Trump's Tariff Decision Sends Euronext Amsterdam Stocks Soaring 8%

Table of Contents

Understanding the Specific Tariff Decision

The unexpected surge in Euronext Amsterdam can be directly linked to a specific Trump administration decision concerning tariffs on steel and aluminum imports from the European Union. Announced on [Insert Date of Announcement], this decision imposed significant import tariffs, impacting various sectors within the EU, particularly those heavily reliant on steel and aluminum in their manufacturing processes. This action was framed within the context of broader US trade policy aimed at protecting American industries and addressing what the administration perceived as unfair trade practices. Relevant keywords here include "Trump tariffs," "US trade policy," "import tariffs," "export duties," and "steel tariffs."

- Impact on US Businesses: While intended to protect domestic industries, the tariffs also led to increased costs for US businesses relying on imported steel and aluminum, potentially hindering their competitiveness.

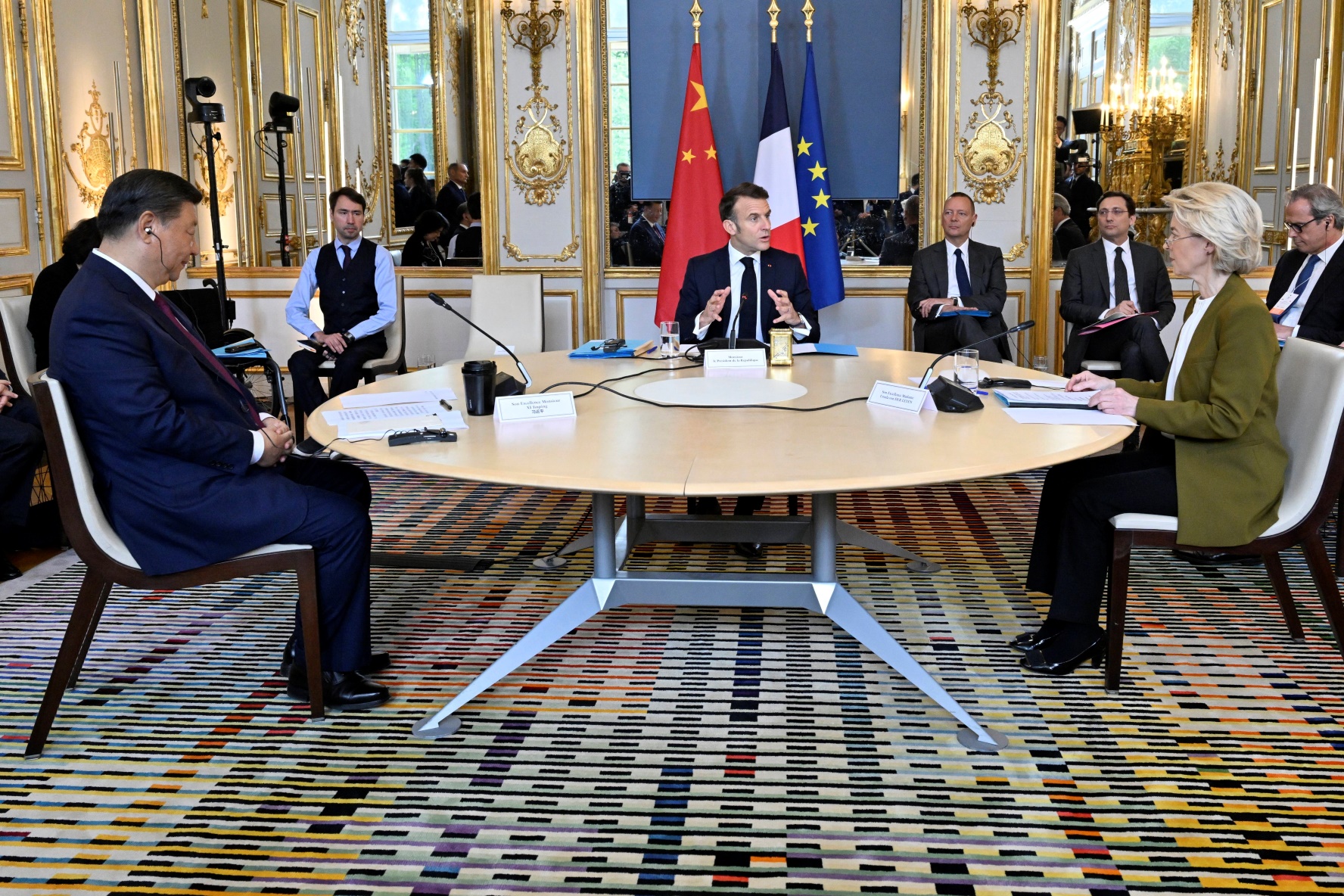

- Repercussions for US-EU Trade Relations: This decision significantly strained US-EU trade relations, leading to retaliatory tariffs from the EU and further escalating trade tensions between the two economic powerhouses.

