Trump's Oil Price Outlook: A Goldman Sachs Social Media Analysis

Table of Contents

Goldman Sachs' Stance on Trump's Energy Policies

Goldman Sachs, a prominent player in the financial world, frequently uses social media to communicate its analyses and perspectives. Examining their online presence provides valuable insight into their assessment of Trump's energy policies and their predicted impact on oil prices.

Deregulation and its Impact

Trump's administration championed deregulation, notably concerning the Keystone XL pipeline and environmental regulations. Goldman Sachs' social media commentary likely reflected their analysis of these policies' effects on domestic oil production and global prices.

- Increased domestic oil production: Deregulation potentially boosted US oil production, increasing supply and, theoretically, putting downward pressure on prices. Goldman Sachs' analysts probably weighed this increased supply against global demand in their predictions.

- Potential impact on OPEC influence: Increased US oil production could challenge the Organization of the Petroleum Exporting Countries (OPEC)'s market control, potentially leading to price volatility as OPEC adjusted its strategies. Goldman Sachs' social media posts might have discussed this shifting power dynamic.

- Goldman Sachs' predictions for price fluctuations based on deregulation: We can analyze Goldman Sachs' social media for specific predictions concerning oil price fluctuations directly linked to deregulation policies. Did they forecast price drops due to increased supply, or did they identify other factors that mitigated this impact?

Trade Wars and Their Influence

Trump's trade policies, including tariffs on imported goods, significantly impacted global economic growth. Goldman Sachs' social media likely addressed the potential consequences of these trade wars on global oil demand and pricing.

- Impact on global economic growth: Trade wars could slow global economic growth, reducing demand for oil and potentially impacting prices negatively. Goldman Sachs' analysts probably modeled the potential effects of reduced economic activity on oil consumption.

- Effect on oil consumption: Slower economic growth in key markets would naturally lead to a decline in oil consumption. This, in turn, would affect oil prices. Examining Goldman Sachs' social media posts helps ascertain how they weighed this factor.

- Goldman Sachs' predictions for oil price volatility due to trade disputes: Analyzing Goldman Sachs' tweets and reports regarding the trade wars would reveal their predictions concerning oil price volatility resulting from these disputes. Did they anticipate significant price swings, and if so, in which direction?

Sentiment Analysis of Goldman Sachs' Social Media Regarding Trump

By carefully analyzing Goldman Sachs' social media activity, we can identify instances reflecting positive and negative sentiment regarding oil prices under the Trump administration.

Positive Sentiment Indicators

Positive sentiment would be indicated by statements expressing optimism about oil prices under Trump's policies.

- Specific tweets or statements showing positive sentiment: Searching Goldman Sachs' social media for keywords like "positive outlook," "growth," or "bullish" related to oil prices during the Trump years would highlight instances of positive sentiment.

- Reasons behind the positive outlook: Understanding the reasons for this optimism helps contextualize Goldman Sachs' perspective. Was it mainly due to deregulation, or were other factors, such as global demand, considered?

- Related economic factors: Positive sentiment might have been associated with robust economic indicators, a strong US dollar, or other macroeconomic factors influencing oil prices.

Negative Sentiment Indicators

Negative sentiment would manifest in statements expressing pessimism or concerns about oil price movements under Trump's policies.

- Specific tweets or statements showing negative sentiment: Identifying tweets or reports using words like "uncertainty," "volatility," "bearish," or expressing concerns about the impact of trade wars on oil prices would indicate negative sentiment.

- Reasons for the pessimistic outlook: Understanding the rationale behind negative sentiment provides crucial context. Were the concerns primarily geopolitical, or were they rooted in economic factors?

- Related economic or geopolitical factors: Negative sentiment might stem from geopolitical instability, concerns about global economic slowdown, or other factors impacting oil market dynamics.

Comparing Goldman Sachs' Outlook to Actual Oil Prices

A critical assessment requires comparing Goldman Sachs' predictions, gleaned from their social media activity, to the actual oil price movements during the Trump administration.

Accuracy of Predictions

This section would involve a quantitative analysis comparing Goldman Sachs' publicly available predictions to actual oil price data.

- Charts showing actual vs. predicted oil prices: Visual representations of actual vs. predicted prices facilitate a clear comparison.

- Reasons for discrepancies (if any): Explaining any discrepancies between predictions and actual prices is vital. Did unforeseen events, such as unexpected geopolitical developments or changes in global demand, impact the accuracy of Goldman Sachs' forecasts?

- Assessment of Goldman Sachs' predictive accuracy: This section concludes with an overall assessment of how accurately Goldman Sachs' social media commentary predicted oil price movements during the Trump era. It's crucial to acknowledge the limitations of relying solely on social media data for this type of analysis.

Conclusion

Analyzing Goldman Sachs' social media commentary reveals a nuanced perspective on Trump's influence on oil prices. Their outlook appears to have been shaped by a complex interplay of factors including deregulation, trade wars, and global economic conditions. While identifying specific predictions and sentiment from social media offers valuable insight, it's essential to acknowledge limitations in this approach. A thorough examination requires considering broader economic contexts and data beyond social media posts.

