

The impact on steel prices varied across markets; some regions experienced price increases while others saw more moderate effects.

Consequences for American and Japanese Steelworkers

The deal's impact on steelworkers was complex, involving both potential job gains and losses.

- Job security: While the merger promised synergies and potential job growth through increased efficiency, some redundancies were inevitable.

- Wage and benefit changes: The impact on wages and benefits varied, requiring close monitoring and potential negotiation.

- Retraining and relocation: Support for retraining and relocation programs was crucial to mitigate job displacement.

The long-term consequences on worker wages and working conditions remain to be fully assessed.

The Deal's Influence on International Trade Relations

The Nippon-U.S. Steel deal had significant implications for international trade relations.

- Trade agreement implications: The merger could influence future trade negotiations and agreements, particularly regarding steel tariffs and quotas.

- Ripple effect on other trade deals: Other countries may reassess their own trade policies in light of this significant merger.

- Future trade policy considerations: The deal sets a precedent, influencing discussions around future trade policies, especially concerning cross-border mergers and acquisitions in the steel industry.

Long-Term Effects: Forecasting the Future of the Steel Industry

The long-term consequences of Trump's endorsement and the Nippon-U.S. Steel deal extend beyond immediate economic impacts.

Sustainability and Technological Advancements in Steel Production

The combined entity's scale and resources could accelerate investments in sustainable steel production and technological innovation.

- Green steel initiatives: The merged company could drive the adoption of cleaner and more environmentally friendly steel production processes.

- Technological improvements: Investment in advanced technologies could enhance efficiency and reduce costs.

- R&D investments: Increased resources for research and development could lead to breakthroughs in steel manufacturing.

Predicting Market Trends and Future Acquisitions/Mergers

The Nippon-U.S. Steel deal likely foreshadows further consolidation within the global steel industry.

- Future mergers and acquisitions: Expect more mergers and acquisitions as companies strive to achieve economies of scale and enhance competitiveness.

- Shifting market share: The deal’s long-term effects will likely lead to significant shifts in market share among steel producers globally.

- Geopolitical influence: Geopolitical factors, including trade wars and protectionist policies, will continue to influence market trends and consolidation.

Conclusion: Trump's Endorsement and the Nippon-U.S. Steel Deal: A Lasting Impact on the Steel Market

Trump's endorsement and the subsequent Nippon-U.S. Steel deal significantly reshaped the global steel market. The merger's political origins, economic consequences, and long-term implications demonstrate the intertwined nature of politics, economics, and the steel industry. Key takeaways include the powerful influence of political endorsements on major business transactions, the complex economic consequences for steelworkers and global markets, and the ongoing implications for international trade relations and future industry consolidation. Analyzing Trump's Influence on Steel Market Deals and understanding the Nippon-U.S. Steel deal's legacy requires continuous monitoring of the global steel industry's evolving dynamics. We encourage readers to continue researching the topic, exploring related news articles, and staying informed about future developments in the steel market following this landmark transaction.

Featured Posts

-

Chainalysis Integrates Ai Through Alterya Acquisition Enhanced Blockchain Security And Analysis

May 25, 2025

Chainalysis Integrates Ai Through Alterya Acquisition Enhanced Blockchain Security And Analysis