- Timeline of the Decision: The announcement was followed by a period of market uncertainty, culminating in the unexpected 8% surge on Euronext Amsterdam. [Insert specific timeframe and relevant details].

Euronext Amsterdam's Response: An 8% Surge Explained

The 8% increase in Euronext Amsterdam's stock market index was a striking reaction to the Trump tariff announcement. While seemingly counterintuitive given the negative impact of tariffs, several factors likely contributed to this surge. The increase wasn't uniform across all sectors; certain stocks experienced far more significant gains than others. While initial reports pointed to a sustained increase, further analysis will be needed to confirm whether this upward trend continues. Key terms here include "Euronext Amsterdam," "stock market volatility," "market reaction," and "stock price increase."

- Winning Sectors: The technology and finance sectors within Euronext Amsterdam saw particularly significant gains. This may indicate that investors perceived these sectors as better positioned to navigate the evolving trade landscape.

- Comparison to Other European Indices: A comparison with other major European stock market indices, such as the FTSE 100 or DAX, is crucial to determine if the Euronext Amsterdam surge was unique or part of a broader market trend.

- Expert Opinions: Financial analysts suggested that the surge could be attributed to a combination of factors, including short-covering, repositioning of portfolios in anticipation of further market adjustments, and potentially, the perception of undervalued stocks on Euronext Amsterdam.

Potential Long-Term Impacts on Euronext Amsterdam and the Broader Market

The long-term impact of this Trump tariff decision on Euronext Amsterdam and the broader European market remains uncertain. Several scenarios are plausible, ranging from continued growth fueled by adaptation and innovation to a market correction driven by economic slowdown or geopolitical instability. Analyzing potential risks and opportunities is paramount for investors navigating this complex situation. Relevant keywords here include "market outlook," "investment strategy," "long-term investment," "economic forecast," and "geopolitical risk."

- Risks and Opportunities: The potential for further escalation of trade tensions, coupled with the uncertainty surrounding global economic growth, presents significant risks. However, adaptive businesses may find opportunities in a reshaped trade landscape.

- Investor Sentiment and Confidence: The initial market reaction reflects a degree of investor uncertainty. Monitoring investor sentiment and confidence will be key in forecasting future market movements.

- Predictions for Future Market Movements: While predicting future market movements is inherently challenging, a careful analysis of various economic indicators and geopolitical events will provide a clearer outlook.

Conclusion: Navigating the Aftermath of Trump's Tariff Decision on Euronext Amsterdam

Trump's tariff decision had a surprisingly positive, albeit potentially temporary, impact on Euronext Amsterdam, resulting in an 8% surge. The reasons behind this increase were complex and likely involved a mix of factors beyond the direct impact of the tariffs. Understanding the nuances of this event is crucial for investors. To successfully navigate this evolving market landscape, stay informed about future "Trump tariff decisions" and their ripple effects on Euronext Amsterdam and global markets. Consult with a financial advisor to develop a robust investment strategy tailored to your risk tolerance and long-term goals. Staying informed is key to making sound investment decisions in this period of significant global economic and political uncertainty.

Featured Posts

-

How 17 Celebrities Ruined Their Reputations

May 24, 2025

How 17 Celebrities Ruined Their Reputations

May 24, 2025 -

Znatok Kino Proydite Test Po Rolyam Olega Basilashvili

May 24, 2025

Znatok Kino Proydite Test Po Rolyam Olega Basilashvili

May 24, 2025 -

Analyzing Apples Performance Under Trumps Tariffs

May 24, 2025

Analyzing Apples Performance Under Trumps Tariffs

May 24, 2025 -

Investing In Amundi Msci All Country World Ucits Etf Usd Acc Nav Considerations

May 24, 2025

Investing In Amundi Msci All Country World Ucits Etf Usd Acc Nav Considerations

May 24, 2025 -

Get Tickets For Bbc Radio 1 Big Weekend 2025 Confirmed Lineup Details

May 24, 2025

Get Tickets For Bbc Radio 1 Big Weekend 2025 Confirmed Lineup Details

May 24, 2025

Latest Posts

-

Actress Mia Farrow Demands Trumps Imprisonment Regarding Venezuelan Deportations

May 24, 2025

Actress Mia Farrow Demands Trumps Imprisonment Regarding Venezuelan Deportations

May 24, 2025 -

Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025

Mia Farrows Plea Jail Trump For Deporting Venezuelan Gang Members

May 24, 2025 -

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025

Mia Farrow Calls For Trumps Arrest Over Venezuelan Deportations

May 24, 2025 -

Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 24, 2025

Farrows Plea Jail Trump For Handling Of Venezuelan Deportations

May 24, 2025 -

Actress Mia Farrow Trump Should Be Jailed For Venezuelan Deportation Policy

May 24, 2025

Actress Mia Farrow Trump Should Be Jailed For Venezuelan Deportation Policy

May 24, 2025