Call to Action: For a deeper understanding of the complex interplay between political decisions and energy markets, explore further analysis on Trump's oil price outlook and the predictions made by leading financial institutions like Goldman Sachs. Continue your research to gain a more comprehensive understanding of Trump's oil price outlook and the multifaceted factors influencing global energy markets.

Featured Posts

-

Indias Farm Sector To Thrive On Promising Monsoon Predictions Ind Ra Report

May 15, 2025

Indias Farm Sector To Thrive On Promising Monsoon Predictions Ind Ra Report

May 15, 2025 -

Kuzey Kibris Gastronomisi Itb Berlin De Bueyuek Basari Kazandi

May 15, 2025

Kuzey Kibris Gastronomisi Itb Berlin De Bueyuek Basari Kazandi

May 15, 2025 -

The Surveillance Potential Of Ai Therapy A Threat To Civil Liberties

May 15, 2025

The Surveillance Potential Of Ai Therapy A Threat To Civil Liberties

May 15, 2025 -

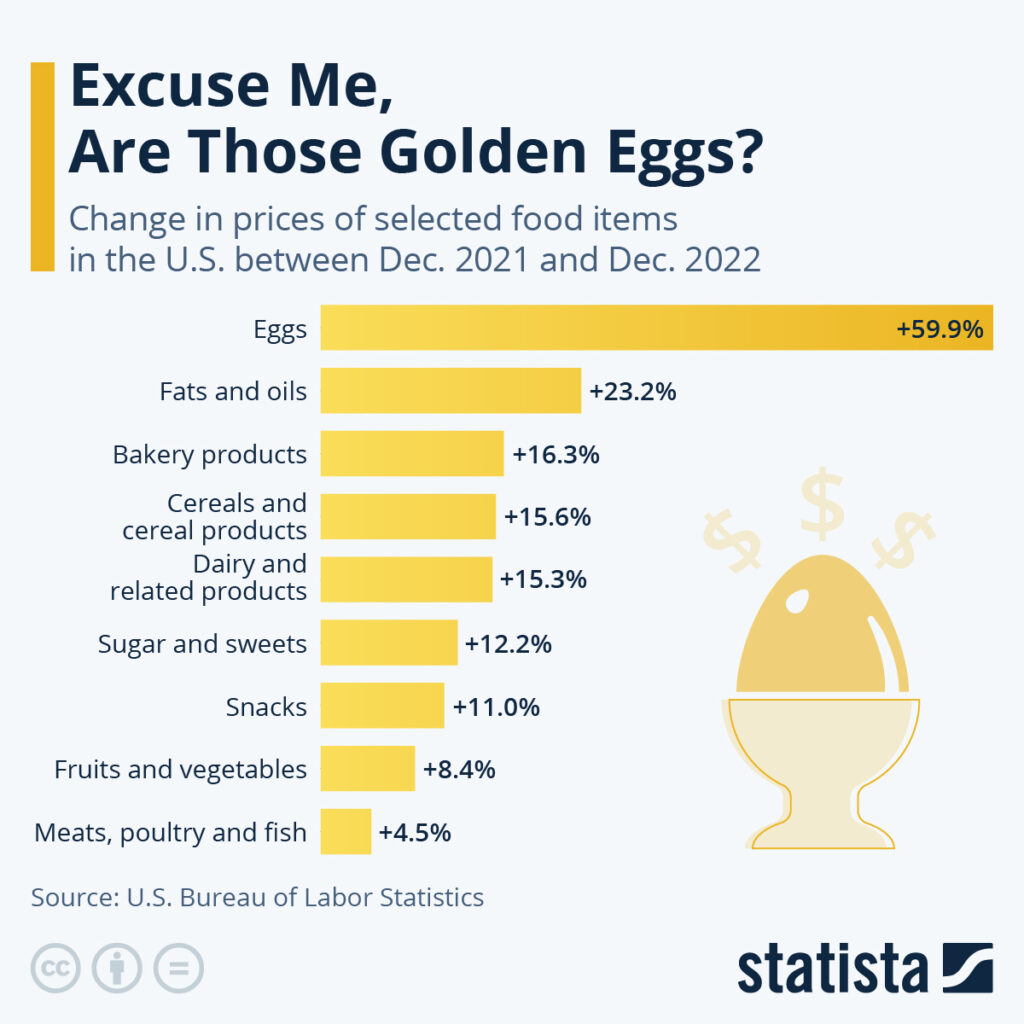

5 A Dozen Egg Prices Fall From Record Highs In The Us

May 15, 2025