May 25, 2025 -

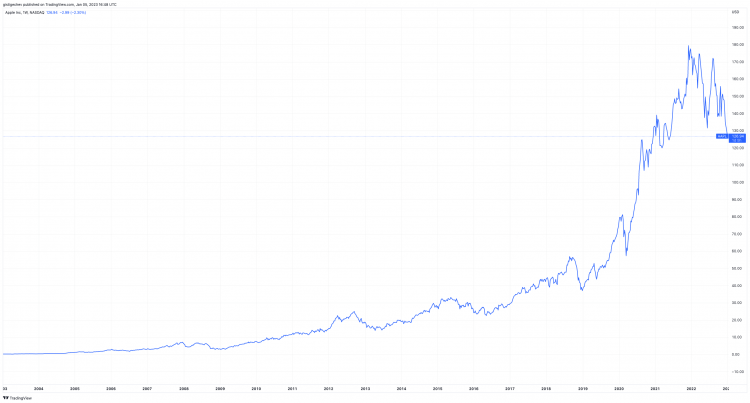

Apple Stock Performance Concerns Before Q2 Results

May 25, 2025

Apple Stock Performance Concerns Before Q2 Results

May 25, 2025 -

Planning Your Country Escape Tips For A Relaxing And Rewarding Experience

May 25, 2025

Planning Your Country Escape Tips For A Relaxing And Rewarding Experience

May 25, 2025 -

Avrupa Borsalari Guenluek Degisimler Ve Gelecek Beklentileri

May 25, 2025

Avrupa Borsalari Guenluek Degisimler Ve Gelecek Beklentileri

May 25, 2025 -

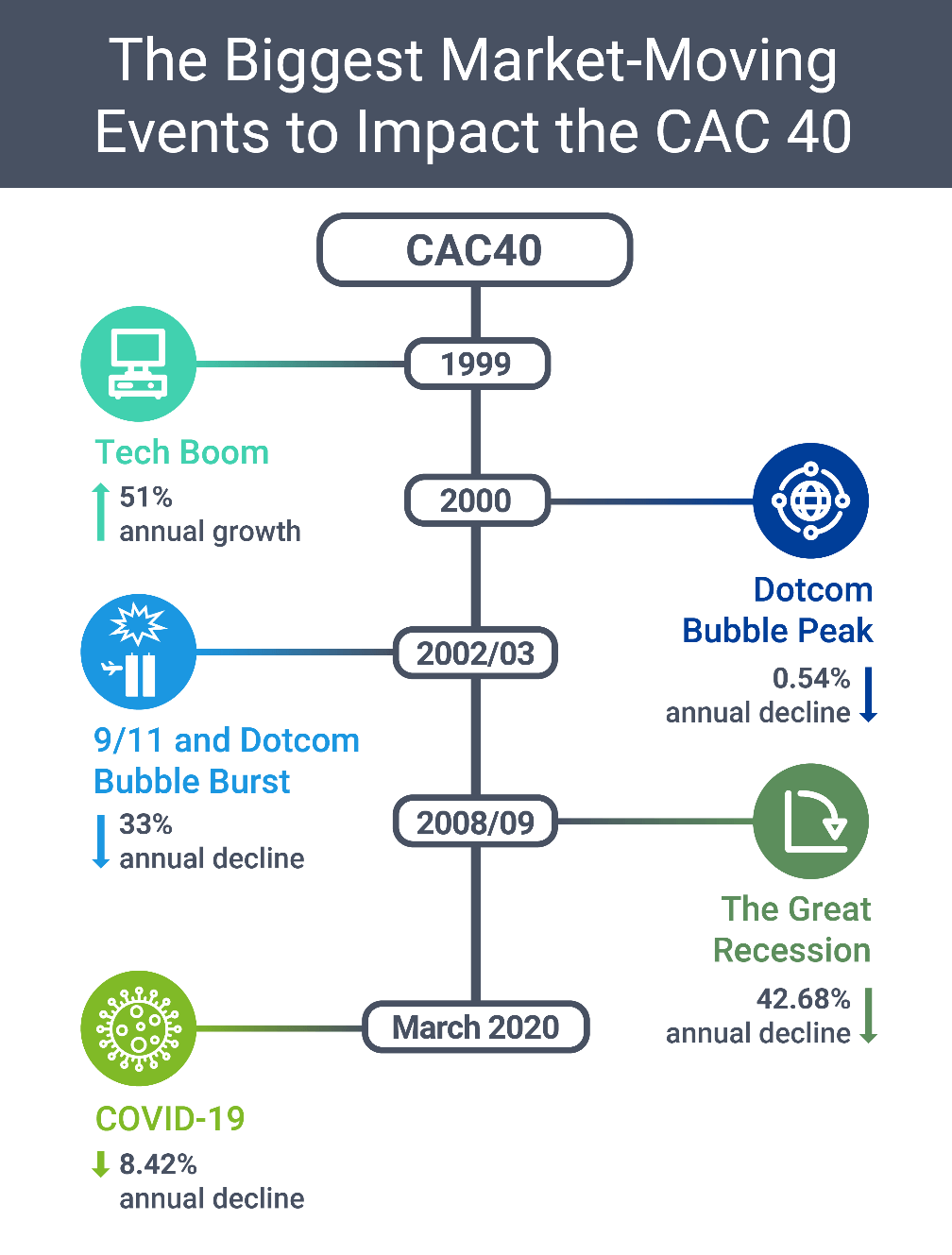

Cac 40 Ends Week Down But Weekly Trend Shows Stability March 7 2025

May 25, 2025

Cac 40 Ends Week Down But Weekly Trend Shows Stability March 7 2025

May 25, 2025

Latest Posts

-

Ipswich Towns Week In Review Mc Kenna Shines Phillips And Cajuste Face Challenges

May 28, 2025

Ipswich Towns Week In Review Mc Kenna Shines Phillips And Cajuste Face Challenges

May 28, 2025 -

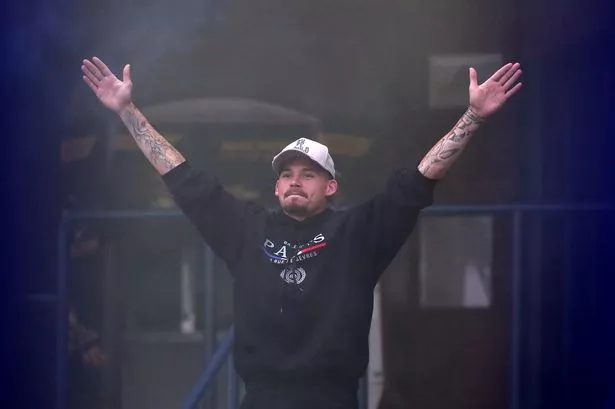

Is A Leeds Return On The Cards For Kalvin Phillips This Summer

May 28, 2025

Is A Leeds Return On The Cards For Kalvin Phillips This Summer

May 28, 2025 -

Could Kalvin Phillips Return To Leeds United Transfer Speculation Mounts

May 28, 2025

Could Kalvin Phillips Return To Leeds United Transfer Speculation Mounts

May 28, 2025 -

Phillips To Leeds Assessing The Likelihood Of A Summer Transfer

May 28, 2025

Phillips To Leeds Assessing The Likelihood Of A Summer Transfer

May 28, 2025 -

Leeds United Transfer News Kalvin Phillips Return On The Cards

May 28, 2025

Leeds United Transfer News Kalvin Phillips Return On The Cards

May 28, 2025