5 A Dozen Egg Prices Fall From Record Highs In The Us

May 15, 2025 -

Activision Blizzard Merger Ftcs Appeal Against Judges Decision

May 15, 2025

Activision Blizzard Merger Ftcs Appeal Against Judges Decision

May 15, 2025

Latest Posts

-

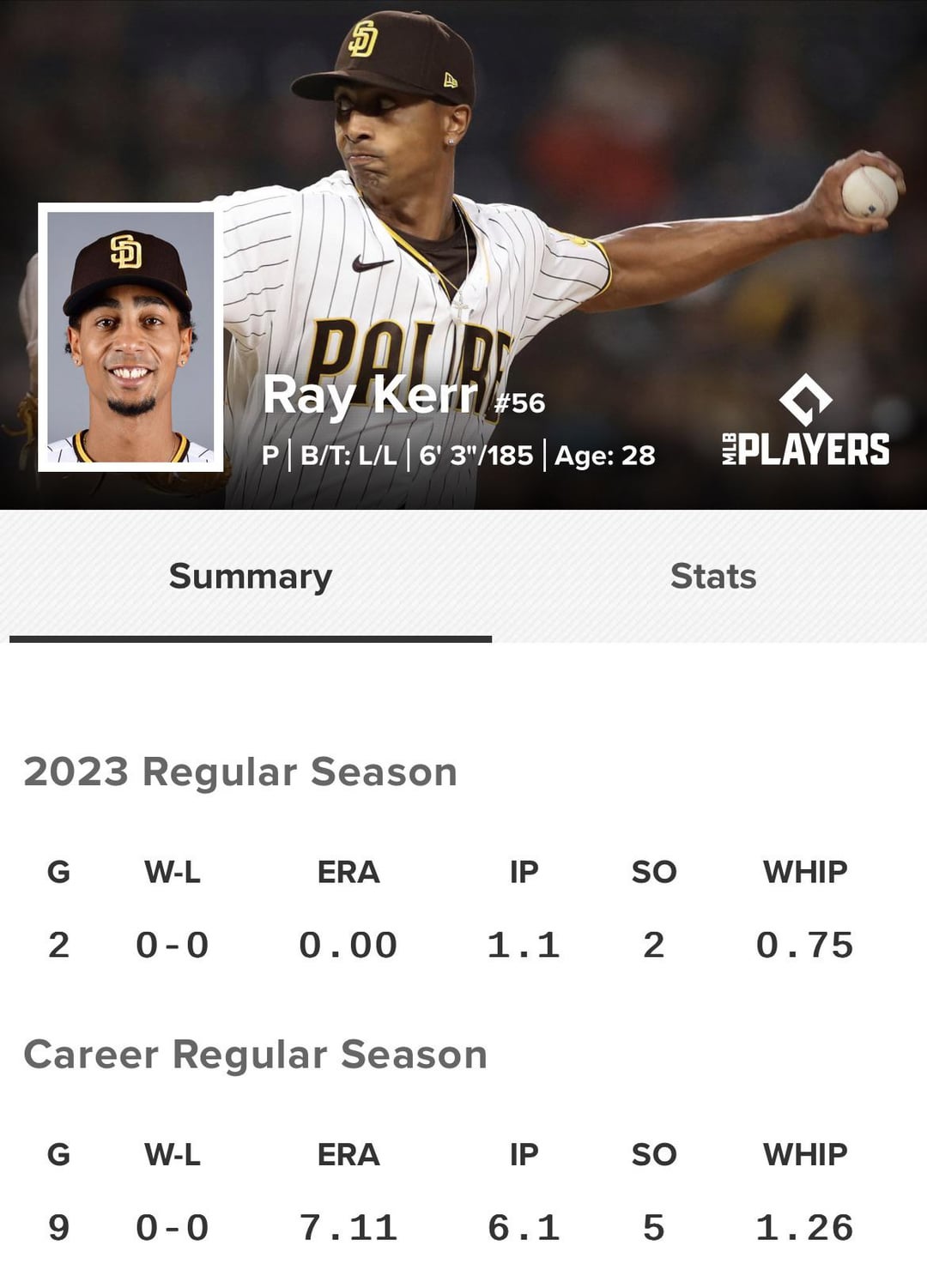

San Diego Padres Vs San Francisco Giants Prediction A Detailed Analysis

May 15, 2025

San Diego Padres Vs San Francisco Giants Prediction A Detailed Analysis

May 15, 2025 -

San Diego Padres Vs Chicago Cubs Game Prediction And Analysis

May 15, 2025

San Diego Padres Vs Chicago Cubs Game Prediction And Analysis

May 15, 2025 -

Predicting The Giants Padres Game Outright Win Or Narrow Defeat For Padres

May 15, 2025

Predicting The Giants Padres Game Outright Win Or Narrow Defeat For Padres

May 15, 2025 -

Predicting The Padres Cubs Game A Second Loss For San Diego

May 15, 2025

Predicting The Padres Cubs Game A Second Loss For San Diego

May 15, 2025 -

Giants Vs Padres Game Prediction Analyzing A Tight Matchup

May 15, 2025

Giants Vs Padres Game Prediction Analyzing A Tight Matchup

May 15, 2025